China's People Are On A Grueling Treadmill

Leftist online personality Hasan Piker recently took a trip to China, and - like many other influencers who have been there - declared it to be a paradise, praising“abundance style consumption paired up with a centrally controlled economy” and“1950s Soviet era building blocks next to the Gucci store.”[1 ]

Meanwhile, pro-China pundits continue to crow about the country's technological achievements and export performance. But when you talk to ordinary Chinese people about what their lives or their families' lives are like these days, a less rosy picture emerges. Helen Gao writes:

For even more direct insight, I recommend the blog Reading the China Dream, which translates Chinese writing and online commentary. The blog has a good translation of a recent report from a Chinese marketing company on morale among the youth. Here are some excerpts from the bloggers' summary:

And this is from the translated report itself:

This all fits with everything my Chinese expat friends tell me about how their relatives are faring back home. It also fits with the descriptions of young Chinese people's disillusionment in Dan Wang's recent book“Breakneck.”

Essentially, it seems as if Chinese people - especially young people - are stuck on a treadmill. China's young people are studying hard, getting a college education and putting in grueling, long work hour.

And yet youth unemployment rates are rising relentlessly, many college graduates can't find the kind of white-collar work they trained for and wage growth is sluggish. To a huge number of Chinese people, the modern Chinese economy is less of a“Chinese Dream” than a Sisyphean nightmare.

In fact, the word“treadmill” also hearkens to where China's problems began. Way back in 2010, hedge fund manager Jim Chanos declared that China's real estate market was on a“treadmill to hell.” That prediction was way too early - the real estate market probably didn't become a bubble until the late 2010s and didn't begin to crash until near the end of 2021.

But crash it eventually did, and four years later it's still in a protracted state of collapse. Despite government support, Chinese property prices are still falling:

This price decline is a catastrophe for regular Chinese households. Even more than in most countries, Chinese households have their wealth concentrated in real estate. The stock market is underdeveloped and bonds have crappy interest rates,[2] so people save money by buying houses or housing-linked bonds. When real estate prices go down, it means Chinese people are getting poorer and poorer, despite working hard and living frugal lives.

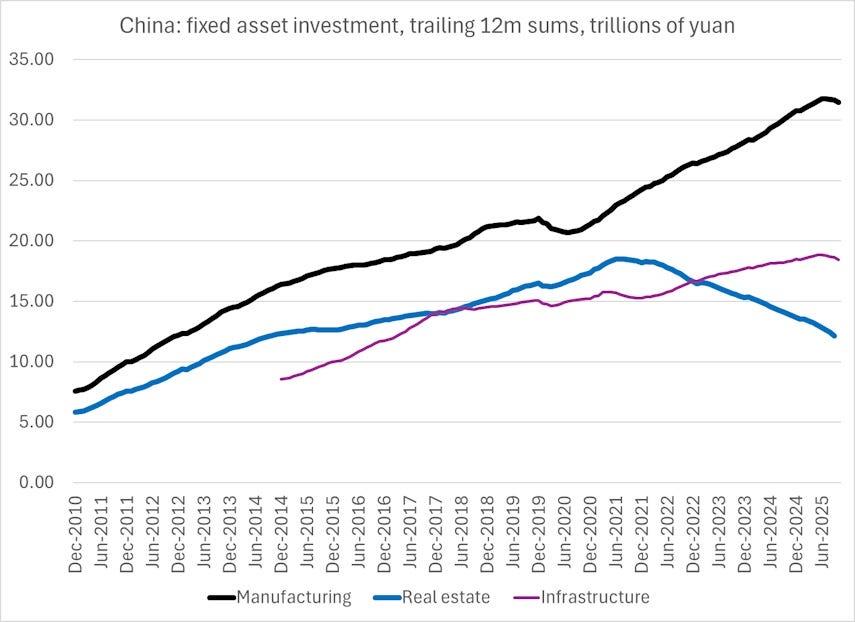

The property bust is also weighing on the macroeconomy. Property investment is down almost 15% since a year ago. This is a big reason why unemployment is rising, wages are stagnant and lots of college grads can't find jobs commensurate with their skills.

For a while, China used manufacturing investment to fill the economic hole left by real estate. The country embarked on the greatest industrial policy push in human history, spending an estimated 4.4% of GDP on manufacturing subsidies of various kinds. Industrial lending and output surged, keeping GDP growth from collapsing even as the real estate sector floundered.

But this strategy also hit its limits. It turns out that if you pay a whole bunch of companies to make the same products, they end up competing viciously with each other, and their profits evaporate. Here are some excerpts from a recent story in the Atlantic about China's EV industry, which is both beating the world and floundering financially at the same time:

This so-called“involution” results in misallocation of capital, reducing productivity growth and ultimately slowing GDP growth. By destroying profit margins for even the best-run Chinese companies, involution damages their ability to invest for the future.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment