CNB Preview: Sailing In Neutral Gear With Stable Rates

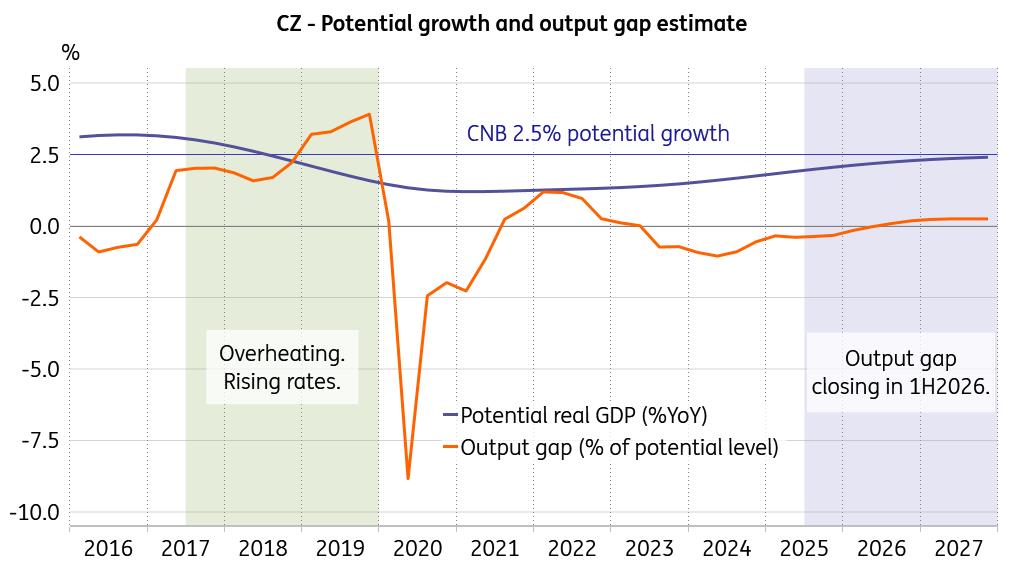

The Czech economy is gradually entering a fully-fledged rebound, supported by vibrant household spending, booming construction, and signs of stabilisation in industry. We forecast the economy to grow 2.5% in real terms this year and 2.6% next, which is broadly in line with the CNB's view. Against this backdrop, the currently negative output gap, which indicates that the economy is still operating slightly below its potential, is expected to close over the coming quarters and turn positive by mid-next year. An output gap near positive territory suggests that output is at levels when production factors like labour and capital are being fully utilised. Any further acceleration in output could exert broad pressure on input costs - namely wages and interest rates. Given the circumstances, we expect policymakers to keep the policy rate unchanged at 3.5% at their meeting next Thursday.

Output gap set to close in 1H26

Source: ING, Macrobond

And here we stand with annual wage dynamics of 7.8% in 2Q25. That reading is stronger than the 6.7% CNB summer forecast, which assumes a gradual deceleration of annual wage increases to below 5% in 2027 despite a continuous upturn in economic activity. We don't see it coming and believe that wage dynamics will likely surprise to the upside over the next two years, should the assumption of a booming economy hold. Indeed, the potential of a classical wage-price spiral represents one of the looming inflationary risks when looking ahead, warranting a restrictive monetary policy setup now. Meanwhile, as Deputy Governor Jan Frait puts it bluntly:“The current level of interest rates and the exchange rate are together having a neutral effect on the economy.” We could not emphasise more how much we appreciate this message, as it feels like the long-awaited return of forward guidance, the central banker's once-mighty tool that all but vanished on both sides of the Atlantic during the pandemic.

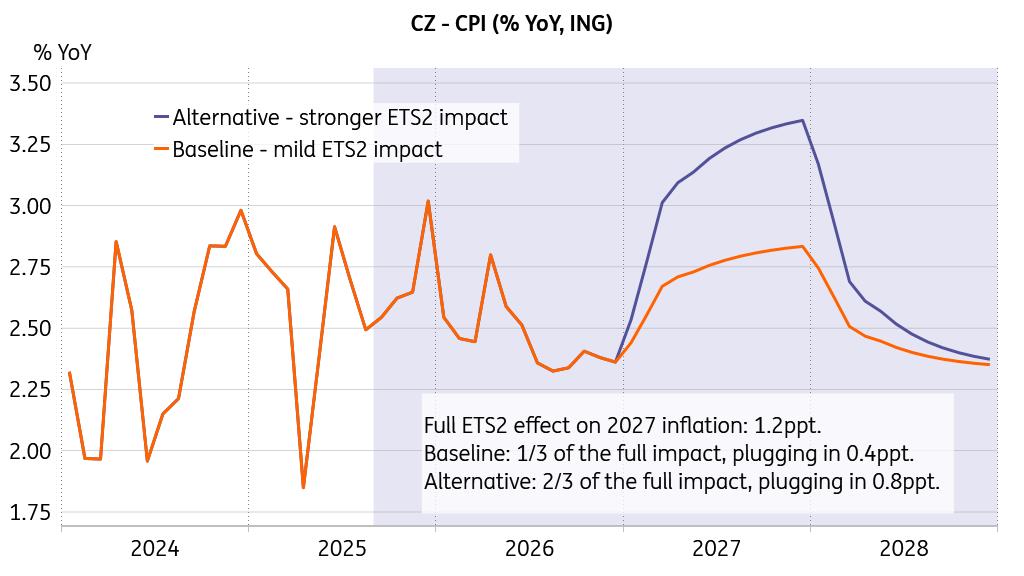

Upward risks to consumer prices on the horizonAs the economy is only expected to reach its full potential over the next year, conditions may appear calm for now. But that's a misleading impression – complacency is not a fitting stance for a forward-looking central banker. Especially as the emission allowances for households and small firms (ETS2) are set to be implemented at the onset of 2027, representing a substantial yet hard-to-quantify upward risk to consumer prices. There is a whole range of uncertainties linked to the implementation. For instance, about whether the government will go ahead with some countermeasures, such as a reduction in fuel duties or subsidies for low-income households on one end, and how the statistical office on the other end would measure the whole effect.

After a relaxed period, surprises may materialise soon enough

Source: CZSO, ING, Macrobond

We proceed with a rather low-impact baseline forecast of a 0.4ppt cumulative effect on consumer inflation in 2027. Yet, we also take seriously the more forceful impact of 0.8ppt that would take 2027 headline inflation to more than 3%. At the same time, there is a risk of some front-loading into 4Q26, which brings the entire episode closer than it might appear. In any event, it remains well within the CNB's monetary policy hot spot. The central bank would most likely exempt a significant portion of the primary impact - stemming from fuel and regulated prices - from its policy response, categorising it as tax effects. Nevertheless, secondary effects will emerge via food and core inflation.

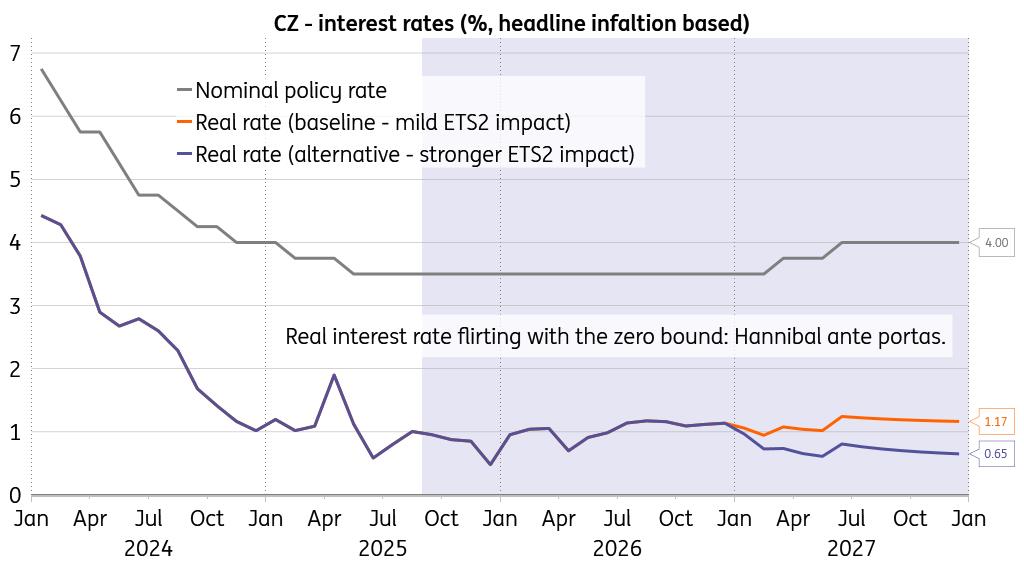

Stable rates do the job for nowAnd honestly, who could stay icy calm seeing inflation crossing the 3% upper bound threshold of the tolerance band over the first few months of the year and then see it creep up further? As the Governor Ales Michl stressed repeatedly, maintaining real interest rates in positive territory is crucial to maintaining a somewhat restrictive monetary policy stance. Well, that will likely be safeguarded by rate stability, and potentially some increases should economic expansion and wage dynamics become more potent than foreseen. We echo the view of board member Jakub Seidler:“That's why I prefer keeping interest rates at the current level now. That's based on balancing inflationary and anti-inflationary risks.”

Real interest rate set to remain positive

Source: CNB, ING, Macrobond

Add to that a booming housing market and resilient credit conditions still driving up house prices, still-elevated price growth in the service sector, and the likelihood of more expansionary fiscal policy following the upcoming election – and the conclusion is clear: rate cuts will not be discussed any further unless a major shock hits the global or eurozone economy.

We see rate stability as the optimal positioning in the current economic setup. That said, it is advisable to remain vigilant and be prepared to adjust the cost of capital should inflationary risks begin to materialise in unison. Given that 2027 is expected to be the year when the economy moves into full swing – likely operating above its potential – and with additional inflationary pressure from ETS2, we see early 2027 as the latest possible starting point for a new rate-hiking cycle.

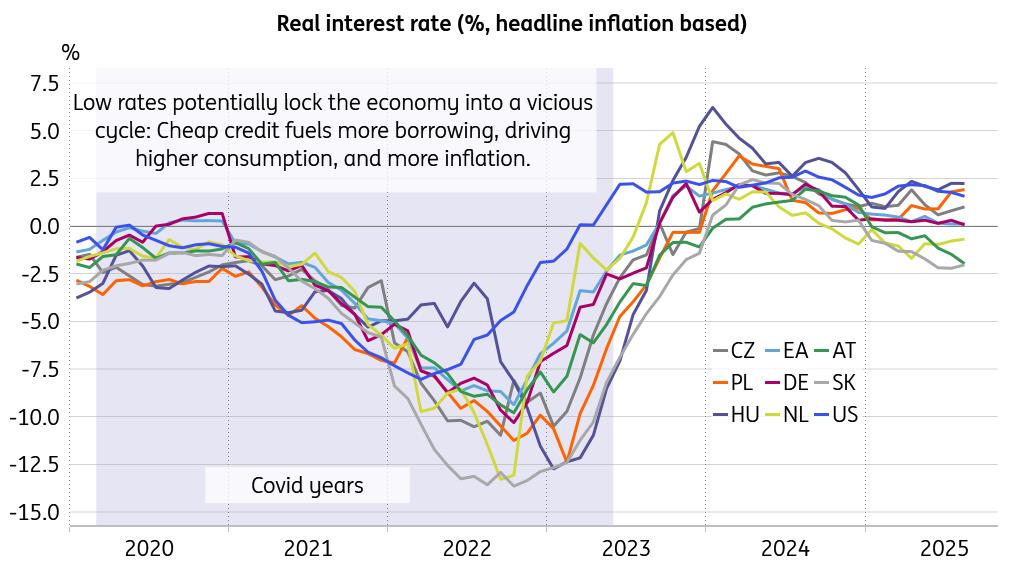

The maxim of positive real ratesStagnant or mediocre labour productivity gains have been plaguing European economies for an extended period of time. One part of the story is attributable to the structural growth hurdles, be it an absent energy strategy that ensures affordable energy prices for both households and industry, an increasingly dense regulatory spiderweb driving up costs relative to foreign competitors, or the inability to effectively protect the seemingly 'unified' market against unfair production and trade practices. However, we take the stance that the other part can be attributed to negative real interest rates, which do not incentivise the drive for improved efficiency, implementation of best practices, or innovation. On the contrary, negative real interest rates feed inefficient 'zombie' firms which block production factors, especially labour, from being reallocated to more productive and innovative sectors. They also risk encouraging fiscal irresponsibility.

The ones with positive real rates and the ones without

Source: Macrobond

We thought that central banks of advanced economies had learnt their lesson, especially as the seemingly endless reservoir of cheap labour in Asia is no longer fully available in light of the ongoing de-globalisation. And here we see a striking difference: most countries in the CEE region, such as Czechia, Poland, and Hungary maintain positive real interest rates. In contrast, the European Central Bank's real interest rate drifted to zero in August, and is negative for a range of eurozone economies, such as the Netherlands, Austria, and Slovakia.

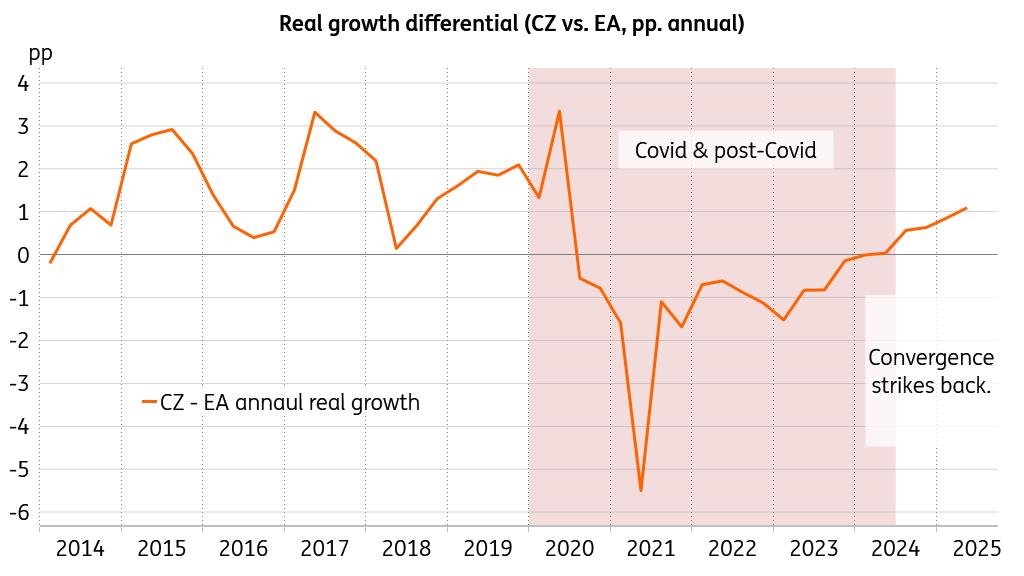

Real convergence contributes to stringent monetary policy

Source: Macrobond

Consequently, we expect the financial incentives for labour productivity gains in the CEE region to beat those in the eurozone. That said, we assume that the Czech economy will further outperform the eurozone economy in terms of real GDP growth and wage growth. At the same time, an economy in convergence mode deserves a tighter monetary policy setup, so we do not expect Czech nominal rates to follow any potential further cuts in the euro rate, should the ECB go ahead with compensating for structural growth barriers via subdued capital costs. We don't see the ECB factor as a deterrent to the CNB maintaining rate stability over the coming quarters.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Motif AI Enters Phase Two Of Its Growth Cycle

- 1Inch Unlocks Access To Tokenized Rwas Via Swap API

- Kucoin Presents Kumining: Embodying Simple Mining, Smart Gains For Effortless Crypto Accumulation

- With Seal, Walrus Becomes The First Decentralized Data Platform With Access Controls

- Jpmorgan Product Head Joins GSR Trading MD To Build Institutional Staking Markets

- Innovation-Driven The5ers Selects Ctrader As Premier Platform For Advanced Traders

Comments

No comment