Brazil Construction Equipment Market To Reach 72K Units By 2030, Entering Next Growth Wave Led By Mining Demand Arizton

"Brazil Construction Equipment Market Research Report by Arizton"Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast 2025–2030.

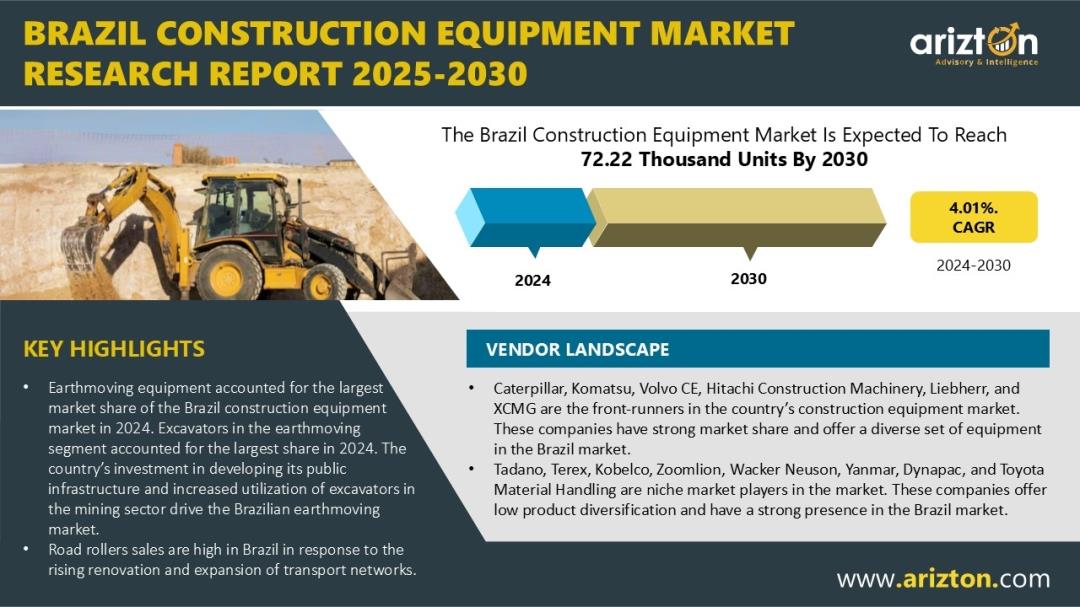

The Brazilian construction equipment market is on a clear growth trajectory, with an estimated 57.03 thousand units sold in 2024 and projections to reach 72.22 thousand units by 2030, reflecting a CAGR of 4.01%, according to a new report by Arizton. The market demonstrated a strong recovery in 2024, fueled by a combination of attractive manufacturer incentives, expanding infrastructure projects, and improving conditions in the real estate sector. These factors collectively are driving renewed demand, positioning Brazil's construction equipment industry for sustained growth in the coming years.

Download an Illustrative overview:Report Summary:

MARKET SIZE- VOLUME (2030): 72.22 Thousand Units

MARKET SIZE- VOLUME (2024): 57.03 Thousand Units

CAGR- VOLUME (2024-2030): 4.01%

MARKET SIZE- REVENUE (2030): USD 4.15 Billion

HISTORIC YEAR: 2021-2023

BASE YEAR: 2024

FORECAST YEAR: 2025-2030

EQUIPMENT TYPE: Earthmoving Equipment, Road Construction Equipment, Material Handling Equipment, and Other Equipment

END-USERS: Construction, Mining, Manufacturing, and Others

Construction Equipment Demand Strengthens as Brazil's Mining Sector Expands

Brazil's mining sector is driving the next wave of construction equipment demand. The industry delivered BRL 86 billion ($15.9B) in taxes and royalties in 2023, generated a $32B trade surplus, and contributes nearly 4% of national GDP, highlighting its importance to the economy. With strong production of iron ore, niobium, manganese, graphite, and bauxite concentrated in Minas Gerais and Pará, Brazil is now pushing further into strategic minerals such as nickel, copper, rare earths, and lithium to support the global energy transition. This expansion is increasing exploration activity and attracting more investment into mining hubs. As projects scale, demand for construction equipment is rising across the full mining lifecycle, from land clearing and site preparation to drilling, extraction, processing, and long-distance haulage, making mining one of the strongest growth drivers

Brazil's Mini Excavator Revolution: Gaining Ground

Brazil's mini excavator market is on the rise, fueled by a growing need for compact, versatile machinery across infrastructure, agriculture, and urban projects. As small- to medium-scale construction gains momentum, operators are increasingly drawn to equipment that combines agility, fuel efficiency, and smart controls. Features like zero-swing design and digital management interfaces are no longer optional-they are becoming essential for maximizing productivity in tight spaces. At the same time, sustainability is shaping choices, with fuel-efficient engines, lower emissions, and adaptable designs meeting both environmental and operational demands. Supported by favorable import conditions and a surge in infrastructure investments, construction machinery sales in Brazil grew 22.2% in 2024, underscoring the strategic role mini excavators now play in powering the country's evolving construction landscape.

Brazil's Infrastructure Acceleration Sparks Soaring Machinery Demand

Brazil's construction equipment market is growing steadily in 2025, driven by economic recovery and stronger public and private investment. The Novo PAC program is pushing major upgrades in transport, cities, energy, water access, and digital connectivity, creating consistent demand for machinery across the country. Brazil's renewable energy push, aiming to lift its share from 16% in 2023 to 45% by 2030, along with ANEEL's BRL 11.3 billion transmission auctions, is further boosting equipment needs. Housing construction is also rising, supported by a national deficit of 6–7 million homes and the Minha Casa, Minha Vida plan to build 2 million units by 2026. Together, these initiatives are keeping equipment utilization high and reinforcing Brazil's position as a key growth market in Latin America.

Is Brazil's New Equipment Market Losing Ground to Rentals and Used Machinery?

Amid rising machinery prices and economic uncertainties, contractors in Brazil are increasingly turning to equipment rental, unlocking new growth avenues for rental firms and manufacturers alike. Flexible lease agreements and innovative financing solutions are making high-quality machinery more accessible, while the market itself is gaining strategic importance, valued at approximately $1.8 billion in 2025. Over the past decade, leasing's share of total machinery sales has doubled from 15% to 30%, reflecting a clear shift in industry behavior. While demand for rental and used machinery may moderate new equipment sales, it simultaneously opens opportunities for service providers to expand offerings, optimize fleet utilization, and strengthen long-term relationships with contractors across the country.

Request Customization:Market Players of Brazil Construction Equipment Market

Key Vendors

-

Caterpillar

Komatsu

Volvo Construction Equipment

Hitachi Construction Machinery

Liebherr

SANY

Xuzhou Construction Machinery Group (XCMG)

JCB

Zoomlion

HD Hyundai Construction Equipment

Other Prominent Vendors

-

Kobelco

Liugong Machinery Co., Ltd.

CNH Industrial N.V.

Toyota Material Handling International (TMHI)

DEVELON

Tadano

Terex Corporation

Manitou

BOMAG GmbH

Bobcat

JLG Industries

John Deere

Yanmar Holdings Co., Ltd.

Ammann

Dynapac

Wacker Neuson

Distributor Profiles

-

Noroeste Máquinas e Equipamentos LTDA

FW Máquinas

Mason Equipment

Engepeças Equipamentos Ltda

The Brazil Construction Equipment Market Research Report Includes Segments By

Earthmoving Equipment

-

Excavator

Backhoe Loaders

Wheeled Loaders

Other Earthmoving Equipment (Other loaders, Bulldozers, Trenchers, Motor Graders)

Road Construction Equipment

-

Road Rollers

Asphalt Pavers

Material Handling Equipment

-

Crane

Forklift & Telescopic Handlers

Aerial Platforms (Articulated Boom Lifts, Telescopic Boom lifts, Scissor lifts)

Other Construction Equipment

-

Dumper

Concrete Mixer

Concrete Pump Truck

End Users

-

Construction

Mining

Manufacturing

Others (Power Generation, Utilities, Municipal Corporations, Oil & Gas, Cargo Handling, Power Generation Plants, Waste Management)

Related Reports That May Align with Your Business Needs

-

Brazil Crawler Excavator Market Strategic- Assessment & Forecast 2024-2029

-

Mexico Construction Equipment Market - Strategic Assessment & Forecast 2024 -2029

What Key Findings Will Our Research Analysis Reveal?

-

What are the trends in the Brazil construction equipment market?

Who are the key players in the Brazil construction equipment market?

How big is the Brazil construction equipment market?

Which are the major distributor companies in the Brazil construction equipment market?

What is the growth rate of the Brazil construction equipment market?

Why Arizton?

100% Customer Satisfaction

24x7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton's report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

-

1hr of free analyst discussion

10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment