How Data Centres Can Be Better Integrated Into The Energy Ecosystem

Soaring energy demand from AI and data centres is putting tremendous pressure on power systems worldwide. Northern Virginia's“Data Center Alley” nearly faced a blackout when faulty grid equipment caused 60 data centres to disconnect at once. In Europe, grid constraints are expected to slow growth in traditional FLAP-D hubs (Frankfurt, London, Amsterdam, Paris and Dublin). The city of Amsterdam even banned new data centres in December 2023, with no new projects expected before 2035. Electricity prices are rising in areas with high data centre demand, limited new capacity, and long connection delays. For example, in New Jersey – part of PJM Interconnection, the regional grid operator serving much of the eastern US, and a key data centre region – retail power prices jumped 20% year over year.

Higher power usage comes with great responsibility. Data centres need to manage their relationships with the grid to avoid stress or instability. If they don't, projects could face local opposition, delays, or even cancellations. This article explores how data centres can help build a more efficient energy system, better manage load growth, and create positive impacts for local communities.

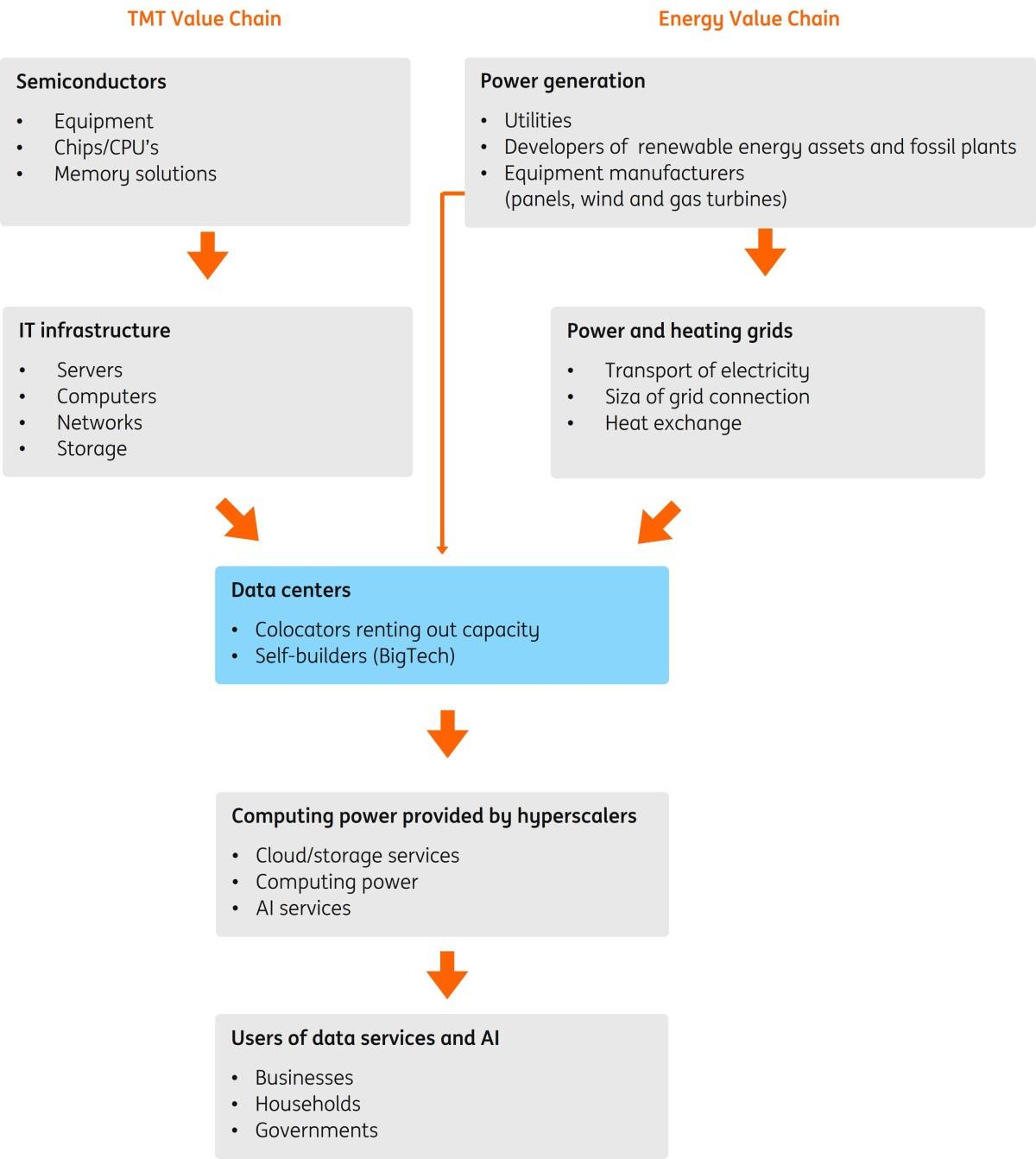

The central role of data centres in both the TMT and energy value chainsBut first, let's take a step back and understand how the power system is an integral part of a data centre's broader value chain.

Data centres occupy a pivotal position at the intersection of the Technology, Media, and Telecommunications (TMT) sector and the energy system. The data centre and energy value chains are intrinsically linked, with each influencing and depending on the other.

At the heart of the TMT value chain, data centres serve as the critical infrastructure that processes, stores, and transmits digital information. This chain typically begins with the IT equipment and infrastructure providers, followed by the compute layer – where data centres process the information – before finally reaching the end“user” who consumes digital services and applications.

Data centres are in the middle of the TMT and Energy value chain

Source: ING research

On the other side, the energy value chain encompasses the generation, transmission, and distribution of electricity. Power grids play a crucial role in linking energy production to consumption. Directly feeding onsite-generated power into data centres is also gaining traction. Data centres are deeply embedded in this energy chain. They depend on grids for steady, reliable power and can also give back through demand response programmes or transmit excess onsite power back to the grid.

The interaction between these two value chains is dynamic. As data centres grow to meet rising digital demand, their energy needs increase, making their connection to the power grid more complex and strategic. Choices in the energy chain directly affect the performance, sustainability, and growth of TMT. Here are the key trends we see emerging.

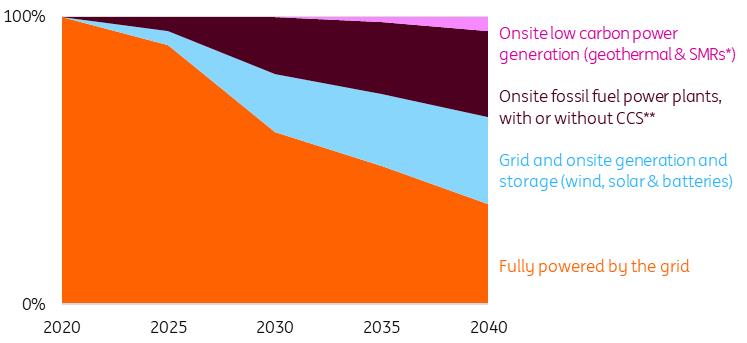

Onsite power gains momentum this decade, but the grid remains the dominant electricity sourceAs data centres choose how to integrate themselves within the power systems, three primary strategies have emerged:

Taking power from the grid; Receiving power directly from onsite generation sources alongside data centre facilities (also called behind-the-meter, or BTM-solutions); A combination of both.Traditionally, data centres have relied entirely on the grid for electricity. However, growing grid disruption risks and lengthy lead times for securing power access are set to reshape this model. The incorporation of onsite power generation to complement electricity from the grid will become more popular in the next few years. According to a report by Bloom Energy, 38% of data centres in the US are expected to adopt primary onsite power generation by 2030, up from 13% last year. The percentage of data centres relying solely on onsite generation, although low a year ago, at 1%, is poised to soar to 27% by the end of the decade in the US.

In the short term, to secure power access quickly, onsite power generation is inevitably more skewed towards using fossil fuels. However, in the long term, clean onsite generation will pick up speed as large clean dispatchable power supply becomes commercially available. We can also anticipate renewed interest from data centres in sourcing electricity from the grid as it becomes cleaner and more efficient.

Data centres are mostly powered by the grid, but new models are emergingIndicated share of power source in total power generation

Note: *SMR technology development till 2035, actual generation from 2035 onwards. **CCS = emission reduction by capturing and permanently storing CO2 emissions. Source: ING Research based on Gartner.

Below, we discuss the specific advantages of each power receiving mechanism:

Power from the grid

Traditionally, data centres have connected to existing electrical grids. They typically provide a reliable and stable source of energy, maintaining 24/7 uptime and minimising data loss.

However, as more data centres integrate, grids risk becoming strained, raising the risk of blackouts, brownouts, and voltage sags or surges. Complicated and fragmented grid interconnection processes have also led to long wait times in Europe and the US. And a lack of effective power system improvements and transmission line upgrades can limit the contribution of renewable energy sources.

Some solutions are helping to ease these challenges. AI-powered smart grids and grid-enhancing technologies allow real-time communication with data centres, adjusting energy use automatically to manage faults and load changes. Google uses software to alert data centres about upcoming supply limits and sends hourly instructions to reduce strain. Microsoft's Pacific Northwest sites use AI to predict energy fluctuations and integrate renewables smoothly. Companies like Google are also shifting peak demand to off-peak hours to further reduce grid stress (discussed below).

Onsite power generation

Instead of relying on receiving electricity from the grid, generating electricity onsite is becoming more popular among data centres. It can offer several benefits:

-

Avoiding grid strains and blackouts

Offering faster access to power

Reducing long term energy costs and efficiently incorporating renewable sources

Allowing more flexible siting by reducing constraint from grid connectivity

More data centres are starting to add onsite power generation. Elon Musk's xAI site in Tennessee and OpenAI and Oracle's Stargate project in Texas use modular natural gas turbines. Meta's Ohio data centre plans to meet all its power needs with onsite gas equipment from Williams Companies. Some companies are also cutting emissions from gas-fired power plants by integrating carbon capture and storage (CCS) technology. Google is taking this approach through a power purchase agreement (PPA) with the Broadwing Energy Center in Illinois. The 400-megawatt plant, now in the design phase and expected to be operational by 2030, will capture around 90% of its CO2 emissions for permanent underground storage. This model could eventually be applied to on-site gas plants, a development closely monitored by oil and gas majors. Exxon CEO Darren Woods recently highlighted CCS as a key advantage for building dedicated power facilities to meet the energy demands of AI data centres. In China, Tencent's Tianjin data centre uses a microgrid combining solar power, battery storage, and AI energy management to cut grid dependence and move towards green energy.

Nevertheless, challenges also exist. For instance, onsite generation may not meet a data centre's entire energy requirement. The amount of electricity a data centre can generate onsite varies, depending on its location and energy strategy. But for now, the share of data centres able to meet most of their power demand through onsite facilities remains very small.

Moreover, onsite power generation can require substantial upfront capital investment. Data centres are also directly exposed to supply chain challenges in the power sector, such as increased tariffs on clean energy equipment. Because of these challenges, some data centres opt to locate near large-capacity, clean, and reliable power generation sources. In Europe, new data centres are being planned adjacent to hydroelectric dams to secure guaranteed green power and leverage efficient water-based cooling.

Combination of onsite power and grid connectivity

While each method has individual advantages, they are increasingly incorporated together to reap the most benefits. By mixing strategies, data centres receive 24/7 power from the grid while protecting against blackouts. Moreover, reduced grid dependency can result in timelier connection. Nevertheless, challenges such as upfront technology costs and geographic flexibility can still remain concerns.

A possible reset of the clean power purchasing marketStrategically structuring power purchase agreement (PPA) contracts is also key for data centres to manage their relationship with the power system.

PPAs provide a long-term option to acquire clean energy. There are two types: physical PPAs, where a customer buys and receives power directly from a generator, and virtual PPAs (VPPAs), which are financial contracts for price hedging without physical delivery. Most PPAs match a customer's electricity use on an annual basis. And VPPAs, along with some physical PPAs, do not require the electricity generator and customer to be from the same local grid.

Recent proposed changes to sustainability accounting rules could change how data centres track emissions from electricity use (called Scope 2 emissions). The Greenhouse Gas (GHG) Protocol, which sets widely adopted standards, has suggested requiring companies to match their electricity consumption on a 24/7 basis – by both hour and location.

This proposal, if implemented, could create system-wide and societal benefits. It would boost a company's sustainability reputation and make PPAs better hedging tools. One study showed that a 90% hourly matched PPA could have saved a major electricity user over €14 million in Finland in 2022. Companies like Google and Microsoft are already working towards buying carbon-free electricity 24/7.

But there can also be substantial challenges. Matching electricity use 24/7 needs detailed data on a customer's electricity consumption. Large companies with more resources can manage this, but smaller ones may struggle. Hourly and geographical matching might also push purchases toward existing power in the spot market instead of supporting new clean energy projects. Companies with operations in many places that rely on VPPAs could also see their buying strategies disrupted by these changes.

We believe big companies should aim for higher standards and try 24/7 matching. But making it mandatory under GHG reporting could shake up the clean power market. In that case, firm clean energy like nuclear and geothermal, plus more co-located renewable generation, would likely be favoured. It could also change how Scope 2 emissions are benchmarked, requiring new performance reference points.

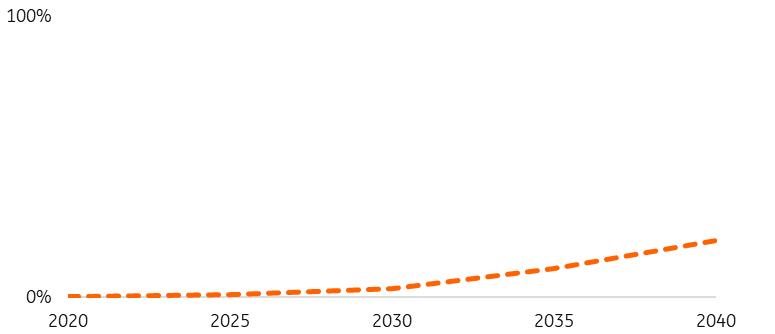

Heat reuse can benefit local communitiesIn addition to improving power usage itself, reusing excess heat from data centres can benefit local communities. Normally, cooling systems release this heat outside, but heat reuse systems send it to other users for purposes like water and space heating. Locating data centres near consumers can be hard, but this approach helps both homes and industries. Regulations are still limited, though several European data centres plan to adopt this technology. For example, Google's data centre in Skein, Norway aims to run on 99% carbon-free electricity and use heat reuse systems with the local community.

Data centres produce a lot of heat and over time more heat will be utilisedIndicative share of heat utilisation in total data centre heat production

Source: ING research Demand flexibility enhances power system efficiency

Lastly, data centres can help to ease grid stress by voluntarily shifting a small portion of their electricity demand away from peak hours. In August, Google announced plans to move less time-sensitive machine learning workloads. Similarly, Aligned Data Centers unveiled plans to fund a 31 MW battery at its upcoming Pacific Northwest facility to increase the flexibility of its power demand.

This voluntary demand shift not only helps free up grid capacity, but may also accelerate grid connections for data centres. In fact, the US Department of Energy has recommended that regulators expedite the interconnection process for large loads that can commit to being flexible.

We do acknowledge that it can be hard for some data centres to shift power demand, as their workloads may lack flexibility or control over workflows. But we do anticipate that demand flexibility will continue to gain traction as the system improves.

With more power demand comes more responsibility – and potentialTo sustain expedited growth, data centres must adopt smart strategies that support the stability and sustainability of local energy systems. This will increasingly define their 'license to operate.' The good news: data centres have the power to deliver, with big tech companies already making efforts to enable a more resilient energy system. Over time, policymakers need to implement reforms that make power systems more efficient and encourage infrastructure investment. These changes will enable a genuine energy transformation, with data centres playing a key facilitating role.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment