403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

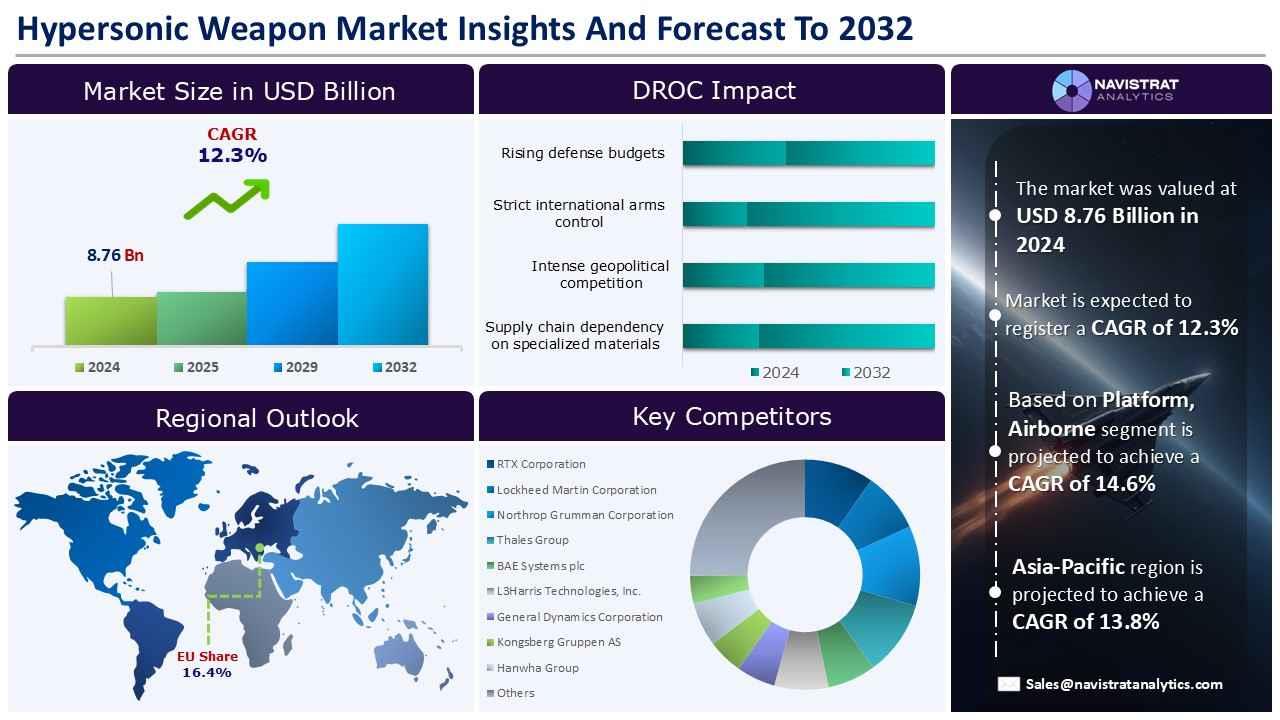

Hypersonic Weapons Market is USD 21.69 Billion in 2024 and is projected to register a CAGR of 12.3%

(MENAFN- Navistrat Analytics) 6th November 2025 – Rising geopolitical tensions and a rise in armed conflicts worldwide will contribute to strong demand for hypersonic weapons systems. According to the Peace Research Institute, 2024 saw the highest number of state-based armed conflicts, with 61 documented in 36 countries. This climate influences both government procurement expenditures and possibilities for military contractors.

The continuing dispute between Israel and Palestine, as well as India and Pakistan, has accelerated the deployment of hypersonic weapons. These countries facing serious security threats will potentially devote a bigger percentage of their expenditures to rapid, precise attack weapons, prioritizing hypersonic technology investments over traditional ones.

For companies engaged in the military industry, this means more contracts with higher volumes, as well as the potential of long-term funding for projects. Furthermore, NATO members spent USD 1,506 billion in 2024, accounting for 55% of global military expenditure. The consistent growth across member states suggests strategic investments combined with geopolitical competition, resulting in a commercially attractive picture.

However, regulatory and export control systems restrict commercial market development. Foreign sales restrictions and multinational cooperation limit access to new markets and have an influence on development prospects beyond the United States. On September 6, 2025, the US Department of Commerce's Bureau of Industry and Security (BIS) released an interim final rule setting worldwide export limitations on a variety of sophisticated technologies. This, in turn, limits the international flow of hypersonic components and technology.

Get Exclusive Report Insights Here:

Segment market overview and growth Insights:

Hypersonic Glide Vehicles (HGVs) account for largest revenue share in 2024. HGVs launched by boost-glide systems are essentially vehicles that will travel at hypersonic speeds while manoeuvring to avoid the traditional missile defence systems. Such a capability allows armed forces to accurately deploy hypersonic vehicles, giving them a definitive tactical edge over regular weaponry. Furthermore, from a commercial standpoint, HGVs' smooth and consistent performance has made them the preferred choice of defence contractors and governments looking for high-impact, cost-effective solutions.

The Defense Forces segment contributed a significant revenue share in 2024. Defense expenditure in major countries such as the United States, China, and Europe has been steadily increasing for several years, creating a stable financial environment for manufacturers and system integrators. Long-term hypersonic weapons development plans often include the development and testing stages, manufacturing, maintenance, and periodic upgrades, assuming several income streams throughout time.

Regional market overview and growth insights:

Asia Pacific is expected to register the fastest revenue growth by 2032. Rising hypersonic missile development in China, North Korea, South Korea, and Japan has driven up market demand for hypersonic missiles. On October 3rd, 2025, China deployed Dongfeng-17 hypersonic ballistic missiles to a PLARF site near Taiwan in response to escalating threats to US forces in the Western Pacific and Taiwan. In addition, North Korea tested a hypersonic missile in January 2025. This device can reach 100-kilometer altitudes and glide toward targets in the East Sea.

Middle East & Africa contributed a substantial revenue share in 2024. Growing security concerns are resulting in new production contracts for missile monitoring and defense systems. For example, on July 25th, 2025, Turkey fired its Tayfun Block-4 hypersonic missile in response to increased escalation in regional capabilities and rising threat perceptions among neighbouring countries.

The region is now involved in 45 armed conflicts, including Iran, Iraq, Syria, Yemen, Libya, Palestine, and others. In March 2024, three crew members were killed when a Houthi missile struck the Greek-owned, Barbados-flagged yacht. These factors are expected to accelerate market revenue growth throughout the forecast period.

Competitive Landscape and Key Competitors:

The Hypersonic Weapons Market is characterised by numerous players, with major players competing across segments and regions. The list of major players included in the Hypersonic Weapons Market report is:

• RTX Corporation

• Lockheed Martin Corporation

• BAE Systems plc

• L3Harris Technologies, Inc.

• General Dynamics Corporation

• Kongsberg Gruppen AS

• Hanwha Group

• Kratos Defense & Security Solutions, Inc.

• Castelion Corporation

• Elbit Systems Ltd.

• MBDA

• URSA Major Technologies Inc

Buy Your Exclusive Copy Now:

Major strategic developments by leading competitors

Castelion corporation : On 4th July 2025, Castelion Corporation received USD 350 million in a Series B financing led by Lightspeed Venture Partners and Altimeter Capital. This funding follows a USD 100 million Series A concluded in January, also led by Lightspeed. Castelion's weapons are intended to provide enhanced hypersonic capabilities to close the national security gap. Castelion has received funding and recognition from many United States Department of Defence institutions, including the Air Force Research Laboratory and the Naval Air Systems Command.

Unlock the Key to Transforming Your Business Strategy with Our Hypersonic Weapons Market Insights –

• Download the report summary:

• Request Customization:

Navistrat Analytics has segmented the hypersonic weapons market on the basis of warhead type, type, sub-system, platform, range, end-use and region:

• Warhead Type Outlook (Revenue, USD Billion; 2022-2032)

• Conventional

• Kinetic

• Nuclear

• Type Outlook (Revenue, USD Million; 2022-2032)

• Hypersonic Glide Vehicles (HGV)

• Hypersonic Cruise Missiles (HCM)

• Boost-Glide Systems

• Hypersonic Tactical Missiles

• Hypersonic Strategic Missiles

• Hypersonic Anti-Ship Missiles

• Others

• Subsystem Outlook (Revenue, USD Billion; 2022-2032)

• Propulsion Systems

• Guidance and Control Systems

• Materials and Structures

• Sensors and Avionics

• Platform Outlook (Revenue, USD Billion; 2022-2032)

• Land-Based

• Airborne

• Naval

• Space-Based

• Range Outlook (Revenue, USD Billion; 2022-2032)

• Short-Range

• Medium-Range

• Long-Range

• End-Use Outlook (Revenue, USD Billion; 2022-2032)

• Defense Forces

• Homeland Security

• Government Bodies

• Defense Research & Testing Agencies

• Regional Outlook (Revenue, USD Billion; 2022-2032)

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Get a preview of the detailed segmentation of market:

The continuing dispute between Israel and Palestine, as well as India and Pakistan, has accelerated the deployment of hypersonic weapons. These countries facing serious security threats will potentially devote a bigger percentage of their expenditures to rapid, precise attack weapons, prioritizing hypersonic technology investments over traditional ones.

For companies engaged in the military industry, this means more contracts with higher volumes, as well as the potential of long-term funding for projects. Furthermore, NATO members spent USD 1,506 billion in 2024, accounting for 55% of global military expenditure. The consistent growth across member states suggests strategic investments combined with geopolitical competition, resulting in a commercially attractive picture.

However, regulatory and export control systems restrict commercial market development. Foreign sales restrictions and multinational cooperation limit access to new markets and have an influence on development prospects beyond the United States. On September 6, 2025, the US Department of Commerce's Bureau of Industry and Security (BIS) released an interim final rule setting worldwide export limitations on a variety of sophisticated technologies. This, in turn, limits the international flow of hypersonic components and technology.

Get Exclusive Report Insights Here:

Segment market overview and growth Insights:

Hypersonic Glide Vehicles (HGVs) account for largest revenue share in 2024. HGVs launched by boost-glide systems are essentially vehicles that will travel at hypersonic speeds while manoeuvring to avoid the traditional missile defence systems. Such a capability allows armed forces to accurately deploy hypersonic vehicles, giving them a definitive tactical edge over regular weaponry. Furthermore, from a commercial standpoint, HGVs' smooth and consistent performance has made them the preferred choice of defence contractors and governments looking for high-impact, cost-effective solutions.

The Defense Forces segment contributed a significant revenue share in 2024. Defense expenditure in major countries such as the United States, China, and Europe has been steadily increasing for several years, creating a stable financial environment for manufacturers and system integrators. Long-term hypersonic weapons development plans often include the development and testing stages, manufacturing, maintenance, and periodic upgrades, assuming several income streams throughout time.

Regional market overview and growth insights:

Asia Pacific is expected to register the fastest revenue growth by 2032. Rising hypersonic missile development in China, North Korea, South Korea, and Japan has driven up market demand for hypersonic missiles. On October 3rd, 2025, China deployed Dongfeng-17 hypersonic ballistic missiles to a PLARF site near Taiwan in response to escalating threats to US forces in the Western Pacific and Taiwan. In addition, North Korea tested a hypersonic missile in January 2025. This device can reach 100-kilometer altitudes and glide toward targets in the East Sea.

Middle East & Africa contributed a substantial revenue share in 2024. Growing security concerns are resulting in new production contracts for missile monitoring and defense systems. For example, on July 25th, 2025, Turkey fired its Tayfun Block-4 hypersonic missile in response to increased escalation in regional capabilities and rising threat perceptions among neighbouring countries.

The region is now involved in 45 armed conflicts, including Iran, Iraq, Syria, Yemen, Libya, Palestine, and others. In March 2024, three crew members were killed when a Houthi missile struck the Greek-owned, Barbados-flagged yacht. These factors are expected to accelerate market revenue growth throughout the forecast period.

Competitive Landscape and Key Competitors:

The Hypersonic Weapons Market is characterised by numerous players, with major players competing across segments and regions. The list of major players included in the Hypersonic Weapons Market report is:

• RTX Corporation

• Lockheed Martin Corporation

• BAE Systems plc

• L3Harris Technologies, Inc.

• General Dynamics Corporation

• Kongsberg Gruppen AS

• Hanwha Group

• Kratos Defense & Security Solutions, Inc.

• Castelion Corporation

• Elbit Systems Ltd.

• MBDA

• URSA Major Technologies Inc

Buy Your Exclusive Copy Now:

Major strategic developments by leading competitors

Castelion corporation : On 4th July 2025, Castelion Corporation received USD 350 million in a Series B financing led by Lightspeed Venture Partners and Altimeter Capital. This funding follows a USD 100 million Series A concluded in January, also led by Lightspeed. Castelion's weapons are intended to provide enhanced hypersonic capabilities to close the national security gap. Castelion has received funding and recognition from many United States Department of Defence institutions, including the Air Force Research Laboratory and the Naval Air Systems Command.

Unlock the Key to Transforming Your Business Strategy with Our Hypersonic Weapons Market Insights –

• Download the report summary:

• Request Customization:

Navistrat Analytics has segmented the hypersonic weapons market on the basis of warhead type, type, sub-system, platform, range, end-use and region:

• Warhead Type Outlook (Revenue, USD Billion; 2022-2032)

• Conventional

• Kinetic

• Nuclear

• Type Outlook (Revenue, USD Million; 2022-2032)

• Hypersonic Glide Vehicles (HGV)

• Hypersonic Cruise Missiles (HCM)

• Boost-Glide Systems

• Hypersonic Tactical Missiles

• Hypersonic Strategic Missiles

• Hypersonic Anti-Ship Missiles

• Others

• Subsystem Outlook (Revenue, USD Billion; 2022-2032)

• Propulsion Systems

• Guidance and Control Systems

• Materials and Structures

• Sensors and Avionics

• Platform Outlook (Revenue, USD Billion; 2022-2032)

• Land-Based

• Airborne

• Naval

• Space-Based

• Range Outlook (Revenue, USD Billion; 2022-2032)

• Short-Range

• Medium-Range

• Long-Range

• End-Use Outlook (Revenue, USD Billion; 2022-2032)

• Defense Forces

• Homeland Security

• Government Bodies

• Defense Research & Testing Agencies

• Regional Outlook (Revenue, USD Billion; 2022-2032)

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Get a preview of the detailed segmentation of market:

Navistrat Analytics

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment