Rates Spark: Bund Yields Not Reflecting The Equities Optimism

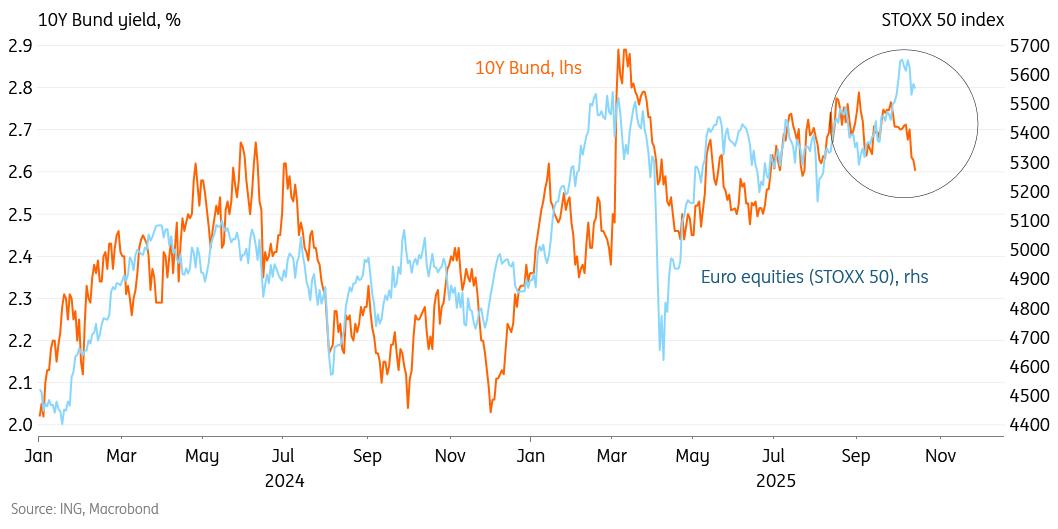

While equities seem to have recovered most of the losses from last week's renewed tariff fears, Bund yields paint a more pessimistic picture. The 10Y Bund yield is down to June levels, when there was significant macro uncertainty in the wake of Trump's 'Liberation Day'. Since then, the eurozone growth outlook and equities have improved materially, helping to push up euro rates. But somehow the past few days have seen a disproportionate drop in Bund yields, seemingly breaking the link with equities.

The swap spread is playing an important role in the decline of Bund yields, potentially reflecting a demand for quality. The 10Y Bund yield has been trading 1bp below swaps for a few days now. From a structural perspective, one would argue Bund yields should trade significantly above swaps, especially given the additional supply from German spending plans and quantitative tightening. But markets may be more focused on the near term, in which we could see more risk-off episodes like the past few days. This then would argue for an increased flow to safe haven assets like the Bund.

However, it may be simply due to the low supply of government bond issuance this month. In fact, we expect the issuance net of redemptions to be negative in October, which means markets have very little to absorb. This also helps explain the benign environment for spreads of European government bonds versus Bunds, which have seen a decent tightening recently, despite lower Bund yields. France's attempt at another budget was well received by markets, bringing the spread down some 5bp over the past week. And that while the pension issue may simply be pushed back for a future government to resolve.

The recent rally in Bunds is not in line with equities performance

Thursday's events and market views

The main focus remains central bank speakers. From the ECB, Wunsch, Kocher, Lane and Lagarde are scheduled to speak. From the Fed, we will hear from Waller, Barr, Miran, Bowman and Kashkari. The BoE will field Mann and Greene.

UK data released in the morning covers GDP growth for August, industrial production and the trade balance. The eurozone will also release the trade balance for August, but little else of note. US data releases will remain impacted by the shutdown, so that markets will have to take their input from reports like Wednesday's Fed Beige Book. On Thursday, jobless claims, retail sales and the PPI are delayed. We will get the Philadelphia Fed's manufacturing index for October.

In primary markets, France and Spain will be active. France auctions short-to-medium term bonds and inflation-linked bonds for a total of up to €12.75bn. Spain auctions 5y, 7y and 10y bonds for a total of €5bn.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment