Australia's Construction Equipment Market To Reach 27.1 Thousand Units By 2030 Arizton

"Australia Construction Equipment Market Research Report by Arizton"Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast 2025–2030.

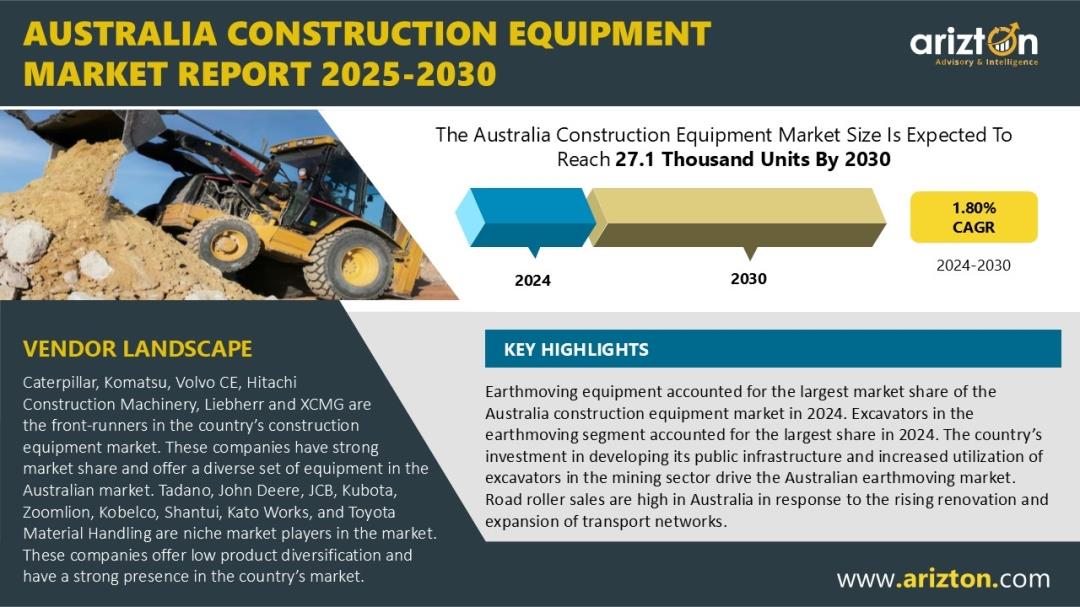

Australia's construction sector is witnessing strong momentum, with real-term growth projected at 3.8% for 2025. This expansion is being strategically fueled by large-scale investments across transportation infrastructure, manufacturing facilities, residential housing, and renewable energy-based power generation. According to Arizton, the Australia construction equipment market was valued at 24.4 thousand units in 2024 and is expected to reach 27.1 thousand units by 2030, growing at a CAGR of 1.8% during the forecast period. This steady growth highlights the sector's pivotal role in advancing Australia's infrastructure and supporting the nation's long-term sustainability agenda.

Explore the Full Market Insights:Report Summary:

Market Size (2030): 27.1 Thousand Units

Market Size (2024): 24.4 Thousand Units

CAGR- VOLUME (2024-2030): 1.80 %

MARKET SIZE- REVENUE (2030): USD 1.75 Billion

HISTORIC YEAR: 2021-2023

BASE YEAR: 2024

FORECAST YEAR: 2025-2030

EQUIPMENT TYPE: Earthmoving Equipment, Road Construction Equipment, Material Handling Equipment, and Other Equipment

END USERS: Construction, Mining, Manufacturing, and Others

What's Powering Australia's Shift from Diesel to Electric in Construction and Mining?

Australia's mining and construction sectors are witnessing a powerful shift toward electric equipment in 2025, driven by sustainability mandates, rising fuel costs, and stricter emissions targets. Liebherr-Australia marked a major milestone with the R 9400 E 400-tonne electric excavator at BHP's Yandi iron-ore mine, BHP's first global electric model, setting the pace for wider adoption across the industry.

This momentum is spreading through the construction space as well. Allworks deployed Volvo's L25 Electric Wheel Loader on the Whiteman Park Tramway Extension, while the ECR25 Electric Excavator is becoming a go-to for quiet, zero-emission urban projects. Adding to this, XCMG Australia is piloting its XLC220-E electric crawler crane on major infrastructure sites. With strong government incentives lowering upfront costs, electric fleets are fast becoming the foundation of Australia's net-zero 2050 ambition.

Key Highlights- Australia Construction Equipment Market

-

Earthmoving Equipment Leads Market: Dominating Australia's construction equipment market in 2024, driven by infrastructure investments and strong excavator demand in mining.

Material Handling on the Rise: Expanding manufacturing and logistics sectors boost demand for forklifts and telescopic handlers, led by major warehouse developments like Bisinella's Geelong project.

Government Push Fuels Crane Demand: The $134.5 million port infrastructure investment in Western Australia is driving the need for heavy-lift crawler cranes.

Urban Growth Drives Equipment Utilization: Major projects in Sydney, Melbourne, and Brisbane - including the Sydney Metro and West Gate Tunnel, are accelerating equipment demand nationwide.

Is the Australian Government's $1.1 B Bet on Low-Carbon Fuels the Spark for a Cleaner Future?

Australia's construction sector is entering a pivotal phase of energy transition as sustainability goals, rising fuel costs, and policy incentives accelerate the shift toward electric, biodiesel, renewable diesel, and hydrogen-powered equipment. The Australian government's AUD 1.1 billion investment in developing a domestic low-carbon fuels industry by 2028 is strengthening this momentum, positioning the nation as a key player in the global biofuels market.

Leading this transformation, CPB Contractors powered all machinery with biodiesel on the Sydney Metro Western Sydney Airport project, significantly cutting emissions and inspiring wider supply chain adoption, including Kennards Hire's transition to biodiesel blends nationwide. Supported by major manufacturers such as Caterpillar, Volvo, John Deere, JCB, and KOBELCO, the sector is advancing rapidly toward low-carbon operations. Collectively, these developments signal a defining moment for Australia's construction market as it builds a sustainable, future-ready pathway to net-zero 2050.

Autonomous Innovation Sets New Efficiency Standards in Australia's Construction Market

Australia's construction industry is advancing into a new era defined by automation, intelligence, and digital precision. Facing workforce shortages and rising safety and sustainability demands, contractors are increasingly relying on smart and autonomous equipment to sustain productivity and competitiveness. OEMs and tech leaders are leading this transformation through factory-integrated digital systems, IoT-enabled connectivity, and autonomous functionalities that enhance efficiency and operational control. Smart machinery with real-time monitoring and predictive maintenance has become a strategic asset, reducing downtime, optimizing fleet use, and improving project outcomes.

Setting a major precedent, Komatsu Smart Construction's 2025 rollout of factory-fitted 3D machine-guidance systems on its PC228 and PC240 crawler excavators redefines deployment speed and accuracy in the field. Together, these advancements are propelling Australia toward a data-driven, resilient, and future-ready construction ecosystem.

Looking for More Information? Click:Prominent Vendors

-

Caterpillar

Komatsu

Volvo Construction Equipment

Hitachi Construction Machinery

Liebherr

SANY

Xuzhou Construction Machinery Group (XCMG)

JCB

Kobelco

Zoomlion

Other Prominent Vendors

-

HD Hyundai Construction Equipment Co. Ltd.

Liu Gong

CNH Industrial N.V.

Toyota Material Handling International (TMHI)

Sumitomo Construction Machinery Co., Ltd.

Yanmar Holdings Co., Ltd.

DEVELON

Tadano

Terex Corporation

Manitou Group

BOMAG GmbH

KATO WORKS CO., LTD.

SAKAI Heavy Industries

Takeuchi Manufacturing Co., Ltd.

Merlo S.p.A.

Bobcat

Kubota

JLG

Shantui Construction Machinery Co., Ltd.

John Deere

Distributor Profiles

-

CJD Equipment

Semco Equipment Sales

Tutt Bryant Group

Conplant

Capital Construction Equipment

BPF Equipment

CEA (Construction Equipment Australia)

Market Segmentation & Forecast

By Type

Earthmoving Equipment

-

Excavator

Backhoe Loaders

Wheeled Loaders

Other Earthmoving Equipment (Other loaders, Bulldozers, Trenchers, Motor Graders)

Road Construction Equipment

-

Road Rollers

Asphalt Pavers

Material Handling Equipment

-

Crane

Forklift & Telescopic Handlers

Aerial Platforms (Articulated Boom Lifts, Telescopic Boom lifts, Scissor lifts)

Other Construction Equipment

-

Dumper

Concrete Mixer

Concrete Pump Truck

By End Users

-

Construction

Mining

Manufacturing

Others (Power Generation, Utilities, Municipal Corporations, Oil & Gas, Cargo Handling, Power Generation Plants, Waste Management)

Related Reports That May Align with Your Business Needs

Thailand Construction Equipment Market Research Report 2025-2030

Philippines Construction Equipment Market Research Report 2025-2030

What Key Findings Will Our Research Analysis Reveal?

-

What is the growth rate of Australia construction equipment market?

How big is the Australia construction equipment market?

What are the trends in the Australia construction equipment market?

Who are the key players in the Australia construction equipment market?

Which are the major distributor companies in the Australia construction equipment market?

Why Arizton?

100% Customer Satisfaction

24x7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton's report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

-

1hr of free analyst discussion

10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment