403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

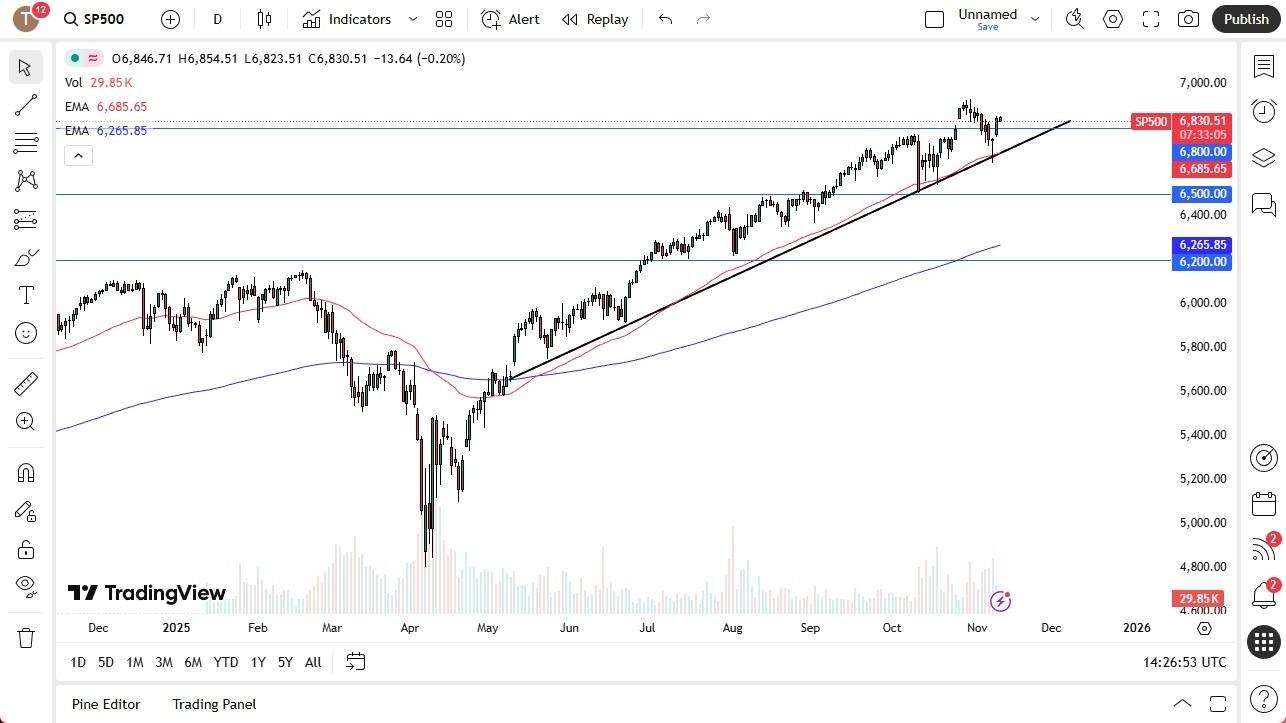

S&P 500 Forecast 12/11: Pull Back And Offer Value (Chart)

(MENAFN- Daily Forex)

- The S&P 500 pulled back on Tuesday but remains in a broader uptrend, with dips likely to attract buyers. Support sits near 6,800, while 7,000 remains a realistic year-end target amid expectations of a seasonal“Santa Claus rally.”

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment