AMD's MI308 Chips May Face H20‐Like Headwinds In China

The move positions AMD's MI308 to re-enter a tightly controlled market even as Beijing continues probing Nvidia's comparable H20 chip for alleged“back doors” or remote‐control vulnerabilities.

The announcement landed amid a surge of investor enthusiasm for Chinese chipmakers, underscored by Moore Threads Technology's blockbuster debut on Friday, when its shares quadrupled on listing. The contrast between US export‐compliant hardware and China's accelerating domestic momentum is sharpening competitive expectations across the sector.

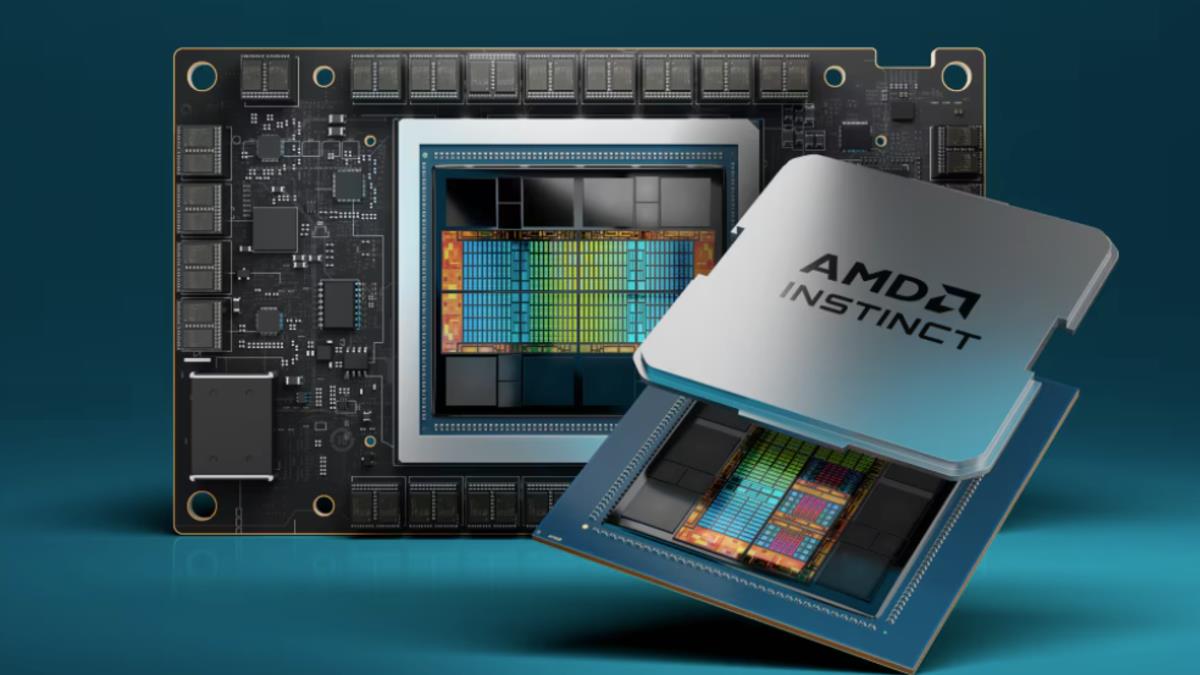

Image: PanDaily

On Friday, the shares of Moore Threads, an AI chipmaker referred to as China's Nvidia, surged 425% in its Shanghai trading debut after raising 8 billion yuan (US$1.13 billion), marking the most significant first‐day jump for a major IPO since China's 2019 reforms. The retail tranche drew extraordinary enthusiasm, oversubscribed roughly 2,750 times even after a clawback mechanism was triggered.

The performance eclipsed Semiconductor Manufacturing International Corp (SMIC)'s 202% leap in 2020, setting a new benchmark for offerings above the US$1 billion threshold.

At a regular press briefing on Friday, Foreign Ministry spokesperson Lin Jian reiterated Beijing's stance of opposing US chip export controls when asked whether China was willing to buy AMD's newly approved MI308 chips.

“China has made clear its position more than once on the US export of chips to China. We hope the US will take concrete actions to keep the global industrial and supply chains stable and unimpeded,” he said.

Latest stories

Free and Open Indo-Pacific 4.0 under Prime Minister Takaichi?

India's warm welcome for Putin sends a cold message to Washington

Is Trump's foreign policy really 'America First'?

Despite Washington's green light for the export of AMD's MI308 chips to China, Chinese analysts remain unconvinced that the US AI chipmaker will secure meaningful upside. They argue that MI308 shipments will be treated no differently from Nvidia's H20, facing the same policy‐driven squeeze that prioritizes homegrown AI chips and constrains foreign suppliers' long‐term market prospects.

“Even with an export license, AMD's so‐called advantage is merely superficial. Like Nvidia, it remains structurally disadvantaged in a policy‐driven market,” says a Jiangsu-based columnist, who claims to be a software engineer for a Chinese robotics firm called Fortucky.

He says AMD's MI308 chips are subject to explicit performance ceilings, making them unsuitable for training large language models such as ChatGPT. In his view, MI308's role in China will lean toward inference tasks, targeted vertical AI applications and a relatively small slice of research and development environments. He says the US still blocks anything that could materially advance frontier AI training, explaining:

Beijing's long-term planIn April, Washington banned exports of both Nvidia's H20 and AMD's MI308 chips to China on national security grounds. The H20 is a downgraded version of the H100, while the MI308 is slower version of the MI300. They were explicitly engineered to comply with US Commerce Department export‐control thresholds.

The US restrictions effectively limited Nvidia's and AMD's utility for advanced AI development, positioning them in China as lower‐tier alternatives rather than strategic compute assets.

After US and Chinese officials met in London on June 9, Washington agreed to resume shipments of Nvidia's H20 in exchange for Beijing's restoration of exports of rare earth minerals to the United States. But optimism was short‐lived. On July 31, the Cyberspace Administration of China (CAC) said it had summoned Nvidia over security risks associated with the H20 chip and subsequently issued notices discouraging domestic firms from deploying it.

Chinese commentators later drew sharper analogies to describe the risks of relying on US hardware. In mid‐July, several pundits likened the use of Nvidia's H20 to drinking“poisoned wine,” which can quench a person's thirst for now but kill him in the long run. They argued that while foreign AI chips can offer an immediate performance boost, over‐reliance on them would stunt the growth of China's domestic semiconductor ecosystem and delay the development of a self‐sustaining AI stack.

Last month, when US officials reportedly considered allowing the export of Nvidia's more powerful H200 chips to China, Chinese media warned that these AI processors would act as“sugar‐coated bullets.” They said the H200 chips may look appealing, but relying on them could again slow the development of China's own AI chip industry.

It remains unclear whether Beijing will take the same tough line against AMD, through either new restrictions or a potential anti‐dumping probe targeting the MI308.

A Shanghai‐based writer using the pen name“Moha Yecheng” says if MI308 shipments do not significantly disrupt China's supply-and-demand balance, there could be room for both competition and cooperation between the US and Chinese chip sectors to develop in parallel.

A Guangdong-based writer using the pseudonym“Zhezhonglun” warns that Washington's approval of MI308 exports may be part of a broader strategy to slow the rapid adoption of Huawei's Ascend 910B chips in China.

Sign up for one of our free newsletters

-

The Daily Report

Start your day right with Asia Times' top stories

AT Weekly Report

A weekly roundup of Asia Times' most-read stories

He notes that during the period when Washington banned H2O exports between April and July this year, Huawei's Ascend 910B had jumped from 12% market share to 37%. He says the absence of Nvidia's chips in China might be a good thing, as it also prompted Chinese buyers to consider chips from Kunlun, MetaX and Moore Threads.

“Cloud service providers may still favor Nvidia for its CUDA ecosystem,” he says, using the acronym for compute unified device architecture,“while financial institutions and government departments are more likely to stick with domestic chips. Large companies may use Nvidia chips for performance and local chips for compliance. Small firms might choose domestic options outright to avoid future uncertainty.”

Read: Is Canon's factory closure tied to strains in China-Japan ties?

Follow Jeff Pao on Twitter at @jeffpao3

Sign up here to comment on Asia Times stories Or Sign in to an existing accounThank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.

-

Click to share on X (Opens in new window)

Click to share on LinkedIn (Opens in new window)

LinkedI

Click to share on Facebook (Opens in new window)

Faceboo

Click to share on WhatsApp (Opens in new window)

WhatsAp

Click to share on Reddit (Opens in new window)

Reddi

Click to email a link to a friend (Opens in new window)

Emai

Click to print (Opens in new window)

Prin

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment