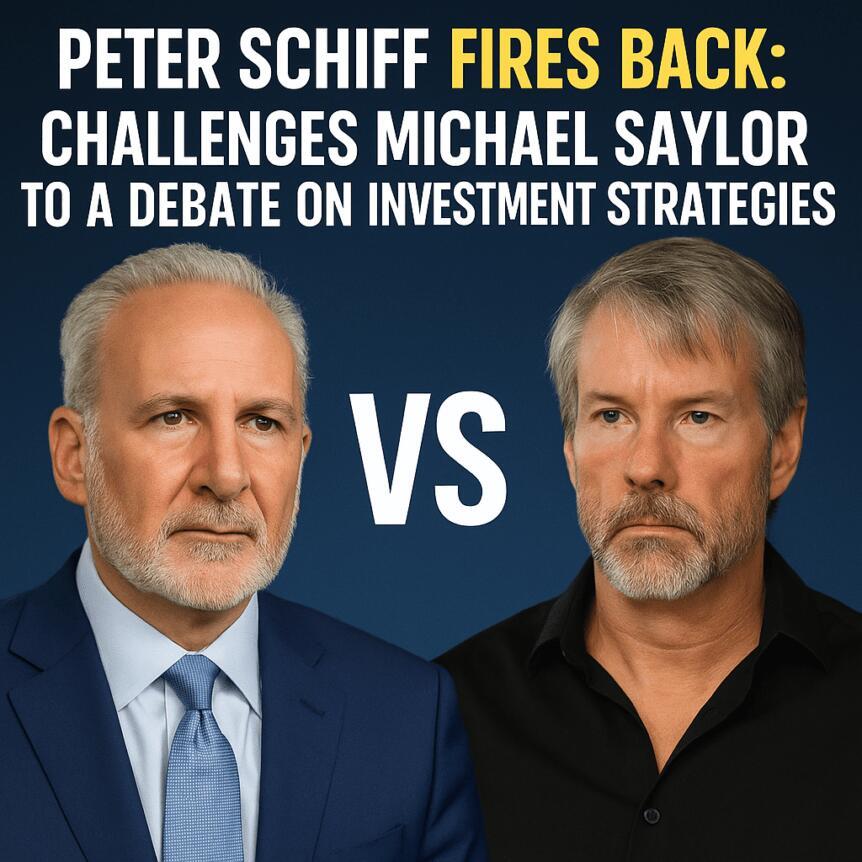

Peter Schiff Fires Back: Challenges Michael Saylor To A Debate On Investment Strategies

-

In recent developments within the cryptocurrency space, gold investor Peter Schiff has publicly criticized MicroStrategy 's business model, which heavily relies on Bitcoin holdings. Schiff labeled Strategy's approach as a“fraud,” challenging company founder Michael Saylor to a debate amid a turbulent crypto market and a rebound in gold prices. This spat highlights ongoing tensions between traditional gold advocates and the rapidly evolving crypto industry, especially as Bitcoin experiences a notable decline from its all-time high.

- Peter Schiff calls MicroStrategy 's Bitcoin treasury strategy a“fraud” and challenges Michael Saylor to a debate. Bitcoin's price has fallen over 20% from its October peak, amid broader market downturns and renewed gold strength. Strategy's net asset value (mNAV) has recovered slightly but remains below ideal levels, reflecting ongoing investor skepticism. Gold continues to defend key support levels, trading above $4,000, after reaching an October high of around $4,380. The debate underscores contrasting views on the future of cryptocurrencies versus traditional metals like gold.

Gold advocate Peter Schiff criticized MicroStrategy's business model, which became the largest Bitcoin treasury holder in the world. Schiff, a well-known critic of cryptocurrencies, called Strategy's approach a“fraud” and publicly challenged founder Michael Saylor to a debate at Binance Blockchain Week in Dubai this December. Schiff argues that Strategy's reliance on income-oriented funds investing in high-yield preferred shares tied to Bitcoin exposes the company to potential collapse.

Source: Peter Schiff

Schiff warned that once the funds recognize the instability of Strategy's business model, the firm would be unable to raise new debt, setting off a“death spiral” for the company. This bearish outlook comes amid recent market declines, with Bitcoin falling below $99,000 and a broader downturn in the crypto treasury sector, which has seen many digital assets retrace from recent highs.

Despite the slump, gold remains resilient, defending its critical support above $4,000 per ounce. Currently trading around $4,085, gold's price has rebounded from a brief dip below the psychologically important level. In October, gold peaked near $4,380, bolstered by a market capitalization exceeding $30 trillion before retreating to current levels.

Strategy's net asset value, represented as its mNAV, had dipped below 1 in November but has since recovered to approximately 1.21. For a treasury company of this nature, investors generally favor an mNAV of 2 or higher; the current level indicates lingering skepticism. Strategy's stock has declined over 50% since July, trading around $199 at present.

Meanwhile, the broader financial environment favors gold, which continues to outperform in the current macroeconomic landscape. As Bitcoin struggles to regain momentum and the crypto markets remain volatile, gold's steady position above key support levels underscores its status as a safe haven amid the turbulence.

-

This version aims to deliver a clear, trustworthy overview while highlighting the ongoing debates and market dynamics affecting cryptocurrencies and gold.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment