EUR Money Markets: Upward Pressure From Declining Liquidity Still Gradual

The ECB has signalled again that it views its monetary policy as being in a“good place” with the deposit facility rate at 2% since the June meeting. There are still risks around the outlook stemming from trade uncertainties and the political developments in France and Germany, for instance, and also differing views on risks surrounding inflation. The market is still eyeing chances of further ECB easing, pricing in a roughly 25% probability of another 25bp cut within the next 12 months.

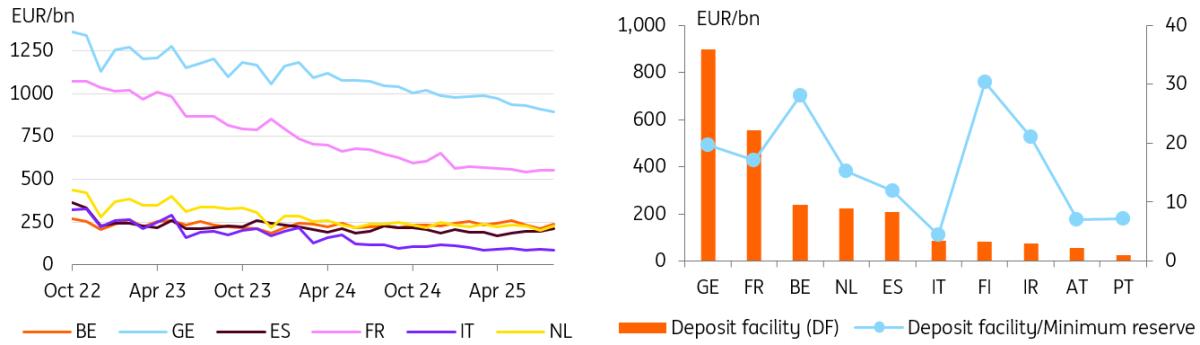

Liquidity in the system remains high, but also unequally distributedWhile ECB policy rates appear to be on hold for the foreseeable future, the market is still looking at a gradual decline of excess reserves in the banking system. This stems from the ongoing roll-off of bonds from the ECB's policy securities portfolios.

The level of excess reserves in the system (i.e. reserves held by banks in the ECB accounts in excess of the minimum reserve requirement) has dropped to €2.5 trillion from around €2.9 trillion at the start of the year. It had peaked at €4.75 trillion in 2022 on the back of ECB interventions to stem the fall out of the pandemic.

Excess reserves are not distributed equally across the banking system. We still see that the bulk of it is concentrated in the banking centres of Germany and France. German banks deposited close to €900bn in reserves in the ECB's deposit facility; French banks still had around €550bn at the end of the summer. Meanwhile, Italian banks deposited only close to €100bn. Viewed as multiples of the individual countries' minimum reserve requirements, we see that Italy's banks are holding a bit more than four times the minimum reserve as excess liquidity, while the factor stands close to 20 and 17 for Germany and France, respectively.

Excess reserves are not distributed equally across the eurozone

Source: ECB, ING The ECB looks to have more time at hand than it US and UK peers

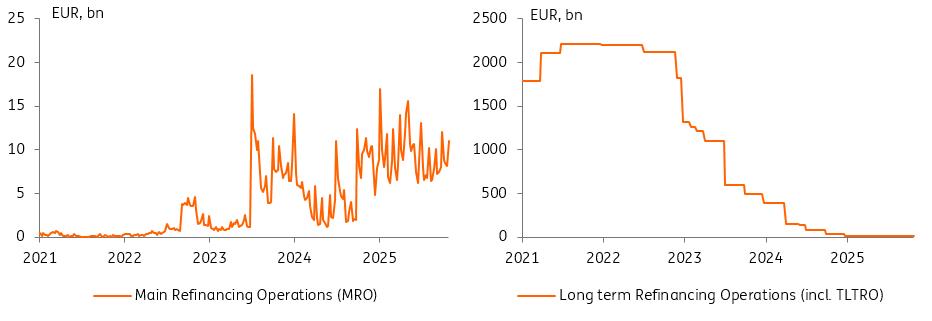

Looking ahead, the question is which level of overall reserves banks will feel comfortable with. As we near that level, we should see more pronounced pressure on market funding rates and/or recourse to the ECB's liquidity-providing operations. Estimates for that level range from €1.5tr to €2tr, but one will know for sure only once we see changes in market prices and behaviour.

Since they appear to have stabilised over the past few months, if we blindly extrapolate the level of Italian reserves in terms of minimum reserve multiples, we would arrive at an overall level even below €1tr for the system as a whole. But we also note that other countries seem to have stabilised at higher multiples of the minimum reserve, such as Spain or Ireland, which highlights that structural differences among the banking sectors can lead to different – and noticeably higher – desired reserve levels.

Banks are currently under little pressure to turn to the ECB for liquidity

Source: ECB, ING

Overall, even the higher end of estimates suggests that the ECB, unlike its US and UK peers, still has more time before a bigger shift in banks' behaviour becomes obvious. But extrapolating the gradual decline of excess liquidity, the upper end could be reached in late 2026 already, while the €1.5tr level could be hit in early 2028.

While the ECB has already laid out its broader plans of implementing policy in the long-run, some details around the use of structural liquidity operations remain rather vague, for instance. That suggests that by the middle of next year, the ECB could think about providing more guidance around the details of its framework if it wants to prepare the market.

Keep in mind that other factors also determine the level of excess liquidity in the system, such as the evolution of banknotes in circulation, or the level of official sector deposits at the ECB.

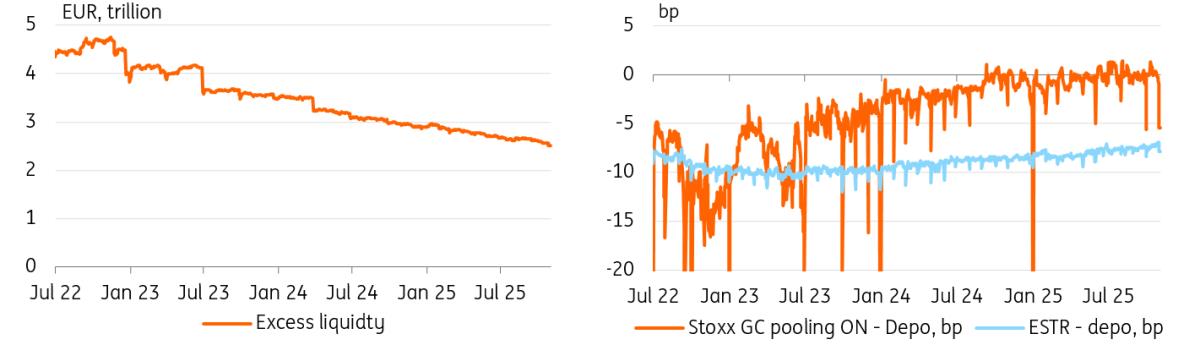

Excess liquidity gradually declines from still-elevated levels, with only gradual impact on overnight rates so far

Source: ECB, Refinitiv, ING The impact on money market rates continues to be gradual, but has to be monitored

Mirroring the gradual decline of excess liquidity in the system, the upward pressure on the ECB's targeted overnight rate relative to the deposit facility rates has also been only gradual so far. Nevertheless, the ESTR fixings at around 7bp below the ECB rate ahead of October end – and now also the day after – have been the highest since 2021. A further gradual increase looks more than likely, though we are not yet looking for an acceleration of the upward dynamic, as overall liquidity still looks more than ample.

Secured overnight funding rates have already stabilised at higher levels for around a year, in an adjustment to the overall availability of collateral. The GC pooling rate, for instance, has been fluctuating a few basis points around the ECB's deposit facility for a while now. There is also very little impact from recent political turmoil in France on the distinction of repo levels between countries' government collateral.

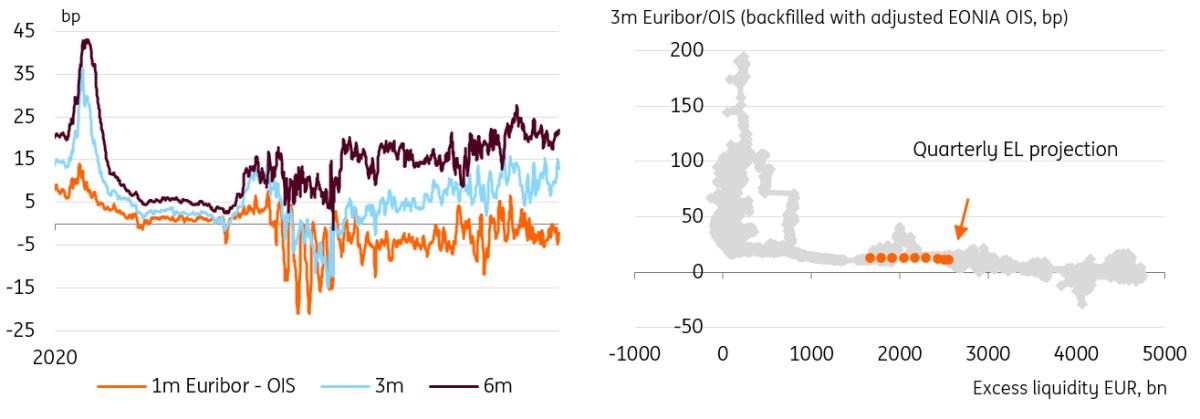

The spread of 3m Euribor fixings relative to the overnight indexed swap still appears to trend sideways around 11bp, although in a somewhat broader range. But markets are looking for some moderate further widening. We see, for instance, that the forward spreads a year out from now implied by Euribor futures contracts have been creeping wider to above 13bp.

Euribor spreads also experience only mild upward pressure

Source: Refinitiv, ING

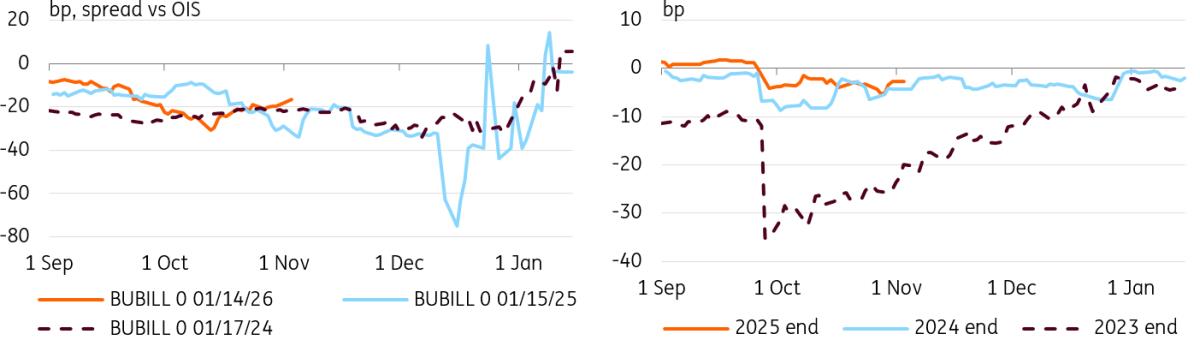

The upcoming year-end also appears to look likely to be a relatively calm affair if one compares how some of the usual funding stress indicators behave in the run-up to the turn, such as the Bubill/OIS or the cross-currency basis. But especially looking at the latter, one could argue that the pressure is now on the other end with the current tightness in US short-term funding markets.

Year-end funding tensions appear less pronounced in Bubill and 3m EUR/USD xccy markets

Source: Refinitiv, ING

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment