ETH Stays At $4K While Traditional Finance Grows And Retail Waits

- Ethereum outperformed Bitcoin in Q3 with a 75% rally, but momentum slowed in September. Institutional demand surged, reducing Ether's circulating supply, while retail participation remained weak. Futures trading data shows a historic shift, with Ethereum's derivatives activity reaching new highs. Key on-chain levels, such as $4,580, are pivotal for a sustained bullish reversal. Persistent retail selling signals potential challenges, though a shift in retail flows could accelerate gains.

Ethereum (ETH) saw a remarkable 75% increase against Bitcoin (BTC) during the third quarter of 2023, driven largely by growing institutional interest. Despite a recent slowdown in its price momentum, many traders remain optimistic about ETH reaching $5,000 in the next two years as on-chain indicators continue to highlight strong demand and trading activity. The cryptocurrency's resilience underscores its evolving role within the broader blockchain ecosystem and the resilience of DeFi and NFT sectors that rely heavily on Ethereum's network.

Data from Glassnode indicates that futures traders continue to favor Ether, with its open interest dominance hitting 43.3%, the fourth-highest on record. Meanwhile, Bitcoin's dominance remains at 56.7%. Notably, Ethereum's perpetual futures volume reached an all-time high of 67%, reflecting a significant shift in trading activity toward ETH, amid high volatility and dynamic market sentiment.

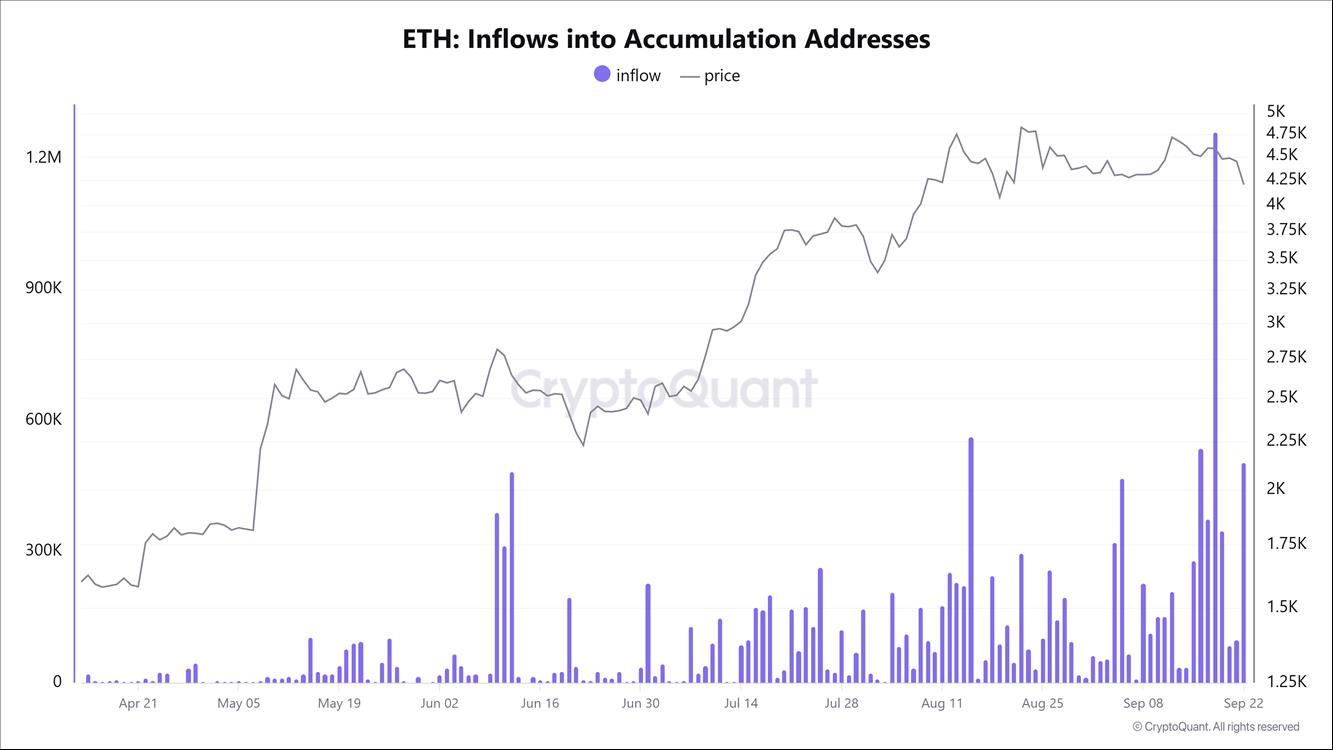

BTC vs. ETH perpetual futures volume dominance. Source: GlassnodeCryptoQuant analyst Crazzyblockk emphasized the importance of Ethereum reclaiming the $4,580 threshold, which relates to exchange outflow cost bases and accumulation levels. Recent movements show that over 1.28 million ETH, valued at more than $5.3 billion, have been transferred into long-term holding addresses, a possible signal of bullish sentiment if sustained. Currently, ETH finds support around $4,100, correlating with the average cost basis of highly active addresses, suggesting a foundation for future upward moves.

Ether inflows into Accumulation Addresses. Source: CryptoQuantInstitutional Demand Alleviates Ether Supply, but Retail Fading Raises Questions

Institutional buyers have played a crucial role in reducing Ethereum's circulating supply, with U.S.-based spot ETH ETFs seeing assets swell to approximately $27.48 billion in September from just over $10 billion in June. This influx, totaling over $17 billion during July and August, highlights substantial institutional confidence and investment in ETH, alongside strategic reserves managed by firms like Bitmine and SharpLink. These reserves increased by 121%, reaching over 12 million ETH-currently valued at around $46 billion-demonstrating a long-term bullish stance among professional investors.

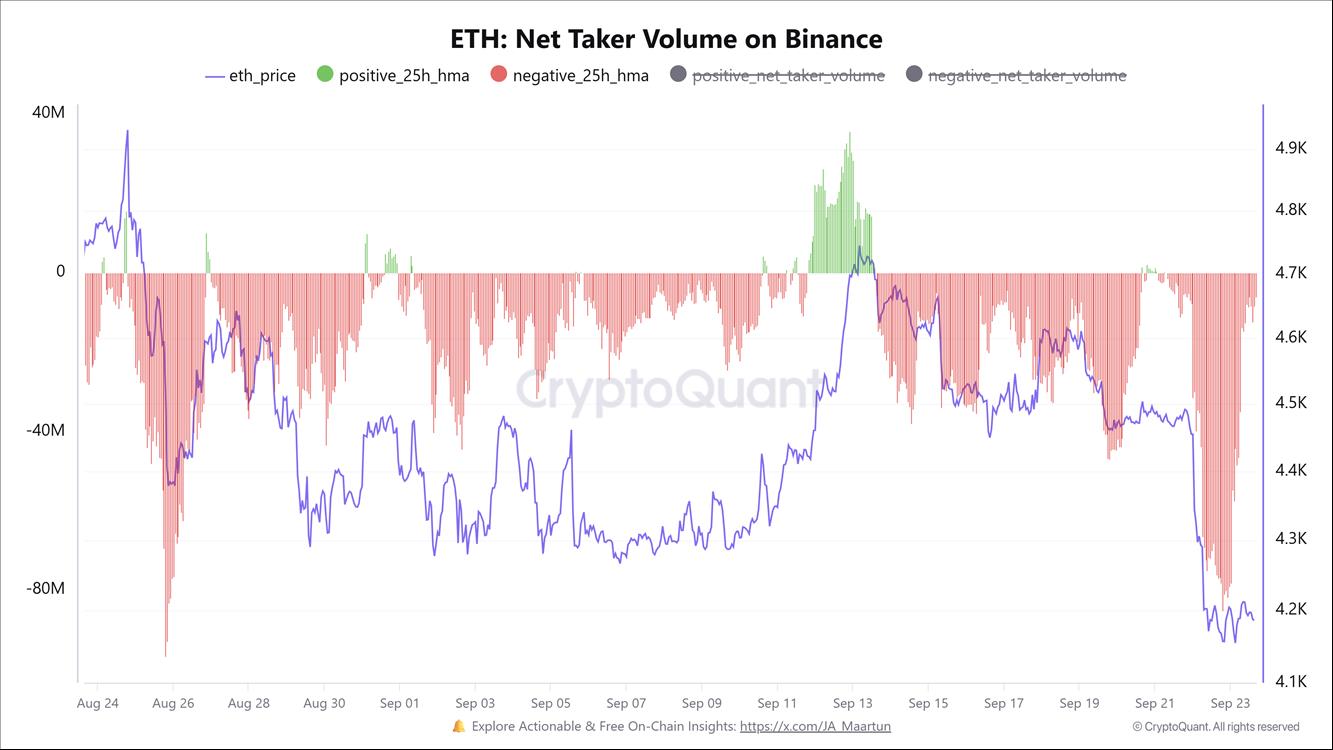

In stark contrast, retail participation shows signs of fatigue. Net taker volume on Binance has remained negative for nearly a month, peaking in late September, indicating persistent sell-side pressure from retail traders despite strong institutional activity. The spot taker CVD, which tracks buying versus selling volume over 90 days, has consistently been sell-dominant since late July, suggesting retail traders have been net sellers of ETH.

ETH net taker volume on Binance. Source: CryptoQuant

However, if retail flows shift towards positive territory and the CVD turns buy-dominant, Ethereum could experience a retail-led rally, potentially accelerating overall market momentum. Watch for a reversal in retail selling trends as a key indicator for sustained upward mobility in ETH prices, alongside ongoing institutional interest and on-chain support levels.

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risks, and readers should conduct their own research before making any trading decisions.

Crypto Investing Risk Warning

Crypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- New Cryptocurrency Mutuum Finance (MUTM) Raises $15.8M As Phase 6 Reaches 40%

- Bydfi Joins Korea Blockchain Week 2025 (KBW2025): Deepening Web3 Engagement

- Yield Basis Nears Mainnet Launch As Curve DAO Votes On Crvusd Proposal

- 0G Labs Launches Aristotle Mainnet With Largest Day-One Ecosystem For Decentralized AI

- Ethereum-Based Defi Crypto Mutuum Finance (MUTM) Raises Over $16 Million With More Than 720M Tokens Sold

- Fintech's Gender Gap In Focus: Drofa Comms' Women Leading The Way Joins Evolvh3r's She Connects At TOKEN2049

Comments

No comment