H-1B Fee Hike: How It Will Affect Indians, Companies And Remittances-In Charts

President Donald Trump signed an executive order on Friday that requires companies to pay $100,000 annually for every foreign worker brought under the H-1B visa, marking a 100-fold increase. This could deal a severe blow to aspirational Indians and companies that rely on Indian workers in the US.

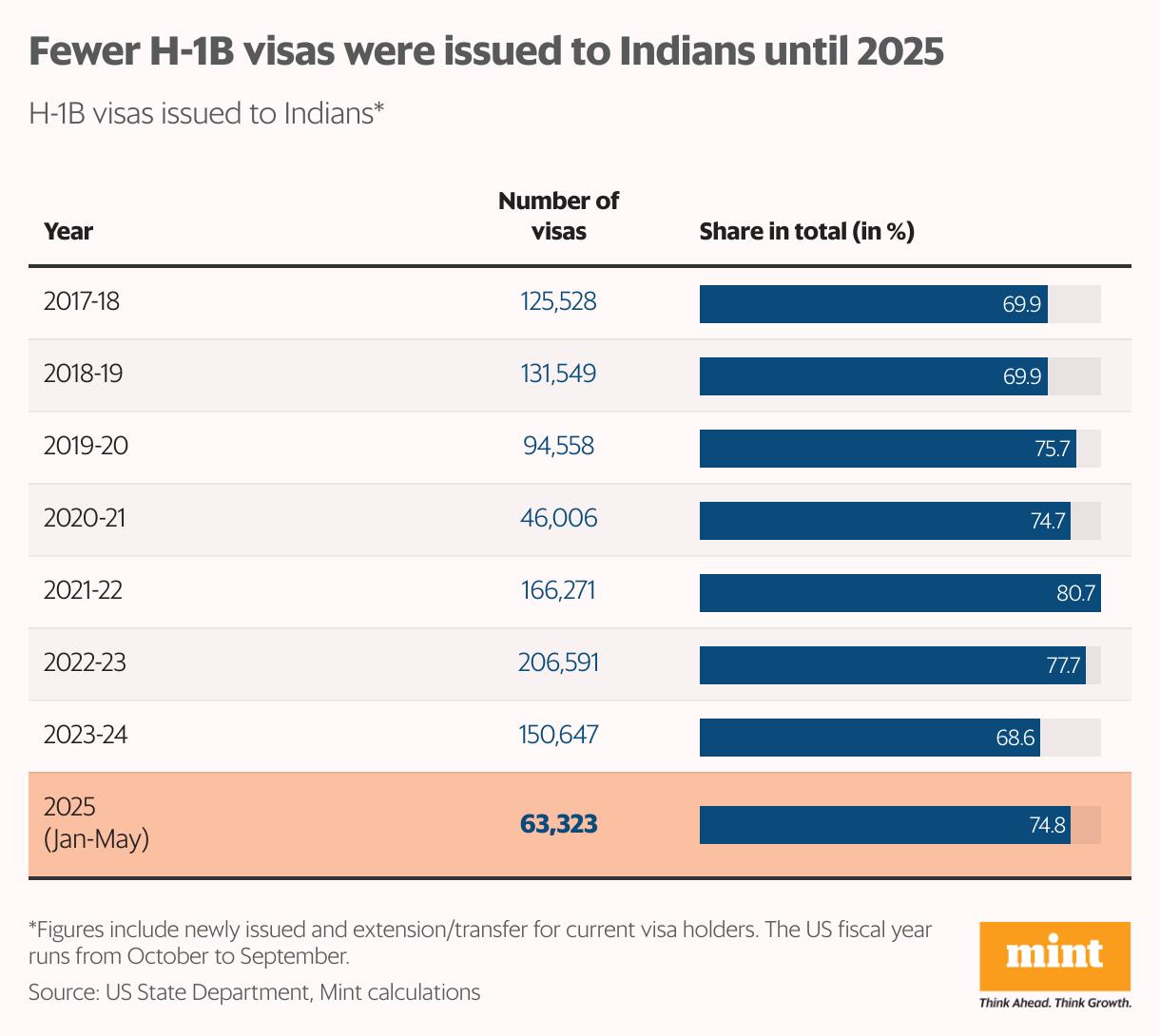

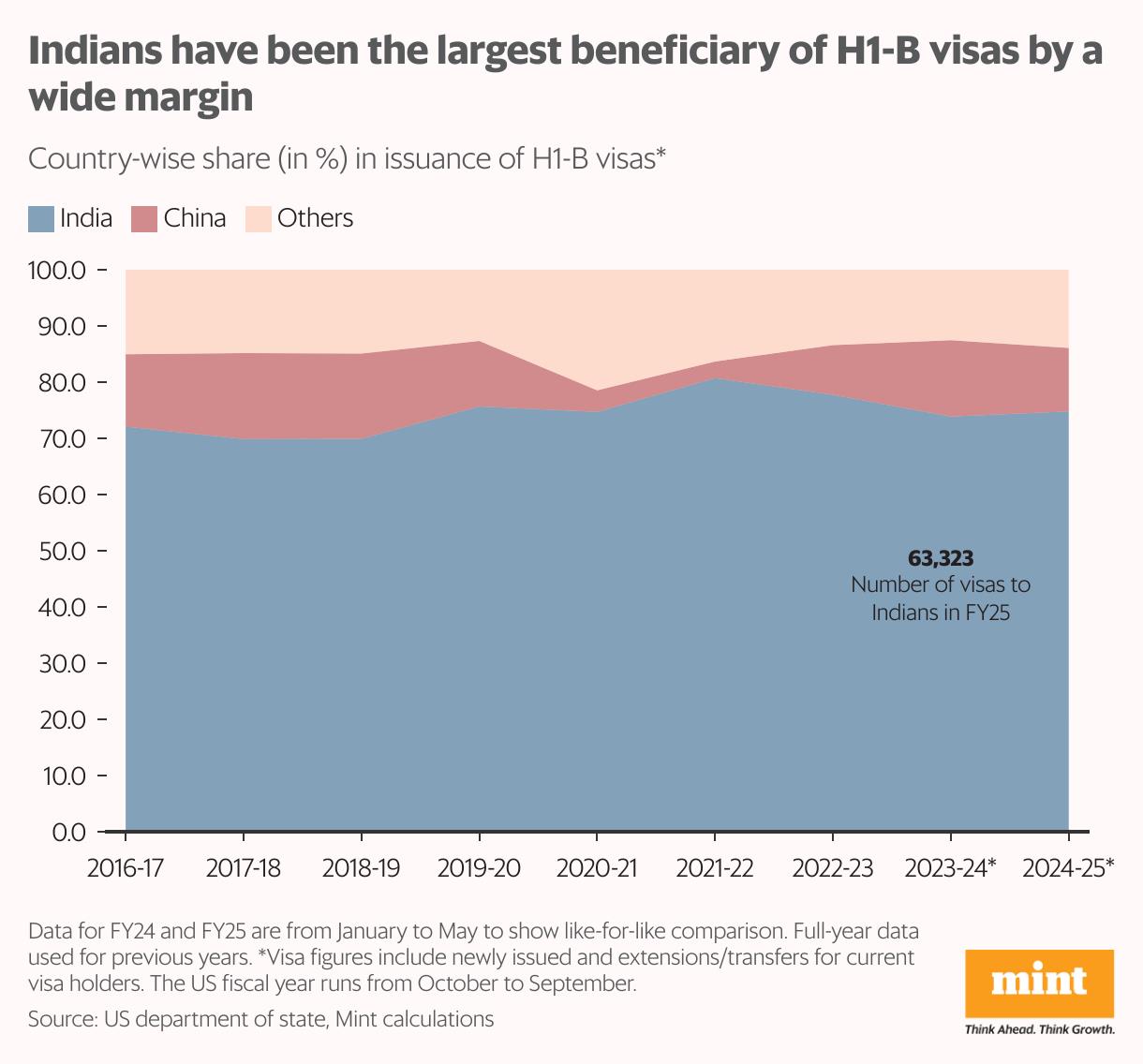

Indians are major beneficiaries of H-1B visas issues by the US government, making up about 70% of the total. Before the sudden and hefty fee hike, the number of H-1B visas issued to Indians had already fallen as the Trump administration tightened the rules, imposing a quota and putting a lottery system in place.

Data from the US State Department showed Indians were issued 63,323 H-1B work visas during January to May 2025, which is 11.1% fewer than the same period in 2024. The H-1B visa is a non-immigrant visa that allows US employers to employ foreign workers in specialised occupations temporarily.

Also Read | Trump's H-1B visa fee hike: the death of onsit

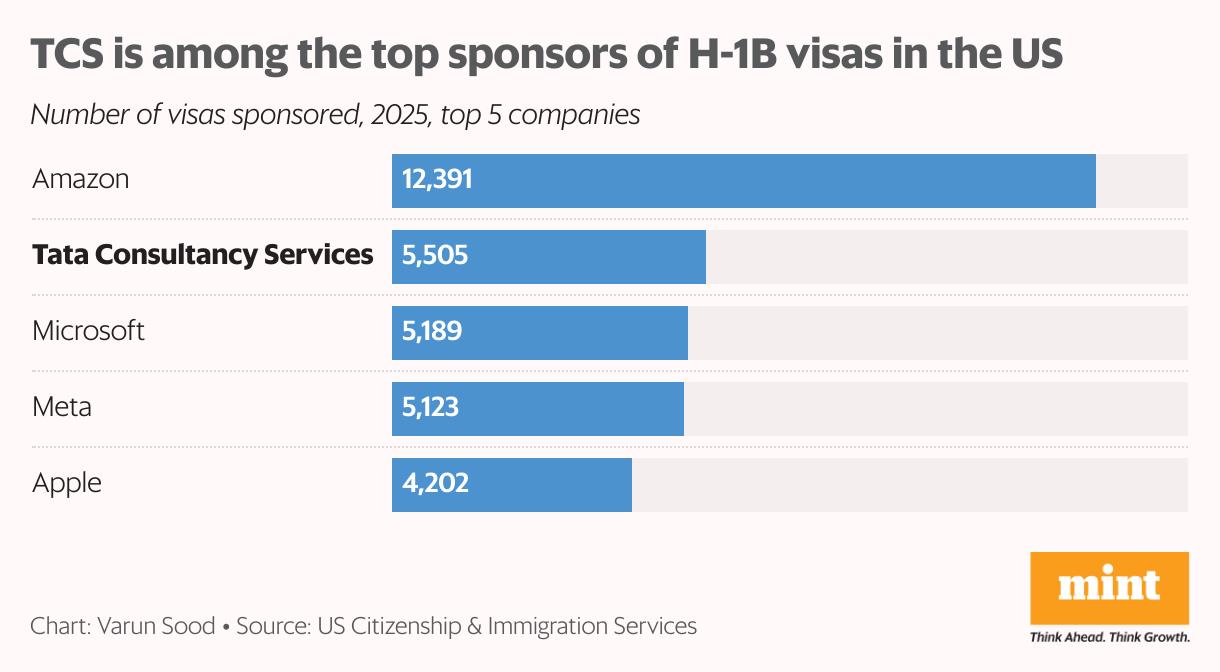

Over the decades, Indians have greatly benefited from the visa, especially in the technology sector. Tata Consultancy Services is among the biggest sponsors of H-1B visas. Several other IT giants including Infosys and HCLTech are also among the top sponsors.

According to a Mint analysis the revised H-1B visa fee would amount to about 10% of the FY25 profits of five companies-TCS, Cognizant, HCLTech, Infosys, and LTIMindtree-at the same level of issuance.

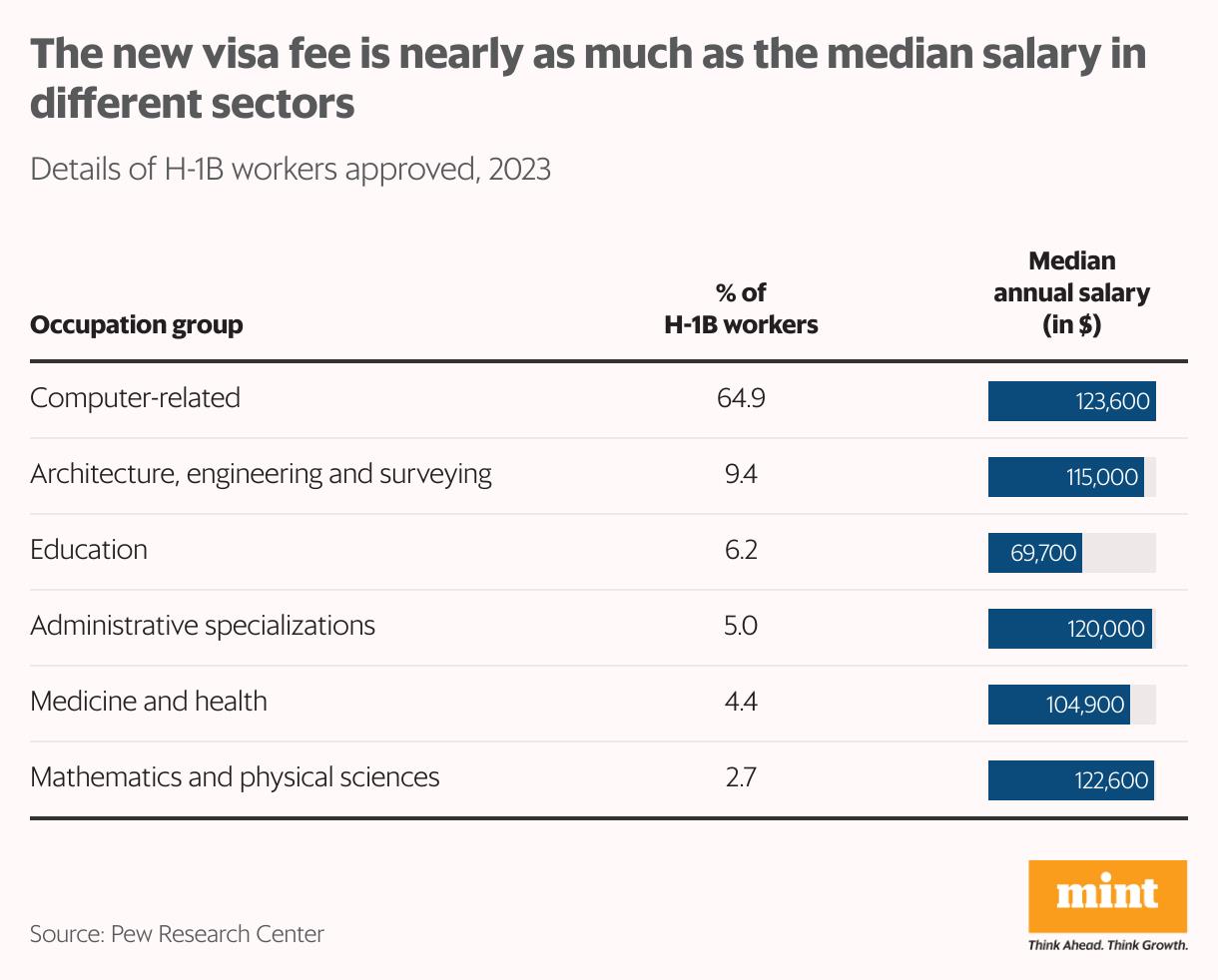

The massive revised fee is likely to be a strong deterrent for the companies as it is nearly as much as the median pay of H-1B workers and, in many sectors, even higher. An analysis by the Pew Research Center showed that 64% of H-1B visa approvals are for computer-related jobs, which have a median salary of $123,600 a year, only about 20% higher than the revised visa fee.

The latest move is part of Trump's 'Make America Great Again' plan, which aims to put American citizens and workers before the immigrants, even those who have migrated to the US legally. This is part of a broader anti-immigration sentiment that has gripped several countries including the US, the UK, and Australia.

Over the decades, millions of skilled and unskilled Indians have moved abroad in search of a better life and opportunities. An analysis by howindialives showed that about 6.5 million Indians live in Organisation for Economic Co-operation and Development (OECD) countries, with over half of them in the US.

Also Read | Beyond the visa: Why foreign universities are flocking to Gurugram and GIFT CitIndians now make up about 10% of the foreign-born population in countries such as Canada, Australia, and the UK. While many of these are imposing restrictions on migration, several of them, with an ageing population, also depend on migrants to fill gaps in their labour force.

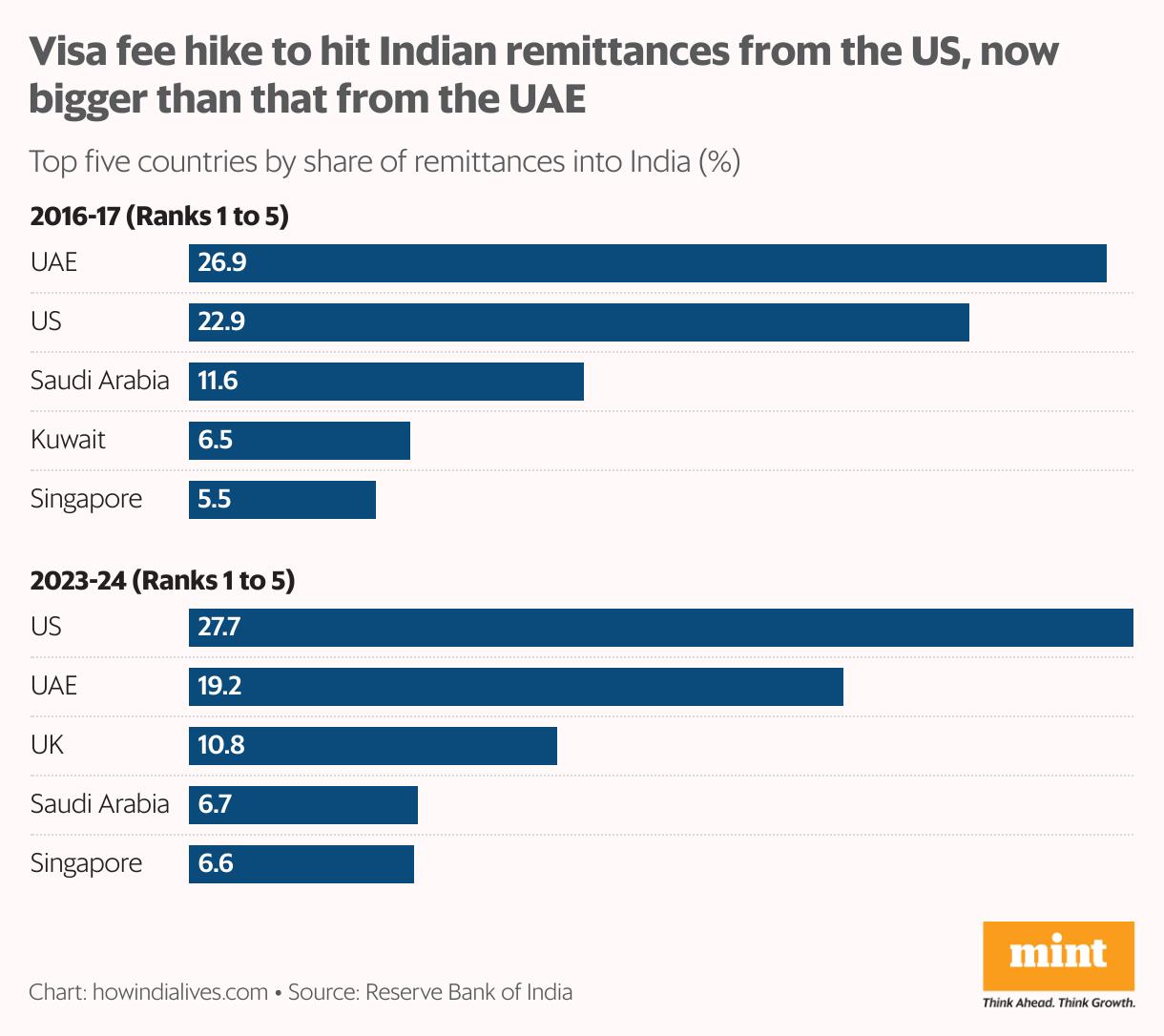

Moreover, the move by the Trump administration could also impact India's economy through the current account deficit. Higher inflow of remittances-the money migrants send back home-helps narrow the deficit and keep the country's external financial health in check. The US is currently the biggest source of inward remittances, accounting for about a quarter of the total.

The Trump administration has also proposed a 3.5% tax on foreign remittances by non-citizens in the US, which could further hit inward remittances to India. According to Reuters, companies such as Microsoft, JPMorgan, and Amazon have already responded to the announcement by advising employees holding H-1B visas to remain in the US to avoid the revised visa fees.

A significant number of American companies – including Amazon, Meta, Apple, and Walmart – also rely on migrant workers from countries such as India and China, and the latest move threatens to disrupt the operations of these firms as well.

Also Read | In charts: The great Indian American dream falters under Trum Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Motif AI Enters Phase Two Of Its Growth Cycle

- 1Inch Unlocks Access To Tokenized Rwas Via Swap API

- Kucoin Presents Kumining: Embodying Simple Mining, Smart Gains For Effortless Crypto Accumulation

- With Seal, Walrus Becomes The First Decentralized Data Platform With Access Controls

- Jpmorgan Product Head Joins GSR Trading MD To Build Institutional Staking Markets

- Innovation-Driven The5ers Selects Ctrader As Premier Platform For Advanced Traders

Comments

No comment