BNB Chain Memecoin Season Stalls As Coin Prices Drop 30%

- Binance 's new“Meme Rush” platform promotes fair token launches but triggered a wave of profit-taking and sell-offs among memecoin traders.

A single wallet held significant quantities of tokens, amplifying concerns over market manipulation and fake volumes. Low liquidity and inflated volumes contributed to a sharp sell-off, causing memecoin prices to fall over 30% in a matter of hours.

BNB itself experienced its first $100 drop in a day, falling to $1,246, shaking investor confidence amid the downturn. Market concentration and suspicious trading activity, including massive batch transactions, raised questions about the integrity of memecoin trading on DEXs.

Multiple memecoins on the BNB Chain saw losses exceeding 30% on Thursday following promising gains earlier in the week. The decline coincided with BNB's first-ever $100 single-day price dip, pushing the token down to around $1,246. While some of these memecoins had market caps under $50 million, notable tokens like PALU, GIGGLE, 4, and Binance Life (币安人生) bore the brunt of the crash. Market sentiment appeared to shift after Binance announced the launch of Meme Rush, a platform designed to facilitate more equitable token launches through collaboration with Four. This move introduces the potential for new tokens on Binance Alpha, offering broader access beyond traditional DEX listings.

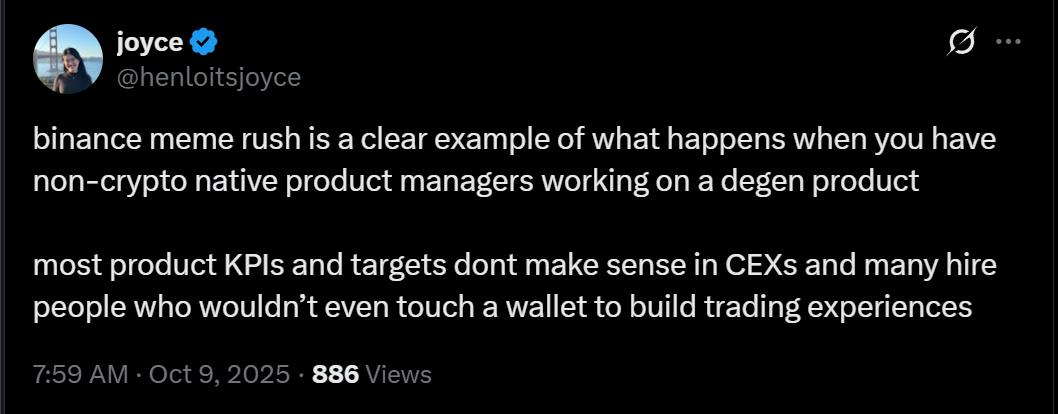

BNB Chain memecoin prices at decentralized exchanges, 24-hour chart. Source: DEX Screener.Critics argue that“degen” projects like memecoin launchpads are often disconnected from the performance metrics of centralized exchanges, thriving instead on lack of regulation and oversight. Many traders likely sold off existing BNB Chain memecoins in anticipation of migrating capital to the new launchpad. However, the sudden plunge highlighted underlying vulnerabilities-especially the high concentration of tokens in a few wallets, low liquidity, and inflated volumes driven by fake trading activities. These factors have historically amplified cyclical crashes in so-called“altcoin seasons,” particularly on decentralized exchanges which rely on automated market makers and liquidity pools.

Source: X/henloitsjoyce

On-chain analysis pinpointed concerning activities, with one wallet controlling nearly 39% of PALU, alongside significant holdings in Binance Life and 4. Some batch transactions exceeded $100,000 across multiple memecoins, suggesting coordinated efforts to manipulate markets. Observations from blockchain analytics firm Bubblemaps echoed these concerns, revealing that an influential wallet purchased approximately $100,000 of PALU just before Binance CEO Changpeng Zhao posted an image featuring its logo, sparking speculation about insider trading. Additionally, insider holdings in some projects, like YEPE, where insiders reportedly controlled around 60% of the supply, raised questions about transparency and potential price manipulation.

Meanwhile, BNB's sharp decline from its all-time high of $1,357 further pressured the memecoin market. The key to the sector's recovery hinges on whether BNB can reclaim the $1,300 level and if Binance's new platform can successfully introduce a more transparent, fair trading environment for meme tokens. As the industry continues to grapple with manipulation concerns and regulatory scrutiny, the coming weeks will be crucial in determining if the current downturn signals the end of this memecoin peak or if it's merely a pause before the next surge.

This analysis is for informational purposes and should not be construed as financial or legal advice. Crypto markets are highly volatile, and investors should conduct their own due diligence before engaging.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment