Falling Turkish Inflation Strengthens Case For A December Rate Cut

November CPI inflation was 0.87% month-on-month, coming in lower than the consensus estimate and our call of 1.3%. This was mainly due to unprocessed food and some non-food groups. As a result, annual inflation has maintained its downtrend with a further decline from 32.9% to 31.1%. While inflation rose by 2.2% in November 2024, the five-year average for November in the 2003-based index was just 2.8%. This suggests a strong base effect, reinforcing the continued decline in annual inflation.

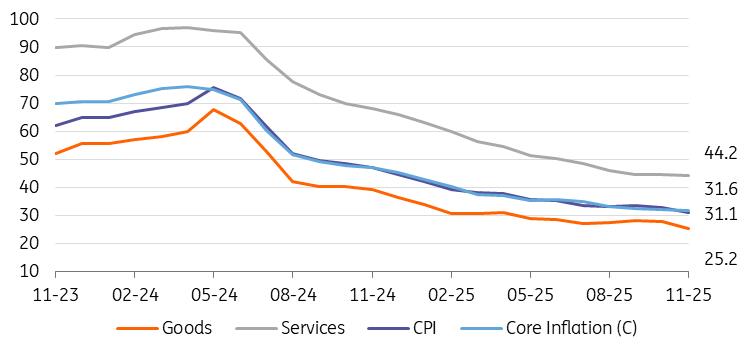

Core inflation (CPI-C) rose by 1.2% MoM, bringing the annual rate down to 31.6% on the back of a large base in 2024, modest nominal TRY depreciation, in addition to a slower pace of increase in the PPI that keeps costs for producers under control. In November, the PPI increased by 0.84% MoM, while a significant portion of the monthly change is attributable to coke and refined petroleum products as well as basic metals.

Annual producer inflation inched up to 27.2% YoY, remaining on a gradual uptrend since April. However, the current level of PPI inflation indicates that cost pressures remain moderate as the FX basket showed only a very limited average increase of 0.7% MoM in November and its cumulative increase over the last 12 months remained at around 28.0%.

Preliminary seasonally adjusted data, set to be published by TurkStat and closely monitored by the Central Bank of Turkey (CBT), indicate, in three-month moving average terms, that the underlying inflation trend is likely to improve, driven by goods, while remaining elevated in services.

Inflation outlook (%)Core = CPI excluding energy, food & drinks, alcoholic beverages, tobacco, gold

Source: TurkStat, ING

A breakdown of the data shows:

-

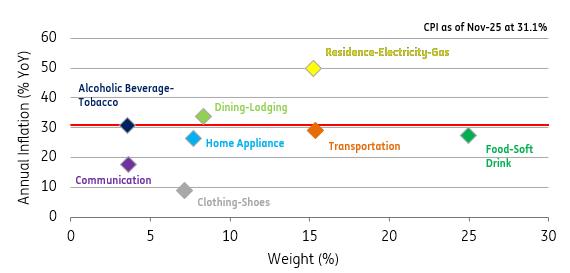

The housing group made the largest contribution to monthly inflation (0.29ppt) driven by rents and coal prices, while a decline in electricity prices limited the monthly change. Another issue worth mentioning is the continuing momentum loss in rent inflation after large increases in recent months.

This was followed by transportation with a 0.27ppt impact on the headline, thanks to pressure on transportation services and a hike in petrol prices.

The food group, however, determined the monthly outlook, pulling the headline down by 17bp. The price increase in processed food has remained close to the level in November 2024. However, unprocessed food turned out to be one of the factors driving lower than expected headline inflation, with a large 3.3% price decline vs 9% increase in the same month of 2024. Annual food inflation plunged to 27.4% (from 34.9% a month ago) vs the CBT's assumption for this item at 32.3% for this year.

As a result:

-

Goods inflation fell to 25.2% YoY, while core goods inflation also improved to 18.6% YoY.

Services inflation recorded a slight decline and stood at 44.2% YoY, its lowest level since early 2022. But it is still elevated, showing the extent of inertia.

Source: TurkStat, ING

Overall, inflation has remained on a declining path, and we anticipate that the annual inflation rate could be around 31% by the end of 2025.

While the November inflation data should encourage the central bank to remain on its easing path, the latest 3Q GDP data and early indicators for the last quarter imply less supportive demand conditions for the disinflation process, increasing upside risks to the inflation outlook with the ongoing rate cut cycle and easing financial conditions.

Accordingly, the central bank will likely remain cautious with a measured 100bp cut in the December MPC, in our view, though we should not rule out the possibility of a larger hike.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment