The Data Centre Divide: Why Europe's Shortfall Threatens Future Economic Growth

Data centres provide the computing power needed for the storage, transport, and processing of our data. That may sound abstract, but data centres are the engine of our digital world, as they offer the computing power that our digital lives require. In doing so, they not only allow us to endlessly watch cat videos, but they also keep hospitals online, enable internet banking, and provide the computing power required for new digital developments, including generative AI. Data centres are thus vital for businesses across all sectors of the economy.

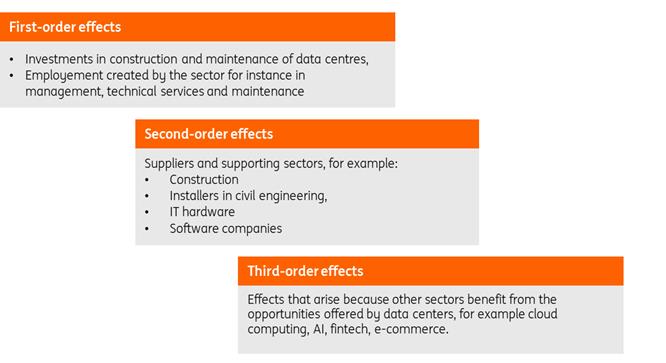

To make this more tangible, we break down the economic importance of the sector into first-, second-, and third-order effects. First-order effects are the direct economic contributions of the data centre sector, such as investments in the construction and maintenance of data centres, the employment the sector creates in areas like management, engineering, maintenance, and security, and the sector's energy purchases. Second-order effects are indirect effects, such as demand for goods and services from suppliers and supporting sectors like construction, civil engineering installers, and IT hardware and software companies. Third-order effects arise because other sectors benefit from the opportunities data centres provide, underscoring their critical role in the economy. These effects include digital services and innovations such as cloud computing, AI, fintech, e-commerce, and streaming services.

Overview of economic effects of data centres

Source: ING Data centre capacity is key, because it unlocks gains from AI

Data centres are so essential within the digital infrastructure sector because they form the core of all digital services we use daily. Think of cloud storage, streaming, AI, online banking, and even smart devices – all these applications run on servers housed in data centres. Data centres therefore function as an economic flywheel: the more digital services emerge, the more data centre capacity is needed. The more capacity there is, the easier it becomes for new digital innovations to arise (for example, generative AI). This creates a self-reinforcing effect: more digital demand leads to more data centres, which leads to more innovation, and more innovation again leads to more demand. Because of this flywheel effect, the third-order effects of data centres are significant.

We can make this more concrete: companies that work with new technologies (e.g. in AI or fintech) tend to congregate in places with excellent digital infrastructure and fast connections (low latency). So, good digital infrastructure is vital if you want to house the companies that will shape the economy of tomorrow. But the importance of data centres is broader. We previously wrote about the economic potential of generative AI. AI is a general purpose technology: it has the potential to drive significant economic growth and affect sectors of the economy outside tech. In countries with abundant data centre capacity, startups building new AI applications and products can more easily access computing power thanks to better availability and lower marginal costs. This means that the tech successes of the future depend on strong digital infrastructure and the computing power that data centres provide. Countries with substantial data centre capacity therefore have a better chance of achieving AI breakthroughs that are still in their infancy.

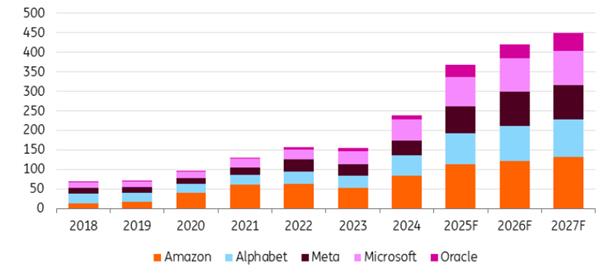

Tech investment booming, but primarily driven by US firmsGiven AI's economic potential, it's no surprise that investment in subsectors such as hardware, software, and data centres is substantial. Spending on AI by US tech companies has increased quite dramatically in recent years and is expected to continue as firms compete for AI leadership.

The expectation is that the companies that lead in AI will see their profits increase. This is already happening for companies that manufacture the software and hardware that is required to 'build' AI. NVIDIA, for instance, has seen its quarterly revenue increase fourteenfold in two years: from roughly $4 billion in the first quarter of 2023 to roughly $39 billion in the first quarter of 2025. These companies are primarily American, which means that the possible gains from AI will be unevenly distributed.

Data centres have traditionally been financed through internal profits. However, given the scale of current investments, funding increasingly comes from bond markets and other forms of lending. While this works for the buildings themselves, internal hardware such as servers has a far shorter lifespan – often much less than 30 years – creating a mismatch between assets and liabilities. As a result, concerns about credit quality and leverage risk are emerging, although these remain limited for now, thanks to the exceptional profitability of many US tech companies.

US tech investment boom to continueInvestments by selected US tech companies in billion USD

Source: Source: Refinitiv; ING Extraordinary investments are having an effect on US GDP

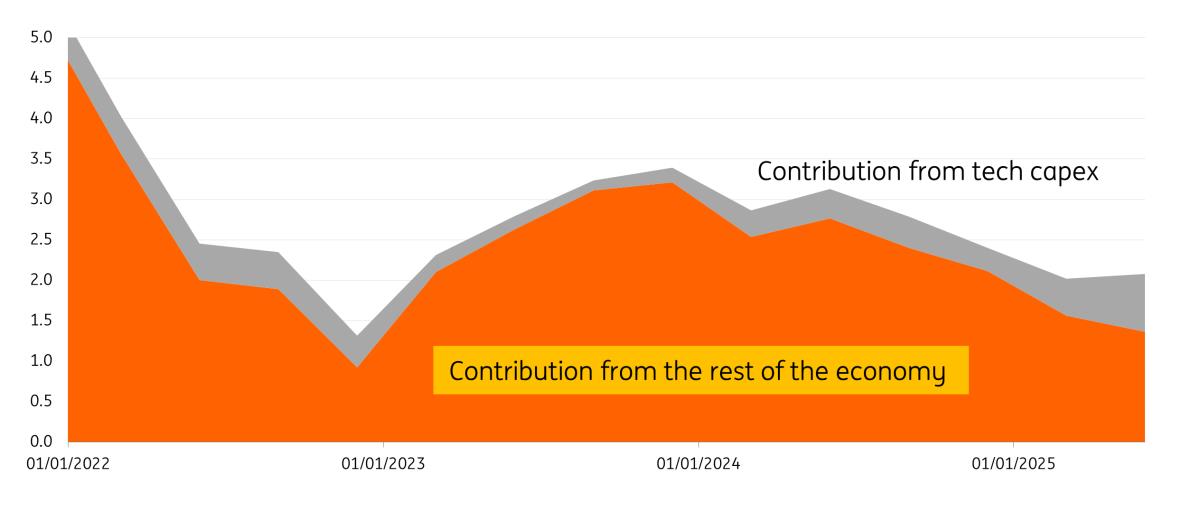

The AI-driven increase in investments (also often called capital expenditure or capex) is also increasingly important for the US economy: the share of tech capex in real US GDP growth has increased, especially in the first half of this year. This clearly underlines the size of these investments and the increasing structural importance of the tech sector for the American economy.

We expect this effect to continue, particularly because the US government incentivises these investments through the CHIPS Act and the One Big Beautiful Bill. They allow companies to immediately deduct the cost of qualifying investments from their tax bill rather than use the depreciation methodology over the lifetime of the asset, which offers significant tax reductions. Moreover, there is a consensus within the US that the country needs to 'win' the AI race out of both economic and geopolitical necessity. Consequently, the government will likely continue or even expand its current subsidies.

Effect of tech investments on US GDP is growingUS real GDP growth contribution from computers & peripheral plus software, in %

Source: Macrobond, ING calculations Data centre capacity will increase steeply, but Europe is lagging behind

With tech investment growing sharply, we expect global data centre power consumption to surge. This growth is primarily driven by increasing AI investment and adoption, which is boosting demand for hyperscale data centres while leaving other types relatively subdued. This means that data centres are becoming larger rather than smaller.

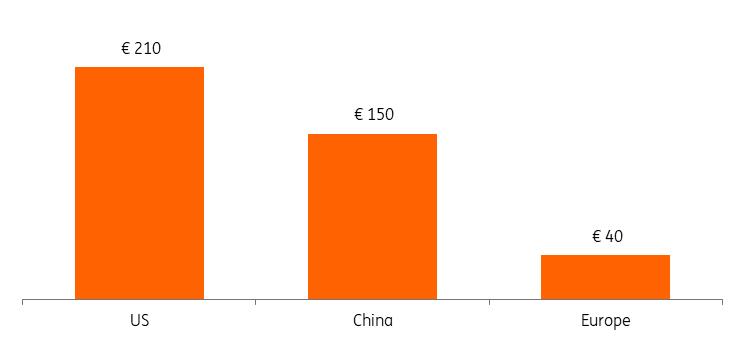

Moreover, growth in added data centre capacity is unevenly distributed: at the current rate of investment, Europe will lag further behind China and the US, which is a worrying development for the continent given that data centres offer the computing power that enable growth and innovation in high-tech and relatively new economic sectors.

From the energy forecast, which is based on the base case of the International Energy Agency (IEA), we extrapolate that global data centre capacity will increase by roughly 15% per year until 2030. Yet, growth will primarily be driven by China and the US. The US will more than double its current capacity and China will add roughly 2.5 times its current capacity. Europe, on the other hand, will add roughly 75% of its current capacity until 2030. Moreover, Europe already has less data centre capacity than China, which has roughly 1.5 times Europe's capacity, and the US, which has roughly three times Europe's capacity. In short, Europe is already behind the US and China and the gap will widen in the years to come.

This is a concern for Europe because, as mentioned, AI is a general purpose technology, which means that it will increase economic growth and productivity and has the potential to disrupt more sectors of the economy than just tech. As data centres are the digital infrastructure that enable AI, countries with excess data centre capacity are best-positioned to profit from the economic gains of the technology.

US data centre investment could be fivefold higher than Europe'sTo calculate which investments are necessary to meet our energy forecast, we take the additional TWh forecast in the US, China and Europe and from there, we convert energy to average data centre capacity. We do so by using power usage efficiency (PUE), which is a measure that shows what percentage of power used goes to IT versus other uses. We assume a PUE of 1.3, which is common for newly built hyperscalers, which gives us an estimate of additional MW in capacity. We then assume that each MW costs roughly 10 million euros to construct, which gives us the required investment to meet our energy growth forecast. In short, from the IEA base case, we extrapolate that the US will spend roughly five times as much as Europe on the construction of data centres, which excludes expenditure on IT hardware.

Required data centre construction expenditure in the US, China and EuropeRequired construction (excluding IT hardware) investment to meet growth forecast until 2030 in billions of euros

Source: IEA, IDC, ING Green shoots of progress emerge in Europe

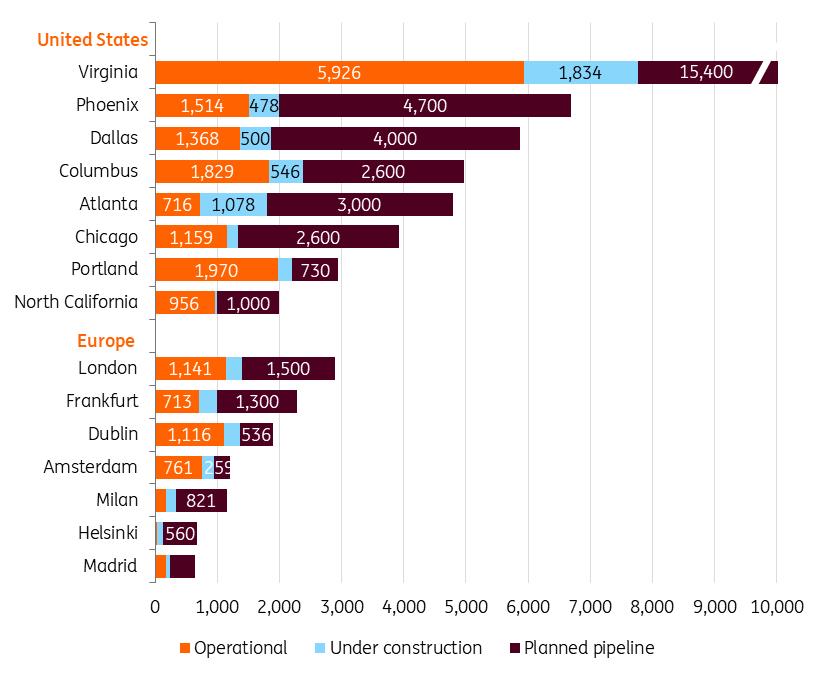

The stark contrast between American and European investment is also evidenced by the developments in Tier 1 markets. Frankfurt, London, Amsterdam, Paris and Dublin (FLAP-D) are Europe's core data centre markets. Taken together, however, America's most important market (Virginia) is bigger than Europe's five core markets combined (we estimate that Paris sits between Dublin and Amsterdam in terms of capacity). This gap will grow in the years to come: the pipeline in Virginia is three times bigger than that of the FLAP-D combined (we estimate a similar pipeline for Paris as London has). In addition, Dublin and Amsterdam have congested power grids, which limits room for expansion.

However, there are green shoots of progress emerging Europe. There are plans for significant build-outs in Frankfurt, Paris and London and important Tier 2 markets have emerged recently: Madrid, Milan and Helsinki will add roughly 2.0 GW in combined capacity in the coming years. These cities can therefore expect significant investment from consortia, rapid growth in the digital services industry, and down the line, more innovative companies making use of data centre capacity.

Core US markets accelerate data centre buildout, leaving Europe in the dustIn MW, as of end 2024

Source: Gartner, ING The need for European ambition and a common strategy

As we have shown, data centres are expanding rapidly, driven by the AI boom. However, new data centres are mostly being built in China and the US, which means that Europe has now fallen behind.

It is therefore imperative that Europe takes decisive action, particularly as generative AI continues to grow. Of course, full-scale expansion is constrained by limited power grids and scarce resources, forcing governments to make difficult trade-offs. However, a stagnating data centre sector could have serious repercussions for the European economy, as companies with ample data centre capacity are best-positioned to profit from AI.

Greater pan-European coordination on where and how data centres can grow could help. If Europe wants to compete in the field of AI now and in the future, data centres are essential due to their computing power and the development of more autonomous European AI applications. Strategic decisions on this front should be made sooner rather than later.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment