Data Centres Race To Innovate As Power Demands Surge

The rapid expansion of artificial intelligence (AI) and data centres is set to reshape the global energy landscape. As an illustration, asking a question on ChatGPT consumes five times as much energy as a web search, and generating a five-second video uses the same amount of energy as running a microwave for over an hour. While these numbers may seem modest, their cumulative effect becomes significant as AI adoption accelerates. As of July, ChatGPT reportedly handled over 2.5bn prompts globally per day.

As a result, global data centre power consumption is projected to soar, but the extent of this increase remains uncertain and is currently highly debated due to several 'known unknowns'. Think of the extent to which AI will:

-

Be scaled and demanded by consumers (both individuals and companies for operations optimisation).

Stimulate GDP growth and hence energy demand (rebound effect);

Meet current expectations (bubble or not?).

Be limited by bottlenecks in the TMT supply chain (production capacity, chip shortages, and the availability of rare earth minerals).

Be restricted by bottlenecks in the energy supply chain (grid congestion, land availability, permitting, incorporation of new energy sources).

Continue advancements in energy efficiency in AI hardware and software.

Over time, big shifts can suddenly change power demand. But slow, gradual changes also add up and can have a major impact.

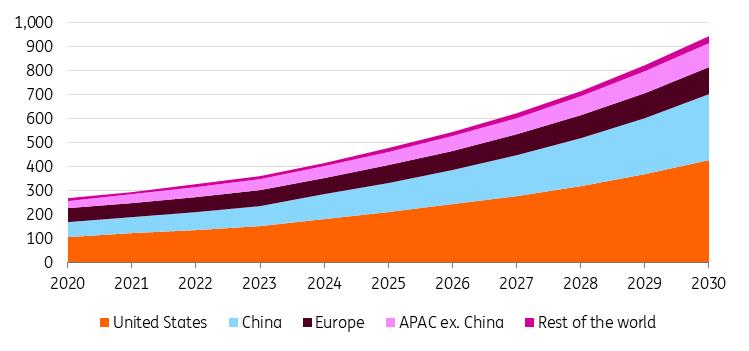

The International Energy Agency therefore explores these factors for different scenarios. It predicts a staggering increase in global power consumption from data centres of 130% by 2030 in its base case scenario. Power consumption almost triples in its high growth scenario, but will only rise 60% in its low growth scenario.

The US leads the market, currently representing around 44% of total data centre electricity demand, followed by China at 25%. In the US, power demand from data centres is projected to jump to above 10% of the national total by 2030 from around 4% today. Europe, accounting for 16% of current global power demand, has the lowest growth rate by 2030, but is still projected to add a substantial 66% of power needs by 2030 in the base case.

Data centre electricity consumption set to jump this decadeGlobal electricity consumption from data centres in the base case, TWh

Source: ING research based on IEA The urgent need for innovative power solutions from data centres

This surge in energy demand from data centres can put a lot of pressure on the power system and society in general. Consider the following:

-

Data centres, with their need for large loads and speedy power access, could push up electricity prices to the detriment of users in other sectors, such as industrial companies and households.

Demanding large loads could also destabilise the grids, leading to more blackouts and voltage sags or surges. If the integration of new data centres does push the grid to its limit, then they risk being forced to reduce workload or delay expansion.

Despite continuously becoming more energy efficient, data centres are poised to raise global emissions and could alter the local environments in which they operate.

Data centres use so much energy mainly because of their computing power. They perform three tasks: storing, distributing, and processing data. Processing – also called 'computing' – is the most energy-intensive because it requires heavy server capacity. Training and running AI models demand even more computation, making them highly energy-consuming.

But despite these interconnected challenges, data centres have huge potential to be part of the solution. With booming investment into the industry, data centres are leading the way in developing and upscaling clean technologies. AI technologies can also help data centres operate more efficiently. Moreover, data centres can work with regulators and utilities to facilitate the improvement of energy systems. In addition to data centres' own energy usage, AI-enabled solutions can also enhance the energy efficiency of other consumers.

This article focuses on how data centres can make smart, sensible choices when selecting their power sources and how different regional strategies vary.

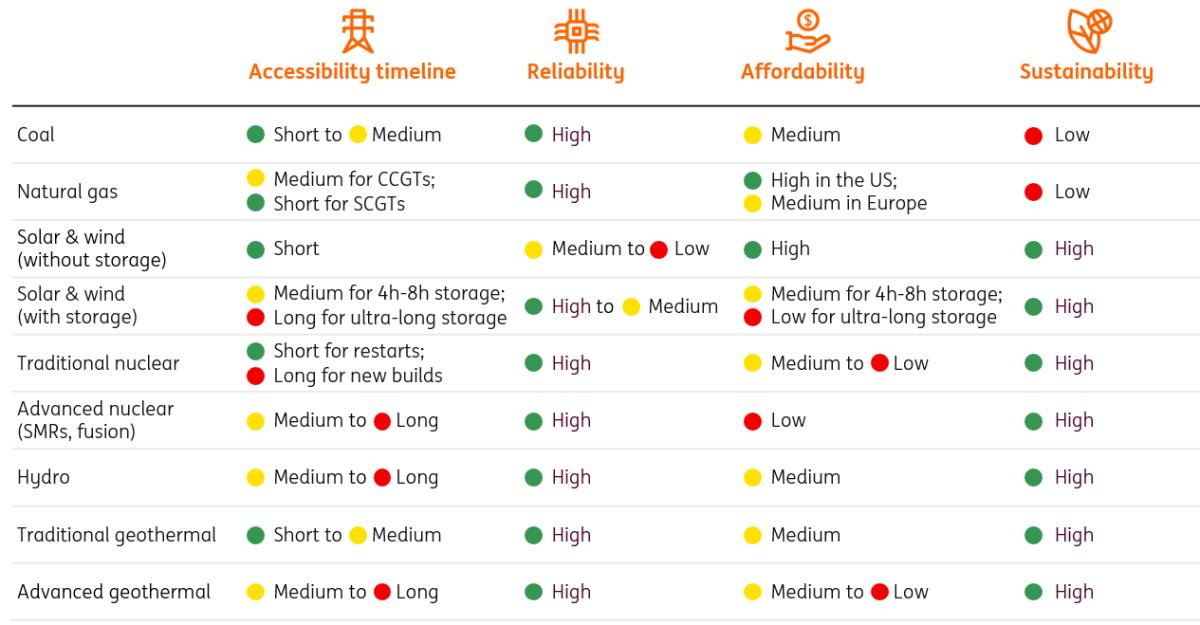

Smart power choices incorporate reliability, accessibility, affordability and sustainabilityData centres must carefully weigh four essential factors: accessibility timeline, reliability, affordability, and sustainability. Below is a summary of how each of the considerations plays out for different energy sources, and we'll later discuss these in detail.

An increasingly complex balancing act for data centres to secure powerAssessment of key considerations for data centres' power sources

Source: ING Research. Note: SMR = small modular reactors; SCGT = simple-cycle gas turbines; CCGT = combined-cycle gas turbines.

Moreover, one region's optimal power mix can look very different to another's because of differences in local infrastructure, regulatory environments, and energy availability. Data centres should take all of these elements into consideration to meet both their immediate operational needs and long-term goals of resilience.

Accessibility timeline

Most planned data centres aim to go live within months to two years, but many energy options can't meet these timelines. In the US, combined-cycle gas turbines (CCGTs) face significant shortages, with equipment backlogged until around 2030. Advanced nuclear technologies – including small modular reactors (SMRs) and fusion – are attracting robust investment but are unlikely to be available until the next decade. Constructing a traditional nuclear plant takes even longer, often up to 15 years. Additionally, complex permitting and grid congestion in both the US and Europe can add further delays.

To address these challenges, data centre operators are seeking short-term solutions that can deliver power capacity more quickly. Renewable sources, with their shorter construction timelines and fewer supply-chain bottlenecks, are expected to fill much of the gap. The industry is also investing in the restart of decommissioned traditional nuclear power plants, which can be brought online relatively quickly. Given the shortage of CCGTs, alternatives like single-cycle gas turbines and gas-powered fuel cells are also gaining traction.

While securing immediate power capacity is critical, data centres must also invest in emerging technologies that promise significant benefits in the long term. These include nuclear, geothermal, and expanded battery storage solutions. The application of carbon capture and storage (CCS) technologies in the power sector will also be key, especially given the US and China's projected continuing reliance on fossil fuels.

It's also important to note that upgrades to grid infrastructure and increased grid flexibility can unlock additional power capacity. Efforts to modernise grids are underway in the US and Europe; we'll explore these developments further a bit later on.

Reliability

Uninterrupted data processing – referred to as 'uptime' – is a core requirement for data centres, with the industry standard set at 99.999%. Achieving this level of reliability demands an uninterrupted power supply, making dispatchable sources like coal, natural gas, nuclear, hydropower, and geothermal especially suitable.

In contrast, solar and wind energy are inherently intermittent. Current battery solutions typically offer four hours of discharge – insufficient to guarantee full reliability. As a result, wind and solar today still need to be complemented by other generation sources to ensure continuous operation. As discussed previously, long-duration storage (LDES) technologies providing at least eight hours of discharge are essential to address the intermittency issue for wind and solar. While most LDES technologies remain in the research and development (R&D) phase, global market players are actively developing these solutions.

Affordability

The choice of energy sources for data centres often hinges on regional cost advantages. In the US, natural gas is the leading choice thanks to its abundance, low cost, and strong infrastructure. The IEA projects it will supply 130TWh of the 250TWh of extra electricity that data centres will need by 2030. Natural gas would then account for half of the country's power mix for data centres.

Similarly, in China, ample and cheap coal has been the dominant source, contributing to 70% of the country's power generation for data centres today. But China's massive build-out of renewable energy will influence its power mix for data centres in the long term, leading to coal's share being reduced to less than 50% by 2035.

In Europe, where cheap fossil fuel is limited, solar and wind are set to be the prevailing power sources for data centres. This, together with the stronger push for sustainability, means that the region's share of renewables and nuclear is expected to become 85% of its electricity supply for data centres by 2030.

In addition to regional differences, affordability also has a time series component. Despite heavy investment from data centres, emerging technologies like SMR, nuclear fusion, and some advanced geothermal technologies are not yet commercially available. Data centres are now partnering with energy companies to advance the R&D of these technologies. Subsequently, investment will also be needed to accelerate mass production and critical infrastructure.

Sustainability

Balancing data centre growth with sustainability goals has become increasingly complex, especially as some regions are rolling back climate policies. Yet with ample financial and operational resources, data centre companies have so far maintained their ambitious sustainability targets, largely driven by the need to future-proof businesses and meet stakeholder expectations. Google, Meta, Microsoft, Equinix, and Digital Realty all have net-zero or carbon-negative targets by 2030, earlier than most companies in other industries.

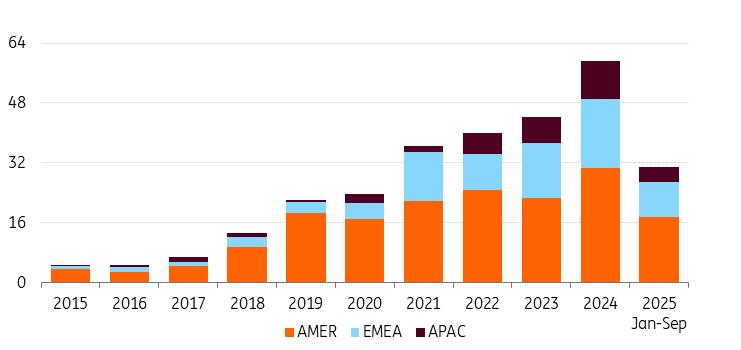

This has positioned them at the forefront of driving clean power demand. Globally, corporate power purchase agreements (PPAs) are on track to exceed 2023 volumes, albeit with weaker momentum than seen in 2024.

Steadily rising interest from corporates to buy clean powerGlobal power purchase agreement (PPA) purchases, GW

Source: Bloomberg New Energy Finance

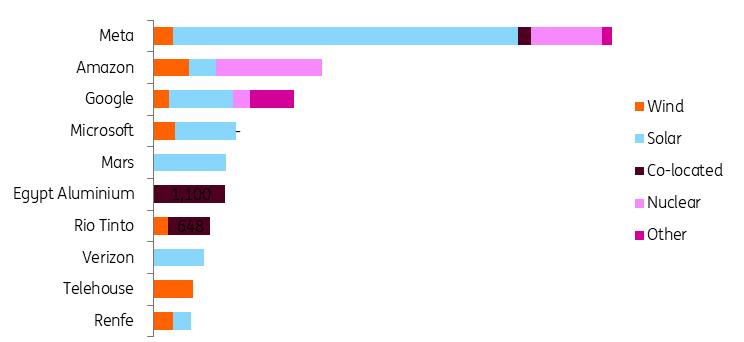

Notably, in 2025, four of the world's five largest buyers of clean PPAs are tech companies, consistent with the historical trend. In the US alone, tech firms account for 75% of all PPA purchases this year.

Tech companies are buying huge amounts of clean electricityTop global buyers of clean power purchase agreements (PPAs) in January-September 2025

Source: Bloomberg New Energy Finance

These PPAs are dominated by established energy sources like wind, solar, and traditional nuclear, but increasingly also include nascent clean technologies. For example, Google has entered into an agreement with Kairos Power to procure electricity from up to seven SMRs expected to come online in the next decade. Meanwhile, Meta has secured a PPA with Sage Geosystems to source advanced geothermal power as soon as it becomes available.

In addition to purchasing clean power, data centre developers are also investing directly in advancing these emerging technologies. Google is providing early-stage funding to Elementl Power to support the development of three advanced nuclear reactor sites. Amazon's Climate Pledge Fund led a $700m funding round for X-Energy to accelerate the commercialisation of its SMR technology. Data centres are now the biggest driving force of clean technology advancement, with their investments set to have a profound impact on the energy sector in the next few decades.

More innovation aheadAs the data centre industry continues its rapid expansion, the challenge of balancing sustainability, affordability, and reliable power supply is becoming more complex than ever. Yet it also triggers technological and market innovation. Case in point, data centres' desire for clean baseload power is re-energising the global nuclear industry.

It is important to recognise that the concept of 'innovation' varies across regions. In Europe, persistent system bottlenecks imply that the data centre industry may opt to innovate within the limits of the power system and strive to make it better. In turn, Europe's AI future may see more moderate growth but with greater emphasis on sustainable energy use. The US also faces key power bottlenecks, but the dominant theme will remain 'growth', propelled by creative strategies to overcome limitations and unlock unprecedented opportunities. China, with fewer infrastructure constraints, will also focus on growth while doubling down on the R&D of emerging technologies. For both the US and China, the aggressive data centre growth strategies will be fuelled by substantial reliance on fossil fuels – but also the clean technologies where they hold competitive advantages.

Regardless of regional approaches, integrating advanced energy management mechanisms will be key to building long-term resilience. With these measures, data centres can transform from energy-intensive facilities into enablers of a smarter, more resilient power system. In the third article of this bundle, we discuss how data centres can be better integrated into the power system.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment