403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

EUR/USD Analysis Today 02/12: Euro Trading Higher (Chart)

(MENAFN- Daily Forex) EUR/USD Analysis Summary Today

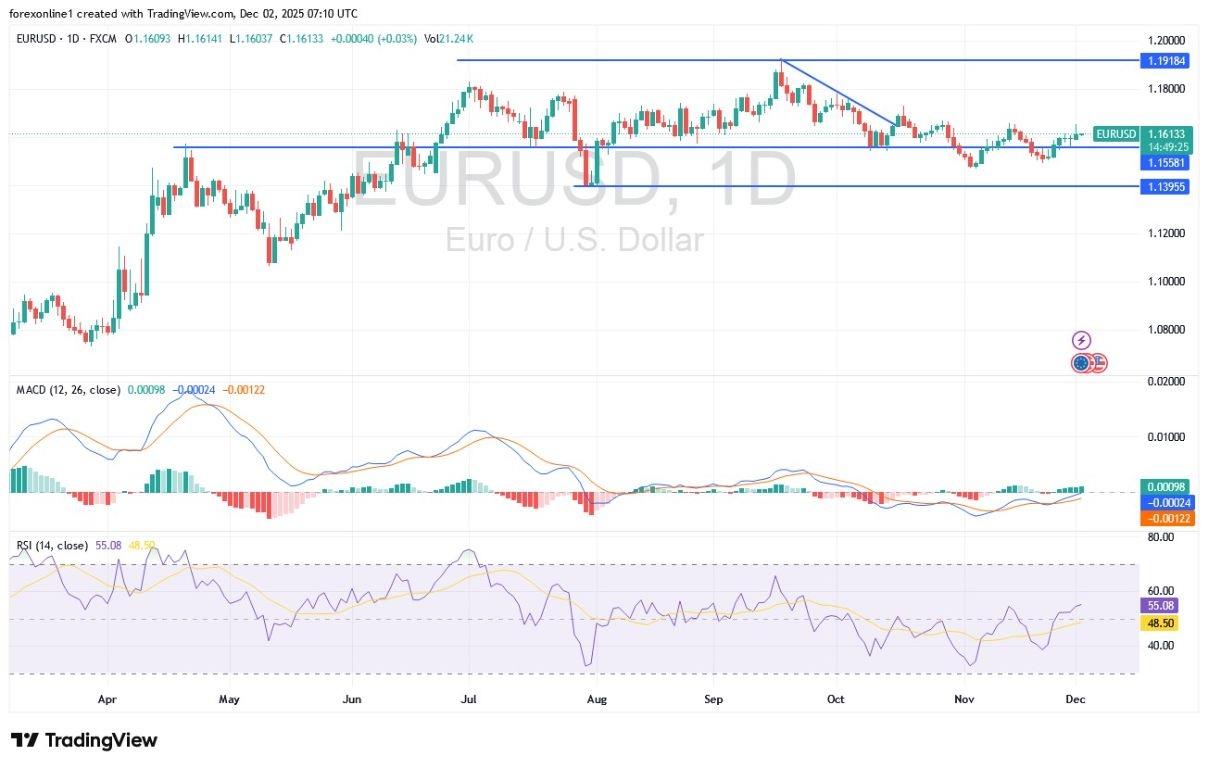

- Overall Trend:: Neutral. Support Levels for EUR/USD Today: 1.1565 – 1.1480 – 1.1400 Resistance Levels for EUR/USD Today:: 1.1670 – 1.1740 – 1.1830

- Buy EUR/USD from the support level of 1.1520 with a target of 1.1700 and a stop-loss at 1.1460. Sell EUR/USD from the resistance level of 1.1720 with a target of 1.1500 and a stop-loss at 1.1800.

At the same time, the Relative Strength Index (RSI) is hovering near the 50 level, indicating a balance between bulls and bears. The oscillator's neutral stance suggests that the direction of the breakout could be decisive once the price breaks out of the triangle's boundaries.

EURUSD Chart by TradingViewTrading Tips:Please be aware that the EUR/USD exchange rate may be affected by upcoming economic data and central bank comments, particularly any shifts in expectations regarding the European Central Bank's (ECB) policy or the US Federal Reserve's (Fed) actions, which could impact the dollar Affecting EUR/USD Trading TodayAmid attempts to bounce higher, and according to forex currency market trades, the EUR/USD path today, Tuesday, December 2, 2025, will be affected by anticipated remarks from US Federal Reserve Chair Jerome Powell. Economically, it will be influenced by the announcement of the Eurozone Consumer Price Index (CPI) reading, along with the announcement of the bloc's unemployment rate, which will be released at 12:00 PM Egypt time.On the front of global central bank policies, expectations suggest that the US Federal Reserve will cut interest rates again on December 17, and several times next year. In contrast, the European Central Bank (ECB) will keep interest rates unchanged for the foreseeable future due to increasing economic recovery and improving inflation dynamics.Recently, the Harmonized Consumer Price Index (HICP) in Germany saw a notable acceleration in November, rising from 2.3% in October to 2.6% in November (consensus was 2.4%). Meanwhile, the ECB's October survey showed a slight increase in one-year inflation expectations from 2.7% to 2.8%, reinforcing the view that the ECB is unlikely to cut rates in December. With the ECB having no justification to move, and the US Federal Reserve likely cutting rates in December, the divergence in interest rate policy between the EU and the US is expected to provide a continuous fundamental source for the EUR/USD price to rise.Ready to trade our EUR/USD daily forecast? Here's a list of some of the top forex brokers in Europe to check out.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment