Cargo Trains To Criss-Cross India In New ₹1.5 Trillion Corridors

Indian Railways is exploring three new freight corridors to extend the high-speed cargo network deeper into southern, eastern, and central India, building on the success of two operational lines to create a continuous nationwide logistics loop, two people aware of the development said.

Detailed project reports for the three new lines have been completed and are under examination, said one of the three people quoted earlier. Together, the new dedicated freight corridors (DFCs) are estimated to cost around ₹1.5 trillion, the person said.

The DFCs under consideration are: 1,115 km East Coast Corridor (Kharagpur–Vijayawada); 1,673 km East–West Corridor (Bhusawal–Dankuni); and 975 km North–South Sub-Corridor (Vijayawada–Nagpur–Itarsi. At least one corridor will be selected first based on technical feasibility, traffic potential, and funding availability.

The proposal may be included in the upcoming Union Budget with token allocations for FY27, according to the three people quoted earlier–all three spoke on the condition of anonymity as details are not public yet.

Also Read | Why Indian Railways is betting on QSR chaThe new corridors will complement the existing 1,337 km eastern and 1,506 km western DFCs. About 1,404 km of the western corridor is operational, while the remaining 102 km from Vaitrana to Jawaharlal Nehru Port Trust (JNPT ) is scheduled to be commissioned soon.

The existing corridors have boosted freight speeds and eased congestion on passenger routes. According to the ministry of railways, the national transporter's share in total freight movement dropped from over 60% in the 1990s to about 25% in 2020. But post-Covid, aided by the dedicated corridors, this has gone up to 27%, and the National Rail Plan targets to hit 45% by 2030.

The railways push comes as India's logistics market expands. Mordor Intelligence, a global market research consulting firm, expects the country's freight and logistics market size to grow from around $350 billion in 2025 to about $550 billion by 2030.

India's mining epicentre a priorityThe East Coast Corridor, which contributes the highest freight loading for railways, is likely to be prioritized, said the first person quoted earlier, as it will support port evacuation in the eastern region and provide a dedicated route for mineral movement from Odisha and Chhattisgarh. The railways aims to complete the stretch-expected to cost ₹40,000–50,000 crore-within five to seven years of commencement.

Queries emailed to the ministries of railways and finance remained unanswered until press time.

“Among all the corridors planned earlier, the East Coast corridor has the highest rate of return," said V. Shanker, former executive director–planning, Railways.“It complements coastal shipping rather than competing with it. Eastern ports desperately need better evacuation capacity. Once dedicated corridors are created, 30–35% of Railways' net tonne-km will move on them, allowing freight trains to run at 75–100 km/h-more than the current average of about 25 km/h. This will make freight more reliable and allow time-tabled operations."

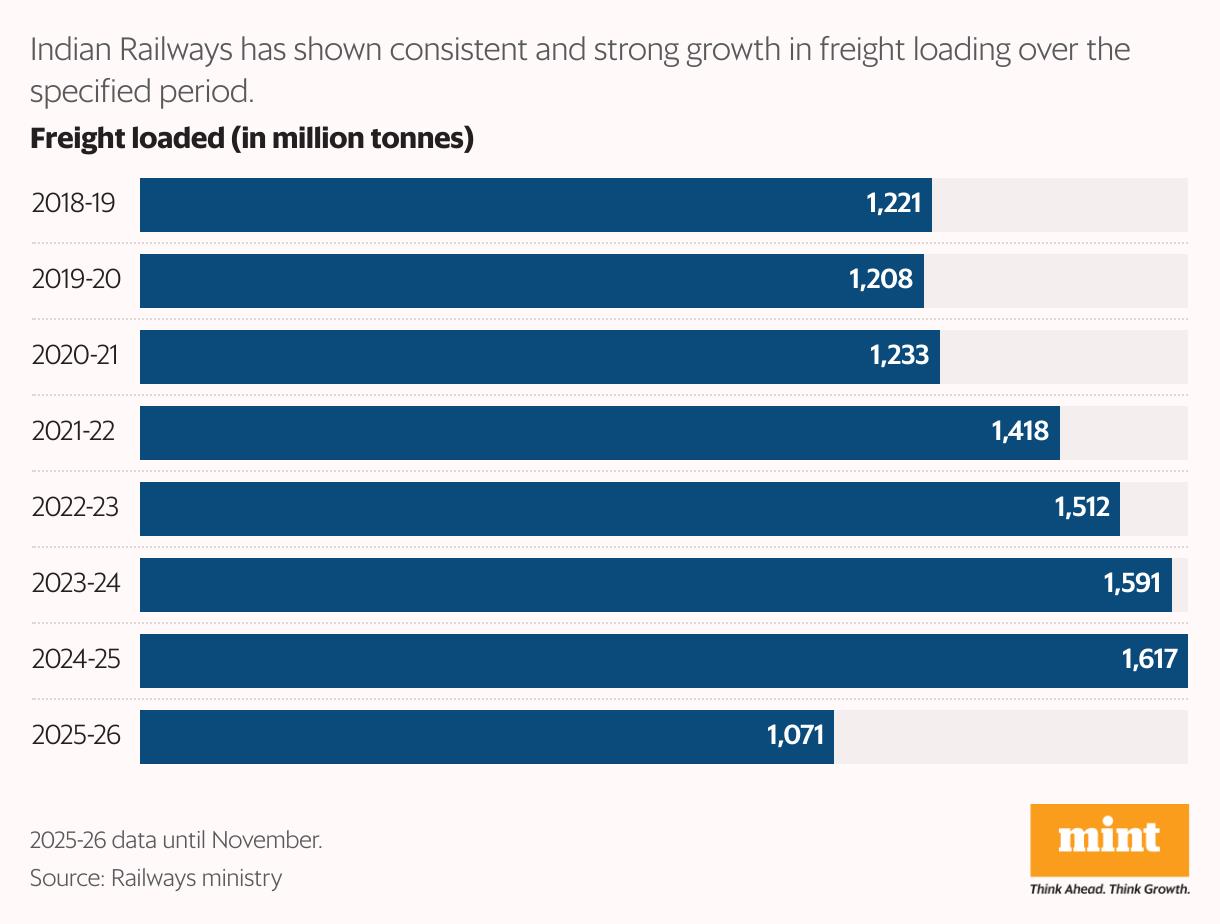

Also Read | Railways eyes record allocation for FY27 as govt ramps up modernization plThe East Coast Railway zone has been the highest freight-loading zone for five consecutive years, driven by coal from Mahanadi Coalfields Ltd's Talcher fields, iron ore from Bailadila and Keonjhar, and cargo from ports such as Paradip, Dhamra, Vizag, Gangavaram and Gopalpur. A dedicated corridor is expected to lift the zone's throughput and help the railways pursue its target of 3,000 million tonnes (MT) of freight loading by 2030, up from an expected 1,702 MT in FY26.

All the proposed corridors are designed to support double-stack container operations, higher axle loads and faster cargo movement between ports and hinterland, the people quoted earlier said. While the East–West and East Coast alignments would enhance connectivity with eastern ports, the North–South route would strengthen mineral and power-sector logistics across central and southern India.

Is it worth the effort?Yet, citing the underutilization of existing freight corridors, some industry experts suggest that investments should instead be directed towards high-speed passenger and freight corridors to address systemic bottlenecks.

“The Eastern and Western DFCs are almost complete and run 300–350 trains daily against a capacity of 480. Yet they haven't led to any major jump in loading or revenue," said Sudhanshu Mani, former general manager of Indian Railways and architect of the Vande Bharat Express. Freight loading is growing only 2–3% annually, with overall freight rising just 1.7% last fiscal, largely due to coal shipments.

“Freight suffers from a lack of seamless inter-modal transfer, inadequate first and last-mile links, uncertain delivery times and sometimes uncompetitive tariffs," said Mani.“Rather than investing more in DFCs, railways should build more high-speed passenger corridors and upgrade existing lines to 120 km/h for passengers and 100 km/h for freight. This will reduce speed differentials and make freight movement more time-bound."

Also Read | Indian Railways is on a spending spree. It may ask govt for more monSubodh Kumar Jain, former member (engineering), Railway Board, is not convinced whether freight corridors are financially viable.

“The concept of a dedicated freight corridor has been abandoned-now it is called multi-tracking, which is quite different," said Jain.“The identified corridors do have freight potential, particularly due to the ports along the route. But the financial viability of the existing DFCs is itself unclear as the data is not in the public domain."

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment