403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

FOMC Recap: Powell Opens The Door-Just Not Wide Enough For Markets

(MENAFN- Mid-East Info) By Daniela Sabin Hathorn, senior market analyst at Capital

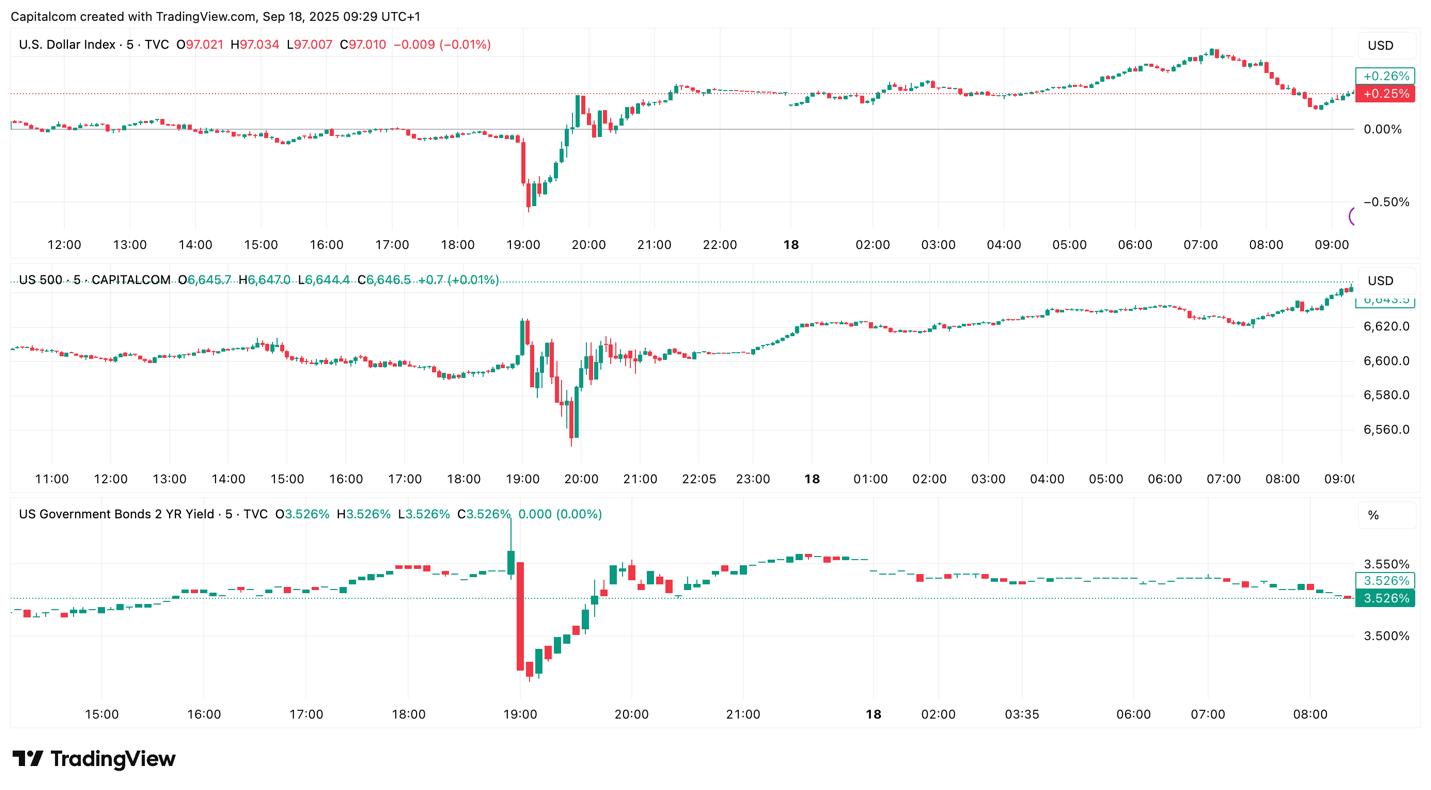

The Federal Reserve delivered the widely expected 25 bp cut, but the market's reaction told a more complicated story. Stocks and gold initially jumped before fading through Chair Powell's press conference, while the dollar and Treasury yields clawed back losses. One of the key takeaways from the night – and possibly what weighed on risk sentiment given how heavily dovish markets were positioned heading into the meeting – was the lack of dissenters in the vote split. Only one member – newly arrived Stephen Miran, who is thought to be a de facto representative of the White House – voted for a 50bps cut. Given the recent labour data, markets had priced in a small chance of a jumbo 50bps cut. The likelihood was small, but the odds were there. The lack of backing offers some important clues for the future. In July, both Christopher Waller and Michelle Bowman broke with the majority to push for a jumbo cut; last night neither pressed for 50. Both are rumoured to have a shot at Fed leadership once Powell's term is over next year, and they must have known that their chances would be heavily influenced by their decision to vote on a larger cut. Their lack of follow-through suggests the Committee has coalesced around a measured cadence rather than a front-loaded easing-despite the politics swirling around the Fed right now. It also lowers the probability of outsized moves near-term and helps explain why equities and gold popped then faded while the dollar and yields firmed during the presser: the path got a touch less dovish than positioning implied. Meanwhile, Powell's remarks confirmed a recalibration in emphasis from stubborn inflation toward safeguarding employment, but he kept the guidance strictly data dependent. With inflation still elevated, he offered no guarantees, framing policy as a meeting-by-meeting exercise. One of the key events for the evening was the updated dot plot, which in all honesty failed to provide much further insight. The shift has been towards lower rates, but it has been very modest, to the dismay of market participants. Traders continue to think that the FOMC will have to cut more than the dot plot implies, yet last night's meeting didn't validate the most dovish paths. US dollar index (DXY), S&P 500 and US 02 year yield 5 minute chart -p fetchpriority="high" decoding="async" class="CToWUd" src="#" width="624" height="345" data-bit="iit" /> Past performance is not a reliable indicator of future results. The labour outlook captured the Fed's balancing act. Policymakers are more alert to the risk that joblessness could rise, yet the median projection for the unemployment rate is now slightly lower than in June. In other words, vigilance has risen, but the baseline still assumes a broadly stable labour market rather than a sharp deterioration. From here, two signposts will shape the near-term debate. First, watch how quickly front-end OIS leans toward-or away from-two additional quarter-point cuts this year (if the labour data continues to wobble, the market will try to front-run a faster cadence again). Second, core PCE at month-end will test the Fed's room to proceed: a softer print buys time and supports a gradual path; a re-acceleration would validate the dots' caution and keep a lid on risk appetite.

The Federal Reserve delivered the widely expected 25 bp cut, but the market's reaction told a more complicated story. Stocks and gold initially jumped before fading through Chair Powell's press conference, while the dollar and Treasury yields clawed back losses. One of the key takeaways from the night – and possibly what weighed on risk sentiment given how heavily dovish markets were positioned heading into the meeting – was the lack of dissenters in the vote split. Only one member – newly arrived Stephen Miran, who is thought to be a de facto representative of the White House – voted for a 50bps cut. Given the recent labour data, markets had priced in a small chance of a jumbo 50bps cut. The likelihood was small, but the odds were there. The lack of backing offers some important clues for the future. In July, both Christopher Waller and Michelle Bowman broke with the majority to push for a jumbo cut; last night neither pressed for 50. Both are rumoured to have a shot at Fed leadership once Powell's term is over next year, and they must have known that their chances would be heavily influenced by their decision to vote on a larger cut. Their lack of follow-through suggests the Committee has coalesced around a measured cadence rather than a front-loaded easing-despite the politics swirling around the Fed right now. It also lowers the probability of outsized moves near-term and helps explain why equities and gold popped then faded while the dollar and yields firmed during the presser: the path got a touch less dovish than positioning implied. Meanwhile, Powell's remarks confirmed a recalibration in emphasis from stubborn inflation toward safeguarding employment, but he kept the guidance strictly data dependent. With inflation still elevated, he offered no guarantees, framing policy as a meeting-by-meeting exercise. One of the key events for the evening was the updated dot plot, which in all honesty failed to provide much further insight. The shift has been towards lower rates, but it has been very modest, to the dismay of market participants. Traders continue to think that the FOMC will have to cut more than the dot plot implies, yet last night's meeting didn't validate the most dovish paths. US dollar index (DXY), S&P 500 and US 02 year yield 5 minute chart -p fetchpriority="high" decoding="async" class="CToWUd" src="#" width="624" height="345" data-bit="iit" /> Past performance is not a reliable indicator of future results. The labour outlook captured the Fed's balancing act. Policymakers are more alert to the risk that joblessness could rise, yet the median projection for the unemployment rate is now slightly lower than in June. In other words, vigilance has risen, but the baseline still assumes a broadly stable labour market rather than a sharp deterioration. From here, two signposts will shape the near-term debate. First, watch how quickly front-end OIS leans toward-or away from-two additional quarter-point cuts this year (if the labour data continues to wobble, the market will try to front-run a faster cadence again). Second, core PCE at month-end will test the Fed's room to proceed: a softer print buys time and supports a gradual path; a re-acceleration would validate the dots' caution and keep a lid on risk appetite.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment