Bitcoin 'Money Vessel' Hits $8B Amid Lack Of ETF Inflows-What's Next?

- Bitcoin's realized market cap surpasses $1.1 trillion amid rising onchain inflows. Major inflows stem from Bitcoin treasury holdings and ETFs, with activity driven by institutional players. Bitcoin miners are expanding operations, leading to a higher hashrate, a bullish indicator for the network's health. Market analysts forecast Bitcoin reaching $140,000 by November, contingent on ETF flows and macroeconomic conditions. Despite market apprehensions, potential Fed easing and ETF inflows could catalyze a significant price rally.

Despite recent market turbulence, Bitcoin's onchain data signals robust demand. Over the past week, Bitcoin's realized capitalization increased by more than $8 billion, pushing its total to over $1.1 trillion. This rise is evidenced by an onchain metric called the realized cap, which measures the total value of all existing coins at their last transaction price. The metric now indicates Bitcoin's realized price has climbed above $110,000, demonstrating growing investor confidence and accumulated investment.

The surge in inflows is largely attributed to institutional holders, including Bitcoin treasury firms and exchange-traded funds (ETFs), according to Ki Young Ju, CEO of crypto analytics platform CryptoQuant. However, he emphasized that a sustained price recovery might depend heavily on large-scale strategic buys by prominent actors such as Bitcoin ETFs and MicroStrategy 's ongoing acquisitions. Ju noted on X (formerly Twitter),

Source: CryptoQuant

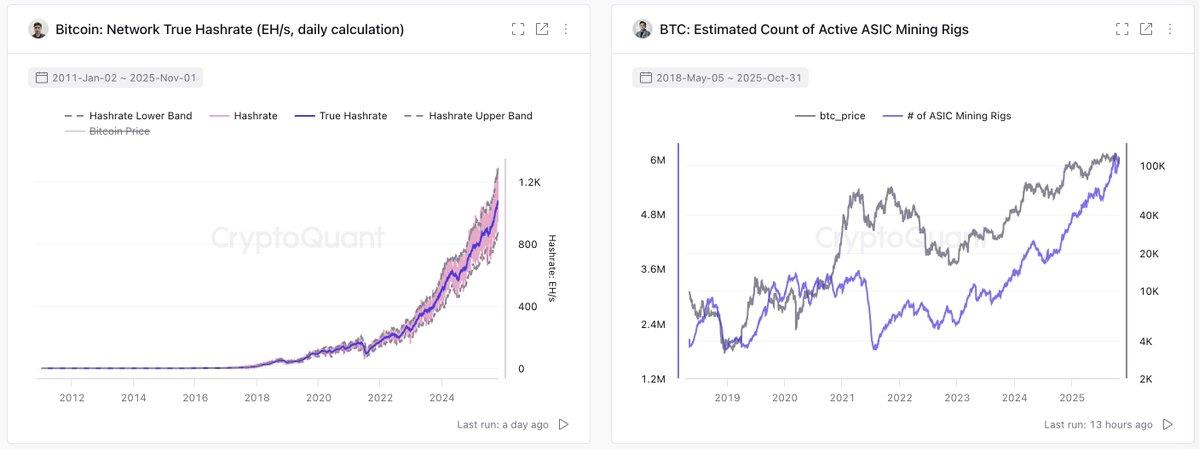

Meanwhile, Bitcoin miners are actively expanding their operations, which is viewed as a bullish sign for the network's long-term growth. Recent reports highlight significant investments, such as Trump -linked American Bitcoin 's purchase of 17,280 ASIC miners for over $300 million, bolstering the network's hash rate-a key indicator of network security and resilience. This willingness of miners to grow their fleets suggests confidence in future Bitcoin price appreciation.

Source: CryptoQuantBitcoin $140K in November, depending on ETF flows: Analysts

Despite the recent inflows, investor sentiment remains cautious, with prevailing fears stemming from the sharp market correction earlier this month. Even after positive developments like the U.S. White House announcing a trade agreement with China, enthusiasm has yet to fully return to the market. Nonetheless, analysts from Bitfinex suggest that improved ETF inflows and potential easing by the Federal Reserve could push Bitcoin's price to $140,000 by November. Their outlook hinges on a notable increase in ETF capital flow, estimated at between $10 billion and $15 billion, acting as a catalyst for a significant rally.

While these macroeconomic factors and ETF flows could drive Bitcoin higher, the market continues to face geopolitical and regulatory headwinds. Still, the underlying fundamentals-such as increasing onchain activity and miner expansion-suggest the cryptocurrency's resilience and potential for a robust rally in the coming months. As the digital asset landscape evolves, investors are keenly watching how these developments influence Bitcoin's trajectory toward new all-time highs.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment