US LNG Export Build-Out To Boost Natural Gas Demand

The US is the largest natural gas consumer, using around 90 billion cubic feet per day, which is equivalent to more than 20% of global gas demand. US natural gas demand has grown at almost 5% per year over the last decade. This growth has coincided with the shale revolution, which has led to significant growth in US natural gas supply, offering consumers a cheap source of energy. This has come at a time when the theme of decarbonisation has only grown, which has seen coal's share in the power mix fall, after peaking in 2007.

It's unsurprising that the power sector has driven the bulk of natural gas demand over the years, and there is further room for growth from the sector as power demand is set to grow due to the build-up of data centres in the US, along with potentially stronger demand from industry with the onshoring of production in the US due to the Trump administration's trade policy.

However, there are also other sectors where there is the potential for robust demand growth, particularly LNG, given the pipeline of LNG export projects in the US.

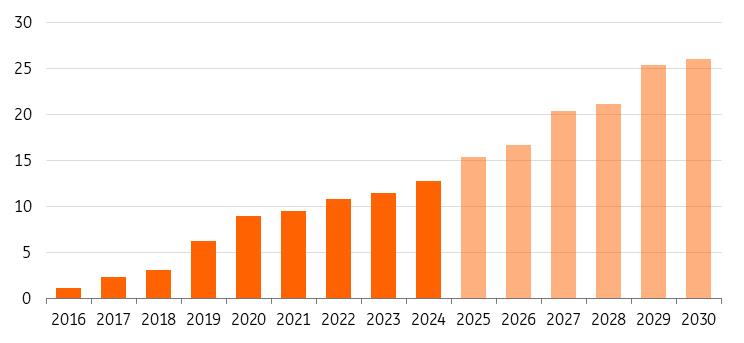

US gas demand could grow as much as 20bcf/d by 2030, which is equivalent to 19% of US dry gas production. However, it is important to point out that this includes and is predominantly driven by growth in feedgas to LNG plants. This number could turn out lower in reality if LNG plants do not operate at close to full capacity. This is not unrealistic when you consider that the global LNG market is set to be in large surplus over the latter part of this decade.

The power sector is expected to experience the next strongest demand growth. However, with potentially 4.2bcf/d of additional demand growth between now and 2030, this falls short of the 6bcf/d of demand growth seen between 2019 and 2024. Production bottlenecks in gas turbines remain a key obstacle to more aggressive demand expansion in the power sector.

US natural gas demand to be driven by the LNG and power sector (bcf/d)

Source: EIA, ING Research LNG sector is a key growth pillar for US gas demand

While not strictly part of US gas demand, LNG export plants have seen feedgas demand grow significantly in recent years. The rapid expansion of US natural gas production was a key driver behind the establishment of the US LNG industry, which has prompted significant investment in export capacity since 2016. The LNG industry is now the third-largest source of natural gas demand in the US. The sector makes up around 11% of total domestic gas and LNG export demand. The US added around 12.7bcf/d of LNG export capacity between 2016 and 2024, and by 2030, the industry is on schedule to add a further 13.3bcf/d. This additional capacity is equivalent to almost 13% of total US dry natural gas production.

In addition to this, there is a large amount of capacity which is in the pre-FID stage. However, it is unlikely that all this will proceed to the final investment decision and construction, particularly given the outlook for a well-supplied global LNG market and large capacity additions from Qatar before the end of this decade.

The additional demand from the LNG industry assumes that plants are operating at full capacity. These facilities have generally operated at full capacity in recent years due to the tightness in the global LNG market. However, with a surplus expected as early as 2026, full utilisation of US export capacity is not guaranteed.

Sizeable amount of LNG export capacity is set to start up in the US (bcf/d)

Source: EIA, ING Research Data centres and manufacturing will drive new gas power growth - but with short-term supply struggles

By 2030, the US's rapidly developing AI-driven data centre industry could consume over 10% of US electricity, up from 4% today. To meet this surge, natural gas has become the preferred source thanks to its low cost and reliability. According to the International Energy Agency, of the nearly 250TWh of projected new electricity generation for data centres by 2030 in the US, natural gas will likely supply 130TWh.

Beyond data centres, increased manufacturing and industrial activities - driven by the Trump administration's America-first onshoring strategy -could also boost electricity demand. For example, in the aluminium industry following Section 232 tariffs, if primary aluminium smelting capacity is added to meet domestic demand, power consumption from the sector could rise from about 10 TWh to 60 TWh - around 1.5% of total US power demand. Whether this investment materialises is another question.

As a result, power companies are planning to expand power generation from natural gas. As of September 2025, approximately 40 GW of gas-fired capacity is scheduled for development by 2030 - double the 21 GW planned a year earlier.

Planned natural gas fired power capacity in the US

Source: US Energy Information Administration, ING Research

However, the ambition to substantially increase natural gas power capacity faces major challenges. The most pressing remains the production backlog of utility-scale combined-cycle gas turbines (CCGTs), an issue that has persisted across the US throughout 2025.

Surging demand for gas-fired power has pushed CCGTs into backorder status until around 2030, driving prices sharply higher. As discussed previously, the capital expenditure for a typical CCGT plant has consistently exceeded $2,500 per kW since 1Q 2025 – up sharply from $1,200–$1,600 per kW in 2023–2024 and $800–$1,000 per kW during 2015–2022.

In addition, projects in the pipeline can face lengthy approval times. Despite the Trump administration's effort to substantially reduce the permitting timeline, the long queue for grid interconnection continues to weigh on project development. This, combined with individual project circumstances, means planned capacity often takes longer to materialise. Of the 40GW of planned natural gas power capacity, less than 10% is under construction or completed.

Status of planned natural gas fired capacity additions by 2030 in the USGW

Source: US Energy Information Administration, ING Research. Note: The data are as of September 2025.

The long lead times and higher CCGT costs have prompted the data centre industry to look into alternatives. Single-cycle gas turbines (SCGTs), though only about 50% as efficient as CCGTs, have re-emerged as a popular choice because they face less severe supply constraints. With smaller outputs, they offer greater flexibility and shorter start-up times. Many SCGTs are also being developed behind the meter, on-site at data centres, which can shorten interconnection approval timelines.

For example, the Stargate data centre project in Abilene, Texas, a joint venture by OpenAI, Oracle, Softbank, and MGX, plans to install 360MW of SCGTs as part of its 15GW project. Other companies planning to use SCGT at their data centres include Elon Musk's xAI, Alphastruxure (joint venture between Carlyle and Schneider Electric), and Homer City Energy Campus (conversion from coal to SCGT). This space is becoming crowded quickly. Aeroderivative gas turbines, also a type of SCGT, are also gaining traction. Crusoe and Balico are among companies adopting these turbines. This means more demand for natural gas as a feedstock, particularly as SCGTs require more input to generate a certain amount of electricity.

And despite not gaining great traction yet, retrofitting existing SCGTs can increase turbine efficiency by up to 10%. SCGTs can also be upgraded to CCGTs with a 50% efficiency jump. Currently, of the 568GW of existing gas-fired power capacity, 157GW is powered by SCGTs. This means that efficiency improvement alone can boost gas power capacity by 16GW. If all the SCGTs are upgraded to CCGTs, power capacity can increase by 79GW. Lastly, there is also growing interest in investing in natural gas-powered fuel cells – such as from Equinix and Brookfield Asset Management – which generates electricity without combustion.

Putting all this together, planned utility-scale gas-fired capacity of about 40 GW by 2030, assuming recent capacity factors, could translate into roughly 4.2 bcf/day of additional natural gas demand through 2030. These projections are relatively conservative (especially considering that gas demand from the power sector grew by 6 bcf/day between 2019 and 2024) but focus on projects that are more likely to come online. Some other analyses, however, anticipate a more aggressive demand outlook for the power sector.

However, there is likely upside to this number. First, planned behind-the-meter gas generating capacity, specifically from on-site SCGTs and fuel cells, is not included in the 40GW estimate. For instance, Williams Company, which processes and transports natural gas, is reportedly planning 6GW of behind-the-meter capacity by mid-2027. Second, the pipeline could expand further with growing data centre investments and continued support for natural gas under the Trump administration. The downside risk is that capacity factors for gas-fired plants may decline if renewable capacity builds up more aggressively. However, this risk is expected to be somewhat lower under the current administration.

The preference for natural gas to serve as a baseload does not exclude other generation options, as we have discussed here.

Flat industrial gas demand although Trump policy leaves upside riskNatural gas usage in the industrial sector is diverse, ranging from heating and processing materials to power generation, and as a feedstock in fertiliser and chemical production. In the US, the sector made up 26% of domestic demand in 2024. Demand from the sector has been fairly stable over the last decade, although it unsurprisingly took a dip during Covid.

The chemical sector is the largest consumer of industrial natural gas, accounting for 37% of industrial demand, according to the EIA's Manufacturing Energy Consumption Survey (MECS) and broader EIA consumption data. This gas is used as both a feedstock and for heat and energy.

The oil refining sector is also a large consumer of natural gas, with the sector making up around 12% of industrial demand, according to the EIA's MECS. Natural gas serves as both a fuel source for refiners and a feedstock for hydrogen, which is used to reduce the sulphur content in diesel. However, with US refining capacity likely having peaked, we expect downside risk to natural gas demand from the refining sector in the years ahead. In 2025 and 2026, the US is set to lose 550k b/d of refining capacity, which is about 3% of total US refining capacity at the start of 2025.

Overall, natural gas demand from the industrial sector is expected to be largely stable in the coming years. The EIA estimates demand from the industrial sector will decline by just 0.4% by 2030 from 2024 levels.

However, there is a great deal of uncertainty around how demand evolves, largely due to the Trump administration's push to bring back manufacturing to the US. For example, the metals industry, which is the fourth-largest consumer of natural gas within the industrial sector, has been a focus for Trump's tariffs and push to increase domestic output. It is unclear how successful the administration will be in doing this, although it clearly leaves some upside risk to industrial demand.

US industrial natural gas demand by sector (bcf/d)

Source: EIA, ING Research Marginal demand growth from the residential and commercial sectors

The residential and commercial sectors account for 13% and 10% of total US gas demand, respectively, with most of this driven by space heating. However, demand from these sectors has remained relatively subdued over the years, with some downward pressure emerging due to increased electrification and renewable adoption.

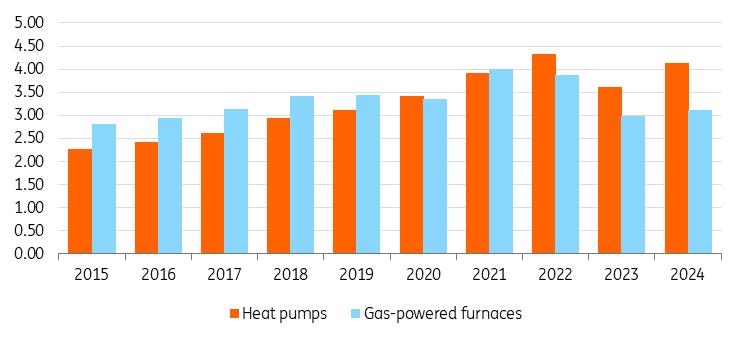

Heat pump sales in the US have risen noticeably over the past decade, a trend strengthened by the Inflation Reduction Act (IRA), which offers a 30% tax credit on installation costs, capped at $2,000.

Data from the Air-Conditioning, Heating, Refrigeration Institute (AHRI) shows that heat pump sales in the US have consistently outpaced gas-powered furnace sales since 2022. While the IRA was passed in 2022, this credit only became available from the start of 2023, likely accelerating this shift and displacing natural gas demand in residential and commercial sectors.

However, under the“One Big Beautiful Bill Act,” this credit is scheduled to be scrapped at the end of 2025, which could slow the trend and provide more support for natural gas demand than previously expected.

The EIA expects these two sectors to see demand growing at a compound annual growth rate of around 1% through 2030. However, the weather will obviously be crucial for the demand outlook, given the large share used for space heating.

US gas furnace sales come under pressure while heat pump sales grow (million units)

Source: AHRI, ING Research

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment