South Korean Exports Unexpectedly Rose In October, Driven By Chips And Ships

| 3.6% |

Exports in October (%YoY)

Imports fell -1.5% YoY |

| Higher than expected |

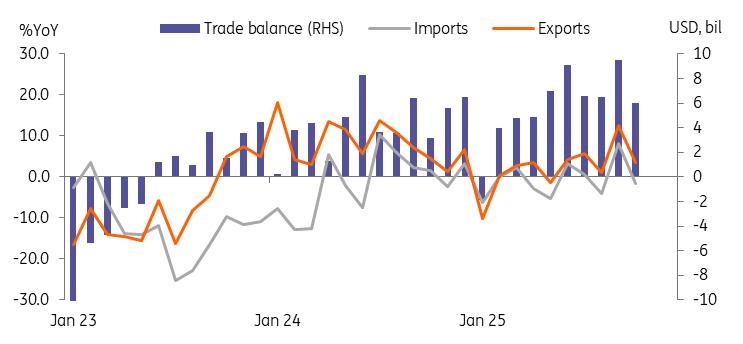

Although South Korean export growth slowed, this was partly due to negative calendar effects. After adjusting for working days, average daily exports increased by 14.0% year-on-year compared to a decline of 6.2% in September. The monthly volatility for the past two months was related to the timing of the Chuseok holiday. Year-to-date, exports accelerated to 2.4% from 2.2% in the first nine months of the year. Thus, we believe the underlying export momentum remained solid. But export gains were narrowly focused. Out of 15 major exports, four showed gains. Semiconductor exports increased by 25.4% thanks to strong demand for high-bandwidth memory (HBM) and DDR5 chips. Vessel exports, including offshore plants, rose by 131.2%, marking the eighth consecutive increase. Petroleum exports rose for the second month. However, other major items, such as cars, steel, general machinery, and home appliances, contracted, partly due to the impact of US tariffs.

Exports rose in October despite less working days and the US tariffs

Source: CEIC Imports dropped -1.5% YoY in October (vs 8.2% in September, -0.4% market consensus)

Energy imports declined by 9.0% due to lower global commodity prices, while non-energy imports rose 0.4%. Semiconductor equipment (9.5%) and computer imports (32.1%) increased, suggesting a positive outlook for continued strong equipment investment in the current quarter.

GDP and BoK outlookLooking ahead, the US-Korea trade agreement reached on 29 October is expected to alleviate pressure on auto exports. Furthermore, easing trade tensions between the US and China would likely have a positive impact on Korean exports. Chipmakers have provided robust forward guidance for their 2026 performance, with major firms having already filled their order books for that year and anticipating sustained strength in memory prices. Vessel exports are expected to remain robust based on the high volume of orders taken over the past 2–3 years. Thus, we believe exports will rise modestly in 2026 despite an anticipated slowdown in US demand.

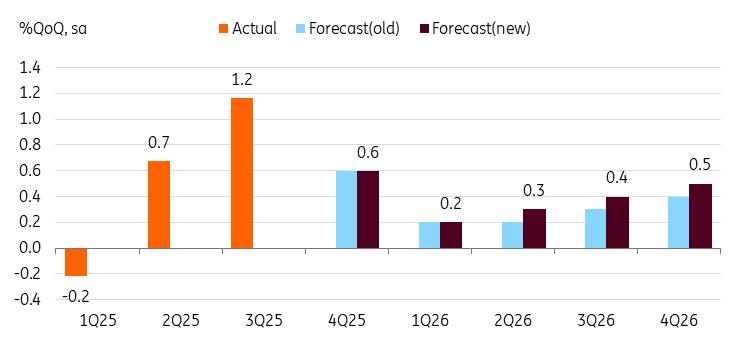

Including October trade outcomes, recent data suggest another solid quarter of growth. Despite reduced government cash handouts, positive consumer sentiment and strong equities are expected to support private consumption, while exports and equipment investment are expected to remain steady. Thus, we maintain a 0.6% quarter-on-quarter, seasonally-adjusted, growth outlook for the fourth quarter 1.2% YoY for 2025. As such, we have raised our 2026 GDP outlook from 1.8% to 2.0% based on a more optimistic outlook for exports and domestic demand.

With growth conditions improving and inflation staying around 2%, the Bank of Korea's focus should remain on financial market instability. Housing prices are expected to stabilise for a couple of quarters while the negative GDP gap still persists. Thus, this could justify the BoK's 25 bp cut in the first half of 2026. However, 2.25% should be the terminal rate for this easing cycle. Lower interest rates could have implications for the housing market, which should be a major concern for the BoK. Additionally, the BoK considers 2.25% to be the lower bound of the neutral interest rate. Additionally, normalisation of growth in the second half of 2026 could support the conclusion of the easing cycle.

2026 GDP revised up due to the recent trade deal and robust chip demand

Source: CEIC

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment