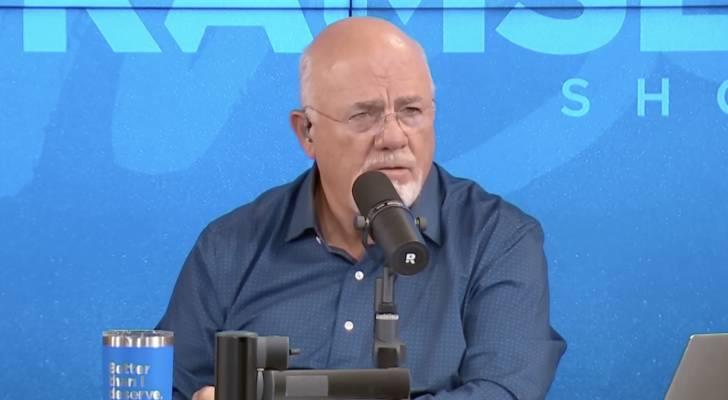

'It's Not That Hard': Dave Ramsey Tells NY Woman - Stuck In A Paycheck-To-Paycheck Cycle Despite $300K Family Income - How To Break The Pattern

This article adheres to strict editorial standards. Some or all links may be monetized.

A school psychologist named Maria called into The Ramsey Show in July with an unusual problem: Despite having minimal debt and a combined yearly income of nearly $300,000, she and her husband could not seem to stick to their budget.

Ramsey and co-host Jade Warshaw were visibly frustrated as Maria, who sounded nervous, waffled through the call and struggled to explain why her family couldn't keep their spending on track.

The couple's debts are relatively small. They owe $17,800 on credit cards, $8,000 on a car loan, and pay $2,700 per month for their mortgage. Maria also shared that the recent deaths of her mother and brother had forced the family to cover the funeral costs of $13,000 and $8,000, respectively.

“Where do you think the rest of the money is going?” Ramsey asked, but Maria couldn't account for her family's monthly spending or explain why the expenses were so overwhelming for their budget.

Must Read-

Thanks to Jeff Bezos, you can now become a landlord for as little as $100 - and no, you don't have to deal with tenants or fix freezers. Here's how

Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake - here's what it is and 3 simple steps to fix it ASAP

No time to lower your crippling car insurance rate? Here's how to do it within minutes - you could end up paying $29/month without a single phone call

Ramsey didn't mince words:“It sounds like you're circling around the airport and refuse to land.”

“It's not an intellectual circus. It's not that hard,” he added.“You're living drama to drama, crisis to crisis, and you're letting that stuff dictate your life rather than you dictating to that stuff.”

He advised Maria to re-evaluate their retirement contributions, given that her husband's take-home pay is lower than expected, and to focus on aggressively paying down their debt. He also urged her to track every dollar and take full advantage of the budgeting tools she already has.

How to keep surprises from wrecking your budgetLife will always come with unexpected expenses. That's why having and regularly contributing to an emergency fund is critical. It helps prevent credit card debt or other borrowing from spiraling out of control.

Ramsey recommends starting with a $1,000 fund if you don't have one, then building up three to six months' worth of expenses after you've paid off debt.

If an emergency has already pushed you into debt, remember that you're still in the driver's seat. Start by reviewing everything you owe, along with your essential monthly expenses. Once you know what's left over, set a realistic monthly goal of paying off debt.

That may mean trimming discretionary spending for a while. But your long-term financial health - and peace of mind - will benefit from a few months of simpler living while you work things out.

One way to build an emergency fund quickly is to take advantage of Wealthfront's cash account.

With a Wealthfront Cash account, you could earn up to 4.15% APY on your uninvested cash for your first three months (0.50% APY boost on top of the 3.75% base variable APY) provided by program banks. That's over ten times the national deposit savings rate, according to the FDIC's September report.

With no minimum balances or account fees, as well as 24/7 withdrawals and free domestic wire transfers, you can ensure your funds remain accessible at all times. Plus, Wealthfront Cash account balances of up to $16 million are insured by the FDIC.

Read more: Warren Buffett used 8 simple money rules to turn $9,800 into a stunning $150B - start using them today to get rich (and then stay rich)

How to fit your lifestyle to your incomeRachel Cruze, another co-host on The Ramsey Show, frequently talks about how high earners can still live paycheck to paycheck.

Cruze says it's more than just the lifestyle creep, or the idea that spending rises with income. It's also who you surround yourself with. As you climb income brackets, your social circles may create a new“normal” where higher spending feels expected.

She also warns that“debt steals your income.” Every dollar spent on interest payments is money you can't put toward savings or goals. If you assume that earning more justifies taking on more debt, Cruze urges you to think again. Pay it off, and you might be surprised how much breathing room it creates.

If managing a budget feels overwhelming to you, apps like Rocket Money can simplify the process.

Rocket Money tracks and categorizes your expenses, providing a clear view of your cash, credit, and investments in one place. It can even uncover forgotten subscriptions, helping you cut unnecessary costs and save potentially hundreds annually.

For a small fee, the app can also negotiate lower rates on your monthly bills, making it a valuable tool for keeping your finances on track.

Finally, Ramsey and Warshaw noted that Maria and her husband didn't appear to be aligned when it came to money. If you're working to get out of debt as a couple, you need to have regular, honest conversations - not just about a plan, but about each other's financial values and attitudes.

Before you bring your concerns to your spouse, it can help to reflect on your own habits and mindset. That way, you'll be better equipped to have calm, productive discussions that stay focused on shared goals.

Cruze acknowledged that inflation is straining many budgets. For those, like Maria, who live in expensive cities, the cost of living has been unsustainable. In such cases, Cruze suggests exploring a job change or moving to a more affordable area to stretch your income further.

One way to find some room in a tight budget is to look at your insurance spending. Many people think of the cost of their car insurance as inevitable, and don't consider shopping around for the best deal.

With OfficialCarInsurance, you can find new deals on insurance in minutes and cut down on monthly costs to as low as $29.

Their policy search includes trusted names like Progressive, GEICO and Allstate. To get started, fill in your information and OfficialCarInsurance will provide a list of the top insurers in your area. You're closer than ever to maximizing your savings on your insurance.

What To Read Next-

Savvy investors are using 5 stealthy alternatives to safeguard their portfolios - here's how to build wealth in 2026 even if trillions vanish from US stocks

Robert Kiyosaki says this 1 asset will surge 400% in a year - and he begs investors not to miss its 'explosion'

I'm almost 50 and have nothing saved for retirement - what now? Don't panic. These 6 easy steps can help you turn things around

Dave Ramsey says this 7-step plan 'works every single time' to kill debt, get rich in America - and that 'anyone' can do it

Join 200,000+ readers and get Moneywise's best stories and exclusive interviews first - clear insights curated and delivered weekly. Subscribe now.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment