Consumer Outlook 2026: Wages Up But European Consumers Still Won't Spend

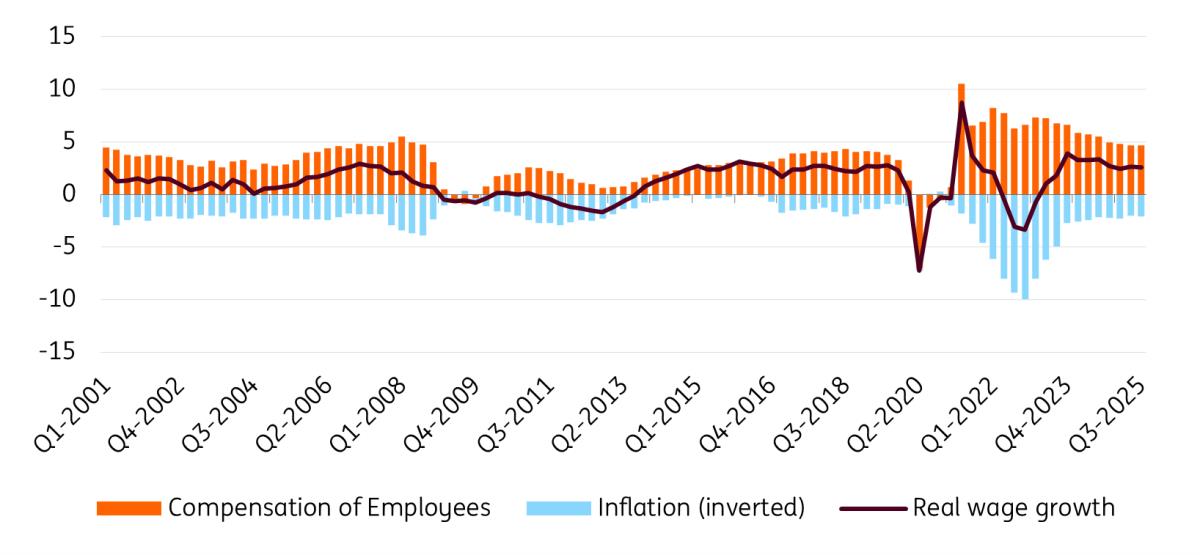

For households, 2025 marked another year of regaining purchasing power. Real wages in the eurozone grew by 2.6% on average. Differences were large, however. Countries with above-average wage growth were Italy, the Netherlands and Germany and, most notably, Spain, while Belgium and France saw much slower development of real wages. Throughout 2025, nominal wage growth has gradually slowed, while unemployment has remained at historically low levels. Looking ahead to next year, we expect unemployment to stay low, with nominal wage growth moderating further compared to this year.

Offsetting this, consumer prices are expected to rise slightly less than this year – just under 2%. The stronger euro, competition from Chinese imports and, most importantly, cheaper energy will all contribute to purchasing power growth next year. The growth in real wages will slow down versus this year, however. Should inflation undershoot – not our base case but still possible – real wages would benefit.

Strong real wage growth over the past two yearsReal wage growth for eurozone 20

Source: Eurostat, ING Research calculations Housing market looks good, but not for everyone

House price growth was solid across the eurozone in 2025 at about 5% on the back of strong wage growth and lower interest rates on new mortgages. Spain stood out here, with price growth of about 9%. Germany's house prices increased at a very sluggish pace. For next year, we expect a more moderate increase in house prices. First, wage growth is slower, and second, mortgage rates creep up somewhat as the yield on long-term rates rises.

Throughout this year, interest rates on outstanding mortgages have come down from last year, on average. There were large differences between countries, however, with Spanish and Italian households seeing a strong decline in the average interest costs compared to last year, while for Germans, French, Belgians and Dutch the interest paid still increased. For the latter countries, we expect to see average interest rates creep up, while we expect the downtrend in Italy and Spain to end.

Support for house prices comes from our expectation that the housing shortage will persist across the continent. Our outlook is mostly favourable for current owners: broadly stable interest costs and a positive wealth effect. For first-time buyers, the picture is less encouraging, as house prices are projected to outpace wage growth. This confirms our consumer survey results, which found that 59% of consumers do not consider housing affordable in their country.

Consumers remain downbeatConsumer confidence still stands at a low level, which is hard to explain when looking at economic growth, the jobs market and housing market. The sentiment has been linked to geopolitical uncertainty. The war in Ukraine hit the continent hard, leading to higher energy prices, increased security threats and the need to spend more on defence. Should there be an enduring peace agreement, this could lift sentiment.

We were wrong: European households savings peak continuesHousehold consumption did rise in 2025, but only modestly – up 1.2%, which is half the pace of real wage growth. There are noticeable differences across the continent: in Spain, household consumption increased strongly, on the back of higher real wages, lower mortgage costs and positive migration. In Italy and Germany, household consumption has been in stagnation ever since the Covid pandemic began.

Households now spend less than €0.85 of every euro earned. Apart from the pandemic period, the savings rate hasn't been this high in the past three decades. We, like many, had expected to see a gradual reduction this year. We were wrong; the ratio increased somewhat. Levels differ between countries (France, Germany and the Netherlands are above average, Spain, Belgium and Italy below), but for all the large countries, the savings ratio is well above the 2015-19 average of 12.6%.

A lack of spending slows down the economy. A normalisation to an average level would have a first-order effect of lifting GDP by about 1.5% and some estimate a much stronger positive effect on GDP.

Finding drivers: inflation eroded wealth and households expect much more to comeSo, whether the savings ratio will fall is a crucial question for the broader economy. A lot of work has been done to explain the high savings ratio. The first thing analysts pointed to is negative consumer sentiment, which has certainly played a role. However, some rightly point out that over the last couple of years, consumer sentiment has improved somewhat, while savings ratios went up, so sentiment can only explain part of the story.

Other analysts point to high interest rates as a driver. Specifically, household loan growth has been impacted and has grown much more slowly than nominal GDP since 2021. The housing market slowed, so households hardly took up new loans and paid down on existing ones. To a large extent, the high savings ratio was a low mortgage uptake ratio. However, interest rates have been coming down for two years, house prices are rising, and there has been a gradual pickup in mortgage loan growth – but none of this has moved the savings ratio.

A year ago we argued that households rarely immediately spend an increase in real income. That seemed reasonable then, but after two years of real wage growth, this reasoning hasn't aged well.

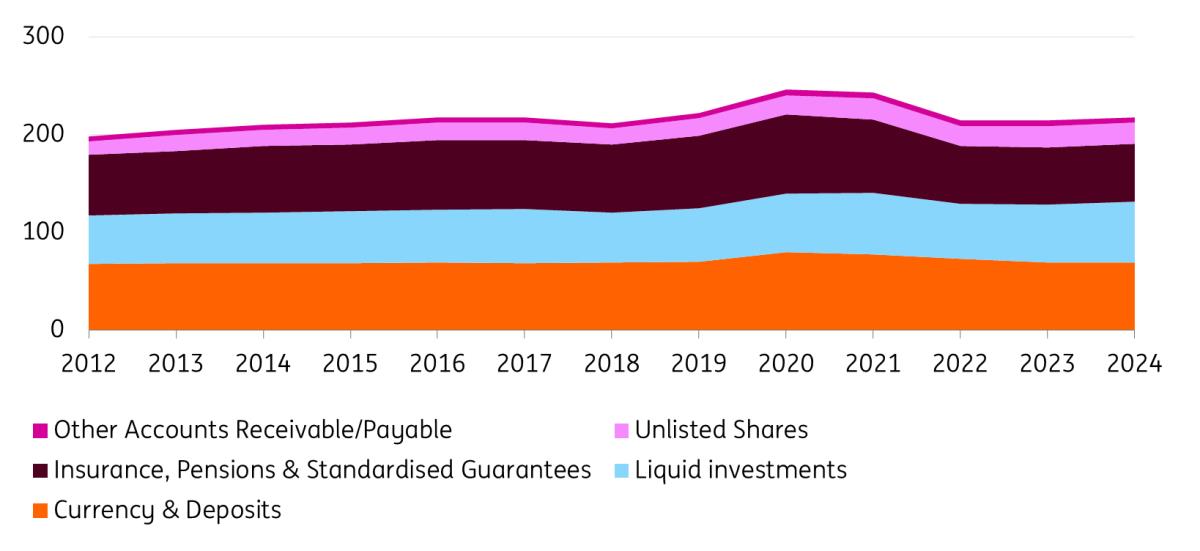

It leaves us with one remaining explainer: the desire to rebuild financial buffers. For eurozone households, the real value of their gross financial assets declined from about 250% of nominal GDP in 2020 to about 220% of GDP in 2024. Savings were high, but inflation was even higher and eroded the value of household wealth.

Households expect inflation to remain elevated. The median expectation in ECB surveys is 2.8% inflation in the coming year. The average expected inflation of 4.8%, however, points to a significant share of people mentally preparing for much higher inflation. These expectations have hovered around elevated levels for the last couple of years and – unlike all other possible drivers of high savings – have not shown a recent turn.

Eurozone households saw the value of their gross financial assets come downEuro area household assets, % of nominal GDP

Source: Eurostat, ING Research calculations Consumers expect to save even more to offset inflation

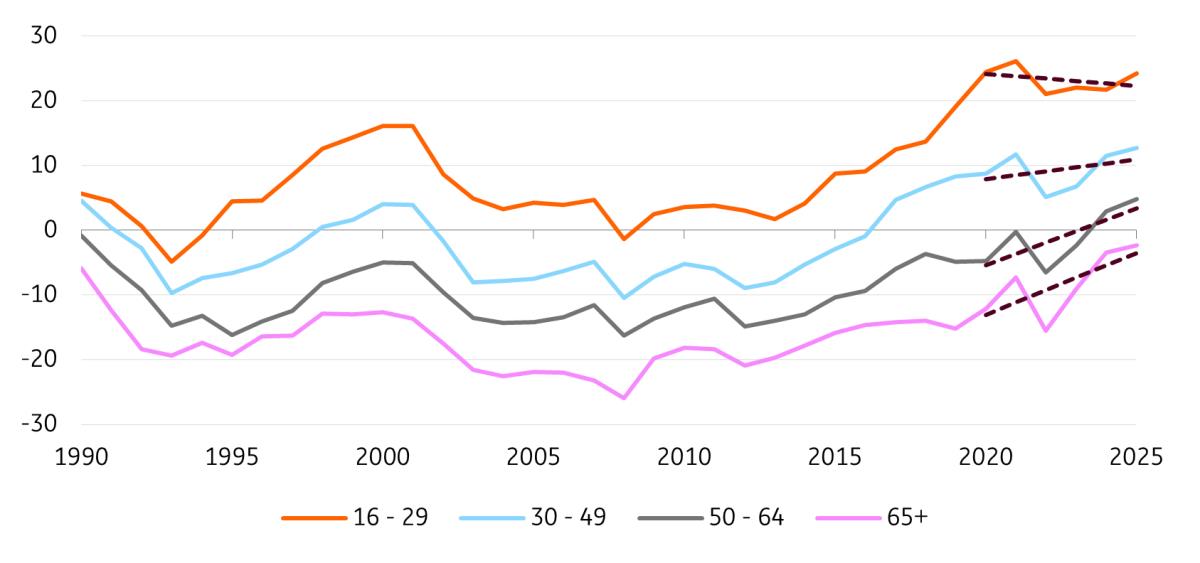

A related observation is that savings intentions have risen strongly over the last five years and are at a long-term peak (graph below). Over this period, savings intentions remained broadly flat for younger people, while there was a clear change in stance for those above 50. This coincides with their inflation expectations having gone up more over this period. All in all, it is likely that inflation's realised and expected erosion of financial buffers is driving European savings up.

There's never been a better time to saveThe difference between the percentages of respondents giving positive and negative replies when asked: 'Over the next 12 months, how likely is it that you will save any money?'

Source: European Commission, ING Research Data for 2025 is the average from Jan-Nov 2025 The real lesson comes from the US

What none of the above explains is the contrast with the US. Inflation expectations there are elevated, as they are in the eurozone. Interest rates remain high and consumers are similarly downbeat. Yet the US savings rate has been below historical norms and only recently returned to its long-term average of 5%. American households have consistently spent a much larger share of their income than their European counterparts.

An important difference between US and eurozone households is the extent to which they hold their financial assets in financial securities (listed shares, bonds, mutual funds and derivatives) versus in deposits. In the eurozone, securities were 90% of deposits in 2024, while in the US they were more than three times deposits.

Among large eurozone economies, three countries (Germany, France, the Netherlands) have below-average securities-to-deposits ratios (83%, 63%, 41%, respectively, in 2024). Belgium, Spain and Italy have securities-to-deposits ratios of 127%, 124% and 145%. For Germany, France and the Netherlands, the average savings ratio was 18.3%, while it was 12.5% for the other three eurozone countries. Differences within the eurozone and the comparison to the US indicate that relying on deposits rather than securities may be an important – mostly structural – driver of higher savings ratios.

A turn, maybe, but not in 2026Needless to say that the returns on securities are more volatile but, on average, higher than on deposits. Over the last five years, the return on eurozone bank deposits was about 1%, while the MSCI World returned 13.7% annually in euro terms. Had households invested a substantially larger share, their wealth would not have been eroded to the same extent. Europe is well aware of missed opportunities and is working on plans to support households when it comes to investing. But it's complex, and it's Europe, so it will take time.

Our outlook for 2026 remains another decent year for wages, jobs and homeowners. But this does nothing to solve a critical dilemma: even though it benefits neither households nor the broader economy, consumers are likely to view 2026 as another good year to keep saving – in the bank.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment