US Soybean Farmers Are Dangerously Overdependent On China

It wasn't a bad call, at least directionally. Within a few years, sales to China were rising and soybeans were ranging from $9 a bushel to well into the teens. Thanks to China, US soybean exports have doubled since I gave that speech.

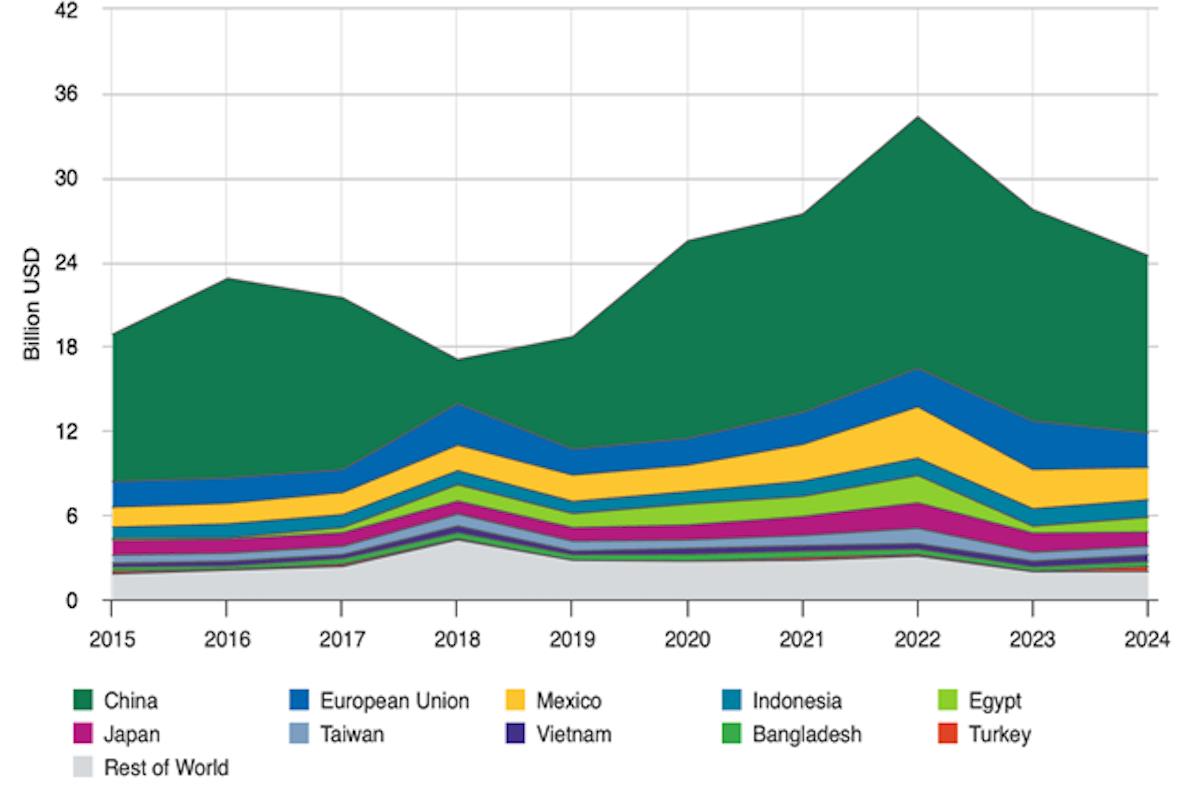

For many years now China has been our soybean farmers' biggest overseas custome r – by a large margin. In 2024, China accounted for more than half of American soybean exports. The next largest customer, the European Union, accounted for only a tenth. In up years and down for US exports, China's lead has been large.

Some of the down years began with China's retaliation for the tariffs President Donald Trump imposed in 2018. Since then, China has increasingly turned to Brazil as its preferred supplier. Still, it has continued to buy a lot of US beans.

Until this year, that is.

As every soybean farmer knows, Trump has hit China with big tariffs once again and China has once again retaliated. In this year's first eight months, the Chinese bought only 200 million bushels, down from a billion in the same period last year. In recent months they bought none.

Latest stories

China, US clash in global shipping after chip and tariff wars

C'mon Nobel Committee, Zhu Rongji is 96, do the right thing!

Mearsheimer's 'optimism' and South Korea's dilemma

Farmers are fearful. The president of the American Soybean Association, Caleb Ragland, said ,“The farm economy is suffering while our competitors supplant the United States in the biggest soybean import market in the world.”

At some point – hopefully before a lot of soybean farmers start declaring bankruptcy – China will buy US beans again. Foreign Agricultural Service staff in Beijing think there will be purchases in the first half of this marketing year, DTN Contributing Analyst Mike McGinnis reported .

That prediction was made before China put new controls on exports of rare earths and Trump responded by imposing additional 100% tariffs on everything China ships us. Hopefully these moves are negotiating tactics that will eventually be rolled back. But who knows when.

Trump had promised to talk to China's President Xi Jinping about soybeans and, assuming there's a ceasefire in this latest volley, he still might. But that isn't the only reason to hope for some sales.

There's also the possibility that Brazil and Argentina won't be able to supply all of China's needs. Moreover, US beans may prove price competitive, assuming retaliatory tariffs are dropped. Finally, it's in China's continuing interest to buy from a variety of suppliers and not rely exclusively on preferred supplier Brazil.

Grateful as they'll be to have China buying again, soybean growers should have learned something from this latest battle in the US-China trade war: They're too reliant on China. In the years ahead they'll either need to find new markets, domestic as well as international, or plant fewer acres.

China, for its part, is determined to reduce its reliance on us. It's spent years helping Brazil expand production . It's working hard to increase domestic soybean output by increasing acreage and improving yields. It's even investing in Russia to boost that country's soybean production.

This doesn't mean the Chinese will never buy from us. They just want enough alternative sources of supply that we can't hurt them badly by cutting them off. They realize embargos are always a possibility given the ups and downs of US-China relations.

By the same logic, we need to develop enough alternative markets that the Chinese can't hurt us as much as they're hurting us now. That will be a herculean task. We're dangerously overdependent. The $12.6 billion in beans China bought from us in 2024 was more than the combined purchases of the next nine customers.

There isn't another China waiting in the wings. India's population is larger, but India bans genetically modified imports and protects its farmers with a 57% duty on non-GMO beans.

Sign up for one of our free newsletters

-

The Daily Report

Start your day right with Asia Times' top stories

AT Weekly Report

A weekly roundup of Asia Times' most-read stories

Indonesia is both the world's fourth most populous country and, in 2024, the fourth largest export market for US soybeans. But its purchases totaled $1.2 billion. At 2024 levels, it would take 10 Indonesias to make up for the loss of China.

The billions in compensatory payments the Trump administration has been talking about would be better than nothing but they aren't a substitute for sales. Farmers need stable customers they can build plans around.

What the government needs to be working on, hard, is helping the industry develop additional markets, lots of them, domestic and foreign, while also helping increase sales to current customers.

If China finally makes purchases this year, those purchases will, for some farmers, mean the difference between just getting by and catastrophe. What farmers need is to have enough other markets that China sales are the difference between a good year and a great year.

Former longtime Wall Street Journal Asia correspondent and editor Urban Lehner is editor emeritus of DTN/The Progressive Farmer.

This article, originally published on October 1 4 by the latter news organization and now republished by Asia Times with permission, is © Copyright 2025 DTN/The Progressive Farmer. All rights reserved. Follow Urban Lehner on X @urbanize

Sign up here to comment on Asia Times stories Or Sign in to an existing accoun

Thank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.

-

Click to share on X (Opens in new window)

X

Click to share on LinkedIn (Opens in new window)

LinkedIn

Click to share on Facebook (Opens in new window)

Facebook

Click to share on WhatsApp (Opens in new window)

WhatsApp

Click to share on Reddit (Opens in new window)

Reddit

Click to email a link to a friend (Opens in new window)

Email

Click to print (Opens in new window)

Print

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Cregis And Kucoin Host Institutional Web3 Forum Discussing Industry Trends And Opportunities

- Bydfi Highlights 'BUIDL' Ethos During Newcastle United Match Against Arsenal

- Cregis And Sumsub Host Web3 Compliance And Trust Summit In Singapore

- Versus Trade Launches Master IB Program: Multi-Tier Commission Structure

- Tapbit Delivers A Strong Presence At TOKEN2049 Singapore

- New Crypto Mutuum Finance (MUTM) Nears $17 Million Raised Ahead Of October

Comments

No comment