EUR Rates: Short End Settles As Rest Of The Curve Drifts Higher

Markets are increasingly convinced that the ECB's policy rate will remain at 2%, and we too have that as our baseline. Inflation is settling nicely and the growth outlook continues to show a careful but gradual recovery. When asked about the balance of risks, however, we still see a higher probability of more easing than a rate hike. While soft data is clearly improving, hard data, such as GDP growth, is still far from painting a more robust growth picture.

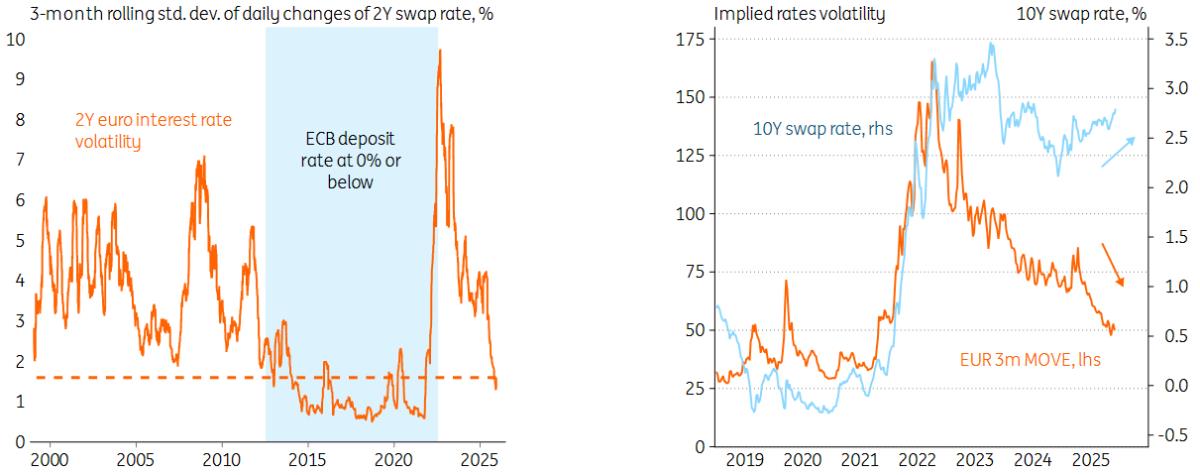

This is the first time the ECB has pulled off a soft landing, bringing us into uncharted territory. When we look at the 3-month rolling volatility of 2Y swap rates, we are now at levels which were only lower during the zero lower bound period pre-Covid. Implied volatility measures are also coming down rapidly, even while 10Y swap rates are on the rise. This suggests to us that markets are growing more comfortable with higher back-end rates.

Soft landing has brought about the lowest rates volatility since the zero lower bound

Source: ING, Macrobond

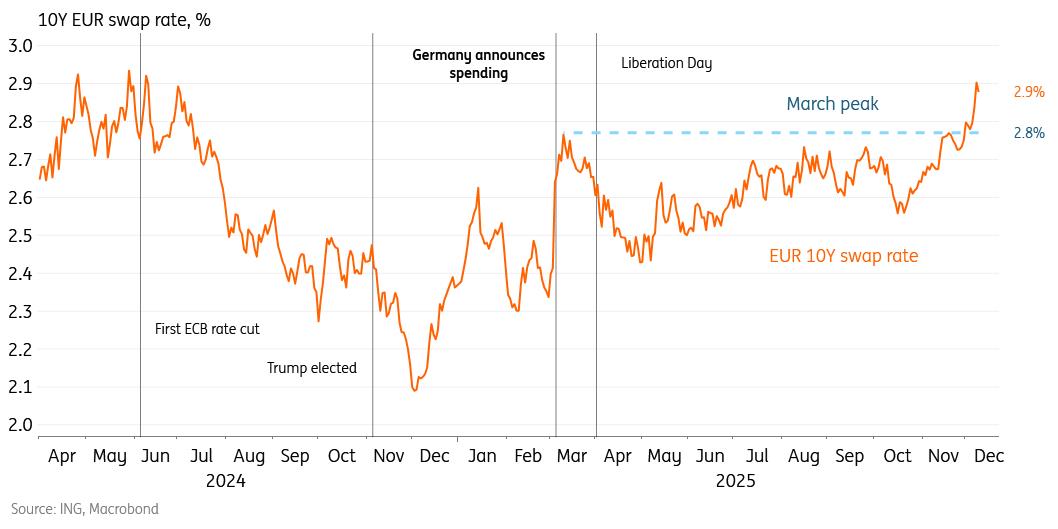

While the front end of the curve is well-anchored, we think longer-dated rates can still make a stretch higher from here. An important driver of this is Germany's spending ambitions, which target up to €1tr of additional spending over the next decade. Since the announcement in March, markets have already priced in significantly higher long-term growth expectations. The 10Y EUR swap rate has already passed 2.8% and we see 3% as the target for 2026.

German spending is a key theme for 2026, pushing 10Y swap rates higher

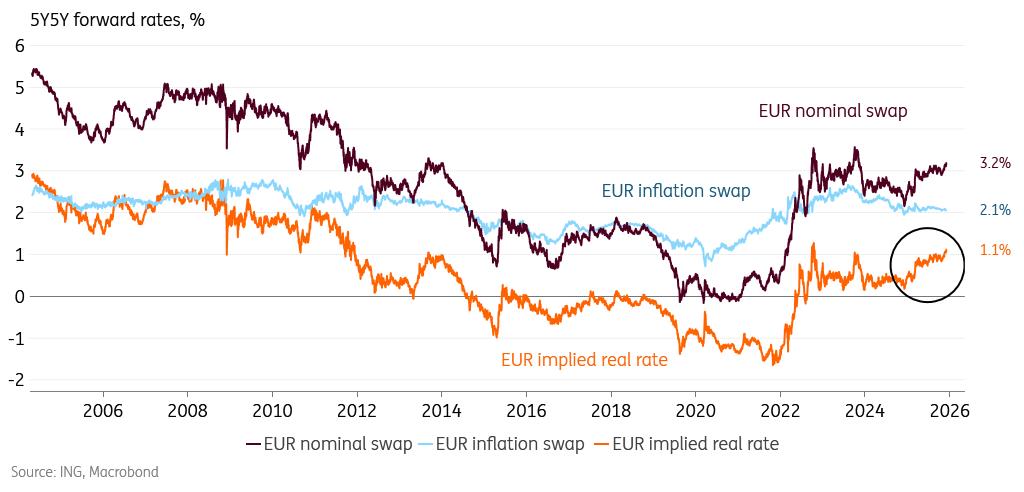

Real rates show that markets remain convinced about the improved long-term eurozone outlook, despite Trump's tariffs posing a drag on trade prospects. The 5Y5Y real rate rose from around 0.4% to above 1% over the course of 2025, which is much closer to our estimate of the long-run growth potential of the eurozone.

When zooming out, the potential for rates to rise further is still significant in our view. Before the euro sovereign crisis, the 5Y5Y real rate was anchored around 2%.

Long-run expectations have jumped, but remain low by historical standards

We don't think German spending ambitions will bring stellar growth numbers, but we do think the risk of returning to secular stagnation has drastically reduced. The additional fiscal impulse increases demand in the eurozone economy and, given tight labour markets, should also add to price pressures.

The chance of an ECB cutting below 1% has therefore come down significantly. With 10Y rates reflecting a probability-weighted average of all possible scenarios, the culling of this tail risk should help rates settle higher.

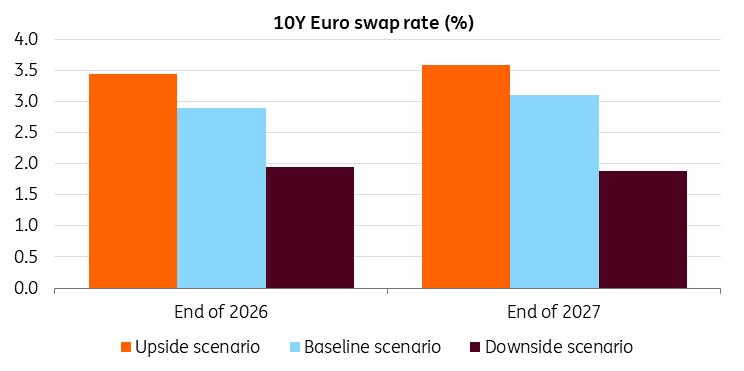

Risk is tilted to lower rates, but an upside scenario should not be discountedIf, however, growth was to stagnate and inflation fell below target, we would still eye an ECB cutting towards 1%. In this downward scenario, fiscal stimulus would fail to ignite growth and a recession would suddenly be back on the table for 2026. Besides cutting the policy rate, the ECB would call a halt to quantitative tightening, triggering a strong bullish reaction from the back end of the curve. The 10Y swap rate would fall back to 1.5-2%.

An upside scenario would see the ECB hike rates on the back of resilient growth and rising price pressures in the second half of 2026. By the end of 2027, the policy rate would be brought back up to 3%. Meanwhile, the back end of the curve would benefit from healthy risk sentiment, especially if the French political turmoil and Russia/Ukraine conflict find some relief. Together, these factors could push the 10Y swap rate as high as 3.6% in 2027.

The upside is limited, but a downside scenario can be drastic

Source: ING, Macrobond

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment