403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Sarmad Launches“Thamar” Investment Platform Supporting Vision 2030 Financial Market Transformation

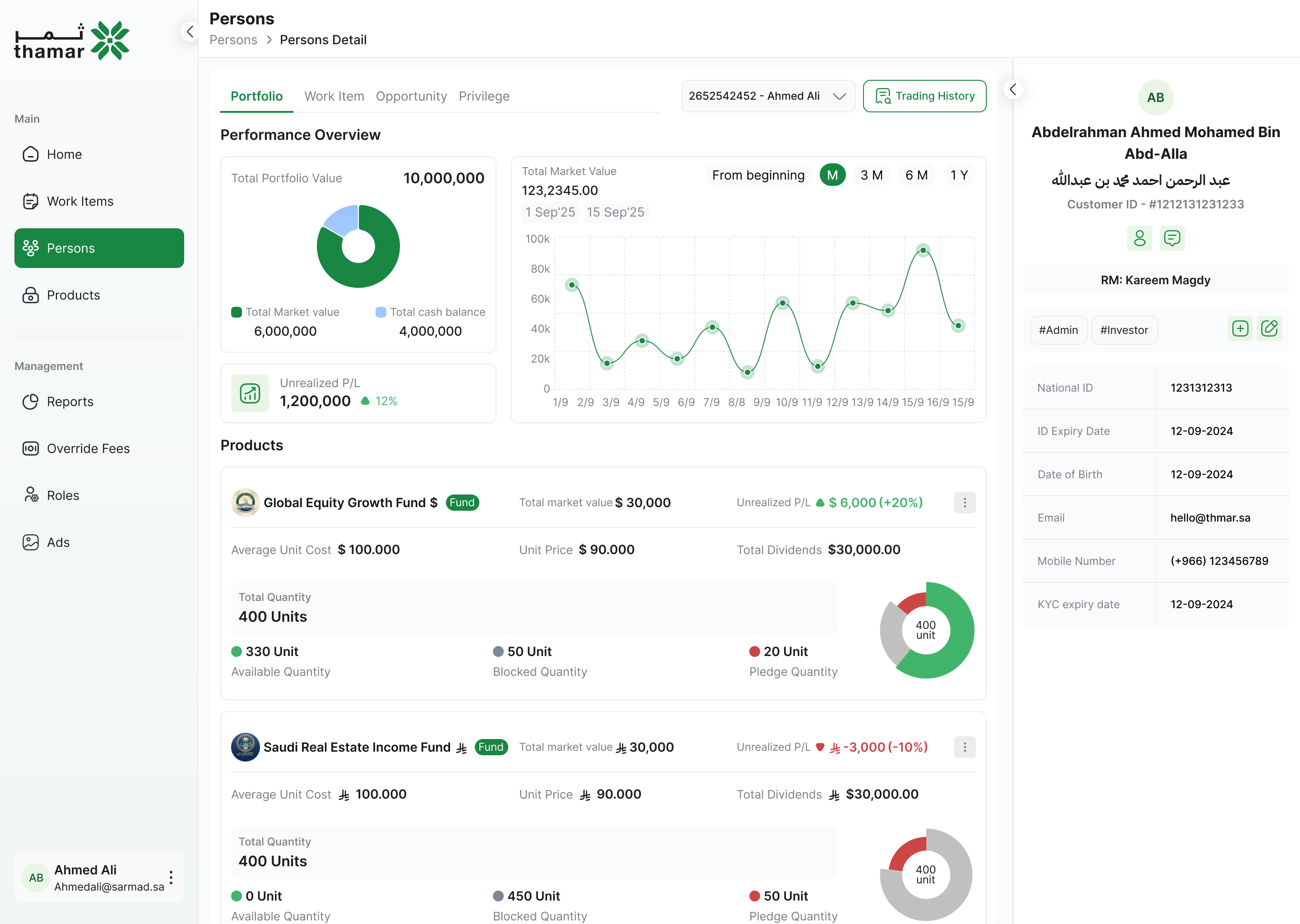

(MENAFN- Mid-East Info) Riyadh, Saudi Arabia – October 2025 – Saudi-based fintech provider, Sarmad, has officially launched“thamar”, an advanced solution for digitalizing customer experience in asset management investment houses. The all-in-one platform that digitizes customer and employee activities, connects asset managers to distributors, and ensures compliance for smoother operations. By doing so, it delivers a seamless investor journey while expanding outreach and distribution capabilities. Aligned with the Financial Sector Development Program under Vision 2030, the solution supports the push toward greater investment literacy, and helps accelerate the transition to a more inclusive and digital economy.

thamar was created by integrating international business norms and state-of-the-art technology to address inefficiencies in how investment firms manage investor services by replacing fragmented systems and manual processes with a single unified solution. The platform is built specifically for local market needs and is fully aligned with local regulatory frameworks. It integrates seamlessly with government services for eKYC and is designed to reflect the unique identity of each Capital Market Institution rather than offering a one-size-fits-all approach. thamar provides full investor-facing investment channels, along with an employee portal for internal activities. It also comes pre-integrated with omnibus bank accounts, payment gateways, and KYC compliance services, supported by a cloud-native and modular architecture that allows firms to scale as their business grows. Ali Alomran, CEO and Founder of Sarmad, said:“KSA is becoming one of the world's most dynamic investment hubs, and with thamar, we are proud to equip local capital market institutions with world-class technology tailored for local markets, directly supporting the transformation goals of Vision 2030. thamar is the first platform of its kind in the Middle East. Built hand in hand with Saudi asset managers, thamar simplifies operations, strengthens compliance, and opens new growth opportunities by connecting asset managers with investors and distributors.” Already in use by leading institutions, thamar has quickly demonstrated its value as it provides a full suite of digital capabilities that enables frictionless investor services. It acts as a central system of records for portfolios, transactions, client documents, and accounting, while giving organizations complete visibility across their operations. thamar will continue to expand its integrations with distributors, robo-advisors, banks, and government services, while introducing new features, including Generative AI-powered tools. Looking ahead, Sarmad aims to extend thamar across the GCC creating a distribution layer that connects investment offerings with a broader base of investors and liquidity pools. About Sarmad: Sarmad is a Saudi technology company building forward-looking software, teams, and ventures for the financial sector. Combining deep banking expertise with innovative software engineering, Sarmad delivers solutions that empower financial institutions to achieve efficiency, compliance, and growth. With a diverse team experienced in global financial markets, Sarmad is committed to shaping the future of finance through excellence and innovation.

thamar was created by integrating international business norms and state-of-the-art technology to address inefficiencies in how investment firms manage investor services by replacing fragmented systems and manual processes with a single unified solution. The platform is built specifically for local market needs and is fully aligned with local regulatory frameworks. It integrates seamlessly with government services for eKYC and is designed to reflect the unique identity of each Capital Market Institution rather than offering a one-size-fits-all approach. thamar provides full investor-facing investment channels, along with an employee portal for internal activities. It also comes pre-integrated with omnibus bank accounts, payment gateways, and KYC compliance services, supported by a cloud-native and modular architecture that allows firms to scale as their business grows. Ali Alomran, CEO and Founder of Sarmad, said:“KSA is becoming one of the world's most dynamic investment hubs, and with thamar, we are proud to equip local capital market institutions with world-class technology tailored for local markets, directly supporting the transformation goals of Vision 2030. thamar is the first platform of its kind in the Middle East. Built hand in hand with Saudi asset managers, thamar simplifies operations, strengthens compliance, and opens new growth opportunities by connecting asset managers with investors and distributors.” Already in use by leading institutions, thamar has quickly demonstrated its value as it provides a full suite of digital capabilities that enables frictionless investor services. It acts as a central system of records for portfolios, transactions, client documents, and accounting, while giving organizations complete visibility across their operations. thamar will continue to expand its integrations with distributors, robo-advisors, banks, and government services, while introducing new features, including Generative AI-powered tools. Looking ahead, Sarmad aims to extend thamar across the GCC creating a distribution layer that connects investment offerings with a broader base of investors and liquidity pools. About Sarmad: Sarmad is a Saudi technology company building forward-looking software, teams, and ventures for the financial sector. Combining deep banking expertise with innovative software engineering, Sarmad delivers solutions that empower financial institutions to achieve efficiency, compliance, and growth. With a diverse team experienced in global financial markets, Sarmad is committed to shaping the future of finance through excellence and innovation.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment