403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

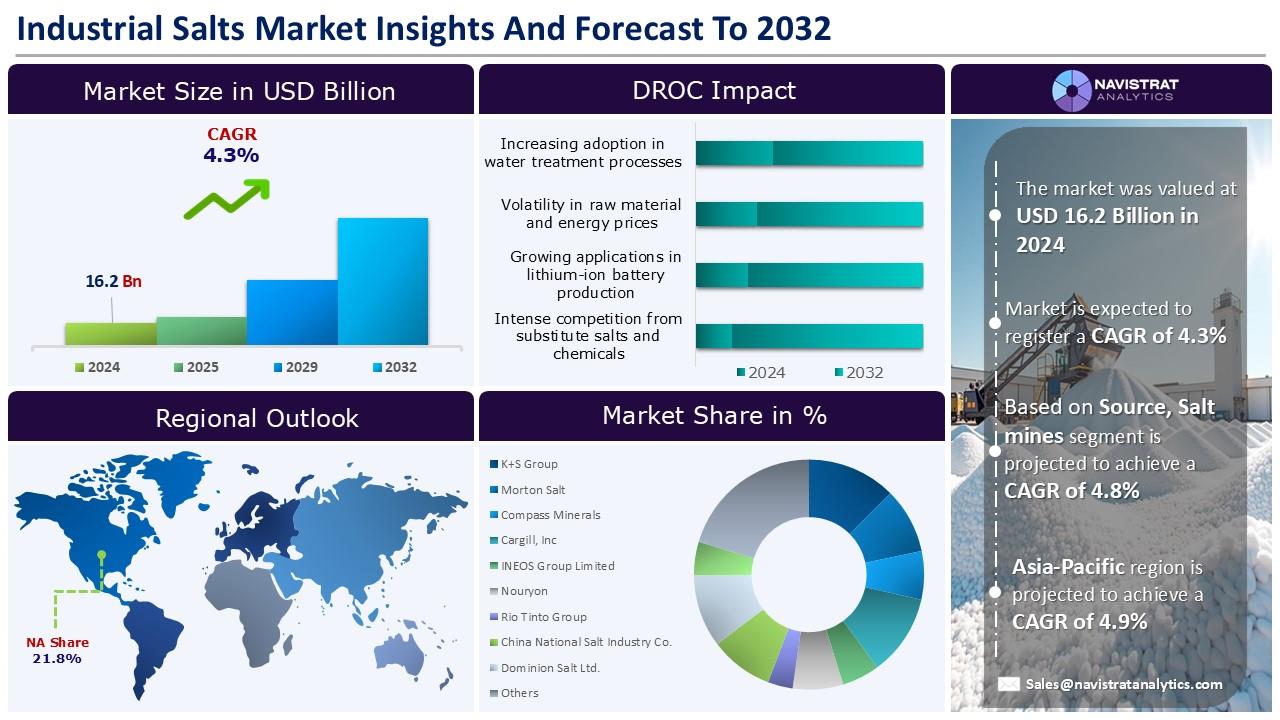

Industrial Salts Market is USD 16.2 billion in 2024 and is projected to register a CAGR of 4.3%

(MENAFN- Navistrat Analytics) 9th October 2025 – Growing demand for the food processing industry is predicted to drive substantial expansion rates over the projection period. According to UNCTAD, global food commerce increased by 350% between 2000 and 2021, reaching USD 1.7 trillion and accounting for approximately 8% of total goods trade. Industrial salt is used as a preservative, taste enhancer, and processing aid in industries like meat curing, bread, dairy, canned goods, and snack manufacture.

Municipalities are expanding treatment capacity as urban populations rise and companies enforce environmental guidelines. According to a UN estimate, over 55% of the world's population lives in cities, with this figure expected to rise to 68% by 2050. The demand for industrial sales is expected to grow with global industrialization with expanding economies.

In addition, major chemical manufacturers and water treatment businesses are developing strategic alliances with salt producers to ensure a steady supply of raw materials. This partnership is hastening the adoption of energy-efficient procedures while also extending the uses for environmentally friendly salts.

However, Competition from salt substitutes and other chemicals may limit revenue development in the industrial salts industry. Industries across the world are exploring alternatives such as potassium-based salts, synthetic brines, and new chemical compositions that replicate the functionalities of classic sodium chloride.

Get Exclusive Report Insights Here:

Segment market overview and growth Insights:

Based on the product type segment, the rock salt segment accounted for the largest revenue share in 2024. Demand for de-icing salt has increased substantially in this segment, particularly in areas with harsh winter weather, where governments and private contractors emphasize effective traffic safety solutions. Rock salt's coarse texture and direct-mining supply chain enable efficient bulk handling and quick seasonal deployment, providing it a competitive advantage over refined or specialist alternatives.

Based on the application segment, the chemical processing accounted for the largest revenue share in 2024. Salts play an important part in the production of chemicals used in water treatment, pharmaceuticals, dyes, and pigments. Salts are crucial in textile finishing and dyeing techniques, and they are widely employed in the food industry for processing, preservation, and seasoning, among other applications. Sodium chloride is the most common salt used in this business. The need for industrial salts in chemical processing is strongly dependent upon the growth of the chemical industry as a whole.

Regional market overview and growth insights:

Asia Pacific accounted highest revenue share in 2024 and is expected to register a CAGR of 4.9% by 2032. The region's agriculture sector has a consistent need for industrial salts, which are used for producing fertilizer. In addition, the expansion of the manufacturing, chemicals, and textile sectors, among others, has a significant influence on demand for industrial salts in countries such as China, India, Japan, and South Korea. The chemical industry, in particular, stands out as a major user of industrial salts, with China and India experiencing significant expansion in chemical manufacturing.

Europe contributed a substantial revenue share in 2024. Government incentives, such as green investment loans and EU innovation subsidies, contribute to accelerating technological adoption. For instance, on April 8, 2025, UP Catalyst received a USD 19 million investment from the European Investment Bank (EIB) to advance the commercial implementation of its molten salt electrolysis technology. Initiatives like decarbonized power integration and brine recycling open up new service lines and specialized, high-margin goods like ultra-pure or customized salts with provable low environmental footprints.

Competitive Landscape and Key Competitors:

The industrial salts market is characterized by numerous players, with major players competing across segments and regions. The list of major players included in the Industrial Salts Market report is:

• K+S Group

• Morton Salt

• Compass Minerals

• Cargill, Inc

• INEOS Group Limited

• Nouryon

• Rio Tinto Group

• China National Salt Industry Co.

• Dominion Salt Ltd.

• Tata Chemicals Ltd

• Salins Group

• Mitsui & Co

Buy Your Exclusive Copy Now:

Major strategic developments by leading competitors

Longpoint : On 15th September 2025, Longpoint acquired two industrial property portfolios in Salt Lake City: the Mountain West Portfolio and the Salt Lake City Infill Portfolio, which comprised slightly more than one million square feet. The Mountain West Portfolio consists of nine shallow-bay buildings totaling over 490,000 square feet, with an occupancy rate of 85% at closure.

Unlock the Key to Transforming Your Business Strategy with Our Industrial Salts Market Insights –

• Download the report summary:

• Request Customization:

Navistrat Analytics has segmented the industrial salts market on the product type, source, form, application, and region:

• Product Type Outlook (Revenue, USD Billion; 2022-2032)

• Rock Salt

• Brine-derived Salt

• Solar Salt

• Vacuum Salt

• Others

• Source Outlook (Revenue, USD Billion; 2022-2032)

• Brine

• Salt mines

• Form Outlook (Revenue, USD Billion; 2022-2032)

• Crystalline

• Granulated

• Powdered

• Application Outlook (Revenue, USD Billion; 2022-2032)

• Chemical processing

• De-icing

• Oil & Gas

• Metal Processing

• Water treatment

• Agriculture

• Others

• Regional Outlook (Revenue, USD Billion; 2022-2032)

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Get a preview of the detailed segmentation of market:

Municipalities are expanding treatment capacity as urban populations rise and companies enforce environmental guidelines. According to a UN estimate, over 55% of the world's population lives in cities, with this figure expected to rise to 68% by 2050. The demand for industrial sales is expected to grow with global industrialization with expanding economies.

In addition, major chemical manufacturers and water treatment businesses are developing strategic alliances with salt producers to ensure a steady supply of raw materials. This partnership is hastening the adoption of energy-efficient procedures while also extending the uses for environmentally friendly salts.

However, Competition from salt substitutes and other chemicals may limit revenue development in the industrial salts industry. Industries across the world are exploring alternatives such as potassium-based salts, synthetic brines, and new chemical compositions that replicate the functionalities of classic sodium chloride.

Get Exclusive Report Insights Here:

Segment market overview and growth Insights:

Based on the product type segment, the rock salt segment accounted for the largest revenue share in 2024. Demand for de-icing salt has increased substantially in this segment, particularly in areas with harsh winter weather, where governments and private contractors emphasize effective traffic safety solutions. Rock salt's coarse texture and direct-mining supply chain enable efficient bulk handling and quick seasonal deployment, providing it a competitive advantage over refined or specialist alternatives.

Based on the application segment, the chemical processing accounted for the largest revenue share in 2024. Salts play an important part in the production of chemicals used in water treatment, pharmaceuticals, dyes, and pigments. Salts are crucial in textile finishing and dyeing techniques, and they are widely employed in the food industry for processing, preservation, and seasoning, among other applications. Sodium chloride is the most common salt used in this business. The need for industrial salts in chemical processing is strongly dependent upon the growth of the chemical industry as a whole.

Regional market overview and growth insights:

Asia Pacific accounted highest revenue share in 2024 and is expected to register a CAGR of 4.9% by 2032. The region's agriculture sector has a consistent need for industrial salts, which are used for producing fertilizer. In addition, the expansion of the manufacturing, chemicals, and textile sectors, among others, has a significant influence on demand for industrial salts in countries such as China, India, Japan, and South Korea. The chemical industry, in particular, stands out as a major user of industrial salts, with China and India experiencing significant expansion in chemical manufacturing.

Europe contributed a substantial revenue share in 2024. Government incentives, such as green investment loans and EU innovation subsidies, contribute to accelerating technological adoption. For instance, on April 8, 2025, UP Catalyst received a USD 19 million investment from the European Investment Bank (EIB) to advance the commercial implementation of its molten salt electrolysis technology. Initiatives like decarbonized power integration and brine recycling open up new service lines and specialized, high-margin goods like ultra-pure or customized salts with provable low environmental footprints.

Competitive Landscape and Key Competitors:

The industrial salts market is characterized by numerous players, with major players competing across segments and regions. The list of major players included in the Industrial Salts Market report is:

• K+S Group

• Morton Salt

• Compass Minerals

• Cargill, Inc

• INEOS Group Limited

• Nouryon

• Rio Tinto Group

• China National Salt Industry Co.

• Dominion Salt Ltd.

• Tata Chemicals Ltd

• Salins Group

• Mitsui & Co

Buy Your Exclusive Copy Now:

Major strategic developments by leading competitors

Longpoint : On 15th September 2025, Longpoint acquired two industrial property portfolios in Salt Lake City: the Mountain West Portfolio and the Salt Lake City Infill Portfolio, which comprised slightly more than one million square feet. The Mountain West Portfolio consists of nine shallow-bay buildings totaling over 490,000 square feet, with an occupancy rate of 85% at closure.

Unlock the Key to Transforming Your Business Strategy with Our Industrial Salts Market Insights –

• Download the report summary:

• Request Customization:

Navistrat Analytics has segmented the industrial salts market on the product type, source, form, application, and region:

• Product Type Outlook (Revenue, USD Billion; 2022-2032)

• Rock Salt

• Brine-derived Salt

• Solar Salt

• Vacuum Salt

• Others

• Source Outlook (Revenue, USD Billion; 2022-2032)

• Brine

• Salt mines

• Form Outlook (Revenue, USD Billion; 2022-2032)

• Crystalline

• Granulated

• Powdered

• Application Outlook (Revenue, USD Billion; 2022-2032)

• Chemical processing

• De-icing

• Oil & Gas

• Metal Processing

• Water treatment

• Agriculture

• Others

• Regional Outlook (Revenue, USD Billion; 2022-2032)

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Get a preview of the detailed segmentation of market:

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Crypto Market Update: Pepeto Advances Presale With Staking Rewards And Live Exchange Demo

- Kucoin Appeals FINTRAC Decision, Reaffirms Commitment To Compliance

- Cregis And Sumsub Host Web3 Compliance And Trust Summit In Singapore

- Chartis Research And Metrika Release Comprehensive Framework For Managing Digital Asset Risk

- Nodepay Launches Crypto's Largest Prediction Intelligence Platform

- Schoenherr Opens London Liaison Office As Gateway To Central Eastern Europe

Comments

No comment