Bitcoin Boosts Toward $113,000 As Fed Rate Decision Approaches

- Bitcoin approaches $112,000 resistance, signaling ongoing bullish momentum. Market traders eye potential new highs amid increased volatility at weekly close. The US Federal Reserve is widely expected to implement a rate cut next week, boosting risk assets.

Bitcoin (BTC ) briefly challenged the $112,000 mark into Sunday's weekly close, sparking hopes of new local peaks among traders. The cryptocurrency's recent price momentum has been driven by a combination of favorable macroeconomic data and technical breakout signals, with many analysts anticipating further gains.

BTC /USD one-hour chart. Source: Cointelegraph /TradingViewBitcoin eyes traders' targets in fresh volatilityWeekend data from Cointelegraph Markets Pro and TradingView indicated that Bitcoin has been trading within a range, with a late-week rebound aiding bulls in pushing prices higher within this zone. Investors responded positively to the recent US inflation data, which pointed towards easing inflation pressures - a potential catalyst for the Fed to consider further rate cuts.

Market participants are closely watching the weekly close, as this often accompanies increased volatility and can signal significant trend shifts. Notably, traders and analysts have set their sights on the $112,000 resistance, viewing a decisive breakout as a possible trigger for new milestones.

Trader Crypto Caesar emphasized the importance of the $112,000 level, suggesting that a clean break above it could pave the way for a rally toward $123,000. Meanwhile, fellow analyst Ted Pillows noted a short-term upward trend, citing four consecutive green daily candles as evidence of sustained buying pressure. He expressed optimism that reclaiming the $112,000–$114,000 zone could propel Bitcoin above $118,000 soon.

BTC/USDT one-day chart. Source: Ted Pillows/X

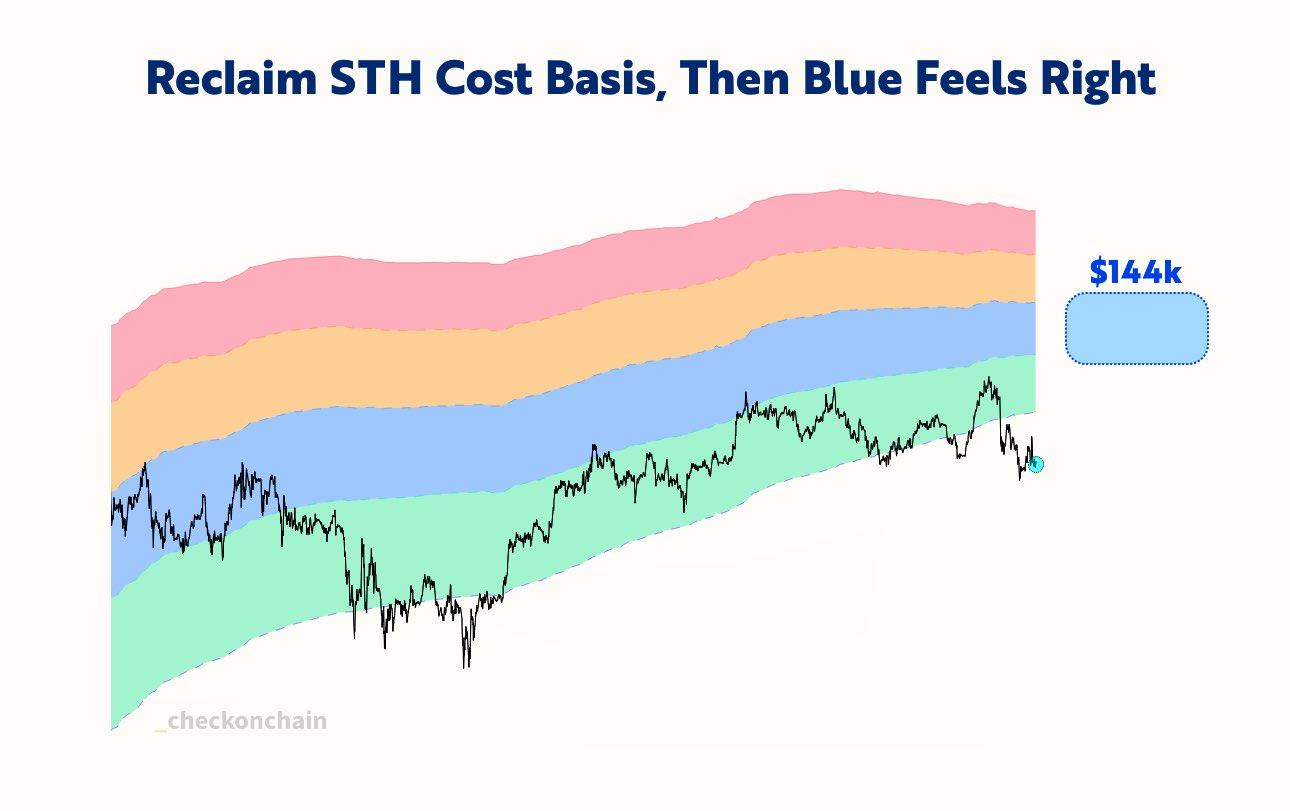

Additionally, the Twitter account named after economist Frank Fetter is monitoring a key threshold at $113,000, which aligns with Bitcoin's recent short-term cost basis for holders holding for up to six months. A breakthrough above this level could target a move into the $130,000–$144,000 range, according to market analytics.

Bitcoin STH cost basis. Source: Frank A. Fetter/XFederal Reserve rate-cut expectations propel risk markets

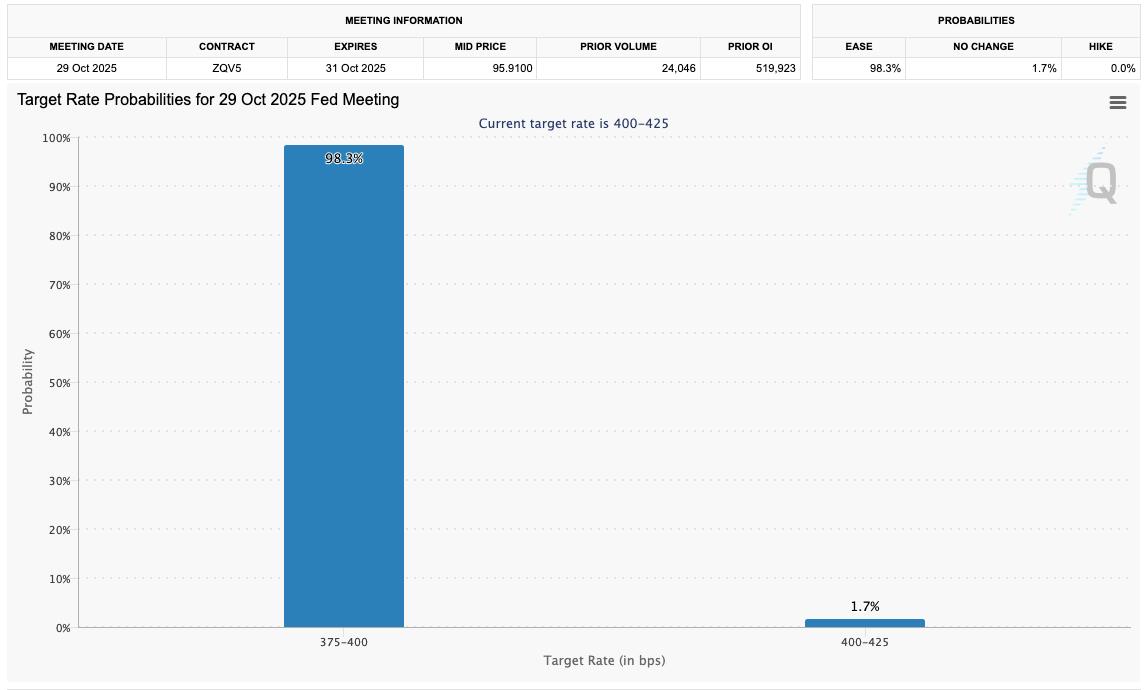

Looking to the upcoming week, the focus shifts to the Federal Reserve's policy decision, with widespread expectations of a 0.25% cut on October 29 based on recent inflation data. The CME Group's FedWatch Tool indicates that the odds of an interest rate reduction have surged past 98%, further supporting risk-on assets including cryptocurrencies.

Fed target rate probabilities for October FOMC meeting (screenshot). Source: CME Group

The global trend toward monetary easing continues, with recent data from The Kobeissi Letter showing that over 80% of central banks worldwide have cut rates in the past six months - a trend rarely seen outside recessions. This easing environment enhances risk asset valuations, among them cryptocurrencies, which remain sensitive to macroeconomic shifts in interest rates and inflation expectations.

This macro backdrop, combined with Bitcoin's technical setup, suggests an optimistic outlook for traders and investors looking to capitalize on a continued bullish phase amidst a supportive macroeconomic environment.

This article does not constitute investment advice. All trading involves risk; readers should undertake their own research before making financial decisions.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment