Bengaluru Metro Fares Zoom: Who Bears The Cost Of Rising Debt And Operations?

Heavy traffic jams and potholes have long drawn public ire in Bengaluru. Namma Metro, or the Bengaluru metro, has been a rare relief, offering commuters a smooth and efficient ride.

But earlier this year, the system itself became a flashpoint when Bangalore Metro Rail Corp. Ltd (BMRCL) raised fares by 71%, sparking debates over affordability. BMRCL said the hike was based on a Fare Fixation Committee (FFC) report, which remained under wraps for months despite political pressure and Right To Information (RTI) requests.

Also Read | Poonawalla wants Royal Challengers Bengaluru-Is Diageo ready to let goFinally, the report was released last month. And it showed the committee had recommended a smaller 51.55% hike, spread over 7.5 years. This has put the Bengaluru metro in the spotlight for the wrong reasons.

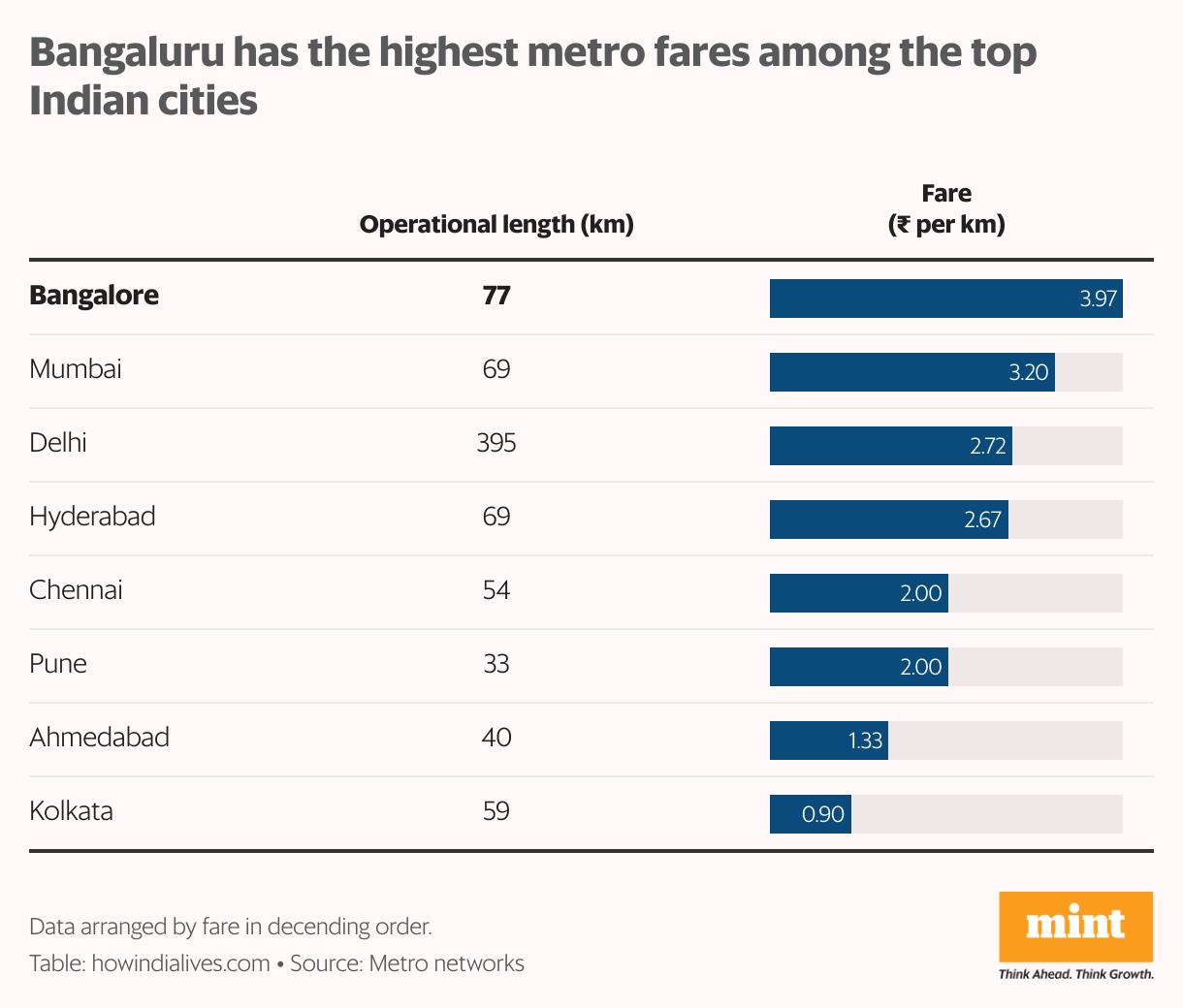

Costly commuteFollowing the hike, effective 9 February 2025, Namma Metro became the most expensive urban rail system in India.

The average cost of travel is now ₹3.97 per kilometre, higher than Mumbai ( ₹3.20), Delhi ( ₹2.72) and Kolkata ( ₹0.90). The contrast is sharper when fares are seen slab by slab. For example, in Delhi, ₹32 covers up to 12 km; in Bengaluru, a comparable fare of ₹30 covers just about half that. For longer distances, Delhi caps fares at ₹64 across its 395 km network, while Bengaluru's highest fare is ₹90, on its 77 km network, a 50% jump from the previous ₹60 maximum.

Initially, some fare brackets rose as much as 105% before being pared back, after chief minister Siddaramaiah called them abnormal and directed revisions. A survey of 1,126 people by the FFC found 51% opposed any hike, while 27% supported a reasonable increase. Following the rise, ridership fell 6%, stoking fears of worsening traffic congestion.

The rising bill

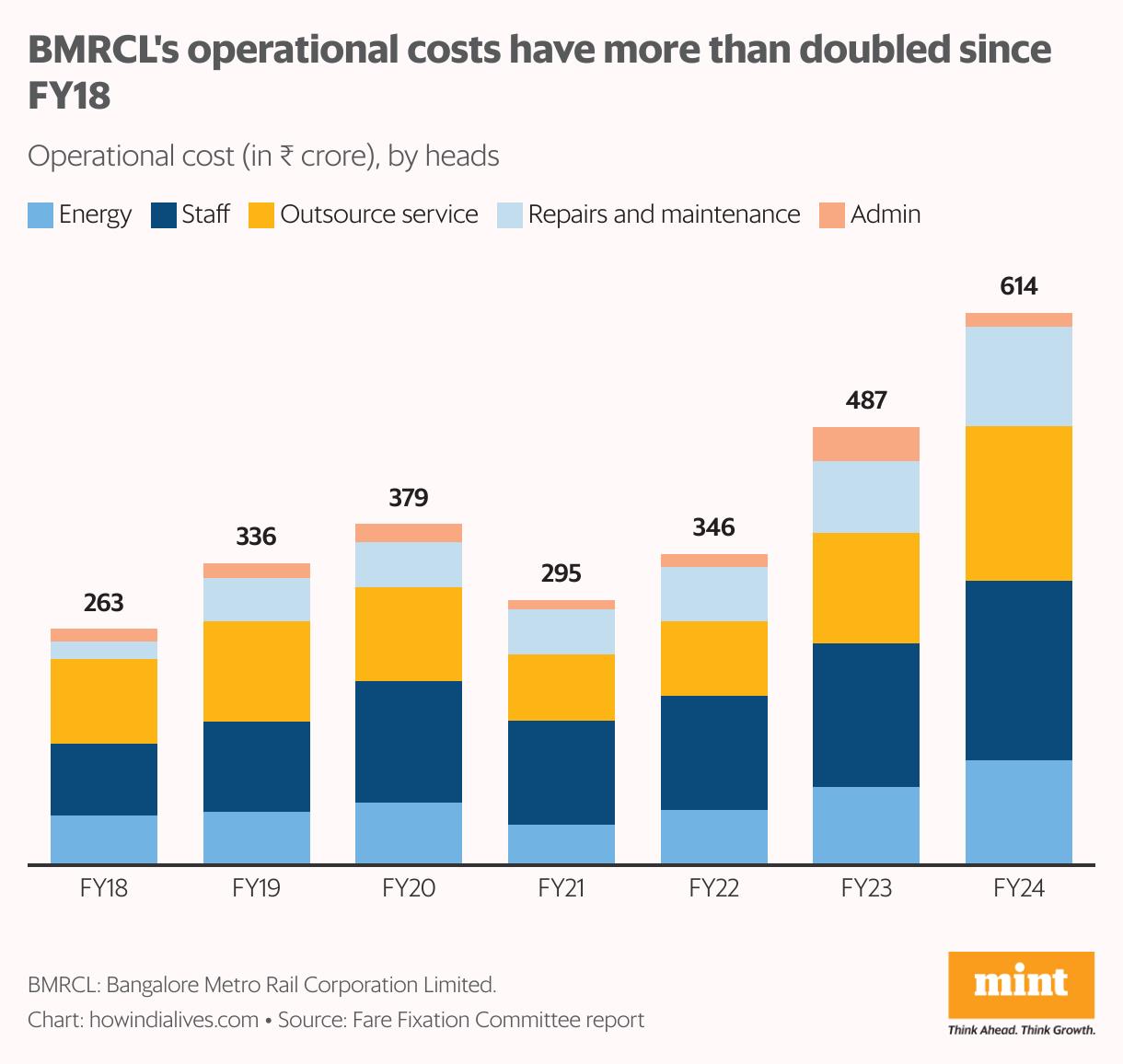

Metro fares remained unchanged for seven years, despite operating costs continuing to rise.

Between FY18 and FY24, BMRCL's operating expenses more than doubled to ₹614 crore from ₹263 crore. Staff costs alone jumped 150% to ₹199 crore, while repairs and maintenance soared over fourfold to ₹110 crore.

Also Read | Rapido sharpens focus on Delhi, partners ONDC for metro-ride integratioThe costs followed the metro's expansion. The network nearly doubled to 77 km in 2024 from 42 km in 2017, demanding more manpower, power and upkeep. Besides, staff salaries climbed due to pay-scale revisions, increments and allowances. Staff costs are the single largest expense for BMRCL. Ageing infrastructure also demanded more frequent maintenance.

These pressures widened the gap between revenue and expenditure, leading to continuous losses, including a net loss of ₹628 crore in FY24. BMRCL initially proposed a 105.15% fare hike, which experts said exaggerated costs; the FFC rejected it, recommending a smaller increase.

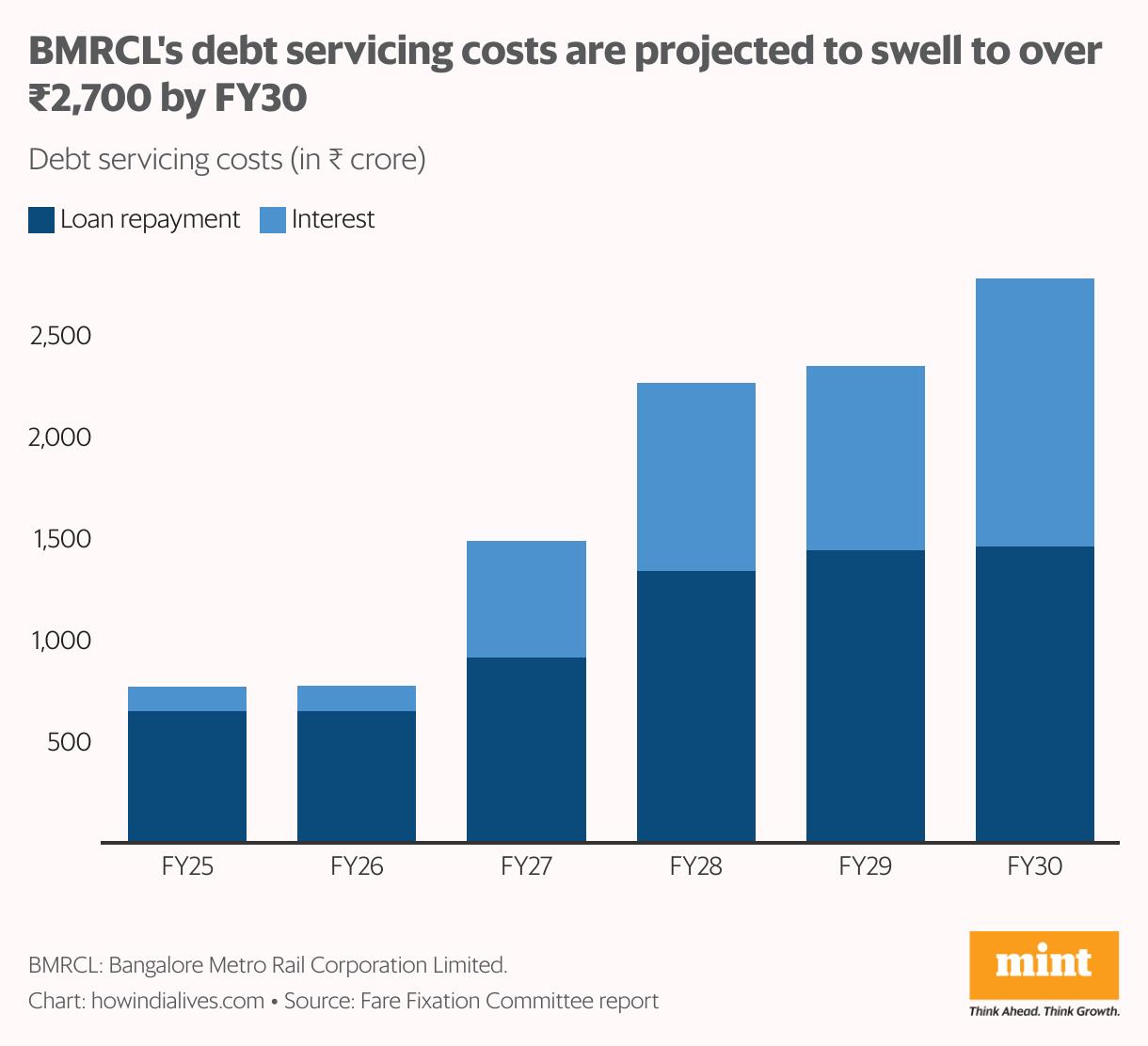

Loan burden

BMRCL's finances rely heavily on government funding and borrowings, creating a rising repayment burden. Although a 50:50 joint venture between the state and central government, Karnataka has shouldered most of the responsibility.

In August, chief minister Siddaramaiah stated that the state has contributed nearly 87% of metro project costs, ₹25,387 crore in direct spending and ₹3,987 crore in loan repayments, while the Centre's share is about 13%, largely in the form of loans. The state has also provided“Shadow Cash Support" to bridge operating losses, though its ability to continue this is uncertain given budget pressures.

Debt servicing is a major cost. BMRCL has outstanding external loans of ₹13,106 crore and subordinate debt of more than ₹21,500 crore as of FY2024. Annual repayments are set to cross ₹770.60 crore in FY25 from ₹591.23 crore in FY24, and projected to reach ₹2,776.58 crore by FY30, per FFC report.

Meanwhile, funding needs are growing. Phase 2 expansion costs have already been revised to ₹40,425 crore, with additional phases planned. Private participation remains limited, such as Embassy REIT's ₹100 crore station investment (for naming rights and commercial space).

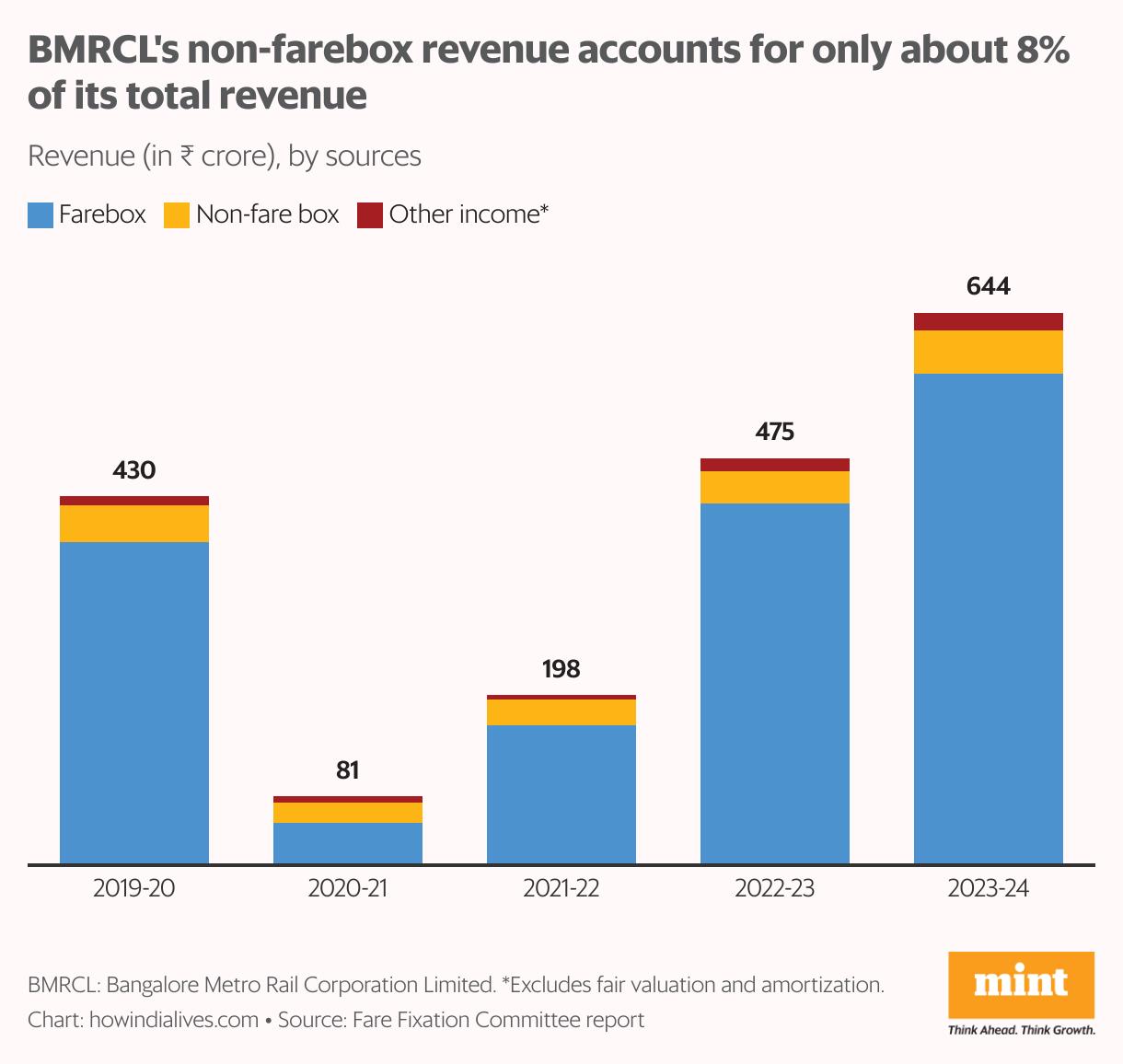

Fare dependence

BMRCL's income continues to rely overwhelmingly on passenger fares. In FY24, farebox collections touched ₹573.9 crore, contributing nearly 89% of total revenue. Non-fare earnings, though rising from ₹43 crore in FY20 to ₹50 crore in FY24, still made up just 8.7%. A further ₹20 crore came from other income, largely interest and grants.

The imbalance highlights the system's dependence on ticket sales, leaving little cushion against cost pressures or delays in ridership growth.

To correct this, BMRCL is stepping up asset monetization . Advertising on metro pillars, reinstated after a seven-year ban, is expected to generate ₹60–80 crore annually, potentially outstripping the entire current non-fare base. Property development provides bigger one-offs, such as IKEA's ₹251 crore lease of 13 acres at Nagasandra. Smaller but steady inflows come from retail kiosks, ATMs, parking and commercial space rentals.

Globally, metros in Hong Kong and Singapore derive 30–45% of revenues from non-fare sources. With Bengaluru's network expanding to 220 km by 2029, diversifying income is central to long-term financial stability.

Also Read | Hold tight, a global metro railway boom has only just begu Tracking growthRidership is the single most important metric for Bengaluru's metro, shaping its impact on congestion, productivity, and financial health.

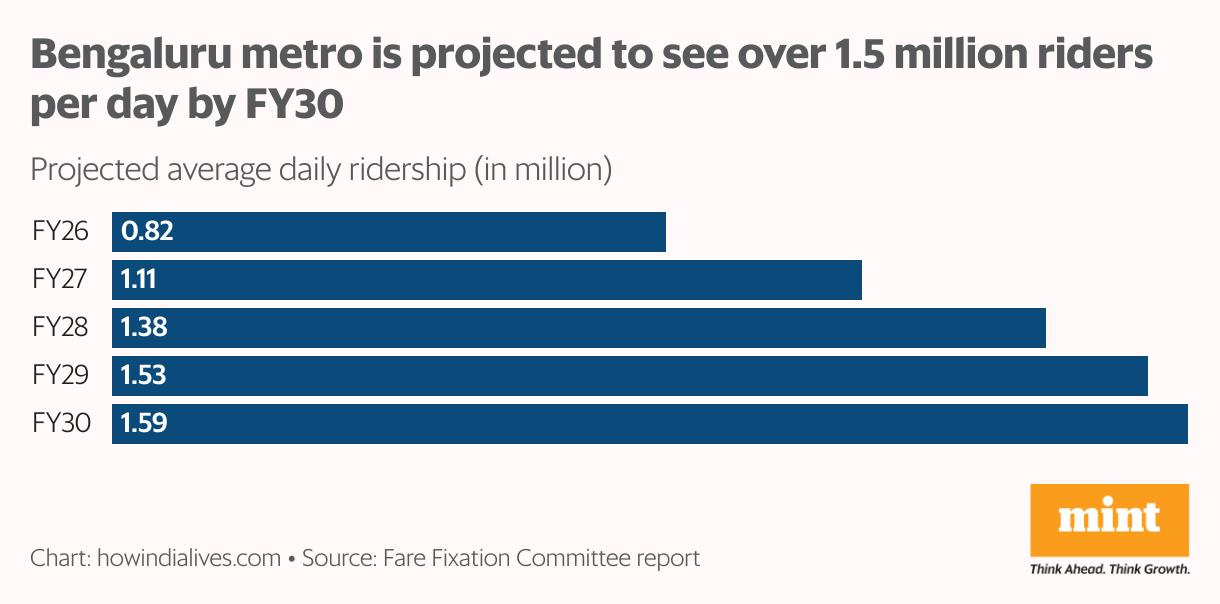

Daily boardings averaged 0.84 million before the February fare hike. While the ridership briefly slipped, they are projected to climb steadily with network expansion. The FFC report projects passenger numbers to cross 1.1 million in 2026–27, nearly 1.4 million by 2027–28, and touch 1.59 million by 2029–30. This is expected to ease the road traffic woes in the city.

The opening of the Yellow Line in the city has already shown the difference, with traffic police data recording a 37.5% decline in peak-hour congestion on its corridor. Upcoming projects like the Pink Line by 2026 and the Blue Line to the airport by 2027 are expected to fuel further growth.

High ridership strengthens fare revenue, justifies large capital spending, and creates a virtuous cycle of expansion and usage. For a city where gridlock undermines productivity, the metro's ability to draw commuters in large numbers is central to its long-term success. High ticket prices might make it less attractive.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment