403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Apple Signal 20/10: Earnings Magnify Recent Slide (Chart)

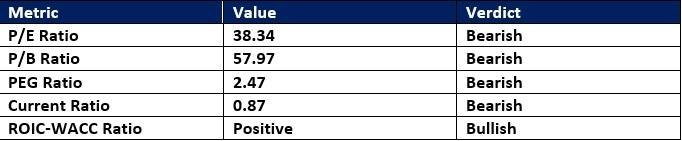

(MENAFN- Daily Forex) Short Trade IdeaEnter your short position between $245.13 (the intra-day low of its last bearish candlestick) and $253.38 (Friday's intra-day high).Market Index Analysis

- Apple (AAPL) is a member of the NASDAQ 100, the Dow Jones Industrial Average, the S&P 100, and the S&P 500 indices. All four indices remain close to all-time highs with bearish cracks rising. The Bull Bear Power Indicator of the NASDAQ 100 is bearish with a descending trendline.

- The AAPL D1 chart shows a price action inside a bearish price channel. It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels. The Bull Bear Power Indicator is bearish with a descending trendline. The average bearish trading volumes are higher than the average bullish trading volumes. AAPL drifted lower as the NASDAQ 100 moved higher, a significant bearish trading signal.

- AAPL Entry Level: Between $245.13 and $253.38 AAPL Take Profit: Between $193.46 and $201.50 AAPL Stop Loss: Between $267.02 and $272.36 Risk/Reward Ratio: 2.36

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Thinkmarkets Adds Synthetic Indices To Its Product Offering

- Ethereum Startup Agoralend Opens Fresh Fundraise After Oversubscribed $300,000 Round.

- KOR Closes Series B Funding To Accelerate Global Growth

- Wise Wolves Corporation Launches Unified Brand To Power The Next Era Of Cross-Border Finance

- Lombard And Story Partner To Revolutionize Creator Economy Via Bitcoin-Backed Infrastructure

- FBS AI Assistant Helps Traders Skip Market Noise And Focus On Strategy

Comments

No comment