GBP Money Markets: A Funding Reshuffle Is Testing Liquidity Plumbing

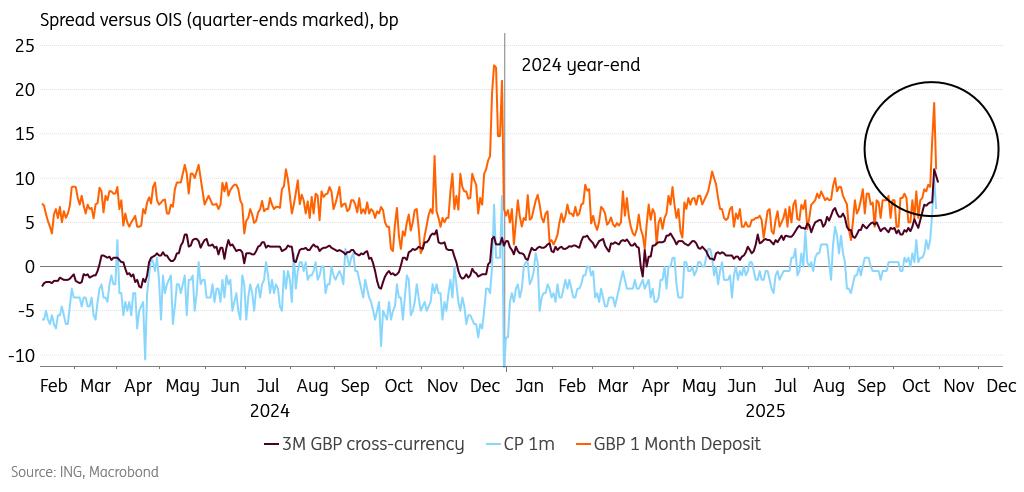

The tightening of money market conditions in October was considerable, but we argue that this was a one-off due to tweaks in the Bank of England liquidity facilities. Overnight repo rates have risen significantly since mid-month, and term deposits, commercial paper and the cross-currency basis also reflected a dash for liquidity. In fact, the spread on short-dated commercial paper peaked above 2024 year-end levels.

October liquidity seemed to fare worse than 2024 year-end

Banks rotated their Covid funding to BoE liquidity for better pricing

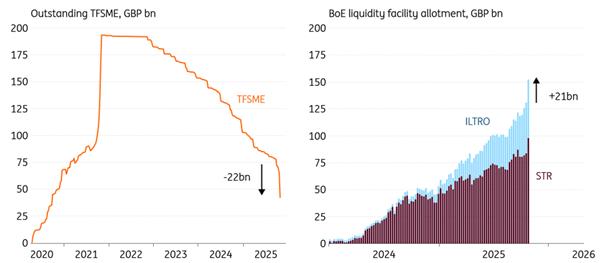

The sudden demand for liquidity was driven by record repayments of Covid-19 loans to encourage SME lending (TFSME). In the last week of October, banks repaid £22bn of these loans, way more than the regular amounts we've seen over the past year. The repayments almost exactly mirrored the demand for the BoE's liquidity facilities: the 1-week Short Term Repo (STR) facility and 6-month Indexed Long-Term Refinancing Operations (ILTRO). This makes the net impact on reserves negligible.

So that begs the question, why did banks decide to rotate funding from the TFSME to the Bank's liquidity facilities? The reason is that the minimum pricing of the ILTRO will increase by 3bp starting from November onwards. That would then make ILTRO funding more expensive than the terms for the TFSME loan. As such, frontloading the repayments and refinancing with a lower ILTRO cost can be beneficial for TFSME loans that mature within six months.

Banks repaid TFSME funding early and refinanced using ILTRO and STR

November should see some easing, but thereafter more tightening again

Because the net impact of reserves is close to zero, we don't anticipate any lasting effects and November should see better conditions. In fact, the strong pickup in the liquidity facility reflects a sound working of the liquidity plumbing set up by the BoE. The tightening in overnight markets reflects the need to bridge the gap between moving liquidity from one funding source to another with slightly different maturities. Combine that with regular month-end effects, and seeing some tightness was entirely expected.

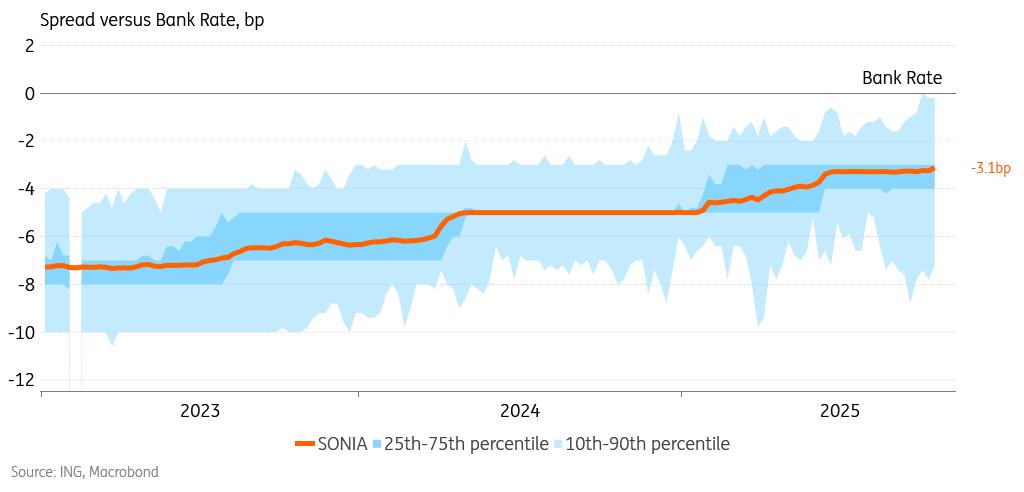

We may, however, see more tightening again in money markets towards year-end as the level of reserves has come down drastically since last year. We can see that the SONIA rate has continued moving closer to the Bank Rate, suggesting the competition for deposits, and thus liquidity, has increased. More notable may be the distribution of the SONIA sample. The tenth-highest percentile of deposit rates was at the Bank Rate or above, whilst the tenth lowest was some 8bp below. This suggests that certain banks are much more willing to pay for reserves than others. Such effects can become more pronounced during year-end, and we could see more volatility as a result.

Dispersion in deposit rates suggest unevenly distributed reserves

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment