Gold Monthly: Fundamentals Remain Strong

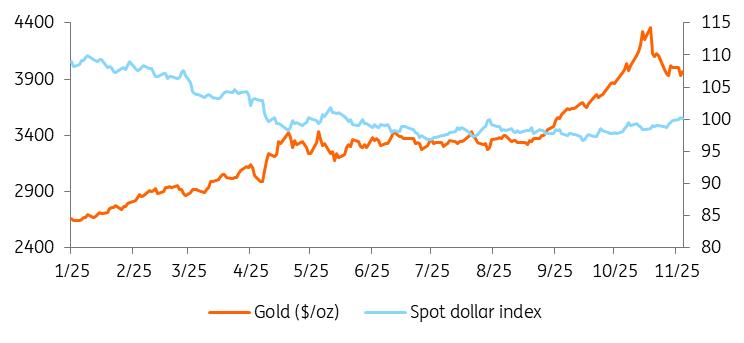

Gold surged to a record in October above $4,300/oz, as retail investors piled in, but prices have since retreated below $4,000/oz amid profit-taking, improved risk sentiment, and uncertainty over investor positioning amid the ongoing US government shutdown. The pullback in prices was accompanied by withdrawals from gold-backed exchange-traded funds.

Despite the recent pullback in prices, we remain positive on our gold outlook, with macro tailwinds and fundamentals pointing to further upside in 2026.

Gold retreats from record

Source: Refinitiv, ING Research

Even after the recent weakness, gold prices are still up by more than 50% year-to-date. Key supports, including central bank and haven demand, remain in place. ETF buying should also resume as the US Federal Reserve is likely to continue cutting interest rates.

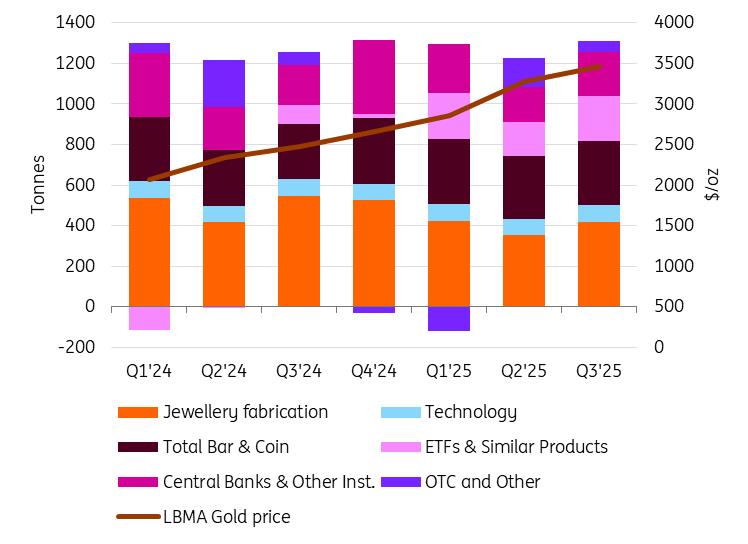

Gold demand hits record high in 3QGlobal gold demand hit 1,313 tonnes in the third quarter, the strongest quarterly total on record, according to the World Gold Council. This surge was driven by strong investment demand, including purchases via exchange-traded funds, bars and coins, as well as significant buying by central banks.

Investment demand drove demand growth in 3Q

Source: World Gold Council, ING Research

ETF investors added 222 tonnes of gold holdings, marking the biggest quarterly inflow in years. Bar and coin demand remained robust at 316 tonnes. Meanwhile, central banks bought 220 tonnes, up nearly 30% from 2Q, led by emerging markets.

But jewellery demand fell 19% year-on year to 371 tonnes, which was the sixth straight year-on-year decline, as record prices curbed consumption. However, in value terms, spending on jewellery rose 13% to $41 billion, with higher prices offsetting weaker volumes.

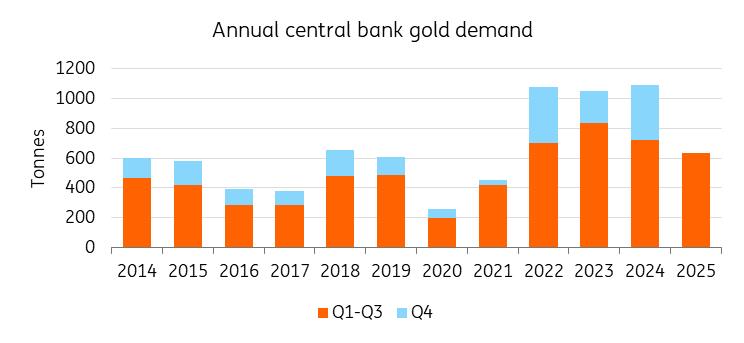

Central banks remain hungryCentral banks remain a key pillar of demand for gold. In 3Q, central banks increased their buying pace following two consecutive quarters of slowing purchases. They bought an estimated 220 tonnes of gold in the quarter, 28% higher than the 2Q total and 6% above the five-year quarterly average.

The National Bank of Kazakhstan was the largest buyer in 3Q, while the Central Bank of Brazil added gold for the first time since 2021. Poland remains the largest buyer of gold so far in 2025 with 67 tonnes.

And central banks are still hungry for more gold. South Korea's central bank is said to be considering adding gold to its reserves, for the first time since 2013. Serbia's president also recently said that the country's gold reserves will almost double to 100 tonnes by 2030.

Key downside risk for gold looking ahead would be if central banks decided to sell their reserves. In the Philippines, Benjamin Diokno, a board member of the central bank, recently said the bank should sell some of its“excessive” gold holdings. In the US, Senator Cynthia Lummis has proposed that the country sell a portion of its gold reserves to buy Bitcoin.

However, we believe the shift in central banks' purchases has been more structural and they will continue to add gold to their reserves, as strategies on currency reserves shift.

Central banks continue to add gold despite higher prices

Source: World Gold Council, ING Research ETF holdings are near all-time highs

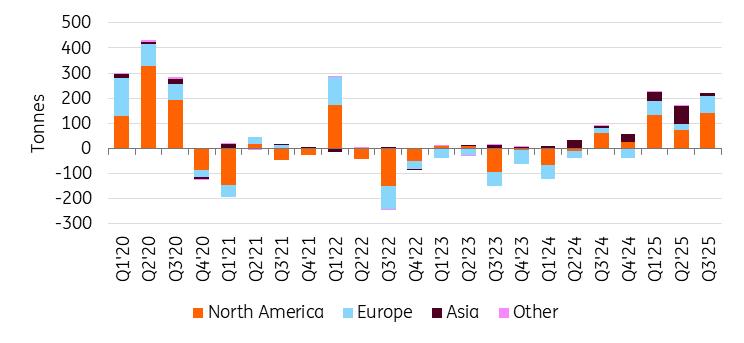

ETFs have been another powerful force behind gold's record-breaking rally this year, with investment demand gathering steam in 3Q. Last quarter marked a record high for gold-backed ETF inflows. Gold ETF investors added 222 tonnes, taking global holdings within reach of their November 2020 all-time high.

Despite the recent withdrawals, we expect ETF buying to resume as the US Fed is likely to continue cutting interest rates. Rates traders still see better than 70% odds for an interest-rate cut in December.

ETFs have had their strongest ytd inflows since 2020

Source: World Gold Council, ING Research Outlook is still positive

We remain positive on our gold outlook, despite the recent pullback in prices, with key supports, including central bank and safe haven demand, still in place. Although trade tensions have recently eased, significant geopolitical uncertainty persists, driving demand for safe assets.

We view the correction as healthy rather than a trend reversal, with any further weakness likely to attract renewed interest from both retail and institutional buyers.

We expect ETF buying to resume as interest rates fall. We also expect central banks to continue adding gold to their reserves.

Downside risks include a major market sell-off which could force investors to dump gold to raise cash. Other downside risks include reduced safe haven demand amid easing geopolitical tensions. Central banks selling their gold reserves poses another risk to our outlook.

Still, we expect gold's downside to be limited and see prices averaging $4,000/oz this quarter and $4,100/oz in 1Q next year, although short-term volatility could remain in place.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment