Corporate Funding Rebounds In Sep Quarter, Driven By Higher Profits And Bank Credit

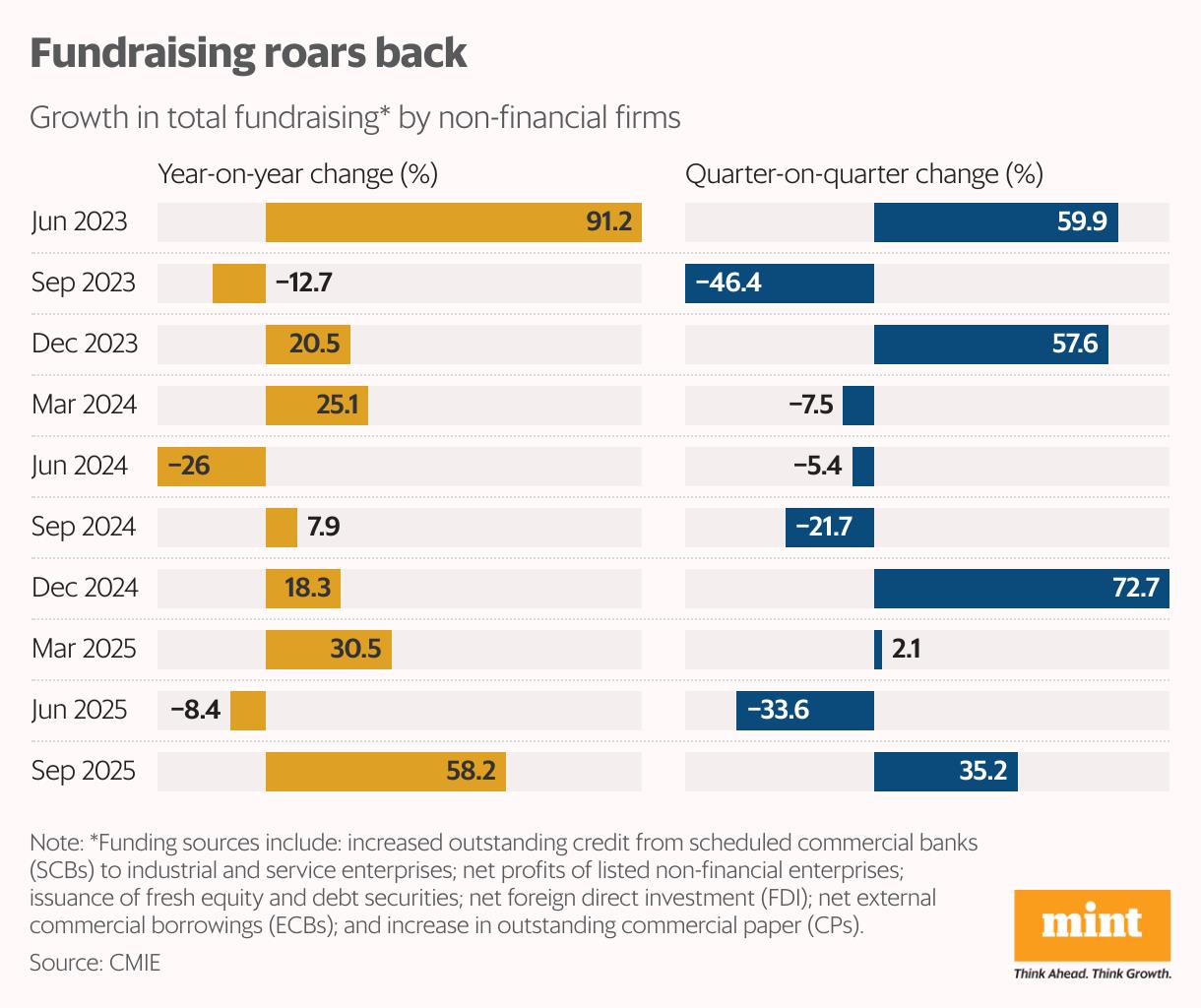

Corporate fundraising activity saw a significant revival in the September 2025 quarter. After a sluggish June quarter, which saw an 8.4% year-on-year decline, non-financial enterprises ramped up fundraising between July and September. According to data compiled by the Centre for Monitoring Indian Economy (CMIE), this period saw growth of 58.1%-the fastest pace since June 2023. Total funds raised during the quarter was estimated at ₹7.5 trillion, up from ₹5.6 trillion in the preceding quarter.

The analysis considered various funding sources, including:

- increased outstanding credit from scheduled commercial banks (SCBs) to industrial and service enterprises, net profits of listed non-financial enterprises, issuance of fresh equity and debt securities, net foreign direct investment (FDI), net external commercial borrowings (ECBs), and increase in outstanding commercial paper (CPs).

On a sequential basis, too, funding jumped 35% against a contraction of nearly 34% in the previous quarter. This stellar performance was especially significant as it shattered a recent pattern. The July-September period has typically been a drag, lacking momentum both yearly and sequentially over the last two years for which the data was available. All eyes are on the next quarter to see if this momentum can be sustained.

Divam Sharma, co-founder and fund manager at Green Portfolio PMS, said domestic macro indicators continued to hold firm, which lifted the confidence of both issuers and investors. Visibility around consumption and broader economic activity also stayed healthy, he said.“This created a more enabling environment across multiple sectors, leading to a recovery that was fairly broad-based after a softer June quarter."

Where did the funds come from?Net profits remained elevated and continued to be the top source of funding in the September quarter. Non-financial companies recorded a massive ₹3 trillion in net profits, which accounted for nearly 40% of all funds raised. Profits rose 54.5% year-on-year, marking the strongest growth in four years.

“The rise in internal accruals reflects a phase of strong profitability, enabling companies to rely more on their own cash flows to fund operations and expansion," Sharma said.

This strategic preference for internal accruals suggests companies are committed to remaining relatively light on debt. They are expected to continue using internal accruals as their primary source of financing, ensuring their balance sheets remain robust and unburdened, experts said.

Also Read | Cross-border payment platforms chase growth with RBI's licenThis partly explains why bank credit took a backseat in the previous quarter. Outstanding bank credit to enterprises actually declined by ₹0.4 trillion in the June quarter, the data showed-meaning companies repaid more than they borrowed. This was a rare occurrence, last seen in September 2021.

However, banks quickly regained their appeal in the September quarter. Net borrowing surged to a substantial ₹2.4 trillion, playing a significant and necessary role in powering the overall corporate funding rebound. Bank credit accounted for about 31 % of total funds mobilised by non-financial enterprises in the quarter.“Bank credit has picked up as businesses are entering this cycle with cleaner, less leveraged balance sheets, which has opened room for fresh funding," Sharma said.

Meanwhile fresh equity issuances, another key source of funding, remained subdued. Companies raised just ₹0.4 trillion this way – a 42% decline from a year ago. Private placements, which had already slowed in the previous quarter, continued to weigh on overall mobilisation, the data showed.

The fourth major source of funds was issuing debt securities, through which firms mobilised ₹0.7 trillion. This represented a strong 42.6% year-on-year increase, though it was slightly lower than the amount raised in the preceding quarter.

Also Read | Fashion tech firms struggle for a funding fit despite AI makeoForeign direct investment (FDI ) remained a strong funding source, contributing 11% of total funds mobilised in the September quarter. Net FDI inflows touched ₹0.9 trillion in the quarter, down from ₹1.2 trillion in the preceding quarter.

Separately, companies' reliance on market debt weakened. Companies tapped international markets, with net external commercial borrowing (ECB) estimated at ₹0.3 trillion in the September quarter (as per CMIE estimates). ECB inflows have remained muted this fiscal year, mainly because domestic lending rates have eased even as the rupee has weakened sharply. Funds raised through commercial papers (CPs), a short-term source, also contracted sharply following a strong June quarter, the analysis showed.

Overall, mobilisation through both ECB and CPs accounted for less than 10% of total funding, with both instruments falling short of levels recorded in the previous year.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment