403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Abu Dhabi Property Market Shows Sustained Momentum In 2025, Bayut Report Finds

(MENAFN- Mid-East Info) Abu Dhabi, UAE: Bayut, the UAE's leading PropTech portal, has released its Abu Dhabi Real Estate Market Report for 2025, highlighting continued resilience across both the sales and rental markets. The findings point to broadly upward price movements in several key residential communities, reflecting Abu Dhabi's sustained attractiveness to both end-users and investors. This positive trajectory is supported by ongoing infrastructure investment, stable economic fundamentals and government initiatives focused on fostering long-term growth in the real estate sector.

Property Buying Trends in Abu Dhabi: Property values across Abu Dhabi have continued their upward trajectory in 2025.

Property Buying Trends in Abu Dhabi: Property values across Abu Dhabi have continued their upward trajectory in 2025.

-

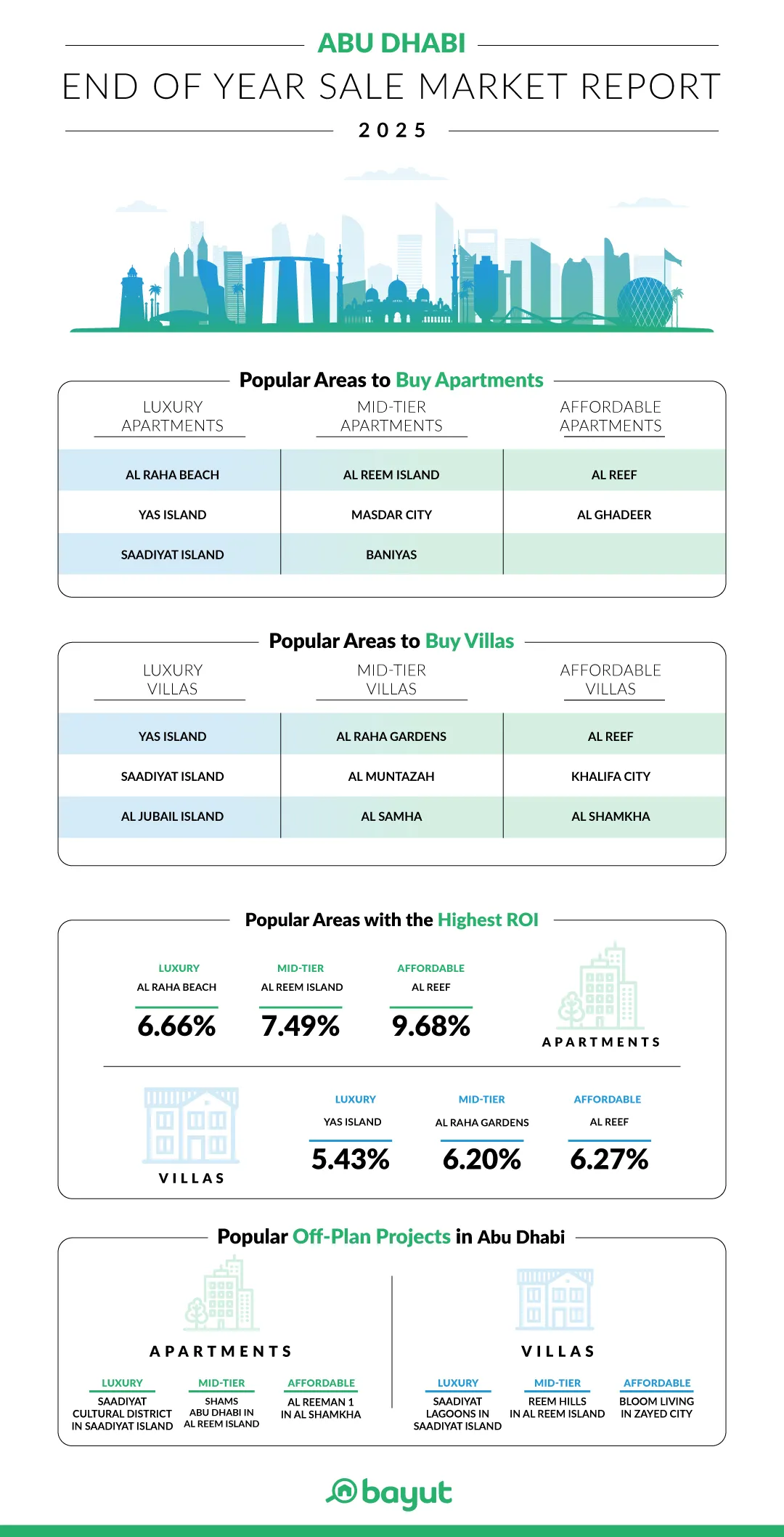

Budget-conscious buyers have focussed their search on communities such as Al Reef, Al Ghadeer, Khalifa City and Al Shamkha. In the mid-tier category, Al Reem Island, Masdar City, Al Raha Gardens and Al Muntazah have emerged as popular choices, while luxury buyers continued to favour Al Raha Beach, Yas Island and Saadiyat Island for their premium lifestyle offerings.

Apartment prices in affordable communities have climbed by 10% to 13%. Mid-tier apartment values have risen by up to 19%, led by Al Reem Island, reflecting sustained demand for waterfront living. In the luxury segment, prices have recorded sharper increases of up to 27%, with Yas Island and Saadiyat Island seeing the strongest growth, particularly following the announcement of Disney World Abu Dhabi.

Affordable villas in established communities have recorded increases of up to 11%, with Al Reef leading the growth. Mid-tier villas have seen price surges ranging from 2% to 41%, with Al Samha registering the strongest appreciation, likely driven by its location along Abu Dhabi's expanding corridor towards Dubai and rising demand for mid-market homes. In the luxury segment, villa prices on Yas Island and Saadiyat Island increased by 10% to 13%, while Al Jubail Island saw a price correction of up to 19%, making select high-end properties more accessible.

-

Among apartments, Al Reef has led the affordable segment with yields of 9.68%, followed closely by Al Ghadeer at 8.40%. In the mid-tier category, Masdar City has generated returns of 8.45%, while Al Reem Island offered yields of 7.49%. Luxury apartments on Yas Island and Al Raha Beach have delivered yields of 7.07% and 6.66%, respectively.

Villa yields have also been competitive. Al Reef has topped the affordable segment with average returns of 6.27%. In the mid-tier market, Al Raha Gardens and Al Samha have recorded yields of 6.20% and 5.37%. High-end villas on Yas Island have continued to perform steadily, with returns exceeding 5%.

-

Affordable off-plan apartment demand has been centred on developments such as Al Reeman 1 in Al Shamkha and Bloom Living in Zayed City. Mid-tier buyers have shown strong interest in projects within Shams Abu Dhabi, Al Reem Island and Gardenia Bay on Yas Island. In the luxury space, Saadiyat Cultural District and Nawayef Park Views, Al Hudayriat Island have stood out as preferred investment destinations.

For off-plan villas in the affordable segment, buyers have mainly focused on Bloom Living and Al Reeman 2. Reem Hills and Yas Acres have continued to attract mid-tier buyers, while Saadiyat Lagoons and Yas Riva have dominated the luxury segment.

-

Affordable communities such as Khalifa City and Al Shamkha have remained popular for both apartments and villas. In the mid-tier segment, tenants have preferred Al Reem Island and Al Khalidiya for apartments, and Shakhbout City and Al Raha Gardens for villas. At the premium end, Al Raha Beach and Yas Island have been the top choices for apartments and villas respectively, with Saadiyat Island continuing to attract demand across all luxury categories.

Affordable apartment rents have risen by 8% to 30%, with Al Nahyan recording the sharpest increases, reflecting stronger tenant demand for well-connected yet affordable locations. Mid-tier apartment rents have climbed by up to 25%, led by notable price growth in Al Reem Island and Hamdan Street. In the luxury segment, apartment rents have increased by as much as 32%, driven largely by high demand for one-bedroom units in Al Raha Beach and Saadiyat Island.

In the villa segment, affordable rents have increased by up to 16%, while mid-tier villas have recorded growth of 1% to 13%. Luxury villa rents have also generally increased, rising by 6% to 16% across key locations 5-bed and 6-bed units in Yas Island and Saadiyat Island have seen corrections of up to 9%, indicating a gradual rebalancing of supply and demand in this segment.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment