403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

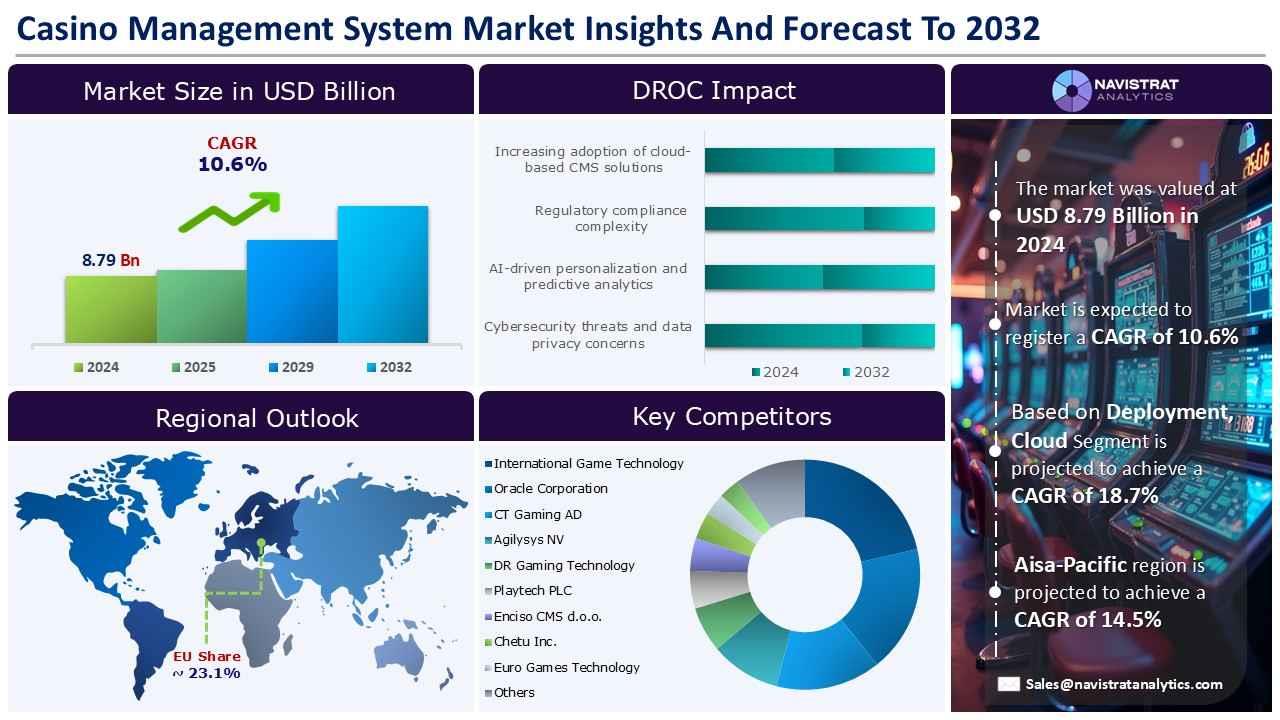

Casino Management System Market is USD 8.79 Billion in 2024 and is projected to register a CAGR of 10.6%

(MENAFN- Navistrat Analytics) The deployment of wireless technologies and online casinos marks a significant shift in the casino management system market. This allows casinos to have more opportunities for technical advancements, such as automated license plate identification and facial recognition, making it simpler for casinos with more traffic. Facial recognition assists in identifying those who were previously barred from entering casinos.

Facial recognition enables fast identification and prevention of unwanted entry. Another key aspect driving market opportunity is casinos' creation of online platforms in order to grab the internet audience, which boosts competitiveness among players. The integration of new applications into the management system, such as online gambling, kiosk, and table monitoring, is the primary element driving the market's revenue growth.

The integration of cryptocurrencies is becoming an emerging trend. As the globe changed swiftly, casino operators began accepting cryptocurrencies, and many regulated casinos have high RTP (Return to Player) rates, which encourages the usage of Bitcoin. The built-in security qualities, such as protecting the user's anonymity without requiring the user to submit personal information.

However, these casino games are conveniently available online, reducing the trouble of visiting a physical casino to wager. The increasing interest of players in online casino games is harming the profitability of brick-and-mortar casinos. Brick-and-mortar casinos possess real premises where gamers may play casino games. If traffic at brick-and-mortar casinos declines, the market's revenue growth may suffer.

Get Exclusive Report Insights Here:

Segment market overview and growth Insights:

Software segment accounts for the largest revenue share in 2024. Software solutions have evolved into the primary tool for casino operations, enabling advanced capabilities such as rapid analytics, player tracking, compliance monitoring, and seamless connection with gaming, hotel, and payment systems. There is a growing need for software platforms that are flexible, scalable, and AI-powered. This has resulted in the software segment being the industry's principal source of income.

Cloud cloud-based segment is expected to register a significant revenue growth rate during the forecast period. The built-in redundancy in cloud computing helps to prevent data loss, allowing casinos to continue normal operations without interruption. Cloud computing's promise of agility and inventiveness is assisting casinos throughout the world in increasing total income. Furthermore, online casinos that employ SSL encryption may provide their consumers with the best security protections.

Regional market overview and growth insights:

North America registered the second-largest market share in the casino management system market. The combination of mobile ordering, point-of-sale (POS) technology, and self-service kiosks is accelerating the implementation of casino management systems. Signature Systems, Inc. deployed PDQ POS systems, iPads, and 3-in-1 kiosks to Live Casino & Hotel Louisiana on April 8, 2025, in addition to a new mobile ordering suite. These technologies boost player engagement, operational visibility, and revenue optimization, contributing to a quicker pace of technology transformation in US casinos.

CMS providers can now expand their presence in tribal and commercial casinos, according to new regulatory authorization. For example, on October 13, 2025, the Washington State Gambling Commission authorized Aristocrat Interactive's OASIS system, which now includes all 29 federally licensed Class III tribal casinos in the state and expands on existing Class II authorizations. This regulatory approval will enable enterprises to deploy scalable solutions across many states in the United States.

The Asia-Pacific region is projected to achieve a CAGR of 14.5% by 2032. China, Japan, India, Australia, and New Zealand have a significant presence in the market. The Macao government is pushing economic diversification, which is speeding the implementation of CMS to increase casino operating efficiency. These strategic initiatives encourage diversified tourist, including hotels, casinos, retail, entertainment, and cultural attractions.

Competitive Landscape and Key Competitors:

The casino management system market is characterized by numerous players, with major players competing across segments and regions. The list of major players included in the casino management system market report is:

• International Game Technology PLC (IGT)

• Oracle Corporation

• CT Gaming AD

• Agilysys NV

• Konami Gaming, Inc.

• DR Gaming Technology (DRGT)

• Playtech PLC

• Enciso CMS d.o.o.

• Chetu Inc.

• Euro Games Technology Ltd. (EGT)

• Gammastack Inc.

• Table Trac Inc.

• Markor Technology Systems

• NOVOMATIC AG

• DRGT Europe NV

• Win Newco Holdings US LLC

Buy Your Exclusive Copy Now:

Major strategic developments by leading competitors

Casino Cash Trac (CCT) : On 18th March 2025, Serent Capital, a private equity firm that focuses on growth-stage technology and software startups, has announced a strategic minority investment in Casino Cash Trac (CCT). This collaboration intends to drive CCT's next phase of growth, with a focus on product innovation and market penetration. CCT is credited for pioneering revenue audit automation for land-based casinos, which eliminated human reconciliation processes and increased financial transparency.

Unlock the Key to Transforming Your Business Strategy with Our Casino Management System Market Insights –

• Download the report summary:

• Request Customization:

Navistrat Analytics has segmented the Casino Management System Market by component, deployment, application, end-use and region:

• Component Outlook (Revenue, USD Million; 2022-2032)

• Software

• Services

• Deployment Outlook (Revenue, USD Million; 2022-2032)

• On-Premise

• Cloud

• Hybrid

• Application Outlook (Revenue, USD Million; 2022-2032)

• Security & Surveillance

• Accounting & Cash Management

• Property Management

• Analytics & Reporting

• Marketing & Promotions

• Player Tracking & Loyalty

• Others

• End-Use Outlook (Revenue, USD Million; 2022-2032)

• Small and Medium-Sized Casinos

• Large Casinos

• Regional Outlook (Revenue, USD Million; 2022-2032)

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Get a preview of the detailed segmentation of market:

Facial recognition enables fast identification and prevention of unwanted entry. Another key aspect driving market opportunity is casinos' creation of online platforms in order to grab the internet audience, which boosts competitiveness among players. The integration of new applications into the management system, such as online gambling, kiosk, and table monitoring, is the primary element driving the market's revenue growth.

The integration of cryptocurrencies is becoming an emerging trend. As the globe changed swiftly, casino operators began accepting cryptocurrencies, and many regulated casinos have high RTP (Return to Player) rates, which encourages the usage of Bitcoin. The built-in security qualities, such as protecting the user's anonymity without requiring the user to submit personal information.

However, these casino games are conveniently available online, reducing the trouble of visiting a physical casino to wager. The increasing interest of players in online casino games is harming the profitability of brick-and-mortar casinos. Brick-and-mortar casinos possess real premises where gamers may play casino games. If traffic at brick-and-mortar casinos declines, the market's revenue growth may suffer.

Get Exclusive Report Insights Here:

Segment market overview and growth Insights:

Software segment accounts for the largest revenue share in 2024. Software solutions have evolved into the primary tool for casino operations, enabling advanced capabilities such as rapid analytics, player tracking, compliance monitoring, and seamless connection with gaming, hotel, and payment systems. There is a growing need for software platforms that are flexible, scalable, and AI-powered. This has resulted in the software segment being the industry's principal source of income.

Cloud cloud-based segment is expected to register a significant revenue growth rate during the forecast period. The built-in redundancy in cloud computing helps to prevent data loss, allowing casinos to continue normal operations without interruption. Cloud computing's promise of agility and inventiveness is assisting casinos throughout the world in increasing total income. Furthermore, online casinos that employ SSL encryption may provide their consumers with the best security protections.

Regional market overview and growth insights:

North America registered the second-largest market share in the casino management system market. The combination of mobile ordering, point-of-sale (POS) technology, and self-service kiosks is accelerating the implementation of casino management systems. Signature Systems, Inc. deployed PDQ POS systems, iPads, and 3-in-1 kiosks to Live Casino & Hotel Louisiana on April 8, 2025, in addition to a new mobile ordering suite. These technologies boost player engagement, operational visibility, and revenue optimization, contributing to a quicker pace of technology transformation in US casinos.

CMS providers can now expand their presence in tribal and commercial casinos, according to new regulatory authorization. For example, on October 13, 2025, the Washington State Gambling Commission authorized Aristocrat Interactive's OASIS system, which now includes all 29 federally licensed Class III tribal casinos in the state and expands on existing Class II authorizations. This regulatory approval will enable enterprises to deploy scalable solutions across many states in the United States.

The Asia-Pacific region is projected to achieve a CAGR of 14.5% by 2032. China, Japan, India, Australia, and New Zealand have a significant presence in the market. The Macao government is pushing economic diversification, which is speeding the implementation of CMS to increase casino operating efficiency. These strategic initiatives encourage diversified tourist, including hotels, casinos, retail, entertainment, and cultural attractions.

Competitive Landscape and Key Competitors:

The casino management system market is characterized by numerous players, with major players competing across segments and regions. The list of major players included in the casino management system market report is:

• International Game Technology PLC (IGT)

• Oracle Corporation

• CT Gaming AD

• Agilysys NV

• Konami Gaming, Inc.

• DR Gaming Technology (DRGT)

• Playtech PLC

• Enciso CMS d.o.o.

• Chetu Inc.

• Euro Games Technology Ltd. (EGT)

• Gammastack Inc.

• Table Trac Inc.

• Markor Technology Systems

• NOVOMATIC AG

• DRGT Europe NV

• Win Newco Holdings US LLC

Buy Your Exclusive Copy Now:

Major strategic developments by leading competitors

Casino Cash Trac (CCT) : On 18th March 2025, Serent Capital, a private equity firm that focuses on growth-stage technology and software startups, has announced a strategic minority investment in Casino Cash Trac (CCT). This collaboration intends to drive CCT's next phase of growth, with a focus on product innovation and market penetration. CCT is credited for pioneering revenue audit automation for land-based casinos, which eliminated human reconciliation processes and increased financial transparency.

Unlock the Key to Transforming Your Business Strategy with Our Casino Management System Market Insights –

• Download the report summary:

• Request Customization:

Navistrat Analytics has segmented the Casino Management System Market by component, deployment, application, end-use and region:

• Component Outlook (Revenue, USD Million; 2022-2032)

• Software

• Services

• Deployment Outlook (Revenue, USD Million; 2022-2032)

• On-Premise

• Cloud

• Hybrid

• Application Outlook (Revenue, USD Million; 2022-2032)

• Security & Surveillance

• Accounting & Cash Management

• Property Management

• Analytics & Reporting

• Marketing & Promotions

• Player Tracking & Loyalty

• Others

• End-Use Outlook (Revenue, USD Million; 2022-2032)

• Small and Medium-Sized Casinos

• Large Casinos

• Regional Outlook (Revenue, USD Million; 2022-2032)

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Get a preview of the detailed segmentation of market:

Navistrat Analytics

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment