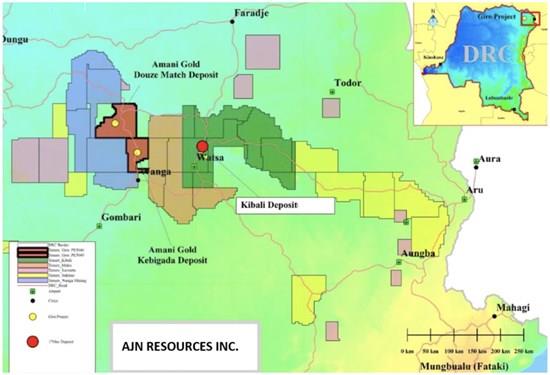

AJN Resources Inc. Signs Non-Binding Term Sheet To Acquire 55% Indirect Interest In Giro Gold Project

| Deposit | Class | Tonnes (Mt) | Au (g/t) | Au (Moz) |

| Kebigada | Measured | 32.9 | 1.08 | 1.1 |

| Indicated | 46.4 | 1.03 | 1.5 | |

| Inferred | 61.9 | 0.87 | 1.7 |

Note that information disclosed from adjacent properties is not necessarily indicative to the mineralization on the Giro Gold Project. The mineral resource estimates disclosed herein were prepared in accordance with the JORC Code (2012). The JORC Code uses the terms Measured Resource, Indicated Resource and Inferred Resource, which are broadly comparable to the CIM Definition Standards (2014) used in NI 43-101. However, the categories are not identical. Under CIM definitions, a Mineral Resource must demonstrate "reasonable prospects for eventual economic extraction" and meet specific confidence thresholds in geology and grade continuity. While JORC and CIM share similar intent and hierarchy among resource categories, differences exist in the underlying reporting requirements, minimum standards, and expectations of modifying factors. The Company considers the JORC estimate to be an historical estimate and has not completed sufficient work to classify the estimate as a current CIM-compliant mineral resource. The Company is not treating the historical estimate as a current mineral resource.

Douze Match Deposit:

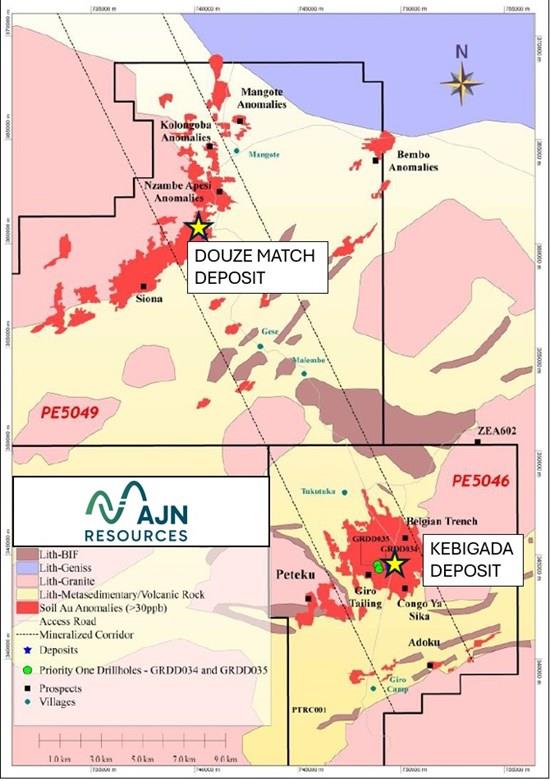

Mineralisation at Douze Match occurs within a north-east trending mineralised corridor of around 2.6km length and up to 600m width. This mineralisation is from surface down to depths exceeding 190m. Douze Match occurs within a 6km x 2.5km gold-in-soil anomaly, with artisanal mining in the area possibly highlighting more exploration potential5.

Table 2 - Douze Match Mineral Resources - H&SC 2018 Resource Evaluation

| Deposit | Class | Tonnes (Mt) | Au (g/t) | Au (Oz) |

| Douze Match | Indicated | 2.2 | 1.2 | 84,879 |

| Inferred | 5.8 | 1.2 | 227,631 |

Historic mineral resource estimates6 of 84,879 oz at 1.2g/t Au (JORC 2012 Indicated) were defined by H&S Consultants Pty Ltd (H&SC) on the Douze Match target at Giro. The Douze Match location is shown in Figure 1.

AJN believes that the above mineral resource estimates were completed according to industry standards and that the resource categorizations defined in (a) the technical report compiled by H&S Consultants Pty Ltd (H&SC), "Mineral Resource Estimate for the Kebigada Deposit, Haut-Uele Province, DRC - March 2020" and (b) the technical report compiled by H&S Consultants Pty Ltd (H&SC), "Resource Estimation of the Douze Match Deposit- December 2018," both of which were prepared for Amani Gold Limited, are in line with NI 43-101 standards in that to the extent known all key assumptions, parameters, and methods were used to prepare the historical estimates. It is also AJN's opinion that the resource work is both reliable and relevant. Further work recommended for AJN at Kebigada and at Douze Match in regards to verifying and upgrading the resources would be to review the drill and related QC data in greater detail, duplicate informing sample data by perhaps twinning holes, re-assaying remaining sample material, analysing laboratory pulps and coarse rejects, and increasing the sample support by closer spaced drilling. No QC data was available for review by the qualified person and H&SC performed no data review as part of their scope of work. It is the qualified person's opinion that there is potentially a significant risk associated with the lack of QC analysis and that AJN should dedicate resources to reviewing this issue. The qualified person has not done sufficient work to classify the 2012 resources as current and AJN does not consider this resource work as anything but a historic resource.

Non-Binding Term Sheet:

Pursuant to the non-binding term sheet, which was fully-signed on December 1st, 2025, AJN can purchase, from Amani Consulting, a 55% registered and beneficial interest in Giro Goldfields ( Giro Interest ) through the issuance of 250,000,000 common shares in its capital to Amani Consulting or its nominee(s). Giro Goldfields holds a 100% registered and beneficial interest in the Giro Gold Project. Amani Consulting, Giro Goldfields and Mabanga are all arm's length to AJN. The Parties have agreed to negotiate in good faith a purchase agreement to more fully document the arrangements, which are the subject of the non-binding term sheet. If and when such a purchase agreement is signed, the Company's shares will be halted and will remain halted until after the closing of the transaction. Upon closing of the purchase of the Giro Interest by AJN ( Closing ), AJN will reconstitute its board of directors to increase the number of directors from four (4) to five (5), of which three (3) will be representatives of Amani Consulting, which representatives will be elected or appointed to AJN's board of directors. Upon Closing, this transaction will constitute a change of control as defined in CSE Policy 1.3(2). AJN will be granted an option to acquire the remaining 10% interest held by Amani Consulting in Giro Goldfields by either (a) paying US$30 million to Amani Consulting within 12 months of the Closing, or (b) paying US$50 million to Amani Consulting within 24 months of the Closing. Closing will be subject to certain conditions precedent including satisfactory due diligence by AJN, Amani Consulting and Mabanga, and receipt of all necessary approvals including board approval, and any shareholder and regulatory approval required to be obtained by AJN.

Change of Name:

The Company has received approval from the British Columbia Registrar of Companies for the Company's proposed new name Giro Gold Corporation and has obtained new ISIN and CUSIP numbers for this name. Subject to Canadian Securities Exchange approval, the name change will be implemented imminently.

Finders' Fee Shares:

The Company has issued 666,666 common shares to each of three finders, for a total of 1,999,998 shares, pursuant to three finder's fee agreements each dated November 10, 2025. The shares were issued pursuant to an introduction by the finders to the holders of a mineral exploration property and are restricted from trading until March 22, 2026.

Private Placement Offering:

The Company also announces a non-brokered private placement offering of up to 3,000,000 units in the capital of the company at a price of 16.5 cents per unit for gross proceeds of up to $495,000. Each unit will be comprised of one common share and one share purchase warrant, where each warrant will entitle the holder to purchase one additional common share at an exercise price of 25 cents per warrant share for a two-year period. Proceeds from this private placement will be used for technical, legal and financial due diligence on Giro Goldfields and on the Giro Gold Project; negotiation, preparation and closing of a purchase agreement; and mineral exploration activities on the Project.

Stock Option Grants:

The Company also announces that it has granted a total of 3,000,000 incentive stock options ( Stock Options ) to consultants in accordance with AJN's omnibus equity incentive compensation plan. These Stock Options have a five-year term, an exercise price of $0.25 per common share and vest immediately.

Restricted Share Units:

The Company also announces that it has issued a total of 6,300,000 restricted share units ( RSUs ) to directors and consultants of the Company in accordance with AJN's omnibus equity incentive compensation plan.

QP Statement

Mr. Dylan le Roux (BSc Hons in Earth Science) is an independent consultant of AJN Resources Inc. and a qualified geologist. Mr. le Roux is a registered Professional Natural Scientist (Geological Science) with the South African Council for Natural Scientific Professions (SACNASP Reg. No. 155814). Mr. le Roux is a qualified person (QP) under NI 43-101 and has reviewed and approved the scientific and technical information contained in this news release.

About AJN Resources Inc.

AJN is a junior exploration company. AJN's management and directors possess over 50 years of collective industry experience and have been very successful in the areas of exploration, financing and developing major mines throughout the world, with a focus on Africa.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment