Stargardt Disease Market Outlook 2034 Clinical Trials, Market Size, Medication, Prevalence, Companies By Delveinsight

"Stargardt Disease Market"Stargardt Disease Companies in treatment market are Ocugen, Kubota Vision Inc, Nanoscope Therapeutics Inc., RBP4 Pty Ltd, Stargazer Pharmaceuticals, Inc., Belite Bio, Inc, Alkeus Pharmaceuticals, Inc., IVERIC bio, Inc., Kubota Vision Inc., Astellas Institute, Nanoscope Therapeutics, Alkeus Pharmaceuticals, and others.

Stargardt Disease Market Summary

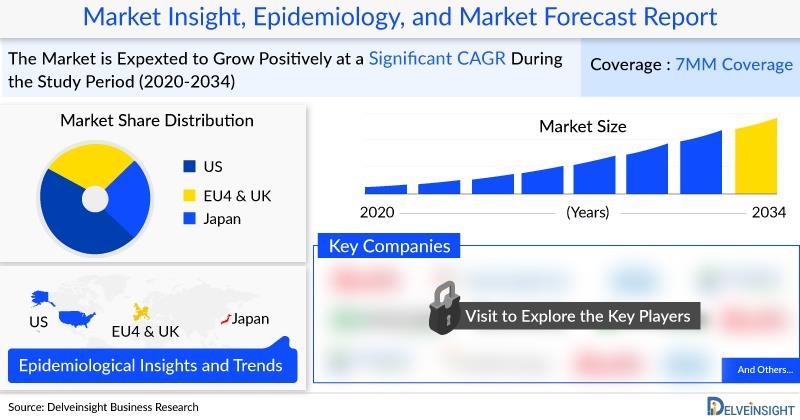

In 2023, the United States led the Stargardt Disease treatment market, accounting for nearly 55% of the global share, followed by the EU4, the UK, and Japan. Stargardt disease, a rare autosomal recessive macular dystrophy caused by ABCA4 gene mutations, results in lipofuscin accumulation in the retinal pigment epithelium, leading to central vision loss. It is the most common recessive macular dystrophy in children, affecting approximately 10–12.5 per 100,000 individuals in the U.S., with earlier onset correlating with more severe progression. Diagnosis relies on family history, visual acuity, fundus examination, visual field testing, fundus autofluorescence, and OCT imaging. Currently, no standard therapies exist to prevent or reverse vision loss; management includes low-vision aids, sunlight avoidance, vitamin A restriction, and anti-VEGF injections for choroidal neovascularization. Emerging pipeline candidates such as ALK-001, Tinlarebant, IZERVAY, Emixustat, and gene therapies like MCO-010 are expected to drive market growth between 2024 and 2034, addressing unmet needs caused by disease heterogeneity and diagnostic challenges.

DelveInsight's report,“ Stargardt Disease Market Insights, Epidemiology, and Market Forecast-2034 ”, provides a comprehensive analysis of Stargardt disease, including historical and projected epidemiology and market trends across the United States, EU5 (Germany, Spain, Italy, France, and the UK), and Japan. The study examines current treatment approaches, emerging therapies, individual drug market shares, and the market size from 2020 to 2034. It also evaluates treatment algorithms, key market drivers and barriers, and unmet medical needs to identify growth opportunities and assess market potential. The Stargardt disease market is expected to expand significantly over the forecast period, driven by increasing disease prevalence, growing awareness, and the introduction of multiple-stage pipeline therapies poised to transform market dynamics.

To Know in detail about the Stargardt Disease market outlook, drug uptake, treatment scenario and epidemiology trends, Click here; Stargardt Disease Market Insights

Some of the key facts of the Stargardt Disease Market Report:

-

The Stargardt Disease market size was valued ~USD 27 million in 2024 and is anticipated to grow with a significant CAGR during the study period (2020-2034)

In Sept 2025, VeonGen Therapeutics received FDA's RMAT designation for VG801, a gene therapy targeting Stargardt disease and other retinal dystrophies linked to ABCA4 mutations. VG801 uses a dual AAV vector and the proprietary vgRNA REVeRT platform to deliver a functional ABCA4 gene via an engineered vgAAV capsid to photoreceptor cells.

In August 2025, AAVantgarde Bio received FDA Fast Track Designation for AAVB-039, its next-generation gene therapy for Stargardt disease secondary to biallelic ABCA4 mutations. The FDA also cleared the IND application for AAVB-039 to proceed, supporting advancement toward clinical development.

In March 2025, Barcelona-based genetic medicines company SpliceBio administered the first dose in its Phase 1/2 ASTRA clinical trial (NCT identifier pending), evaluating SB-007, a dual AAV vector-based gene therapy for Stargardt disease. This inherited retinal dystrophy, caused by ABCA4 gene mutations, is a progressive condition with no currently approved treatments.

In February 2025, Ocugen, Inc. (NASDAQ: OCGN) , a biotechnology leader in gene therapies for blindness-related diseases, has secured FDA alignment to proceed with a Phase 2/3 pivotal confirmatory trial for OCU410ST. If successful, the trial could support a biologics license application (BLA) submission.

In December 2024, The FDA approved SpliceBio's IND application to initiate a clinical trial for SB-007, a protein splicing gene therapy aimed at treating Stargardt disease. As the first therapy to receive this clearance, SB-007 targets the genetic root cause of the disease and has the potential to benefit all patients, regardless of their ABCA4 mutation. SpliceBio plans to launch the Phase I/II ASTRA trial in the first half of next year.

In September 2024, Nanoscope Therapeutics Inc. announced a successful End-of-Phase II (EOP2) meeting with the FDA, discussing its clinical program for MCO-010 in treating severe vision loss from Stargardt Macular Degeneration (SMD). The meeting supports the advancement of MCO-010 into a Phase III registrational trial.

In August 2024, Ocugen, Inc. announced the completion of dosing in the third cohort of its Phase I/II GARDian clinical trial for OCU410ST (AAV-hRORA), a modifier gene therapy candidate designed to treat Stargardt disease.

In July 2024, Alkeus Pharmaceuticals Inc. presented interim findings from its TEASE-3 study, revealing that early-stage Stargardt disease patients treated with gildeuretinol acetate showed no disease progression and remained asymptomatic while receiving treatment for 2 to 6 years.

In January 2024, Alkeus Pharmaceuticals disclosed encouraging interim findings indicating that gildeuretinol effectively arrested the progression of Stargardt disease for a period of up to six years. Within the ongoing TEASE-3 clinical trial targeting early-stage Stargardt disease, the initial three adolescent participants who received oral gildeuretinol acetate remained symptom-free and did not experience any advancement of the disease throughout their treatment duration, which ranged from two years for one patient to six years for two patients.

According to information from Orphanet (2023), the prevalence of Stargardt Disease is approximated to vary between 1 in 8,000 to 1 in 10,000 people, with both males and females equally impacted by the condition in Europe.

According to the NIH (2023), the projected prevalence of Stargardt macular degeneration stands at approximately 1 in 6,500 individuals within the United States.

In 2023, the United States had the highest number of diagnosed prevalent cases of Stargardt, representing 43.0% of the total diagnosed-incident cases across the 7MM.

In the EU4 and the UK, Germany reported the highest number of Stargardt disease cases, followed by the UK, while Spain had the fewest prevalent cases.

Throughout the forecast period (2024–2034), pipeline candidates like ALK-001 (gildeuretinol), Tinlarebant (LSB-008), IZERVAY (avacincaptad pegol), MCO-010 (Sonpiretigene Isteparvovec), and Emixustat are anticipated to contribute to the growth of the Stargardt disease market.

By 2034, MCO-010 (Sonpiretigene Isteparvovec) is projected to capture the largest market share, with ALK-001 (gildeuretinol) following in the 7MM.

Key Stargardt Disease Companies: Ocugen, Kubota Vision Inc, Nanoscope Therapeutics Inc., RBP4 Pty Ltd, Stargazer Pharmaceuticals, Inc., Belite Bio, Inc, Alkeus Pharmaceuticals, Inc., IVERIC bio, Inc., Kubota Vision Inc., Astellas Institute, Nanoscope Therapeutics, Alkeus Pharmaceuticals, and others

Key Stargardt Disease Therapies: OCU410ST, Emixustat, Gene Therapy-vMCO-010, tinlarebant, STG-001, Tinlarebant, ALK-001, Zimura, Emixustat, MA09-hRPE, MCO-010 (Sonpiretigene Isteparvovec), ALK-001 (Gildeuretinol), and others

The Stargardt Disease market is expected to surge due to the disease's increasing prevalence and awareness during the forecast period. Furthermore, launching various multiple-stage Stargardt Disease pipeline products will significantly revolutionize the Stargardt Disease market dynamics.

Stargardt Disease Overview

Stargardt disease, also known as Stargardt macular dystrophy or juvenile macular degeneration, is a genetic eye disorder that affects the macula, a small area near the center of the retina responsible for sharp, central vision. It is typically diagnosed in childhood or adolescence. Stargardt disease is characterized by the gradual degeneration of the cells in the macula, leading to progressive central vision loss.

Get a Free sample for the Stargardt Disease Market Report: Stargardt Disease Treatment Market

Stargardt Disease Market Outlook

In 2023, the total Stargardt Disease treatment market size was around USD 27 million, which is expected to increase by 2034 during the study period (2020 – 2034) in the 7MM.

Stargardt disease is a rare genetic eye disorder caused primarily by mutations in the ABCA4 gene, leading to the accumulation of fatty material on the macula, which gradually destroys central vision. Currently, no FDA-approved treatments exist to prevent or reverse vision loss. Management focuses on lifestyle modifications such as avoiding smoking and vitamin A supplements, using photoprotection, employing low-vision aids, and correcting refractive errors. In rare cases of choroidal neovascularization, intravitreal anti-VEGF injections are used.

Several novel therapies and gene treatments-including emixustat, gildeuretinol, tinlarebant, avacincaptad pegol, and MCO-010-are under development by companies like Kubota Vision, Nanoscope Therapeutics, Alkeus Pharmaceuticals, Belite Bio, and Astellas Pharma. These emerging therapies are expected to address the significant unmet need, improve patient outcomes, and drive substantial growth in the Stargardt disease treatment market across the 7MM between 2024 and 2034.

Stargardt Disease Epidemiology

In 2023, the United States had the highest share of diagnosed Stargardt disease cases among the 7MM, representing 43% of total diagnosed-incident cases. In the U.S., disease onset was most common in individuals over 20 years, particularly those aged 20–39, while cases were lowest in those aged 60 and above. Within the EU4 and the UK, Germany reported the highest prevalence, followed by the UK, with Spain having the lowest. In Japan, the most frequently reported symptoms among symptomatic patients were reduced vision, followed by nyctalopia, photophobia, and other visual impairments.

Stargardt Disease Epidemiology Segmentation:

The Stargardt Disease market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

-

Total Prevalence of Stargardt Disease

Prevalent Cases of Stargardt Disease by severity

Gender-specific Prevalence of Stargardt Disease

Diagnosed Cases of Episodic and Chronic Stargardt Disease

Download the report to understand which factors are driving Stargardt Disease epidemiology trends @ Stargardt Disease Patient Pool Forecasting

Stargardt Disease Drugs Uptake and Pipeline Development Activities

Emixustat: Kubota Pharmaceuticals

Emixustat, developed by Kubota Pharmaceuticals, is an oral drug initially designed to target the dry form of age-related macular degeneration. It functions by slowing the buildup of toxic waste products that contribute to retinal degeneration in various retinal conditions, including Stargardt disease.

The Stargardt Disease mechanism of action involves the modulation of the visual cycle by inhibiting a critical enzyme in this pathway, Retinal pigment epithelium-specific 65 kDa protein (RPE65). By slowing the visual cycle, Emixustat reduces the availability of vitamin A derivatives (11-cis-and all-trans-retinal) to form precursors of A2E and related compounds. In animal models of Stargardt disease and retinal degeneration, Emixustat has demonstrated the ability to decrease the accumulation of A2E and protect the retina from light-induced damage.

In human clinical studies, orally delivered Emixustat has been generally well tolerated. An interesting pharmacological observation is a delayed dark adaptive response in an electrical retinogram, which is considered a common sign of Emixustat's effect. In August 2020, Kubota Vision Inc., a clinical-stage ophthalmology company and a wholly-owned subsidiary of Kubota Pharmaceutical, announced that the US FDA Office of Orphan Products Development (OOPD) had awarded an orphan products clinical trial grant to support the Phase III study of emixustat in Stargardt disease.

MCO-010: Nanoscope Therapeutics

Nanoscope's MCO-010 is an optogenetic gene therapy that utilizes a convenient and well-established intraocular injection to deliver a gene encoding the ambient light-sensitive MCO protein into retinal cells. Multi-Characteristic Opsin (MCO) re-sensitize the retina for detecting low light levels to restore vision in blind patients, specifically for the treatment of Stargardt disease, with the goal of improving visual function.

The company's lead asset, MCO-010, holds the potential to restore vision in millions of visually impaired individuals suffering from retinal degenerative diseases, including Stargardt Disease and others. The company has fully enrolled in the Phase II STARLIGHT trial of MCO-010 therapy in Stargardt patients.

In January 2023, Nanoscope Therapeutics Inc. announced that the US FDA had granted Fast Track Designation (FTD) to MCO-010.

Stargardt Disease Therapies and Key Companies

-

OCU410ST: Ocugen

Emixustat: Kubota Vision Inc

Gene Therapy-vMCO-010: Nanoscope Therapeutics Inc.

tinlarebant: RBP4 Pty Ltd

STG-001: Stargazer Pharmaceuticals, Inc.

Tinlarebant: Belite Bio, Inc

ALK-001: Alkeus Pharmaceuticals, Inc.

Zimura: IVERIC bio, Inc.

Emixustat: Kubota Vision Inc.

MA09-hRPE: Astellas Institute

Emixustat : Kubota Pharmaceuticals

MCO-010 (Sonpiretigene Isteparvovec): Nanoscope Therapeutics

ALK-001 (Gildeuretinol): Alkeus Pharmaceuticals

To know more about Stargardt Disease treatment, visit @ Stargardt Disease Medications

Stargardt Disease Market Drivers

-

Rising disease awareness: Increased understanding among patients and healthcare providers is improving diagnosis rates.

Advancements in pipeline therapies: Emerging drugs (emixustat, gildeuretinol, tinlarebant, avacincaptad pegol) and gene therapies (MCO-010, Sonpiretigene Isteparvovec) are expected to transform disease management.

High unmet medical need: Lack of FDA-approved treatments drives demand for innovative therapies.

Technological progress in diagnosis: Tools like fundus autofluorescence (FAF) and optical coherence tomography (OCT) enable earlier and more accurate detection.

Growing healthcare spending: Increased investments in ophthalmology and rare disease treatment support market expansion.

Stargardt Disease Market Barriers

-

Disease heterogeneity: Variable symptom onset and progression complicate treatment standardization.

Limited epidemiological data: Incomplete knowledge of prevalence and incidence restricts market planning.

High development costs: Gene therapies and novel drugs involve significant R&D and regulatory expenses.

Long clinical development timelines: Rare disease trials face recruitment challenges and prolonged regulatory pathways.

Restricted access in some regions: Limited availability of advanced therapies outside major markets like the U.S. and EU.

Scope of the Stargardt Disease Market Report

-

Study Period: 2020–2034

Coverage: 7MM [The United States, EU5 (Germany, France, Italy, Spain, and the United Kingdom), and Japan]

Key Stargardt Disease Companies: Ocugen, Kubota Vision Inc, Nanoscope Therapeutics Inc., RBP4 Pty Ltd, Stargazer Pharmaceuticals, Inc., Belite Bio, Inc, Alkeus Pharmaceuticals, Inc., IVERIC bio, Inc., Kubota Vision Inc., Astellas Institute, Nanoscope Therapeutics, Alkeus Pharmaceuticals, and others

Key Stargardt Disease Therapies: OCU410ST, Emixustat, Gene Therapy-vMCO-010, tinlarebant, STG-001, Tinlarebant, ALK-001, Zimura, Emixustat, MA09-hRPE, MCO-010 (Sonpiretigene Isteparvovec), ALK-001 (Gildeuretinol), Zimura, and others

Stargardt Disease Therapeutic Assessment: Stargardt Disease current marketed and Stargardt Disease emerging therapies

Stargardt Disease Market Dynamics: Stargardt Disease market drivers and Stargardt Disease market barriers

Competitive Intelligence Analysis: SWOT analysis, PESTLE analysis, Porter's five forces, BCG Matrix, Market entry strategies

Stargardt Disease Unmet Needs, KOL's views, Analyst's views, Stargardt Disease Market Access and Reimbursement

Discover more about therapies set to grab major Stargardt Disease market share @ Stargardt Disease Treatment Landscape

Table of Contents

1. Stargardt Disease Market Report Introduction

2. Executive Summary for Stargardt Disease

3. SWOT analysis of Stargardt Disease

4. Stargardt Disease Patient Share (%) Overview at a Glance

5. Stargardt Disease Market Overview at a Glance

6. Stargardt Disease Disease Background and Overview

7. Stargardt Disease Epidemiology and Patient Population

8. Country-Specific Patient Population of Stargardt Disease

9. Stargardt Disease Current Treatment and Medical Practices

10. Stargardt Disease Unmet Needs

11. Stargardt Disease Emerging Therapies

12. Stargardt Disease Market Outlook

13. Country-Wise Stargardt Disease Market Analysis (2020–2034)

14. Stargardt Disease Market Access and Reimbursement of Therapies

15. Stargardt Disease Market Drivers

16. Stargardt Disease Market Barriers

17. Stargardt Disease Appendix

18. Stargardt Disease Report Methodology

19. DelveInsight Capabilities

20. Disclaimer

21. About DelveInsight

About DelveInsight

DelveInsight is a leading Business Consultant, and Market Research firm focused exclusively on life sciences. It supports Pharma companies by providing comprehensive end-to-end solutions to improve their performance.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- New Cryptocurrency Mutuum Finance (MUTM) Raises $15.8M As Phase 6 Reaches 40%

- Bydfi Joins Korea Blockchain Week 2025 (KBW2025): Deepening Web3 Engagement

- Yield Basis Nears Mainnet Launch As Curve DAO Votes On Crvusd Proposal

- 0G Labs Launches Aristotle Mainnet With Largest Day-One Ecosystem For Decentralized AI

- Ethereum-Based Defi Crypto Mutuum Finance (MUTM) Raises Over $16 Million With More Than 720M Tokens Sold

- Fintech's Gender Gap In Focus: Drofa Comms' Women Leading The Way Joins Evolvh3r's She Connects At TOKEN2049

Comments

No comment