403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Forecast Today - 15/10: As The U.S. Dollar Gains Continue

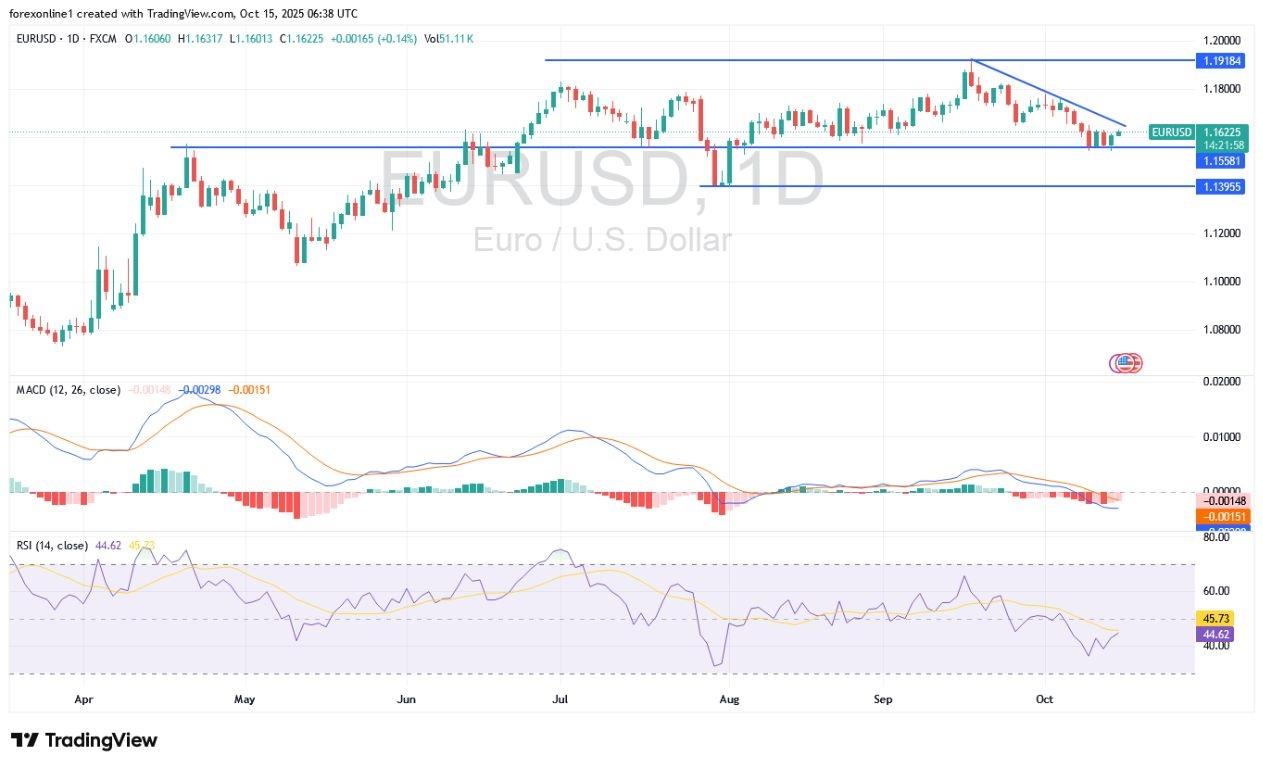

(MENAFN- Daily Forex) Wednesday, October 15, 2025: Analysis of euro price against the dollar EUR/USD EUR/USD Analysis Summary Today

- General Trend: Bearish. Today's Support Points for EUR/USD: 1.1540 – 1.1460 – 1.1380. Today's Resistance Points for EUR/USD: 1.1670 – 1.1730 – 1.1800.

- Buy the EUR/USD from the support level of 1.1510, target 1.1700, and stop loss 1.1420. Sell the EUR/USD from the resistance level of 1.1720, target 1.1500, and stop loss 1.1700.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Crypto Market Update: Pepeto Advances Presale With Staking Rewards And Live Exchange Demo

- Tria Raises $12M To Be The Leading Self-Custodial Neobank And Payments Infrastructure For Humans And AI.

- Simplefx Relaunches First Deposit Bonus

- Chartis Research And Metrika Release Comprehensive Framework For Managing Digital Asset Risk

- Whale.Io Launches Battlepass Season 3, Featuring $77,000 In Crypto Casino Rewards

- M2 Capital Announces $21 Million Investment In AVAX Digital Asset Treasury, AVAX One

Comments

No comment