Why FD Interest Rate Calculators Are Essential For Fixed Monthly Income Planning

The search for stability has always shaped the way people think about money. When markets shift and inflation whispers its unease into daily life, investors look for something that does not move with the tide. A fixed deposit offers precisely that-security without spectacle. Yet even a simple product such as an FD benefits from planning that is sharper, more deliberate. The modern investor, after all, values precision as much as safety.

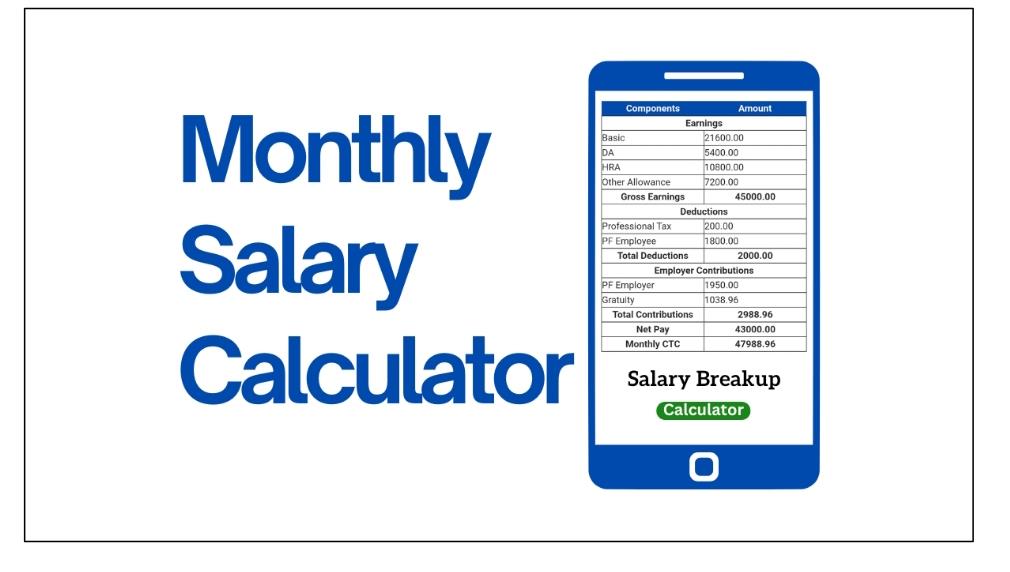

The FD interest rate calculator has quietly become the instrument that enables this precision. It translates interest rates and tenures into a clear picture of income. It turns estimates into facts, and those facts into decisions. For anyone serious about fixed monthly income planning, the calculator has become as fundamental as the deposit itself.

A shift in the way people saveThe habit of saving has not disappeared; it has merely changed its rhythm. In earlier years, saving was linear-set aside money once, collect it at maturity, and feel accomplished. But life now runs in cycles. Expenses are constant, aspirations grow, and financial planning has become more fluid. The desire for regular income, rather than a distant lump sum, has brought new relevance to fixed deposits that pay interest monthly.

ADVERTISEMENTThis is where the monthly FD income calculator earns its place. It allows investors to see what their savings will yield in real time. By entering an amount, tenure, and rate, they can forecast a steady stream of monthly inflows-an income that mirrors a salary yet carries none of the stress of market volatility. For retirees, this brings independence; for families, it brings order.

Understanding interest ratesInterest rates are not static; they move with the pulse of the economy. When inflation rises or liquidity tightens, banks increase rates. When conditions ease, those rates contract again. For investors who rely on fixed deposits for income, such movement can affect monthly returns more than they might expect.

Here again, a calculator adds balance. Suppose deposit rates rise after a policy review. By recalculating potential earnings, investors can decide whether it is wiser to renew early or hold their existing deposits. The same logic applies when rates fall. In both directions, the calculator prevents decisions from being impulsive. It restores perspective.

That awareness is valuable because timing, while impossible to perfect, can still be refined. The more informed the decision, the less it depends on luck.

Why Bajaj Finance stands outAmid several institutions offering deposits, Bajaj Finance has maintained a reputation for consistency and credibility. Its approach to customer clarity reflects in the design of the Bajaj Finance FD calculator-a tool that simplifies complex comparisons. It lets users test cumulative and non-cumulative options, vary tenures between one and five years, and view the difference each decision makes to total returns.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment