Low Czech Inflation Bolsters Odds For A Future Rate Cut

Czech annual inflation eased noticeably, and against expectations, to 2.1% in November, according to a preliminary estimate. The headline figure dropped even below the Czech National Bank (CNB) estimate of 2.2% year-on-year for November. Consumer prices shaved 0.3% month-on-month, predominantly driven by a drop in processed food prices. At the same time, overall prices of goods declined noticeably from the previous month, which may contribute to lower core inflation in November. That said, annual price growth in services remained unchanged at an elevated 4.6% in November. Core inflation likely eased to about 2.7% YoY in the same month.

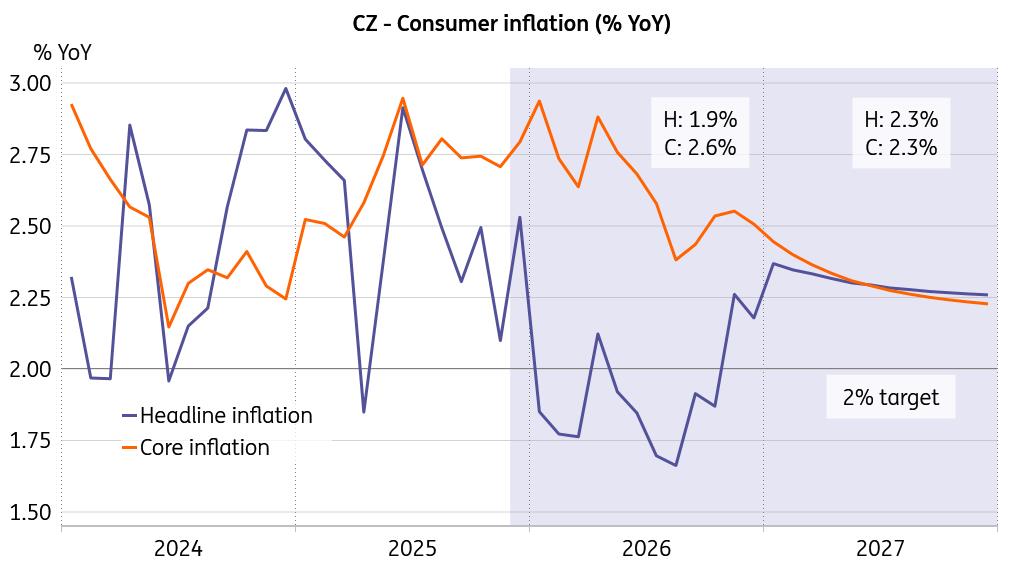

Inflation set to slide below the target

Source: CNB, ING, Macrobond

The average nominal wage added 7.1% YoY in the third quarter, coming in only marginally stronger than the CNB had expected. When adjusted for inflation, wages increased by 4.5% from a year earlier, suggesting that households have ample resources to carry on with solid spending.

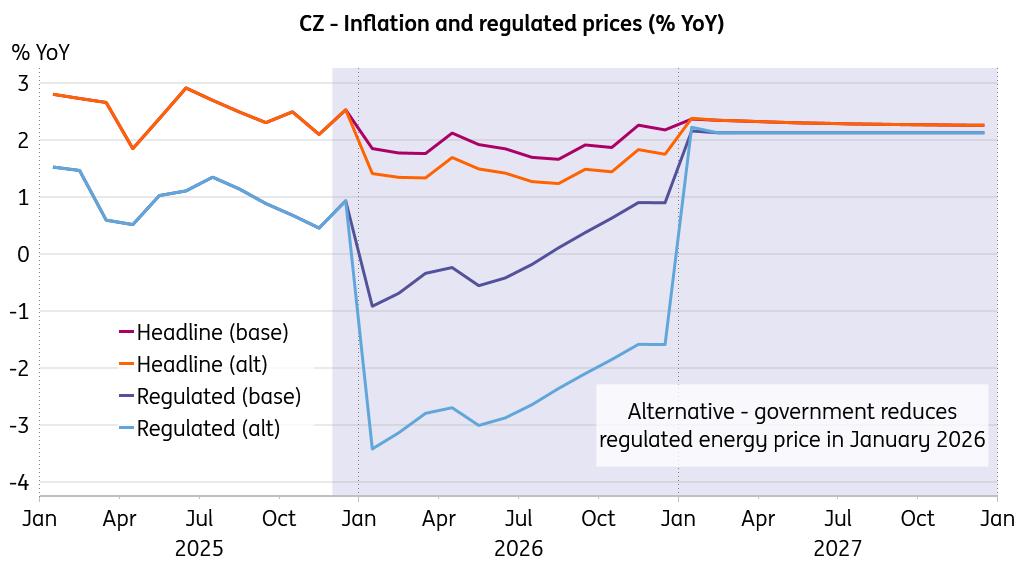

Ample discretionary purchases are about to provide solid ground for price dynamics in the service sector. However, taking into account the announced reductions in electricity and natural gas end prices in January, headline inflation is set to hover just below the target over the next year. Should the government proceed with the suggested reduction in the regulated part of energy prices, headline inflation would fall well below the target in 2026, raising the odds of a rate cut should economic performance not meet expectations for whatever reason.

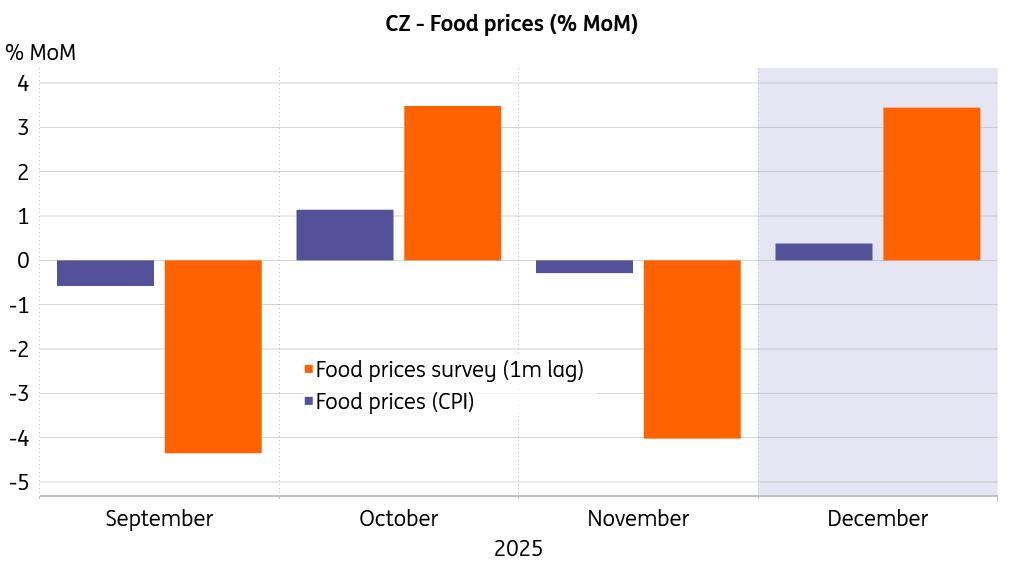

Below-target headline inflation next year favours a cutIn our inflation forecast, we partially compensate for November's negative surprise in processed food prices. When taking the extremely volatile food price survey that lags by one month, we see a good overlap in direction with the zigzagging food prices over the past few months. The lagged food prices survey, weighted equally, suggests that food prices should increase in December. At the same time, there is significant uncertainty due to possible Christmas discounts in the food segment, so we only partially offset the previous drop. Still, November's lower food prices bring the annual comparison down for almost the entire next year, pushing the headline rate downward as well.

Food prices are full of surprises

Source: CZSO, ING, Macrobond

Combined with the announced decreases in electricity and natural gas prices, this would bring headline inflation below the target for most months of the following year, averaging 1.9%. We still don't have enough clarity about when the new government will proceed with the planned reduction in the regulated part of energy prices, yet if applied from January, it would shave 0.3ppt to 0.4ppt from headline inflation, slashing it ultimately to 1.5% on average.

Winter is coming for regulated prices

Source: CZSO, ING, Macrobond

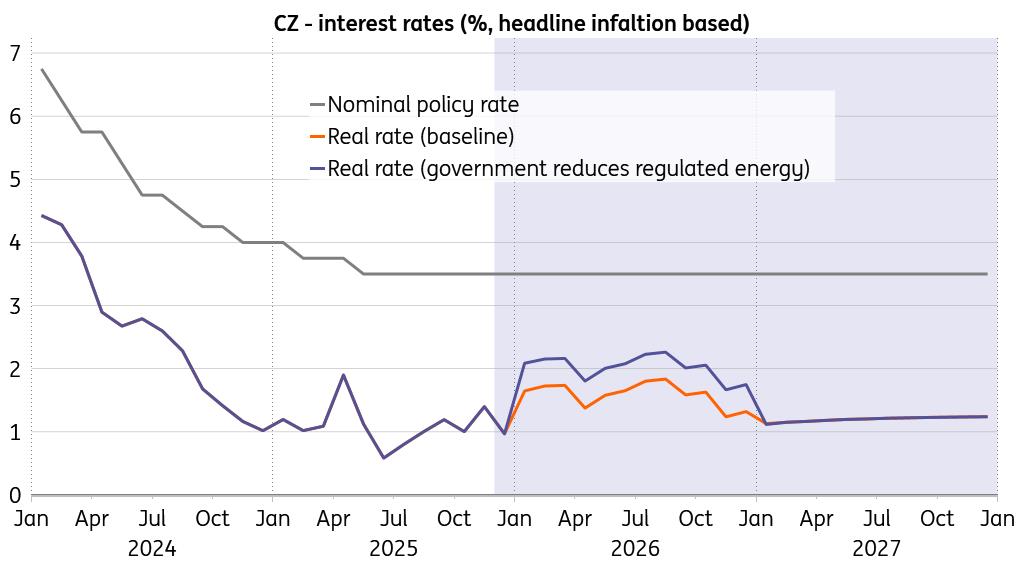

Indeed, an average real interest rate of 2% might be a little bit on the upside, should the base rate remain at 3.5% over the upcoming year. That said, the relaxed household budgets would free up extra resources for discretionary spending, so we expect this effect to keep the core inflation rate elevated at above 2.5% for most months of the year, averaging 2.6%.

Core inflation will be supported by relaxed budgetsAs we see a likely trade-off between zero or negative dynamics in regulated prices and core inflation, there is a risk that the core rate could get punchier as the year passes by. There will be two counter effects at play, namely i) the lower energy prices rippling through the economy, and ii) the positive budget effect supporting discretionary spending. The strength of both also depends on the position of the economy is the business cycle. We expect the output gap to turn positive in the second quarter of 2026, which could help the income effect to dominate.

Real rates a little bit on the high side

Source: CNB, ING, Macrobond

So, November's low inflation print and the outlook for a below-target headline rate clearly increase the odds of a rate cut, especially if the economy does not perform as expected for whatever reason. At the same time, the CNB will not be in haste as long as core inflation hovers above 2.5% and may wait to see how the potential price level trade-offs play out.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment