Dutch Pension Reforms Are Bumping Up Rates From The Long End

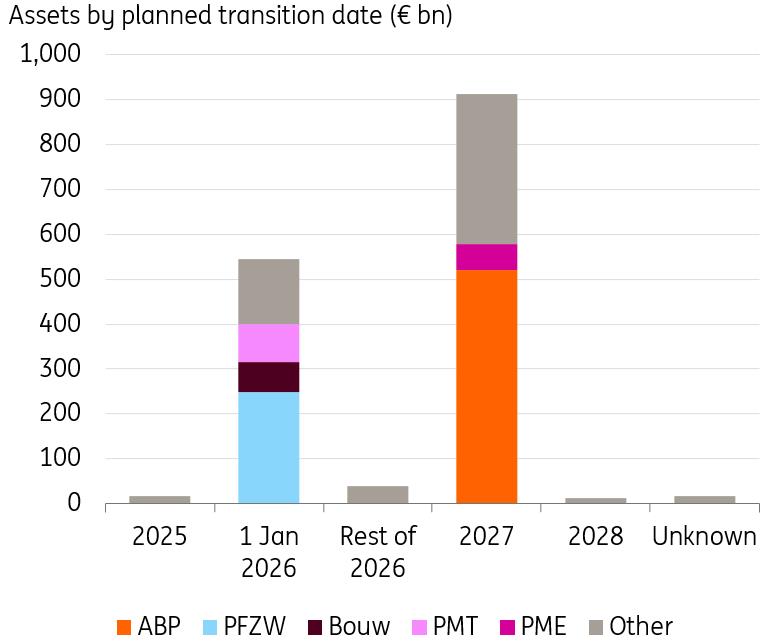

On 1 January 2026, around €550bn in assets will transition to a new pension system, which will trigger a significant unwind of longer-dated bonds and swaps. And with another ~€900bn assets planned to transition in 2027, we foresee a broader structural fall in the demand for longer maturities in euro fixed income. This means that 30Y rates should continue to feel upward pressure for the time being.

Fixed income with maturities of 30Y and beyond will see the largest unwinds, but for tenors shorter than 20Y we may actually see an increase in demand from Dutch pension funds. The reason is that the new system gives flexibility to hedge by age cohort. In effect, funds will choose to reduce the hedges for their younger participants (those with long maturities on their liabilities), whilst for older participants, funds may actually increase the hedging ratios (these have relatively shorter liabilities).

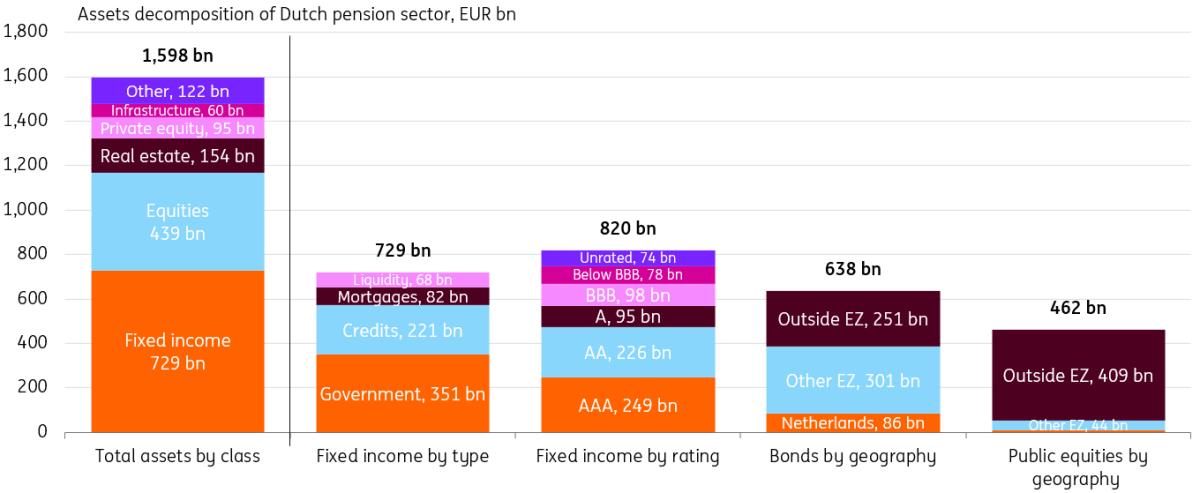

Besides the unwinding of fixed receiver swaps, we also expect a reduction of around €100bn in European government bonds (EGB). Currently, EGBs provide attractive duration and enjoy a zero percent risk weight for capitalisation purposes. The new regulatory framework no longer has such capital requirements, and the need for very long tenors will be reduced. As such, we think credits, including SSA, could see a net benefit from the reforms.

Government bonds make up a significant portion of Dutch pension funds' balance sheet

Source: ING, DNB

Currently, around €900bn of assets should transition in 2027, but we see a non-negligible probability that a material amount of this will be delayed to 2028. Most eyes will be on ABP, the largest fund with over €500bn in investments, accounting for around a third of the sector's total size.

In recent years, we have learned that delays are common, often caused by regulatory hurdles, IT issues, or administrative challenges. Some delays were announced as late as two weeks before the intended transition date. Markets are closely watching the progress of the major funds, with the 10s30s immediately jumping on headlines about PFZW's transition progress. As such, for 2026, we expect more long-end curve volatility around pension-related headlines, and we should pay particular attention to ABP mentions.

Around €550bn of assets are set to transition in January 2026

Source: ING, DNB, PensioenPro

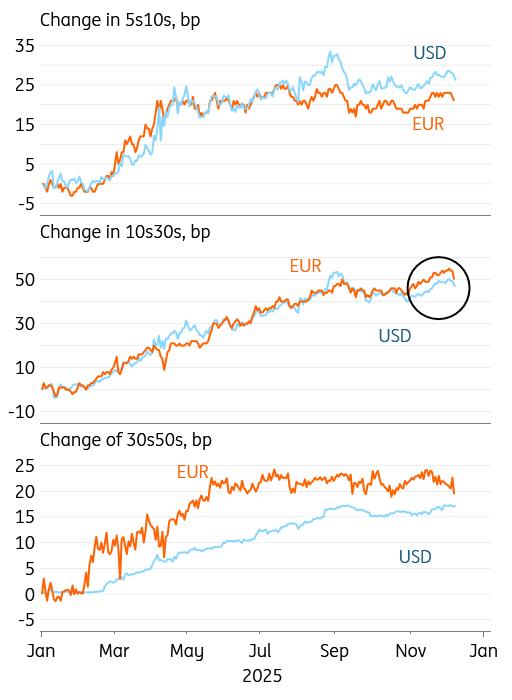

The volatility around pension-related headlines gives us a sense of the material market impact of the transition. When PFZW published its article on 2 October 2025 about its confidence in transitioning in January 2026, the 10s30s curve immediately steepened by about 2bp. Or earlier (20 May 2025), an important approval related to the reforms was passed through parliament, steepening the 10s30s that day by around 5bp.

It is important to note that these intraday jumps are driven by speculative flows, and a significant portion of the actual unwinds by pension funds should still occur in the years to come. Since the beginning of 2025, the 10s30s has only steepened by 5bp more than the US curve, suggesting most of the market moves so far have been macro-driven.

The 10s30s steepening can mostly be attributed to global drivers...but we identified some additional steepening at the end of 2025

Source: ING, Macrobond

Estimating the precise flows from funds is incredibly difficult, which means we expect increased volatility around transition dates. The flows will depend on market conditions, such as equity performance and each fund's transition strategies. This means we're particularly expecting increased volatility in January as market participants try to gauge the flows being realised. From swaption pricing, we can already see that, especially for 30Y tenors, the implied volatilities are relatively elevated.

If January flows disappoint, we could see an initial flattening in the 10s30s. Having said that, we do believe that the overall direction is still for steeper curves, as the broader supply picture also argues in favour of a higher term premium. This is a global theme, with the US, Japan, and the UK also bringing spillovers to the euro curve in the form of a higher term risk premium. We therefore think 30Y bond yields are still not close to reaching their new highs.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment