Data Shows Bitcoin & Altcoin Selling Continues - What You Need To Know

- Over $20 billion in crypto liquidations underscores widespread trader panic amid geopolitical shocks and market volatility. Bitcoin and major altcoins are experiencing continued weakness, with open interest declining across the board. Liquidation heatmaps reveal key levels of leverage and potential areas of market exploitation, indicating possible discounts for Bitcoin. Market participants are cautious, with open interest in perpetual futures markets shrinking, suggesting reluctance to open new positions. Upcoming CME futures market open could serve as a critical moment for gauging the market's next direction after a period of sustained declines.

The cryptocurrency market is currently struggling to recover from last Friday's unprecedented sell-off, which saw over $20 billion liquidated on centralized exchanges alone. The sudden drop was triggered by a surprise announcement from President Trump , who posted on Truth Social about a 100% tariff on Chinese imports, igniting fears of escalating geopolitical tensions and trade disputes. This volatility caught many traders off guard, leading to sharp declines across top digital assets.

As of now, Bitcoin (BTC ) continues to face selling pressure, staying below the $110,000 mark, with other major altcoins like Ether (ETH ) down approximately 3.74% and Solana (SOL ) dropping around 7%. CoinGlass data visualizes the extent of liquidations, emphasizing how sudden market shifts can lead to cascading liquidations, especially in leveraged positions.

24-hour crypto market liquidations. Source: CoinGlassSince last Friday, the timing of Trump 's tweet during the last two hours of the trading day for traditional markets and crypto exchanges means there is potential for continued downside before markets reopen for the week. Trading volume and order book depth are thinning over the weekend, increasing the likelihood of further price swings.

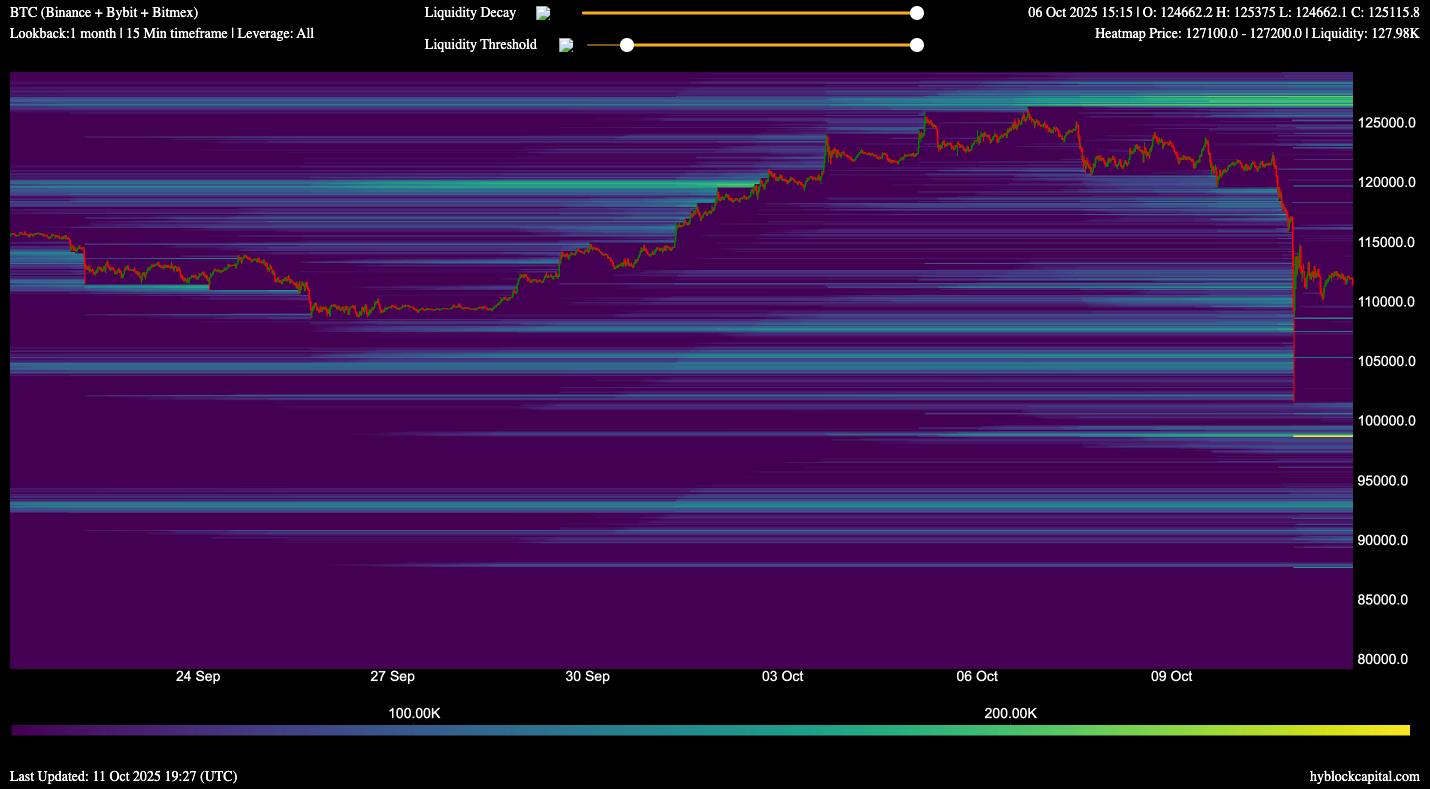

Market analyst Ray Salmond explained that liquidation heatmap data from Hyblock Capital indicates significant liquidity pockets where traders' long positions are vulnerable to exploiting. Specifically, these pockets extend between $120,000 and $113,000, revealing opportunities for downside risks stemming from leveraged trading behavior.

Ray Salmond explains the crypto market sell-off. Source: Schwab Network

According to Salmond, the current market conditions suggest Bitcoin is trading at a notable discount. He pointed out that with a mean price around $120,000 and standard deviation analysis indicating potential downside levels near $115,000 and $110,000, the aggregated order book still holds ample bids within this range, presenting possible entry points for strategic traders.

Related: Bitcoin may get 'dragged around a bit' amid Trump tariff fears: Analyst

BTC /USDT Binance , Bybit , BitMEX liquidation heatmap, 30-day view. Hyblock

Despite the ongoing weakness, open interest in Bitcoin's perpetual futures market has decreased, with a notable pocket of leveraged long positions around $98,600 still vulnerable to liquidation. The decline in open interest reflects traders' widespread hesitation to establish new exposures amid heightened volatility.

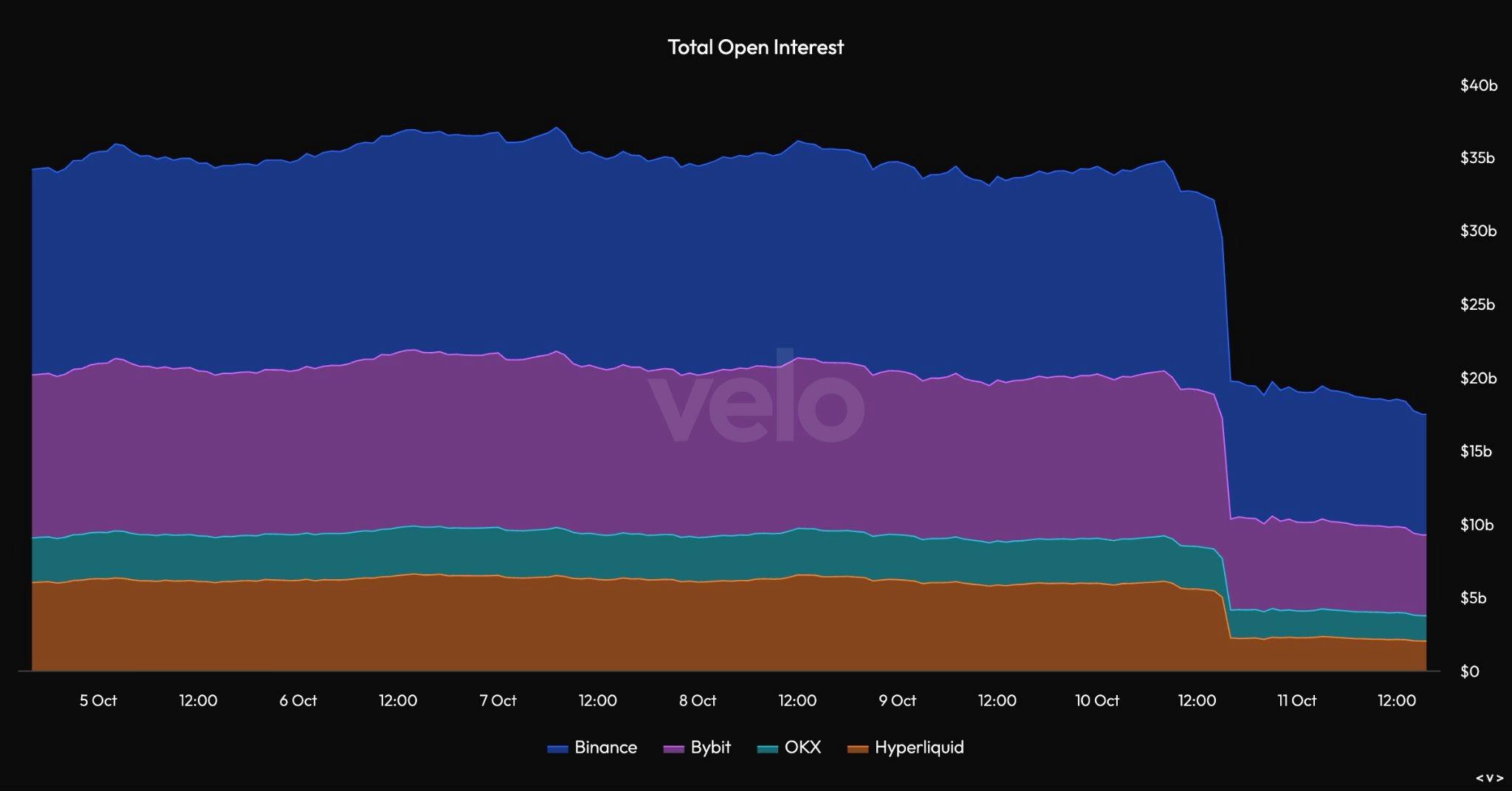

BTC/USDT/USDC aggregate open interest. Source: TradingView

Market-wide, the open interest for cryptocurrencies excluding Bitcoin and Ethereum has also fallen sharply - nearly 45% on most exchanges - signaling a broad retreat from speculative positions during this period of heightened uncertainty.

CEX and DEX open interest, excluding BTC and Ether . Source: Velo

Looking ahead, market analysts expect continued softness over the weekend, with the critical test coming when the CME Bitcoin futures and broader equities markets reopen Sunday evening. The upcoming futures opening will likely provide insights into how institutional investors are positioning and whether bullish momentum can resurface. The evolution of global open interest during this period will serve as an important gauge of the market's next trend, whether stabilization, further decline, or a potential rebound.

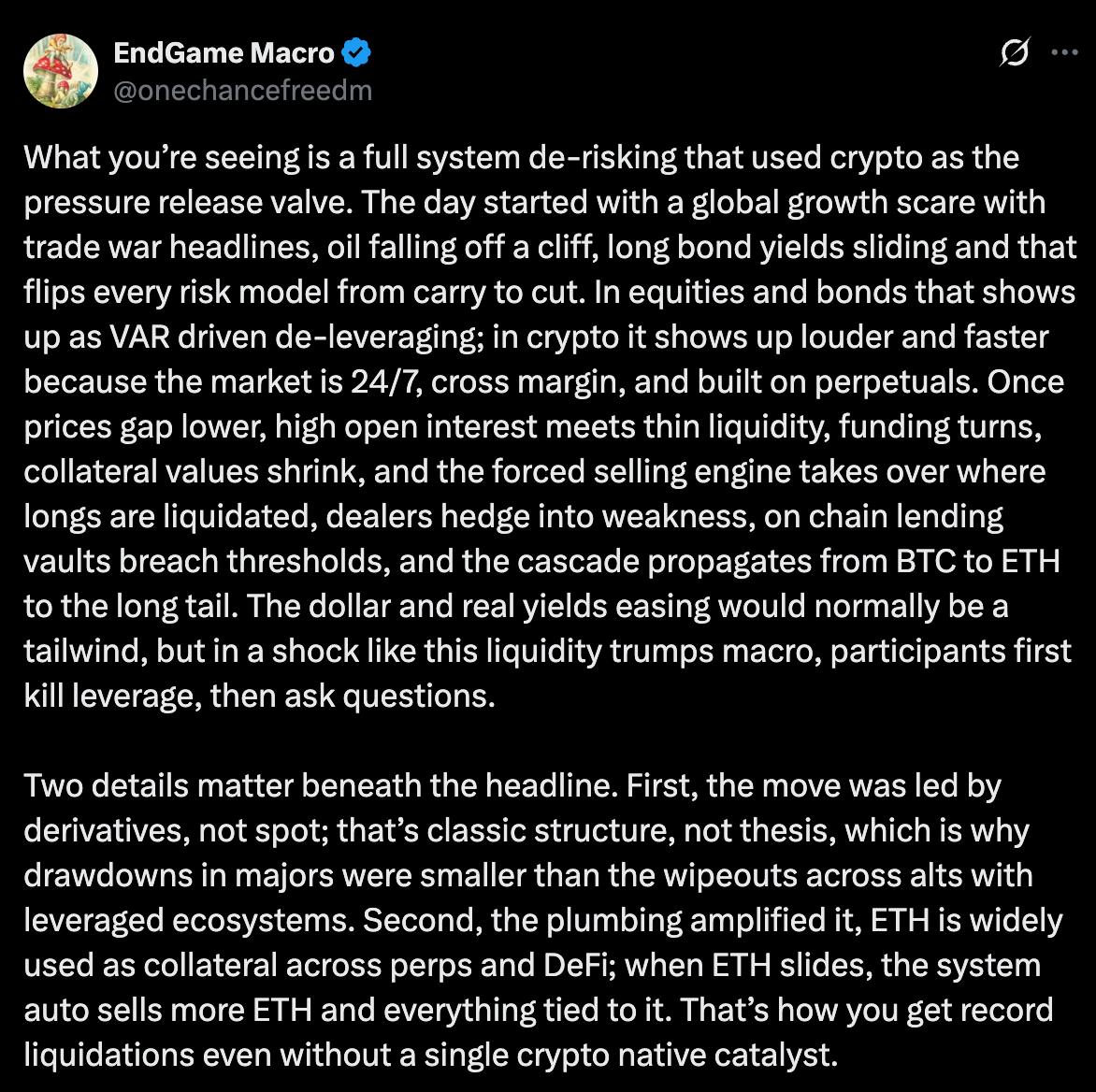

X user EndGame Macro offers a comprehensive background analysis, shedding light on the macroeconomic factors influencing the recent market turmoil, further emphasizing the importance of understanding broader economic signals in crypto trading.

EndGame Macro's market meltdown explanation. Source: EndGame Macro / X

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment