Citi Wealth 2025 Global Family Office Report Highlights Resilience, Trade Risks, And Family Priorities

Table of Contents

Toggle- Executive summary

- Asset allocations largely held steady amid wait for greater policy clarity Positive outlook for portfolio returns despite tariff uncertainty Active management was the main response to the tariff-induced market volatility

Optimism prevails despite earlier market turmoil around U.S. tariff announcements and ongoing trade policy uncertainty

NEW YORK -- Citi Wealth today released its 2025 Global Family Office Report, offering a rare glimpse into the thinking and behaviors of some of the world's most sophisticated investors. The report was compiled by Citi Wealth's Global Family Office Group, which works with over 1,800 family offices worldwide.

Amid trade policy uncertainty, geopolitical tensions and technological transformation, this flagship publication explores issues such as investment sentiment, portfolio actions and operational best practices. Its findings are drawn from an annual survey, in which a record 346 family office respondents from 45 countries participated. Conducted in June and July 2025, the survey sheds light on how expectations and strategies have changed since the U.S. tariff announcements earlier this year.

Key themes to emerge include:

-

Staying Resolute: Asset allocations were largely held steady, with family offices making fewer shifts than last year, pending greater clarity on trade policy. Among those implementing changes, bullish moves predominated. Private equity saw the most positive activity.

Optimistic Outlook: Family offices expressed optimism about 12-month portfolio returns, despite limited consensus about which asset classes might drive performance. Potential U.S. deregulation, interest rate cuts and advances in artificial intelligence may explain positive sentiment.

Active Response to Market Volatility: U.S. tariff announcements triggered swift, calculated adjustments to bolster portfolio resilience, with 39% of family offices favoring active management. They also pivoted toward perceived defensive asset classes and geographies as well as hedging strategies.

Strong Commitment to Direct Investments: Seventy percent of respondents said they were engaged with direct investments. Of those, four out of ten said they had increased or significantly increased their activity in the last year, suggesting confidence in their ability to select deals that drive returns.

Geopolitical Concerns: Global trade disputes emerged as a top concern (60%) for family offices, followed by U.S.-China relations (43%) and a resurgence of inflation (37%). Geopolitical tensions and government initiatives to attract capital are fueling interest in asset location and a re-evaluation of jurisdictions.

Professionalization Gaps: While family offices have made progress in professionalizing their investment function, more improvement is needed in operational risk management, cybersecurity and leadership succession planning.

Outsourcing Services: To manage their growing responsibilities in a cost-efficient manner, many family offices are considering external suppliers, but with decision-making authority largely remaining in-house.

Advancing AI Deployment: The proportion of respondents mentioning they had deployed AI has doubled since last year, particularly in the automation of operational tasks and investment analytics. However, full integration will take time.

"These are exciting times for family offices worldwide," comments Hannes Hofmann, Head of Citi Wealth's Global Family Office Group. "These sophisticated clients are finding new ways to address their families' ever-increasing expectations. Our 2025 report highlights how they are refining priorities, reimagining their operations and seeking to build resilient portfolios. We are proud to partner with them, drawing upon Citi's global reach and deep resources to help them seize potential opportunities and achieve their ambitious goals."

Almost all respondents said that they anticipated portfolio upside over the year ahead – with nearly four out of ten family offices expecting returns of 10% or more. That said, sentiment toward many individual asset classes was somewhat less positive than it was in 2024's survey.

"Family offices globally remain highly focused on direct investing, as they seek exposure to the key transformative technologies of tomorrow and attractively valued companies across sectors," says Dawn Nordberg, Head of Integrated Client Engagement for Citi Wealth. "We have a specialist team that works alongside colleagues from Citi's world-class investment bank. Our mission is to enable our sophisticated family office clients to access proprietary private capital raises, asset divestitures and thought leadership across industries and geographies to support their direct investing."

When it comes to risks faced, 70% of respondents cited those related to investments, followed by operational (37%) and family-related risks (33%). But while many family offices reported strengthening risk management, approximately half of respondents acknowledged being underprepared to address cybersecurity, personal security and geopolitical risks. Resource constraints remain a significant challenge here.

"Our survey reveals ongoing professionalization among family offices, particularly in the investment function," explains Alexandre Monnier, Head of Global Family Office Advisory for Citi Wealth. "It also identifies areas where further development is crucial, such as risk management and talent acquisition for non-investment services. Our findings can help frame the discussion for those seeking to formalize their operations, prepare their family's future leaders and preserve and grow generational wealth."

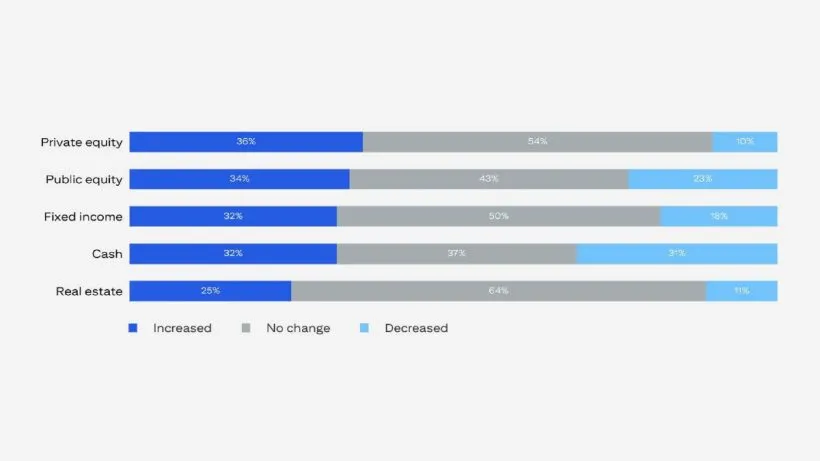

Executive summary Asset allocations largely held steady amid wait for greater policy clarityFamily offices largely maintained their asset allocations, making fewer shifts than last year. Half of respondents kept their fixed income holdings steady, and two thirds did so in real estate. Private equity saw the most notable bullish movement, with those increasing allocations outnumbering those decreasing by 26%.

Among the minority who altered their public equity and fixed income exposure, a net 11% and 14% made increases respectively, well down from last year's levels. Regionally, Asia Pacific made the greatest increases in public equity, with the Americas leading in private equity. Overall, though, ongoing trade and monetary policy uncertainty, geopolitical tensions and fiscal concerns may have kept many family offices in wait-and-see mode.

Positive outlook for portfolio returns despite tariff uncertaintyFamily offices expressed optimism about twelve-month portfolio returns. Possible drivers of this positive sentiment include potential US deregulation, interest rate cuts and advancements in artificial intelligence. A significant cohort (30%) anticipated returns between 10–15%, with an additional 8% expecting returns exceeding 15%.

Despite the optimism, there was little consensus as to which asset classes could potentially drive portfolio performance. Sentiment was neutral across all asset classes on a six- to twelve-month horizon. Even in private and public equity, neutral sentiment stood at 59%. It therefore seems likely that family offices believe their active selection of individual assets may drive portfolio returns, rather than broad asset class exposure.

Active management was the main response to the tariff-induced market volatilityAmid the market turmoil following the US tariffs announcement in April, nearly two thirds of family offices took action to boost portfolio resilience. Thirty-nine percent cited active management as their response. They allocated more to perceived defensive asset classes and geographies (25% and 15% respectively). Some 14% engaged in hedging strategies, while 13% shifted to perceived defensive sectors. During the period, we noticed family offices showing even greater interest in seeking analyses of their liquid and illiquid risk exposures across all their providers. These frequently inform hedging and active investment strategies.

Read the full report here.

About the Survey

This year's survey was initiated during Citi Wealth's tenth annual Family Office Leadership Summit in June 2025. The event was attended by over 150 family office leaders from more than 25 countries, with an average family net worth of $3.8 billion. The 56-question survey was subsequently opened to the wider population of family office clients globally.

About the Global Family Office Group

Citi Wealth's Global Family Office Group serves single family offices, private investment companies and private holding companies, including family-owned enterprises and foundations, around the world. The team offers clients comprehensive private banking and advisory services, institutional access to global opportunities and connections to a community of like-minded peers.

About Citi

Citi is a preeminent banking partner for institutions with cross-border needs, a global leader in wealth management and a valued personal bank in its home market of the United States. Citi does business in more than 180 countries and jurisdictions, providing corporations, governments, investors, institutions and individuals with a broad range of financial products and services.

Additional information may be found at | X: @Citi | LinkedIn: | YouTube: | Facebook:

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment