IAMGOLD 2025 Drill Program Extends Mineralization At Nelligan And Monster Lake

| Mineral Resources Statement - Nelligan Project As of December 31, 2024 | |||

| Classification | Tonnes (000s) | Grade (g/t Au) | Ounces (000s) |

| Total Indicated | 102,845 | 0.95 | 3,125 |

| Total Inferred | 166,395 | 0.96 | 5,161 |

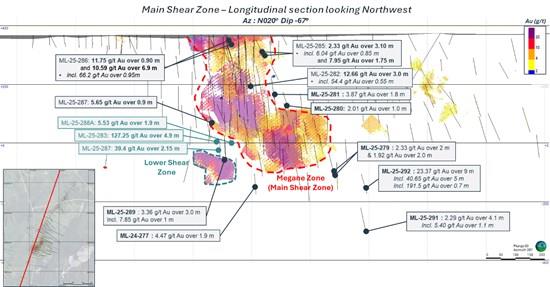

MONSTER LAKE DRILLING PROGRAM RESULTS

IAMGOLD is also reporting assay results from 16 diamond drill holes totaling 10,137.5 metres completed as part of the ongoing 2025 Monster Lake Resources Area drilling program. These drill holes were completed between December 2024 and early June 2025. This total includes 12 delineation holes completed around the resources block model and four deeper exploration holes testing the extension of the Megane and Lower Shear Zones. Few holes were recollared due to excessive deviation. Please refer to the longitudinal section for drill hole locations in Figure 3. In addition, the full assay results are provided in Table 2 at the end of this news release.

The 2025 Monster Lake diamond drilling program was designed to expand the mineralized zones in the lateral and depth extensions, with a few in-fill holes in selected areas where drill hole spacing left some untested gaps. The drilling program tested the Main Shear Zone that hosts the Megane Zone and the parallel structure to the Main Shear Zone and adjacent to the 325-Megane Zone, referred to as the Lower Shear Zone. All holes have intercepted both structures and occasionally secondary structures.

Next Steps

The drilling program will continue at depth and along strike in areas where drill hole spacing remains too wide. These areas will be progressively evaluated along the most prospective areas of the Monster Lake Shear Zones and its secondary associated structures.

The exploration field activities results are continuously compiled to refine the geological and structural model to help identify and prioritize various regional targets developed from targeting exercises to guide future drilling programs.

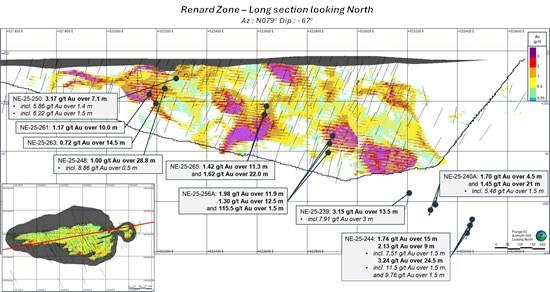

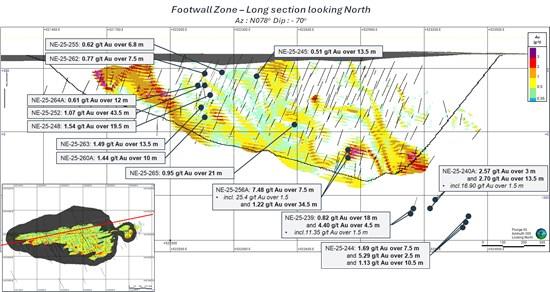

Figure 3 - Monster Lake Long Vertical Cross Section

To view an enhanced version of this graphic, please visit:

About the Monster Lake Project

Monster Lake, located 15 kilometres north of Nelligan, is a high-grade underground gold project with a focus on the Megane Zone. The project's high-grade nature and exploration upside make it a valuable complement to Nelligan in IAMGOLD's Canadian portfolio.

The Monster Lake Project is underlain by Archean volcanic rocks of the Obatogamau Formation, which are traversed by an important deformation corridor with associated gold-bearing mineralized structures and dyke swarms. Exploration to date has traced this prospective structural shear zone system for at least 4 kilometres along strike, along which several gold prospects have been discovered and a Mineral Resource delineated at the Megane Zone.

The gold zones observed at Monster Lake are typically of orogenic style with mineralization mostly associated with smokey quartz veins (grey to black) with free gold and sulphide minerals in the sheared wall rocks (pyrite, pyrrhotite, chalcopyrite and sphalerite).

As of December 31, 2024, estimated Mineral Resources at the Monster Lake Project were comprised of 239,000 tonnes of Indicated Resources grading 11.0 grams of gold per tonne for 84,200 ounces of contained gold and 1,053,000 tonnes of Inferred Resources grading 14.4 grams of gold per tonne for 488,500 ounces of contained gold for an underground mining scenario.

Underground Mineral Resources (at 4.1 g/t Au cut-off)

| Mineral Resources Statement - Monster Lake Project As of December 31, 2024 | |||

| Classification | Tonnes (t) | Grade (g/t Au) | Ounces (oz Troy Au) |

| Total Indicated | 239,000 | 11.0 | 84,200 |

| Total Inferred | 1,053,000 | 14.4 | 488,500 |

QUALIFIED PERSON AND TECHNICAL INFORMATION

The drilling results contained in this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101").

The qualified persons ("QPs") responsible for the planning, supervision and execution of the diamond drilling programs and construction of the geological models and review of the technical information in this news release are Shana Dickenson, P. Geo., Senior District Geologist, Adrien Zamparutti, P. Geo., Senior Geologist, and Maxime Douëllou, P. Geo., Senior Project Geologist. Each of Ms. Dickenson, Mr. Zamparutti and Mr. Douëllou is a QP for the purposes of NI 43-101 with respect to the technical information being reported on in this news release. The technical information has been included herein with the consent and prior review of the above noted QPs.

The information in the news release was also reviewed and approved by Marie-France Bugnon, P.Geo. Vice-President, Exploration for IAMGOLD, who is also a QP.

The design of the drilling programs and interpretation of results is under the control of IAMGOLD's geological staff, including QPs employing strict protocols consistent with NI 43-101 and industry best practices. The sampling of, and assay data from, the drill core is monitored through the implementation of a quality assurance - quality control (QA-QC) program. Drill core (NQ size) is logged and samples are selected by the IAMGOLD geologists and sawn in half with a diamond saw at the project site. Half of the core is retained at the site for reference purposes. Sample intervals may vary from 0.5 to 1.5 metres in length depending on the geological observations. Half-core samples are packaged and transported in sealed bags to ALS Minerals Laboratory ("ALS") located in Val-d'Or, Québec. A formal chain-of-custody procedure was adopted for security of samples until their delivery at the laboratory. Samples are coarse crushed to a -10 mesh and then a 1,000 gram split is pulverized to 95% passing -150 mesh. ALS processes analytical pulps directly at their facilities located in Val-d'Or which is ISO / IEC 17025 certified by the Standards Council of Canada. Samples are analyzed using a standard fire assay with a 50 gram charge with an Atomic Absorption (AA) finish. For samples that return assay values over 5.0 grams per tonne, another pulp is taken and fire assayed with a gravimetric finish. Core samples showing visible gold or samples which have returned values greater than 10.0 grams per tonne are re-analyzed by pulp metallic analysis. IAMGOLD inserts blanks and certified reference standards in the sample sequence for quality control. In accordance with recommendations from our on-going QA-QC program, additional check analyses are underway at a secondary (umpire) laboratory.

About IAMGOLD

IAMGOLD is an intermediate gold producer and developer based in Canada with operating mines in North America and West Africa, including Côté Gold (Canada), Westwood (Canada) and Essakane (Burkina Faso). The Côté Gold Mine achieved full nameplate in June 2025 and has the potential to be among the largest gold mines in Canada. IAMGOLD operates Côté in partnership with Sumitomo Metal Mining Co. Ltd. In addition, the Company has an established portfolio of early stage and advanced exploration projects within high potential mining districts. IAMGOLD employs approximately 3,700 people and is committed to maintaining its culture of accountable mining through high standards of Environmental, Social and Governance practices. IAMGOLD is listed on the New York Stock Exchange (NYSE: IAG) and the Toronto Stock Exchange (TSX: IMG).

IAMGOLD Contact Information

Graeme Jennings, Vice President, Investor Relations

Tel: 416 360 4743 | Mobile: 416 388 6883

Toll-free: 1 888 464 9999

...

Table 1. Nelligan Project Drilling Results - 2025 Drilling program

| Hole No. | UTM NAD83 Zone18 | AZ | Dip | Dep | From | To | Interval | True Width (1) | Au (2) (3) | NOTE | ||

| | Easting | Northing | Elevation | (°) | (°) | (m) | (m) | (m) | (m) | (m) | (g/t) | |

| Nelligan Resources Area - Depth Exploration | ||||||||||||

| NE-25-239 | 523352.00 | 5473553.00 | 370.00 | 336 | -65 | 1044 | 9.00 | 20.30 | 11.30 | 8.04 | 0.64 | DAN ZONE |

| | | | | | | | 47.95 | 53.60 | 5.65 | 4.06 | 1.22 | |

| | | | | | | | 63.00 | 75.00 | 12.00 | 8.51 | 1.73 | |

| | | | | | | | 200.40 | 226.05 | 25.65 | 18.19 | 0.94 | LIAM ZONE |

| | | | | | | | 330.00 | 350.60 | 20.60 | 15.25 | 1.93 | ZONE 36 |

| | | | | | | | 437.50 | 451.50 | 14.00 | 10.74 | 0.87 | |

| | | | | | | | 471.30 | 476.00 | 4.70 | 3.64 | 1.24 | |

| | | | | | | | 513.00 | 520.50 | 7.50 | 5.97 | 1.39 | |

| | | | | | | | 559.50 | 573.00 | 13.50 | 10.89 | 2.17 | |

| Including | | | | | | | 565.50 | 567.00 | 1.50 | 1.21 | 6.62 | |

| | | | | | | | 589.50 | 604.50 | 15.00 | 12.16 | 0.94 | |

| | | | | | | | 616.50 | 630.00 | 13.50 | 10.98 | 3.15 | RENARD ZONE |

| Including | | | | | | | 621.00 | 627.00 | 6.00 | 4.88 | 7.91 | |

| | | | | | | | 724.50 | 732.00 | 7.50 | 6.27 | 1.75 | FOOTWALL ZONE |

| | | | | | | | 741.00 | 744.00 | 3.00 | 2.51 | 2.79 | |

| | | | | | | | 877.50 | 885.00 | 7.50 | 6.83 | 0.68 | |

| | | | | | | | 895.50 | 913.50 | 18.00 | 16.64 | 0.82 | |

| | | | | | | | 918.00 | 922.50 | 4.50 | 4.20 | 4.40 | |

| Including | | | | | | | 921.00 | 922.50 | 1.50 | 1.40 | 11.35 | |

| NE-25-240 | 523553.00 | 5473472.00 | 374.00 | 324 | -60 | 33 | Abandoned due to excessive deviation & No significant results | |||||

| NE-25-240A | 523553.00 | 5473472.00 | 374.00 | 324 | -60 | 1169 | 140.10 | 152.50 | 12.40 | 9.65 | 2.03 | DAN ZONE |

| | | | | | | | 170.80 | 176.75 | 5.95 | 4.66 | 0.85 | |

| | | | | | | | 181.20 | 183.40 | 2.20 | 1.73 | 9.23 | |

| Including | | | | | | | 181.20 | 182.10 | 0.90 | 0.71 | 21.60 | |

| | | | | | | | 243.80 | 253.70 | 9.90 | 7.11 | 0.55 | LIAM ZONE |

| | | | | | | | 290.00 | 292.20 | 2.20 | 1.58 | 2.40 | |

| | | | | | | | 361.70 | 375.60 | 13.90 | 10.35 | 0.55 | |

| | | | | | | | 441.00 | 447.00 | 6.00 | 4.64 | 1.23 | |

| | | | | | | | 615.00 | 622.50 | 7.50 | 6.52 | 0.68 | ZONE 36 |

| | | | | | | | 637.50 | 655.50 | 18.00 | 15.77 | 0.50 | |

| | | | | | | | 685.20 | 699.00 | 13.80 | 12.21 | 0.69 | |

| | | | | | | | 712.50 | 717.00 | 4.50 | 3.99 | 1.70 | RENARD ZONE |

| | | | | | | | 732.00 | 753.00 | 21.00 | 18.80 | 1.45 | |

| Including | | | | | | | 748.50 | 750.00 | 1.50 | 1.34 | 5.48 | |

| | | | | | | | 783.00 | 796.50 | 13.50 | 12.25 | 0.88 | FOOTWALL ZONE |

| | | | | | | | 802.50 | 814.50 | 12.00 | 10.95 | 0.66 | |

| | | | | | | | 819.60 | 825.00 | 5.40 | 4.94 | 2.69 | |

| | | | | | | | 849.00 | 856.50 | 7.50 | 6.97 | 1.22 | |

| | | | | | | | 910.50 | 913.50 | 3.00 | 2.84 | 2.57 | |

| | | | | | | | 979.50 | 993.00 | 13.50 | 13.15 | 2.70 | |

| Including | | | | | | | 981.00 | 982.50 | 1.50 | 1.46 | 16.90 | |

| | | | | | | | 1026.00 | 1036.50 | 10.50 | 10.40 | 1.05 | |

| NE-25-244 | 523695.00 | 5473416.00 | 377.00 | 328 | -59 | 1239 | 244.50 | 251.00 | 6.50 | 5.23 | 2.03 | DAN ZONE |

| | | | | | | | 310.00 | 313.00 | 3.00 | 2.19 | 1.71 | LIAM ZONE |

| | | | | | | | 343.50 | 352.50 | 9.00 | 6.61 | 2.01 | |

| | | | | | | | 521.50 | 538.50 | 17.00 | 12.97 | 0.62 | |

| | | | | | | | 574.70 | 585.00 | 10.30 | 8.09 | 0.52 | |

| | | | | | | | 682.00 | 689.50 | 7.50 | 6.34 | 4.28 | ZONE 36 |

| Including | | | | | | | 686.50 | 688.00 | 1.50 | 1.27 | 18.10 | |

| | | | | | | | 797.00 | 812.00 | 15.00 | 12.88 | 1.74 | RENARD ZONE |

| Including | | | | | | | 803.45 | 808.25 | 4.80 | 4.12 | 3.03 | |

| | | | | | | | 824.00 | 833.00 | 9.00 | 7.74 | 1.04 | |

| | | | | | | | 837.50 | 846.50 | 9.00 | 7.75 | 2.13 | |

| Including | | | | | | | 837.50 | 839.00 | 1.50 | 1.29 | 7.51 | |

| | | | | | | | 851.00 | 875.50 | 24.50 | 21.20 | 3.24 | |

| Including | | | | | | | 857.00 | 858.50 | 1.50 | 1.30 | 11.50 | |

| Including | | | | | | | 861.50 | 863.00 | 1.50 | 1.30 | 9.76 | |

| Including | | | | | | | 874.50 | 875.50 | 1.00 | 0.89 | 21.50 | |

| | | | | | | | 905.50 | 926.50 | 21.00 | 18.72 | 2.23 | FOOTWALL ZONE |

| Including | | | | | | | 923.50 | 925.00 | 1.50 | 1.34 | 13.05 | |

| | | | | | | | 991.50 | 999.00 | 7.50 | 7.11 | 1.69 | |

| | | | | | | | 1007.00 | 1009.50 | 2.50 | 2.38 | 5.29 | |

| | | | | | | | 1023.00 | 1033.50 | 10.50 | 10.03 | 1.05 | |

| | | | | | | | 1069.50 | 1080.00 | 10.50 | 10.16 | 1.13 | |

| | | | | | | | 1093.50 | 1102.50 | 9.00 | 8.77 | 0.88 | |

| Nelligan Resources Area - Infill drilling | ||||||||||||

| NE-25-241 | 522342.15 | 5474027.97 | 369.00 | 330 | -50 | 150 | No significant results | |||||

| NE-25-242 | 522394.46 | 5474005.95 | 369.00 | 332 | -50 | 135 | No significant results | |||||

| NE-25-243 | 522471.74 | 5474006.17 | 369.00 | 332 | 50 | 174 | No significant results | |||||

| NE-25-245 | 522449.19 | 5473952.01 | 369.00 | 332 | 50 | 303 | 63.00 | 74.70 | 11.70 | 9.83 | 0.63 | RENARD ZONE |

| | | | | | | | 139.50 | 153.00 | 13.50 | 11.34 | 0.51 | FOOTWALL ZONE |

| NE-25-246 | 522388.00 | 5473968.00 | 369.00 | 332 | -50 | 180 | No significant results | |||||

| NE-25-247 | 522334.00 | 5473965.00 | 369.00 | 332 | 50 | 183 | No significant results | |||||

| NE-25-248 | 522274.00 | 5473779.00 | 369.00 | 332 | 52 | 450 | 148.20 | 177.00 | 28.80 | 24.62 | 1.00 | RENARD ZONE |

| Including | | | | | | | 163.80 | 164.30 | 0.50 | 0.43 | 8.86 | |

| | | | | | | | 219.00 | 240.00 | 21.00 | 18.33 | 1.37 | FOOTWALL ZONE |

| Including | | | | | | | 223.50 | 225.00 | 1.50 | 1.31 | 6.71 | |

| | | | | | | | 252.00 | 271.50 | 19.50 | 17.17 | 1.54 | |

| | | | | | | | 323.70 | 339.50 | 15.80 | 14.49 | 0.79 | |

| NE-25-249 | 522291.62 | 5473987.23 | 369.00 | 332 | 50 | 156 | No significant results | |||||

| NE-25-250 | 522309.05 | 5473814.34 | 369.00 | 332 | -50 | 360 | 97.00 | 106.00 | 9.00 | 7.85 | 1.10 | RENARD ZONE |

| | | | | | | | 110.40 | 117.50 | 7.10 | 6.21 | 3.17 | |

| Including | | | | | | | 111.60 | 113.00 | 1.40 | 1.22 | 5.86 | |

| Including | | | | | | | 114.50 | 116.00 | 1.50 | 1.31 | 6.22 | |

| | | | | | | | 162.70 | 172.50 | 9.80 | 8.68 | 0.79 | FOOTWALL ZONE |

| | | | | | | | 178.50 | 184.50 | 6.00 | 5.35 | 0.99 | |

| | | | | | | | 190.50 | 201.80 | 11.05 | 10.14 | 0.69 | |

| | | | | | | | 261.00 | 265.50 | 4.50 | 4.18 | 1.63 | |

| | | | | | | | 274.00 | 282.00 | 8.00 | 7.51 | 0.63 | |

| | | | | | | | 304.50 | 306.00 | 1.50 | 1.43 | 4.62 | |

| NE-25-251 | 522240.06 | 5473959.50 | 369.00 | 332 | -50 | 191 | No significant results | |||||

| NE-25-252 | 522228.59 | 5473816.68 | 369.00 | 332 | -50 | 399 | 162.00 | 205.50 | 43.50 | 38.77 | 1.07 | FOOTWALL ZONE |

| Including | | | | | | | 199.50 | 201.00 | 1.50 | 1.34 | 6.06 | |

| NE-25-253 | 522214.95 | 5473910.01 | 369.00 | 322 | -48 | 270 | 65.50 | 85.50 | 20.00 | 16.66 | 1.25 | FOOTWALL ZONE |

| Including | | | | | | | 81.00 | 82.50 | 1.50 | 1.26 | 6.46 | |

| NE-25-254 | 522274.93 | 5473848.19 | 369.00 | 332 | -50 | 330 | 83.00 | 89.00 | 6.00 | 5.20 | 1.44 | RENARD ZONE |

| | | | | | | | 123.90 | 137.40 | 13.50 | 11.85 | 0.61 | FOOTWALL ZONE |

| | | | | | | | 141.90 | 157.90 | 16.00 | 14.14 | 0.95 | |

| | | | | | | | 201.40 | 202.90 | 1.50 | 1.36 | 5.40 | |

| | | | | | | | 266.40 | 269.10 | 2.70 | 2.51 | 17.45 | |

| Including | | | | | | | 266.40 | 267.90 | 1.50 | 1.39 | 31.00 | |

| NE-25-255 | 522284.20 | 5473934.70 | 369.00 | 332 | -50 | 240 | No significant results | |||||

| NE-25-256 | 523034.62 | 5473643.58 | 379.43 | 328 | -58 | 45 | Abandoned due to excessive deviation & no significant results | |||||

| NE-25-256A | 523034.62 | 5473643.58 | 379.43 | 328 | -58 | 822 | 120.00 | 129.00 | 9.00 | 7.24 | 1.18 | ZONE 36 |

| | | | | | | | 134.00 | 165.00 | 31.00 | 25.00 | 0.97 | |

| | | | | | | | 177.00 | 225.50 | 48.50 | 39.38 | 1.32 | |

| Including | | | | | | | 192.00 | 194.80 | 2.80 | 2.27 | 6.47 | |

| | | | | | | | 265.00 | 279.30 | 14.30 | 11.77 | 1.24 | |

| | | | | | | | 292.00 | 326.00 | 34.00 | 28.10 | 1.13 | |

| | | | | | | | 398.60 | 410.50 | 11.90 | 10.01 | 1.98 | RENARD ZONE |

| Including | | | | | | | 406.00 | 407.50 | 1.50 | 1.26 | 6.37 | |

| | | | | | | | 434.50 | 447.00 | 12.50 | 10.62 | 1.30 | |

| | | | | | | | 486.50 | 488.00 | 1.50 | 1.27 | 115.50 | |

| | | | | | | | 488.00 | 492.00 | 4.00 | 3.40 | 1.19 | |

| | | | | | | | 522.00 | 531.00 | 9.00 | 7.86 | 2.92 | FOOTWALL ZONE |

| Including | | | | | | | 529.50 | 531.00 | 1.50 | 1.31 | 11.20 | |

| | | | | | | | 592.50 | 600.00 | 7.50 | 7.11 | 2.92 | |

| | | | | | | | 633.00 | 640.50 | 7.50 | 6.76 | 7.48 | |

| Including | | | | | | | 634.50 | 636.00 | 1.50 | 1.35 | 25.40 | |

| | | | | | | | 670.50 | 705.00 | 34.50 | 31.86 | 1.22 | |

| NE-25-257 | 522250.21 | 5473887.74 | 369.00 | 332 | -50 | 288 | 78.00 | 91.50 | 13.50 | 11.58 | 1.00 | FOOTWALL ZONE |

| | | | | | | | 96.00 | 107.00 | 11.00 | 9.51 | 1.13 | |

| | | | | | | | 214.50 | 216.00 | 1.50 | 1.37 | 5.96 | |

| NE-25-258 | 522345.64 | 5473918.90 | 369.00 | 332 | -50 | 264 | 66.50 | 77.00 | 10.50 | 8.88 | 1.00 | FOOTWALL ZONE |

| | | | | | | | 87.50 | 94.80 | 7.30 | 6.28 | 1.24 | |

| NE-25-259 | 522310.29 | 5473883.55 | 369.00 | 332 | -50 | 300 | 68.50 | 76.50 | 8.00 | 6.76 | 3.29 | RENARD ZONE |

| Including | | | | | | | 70.00 | 71.50 | 1.50 | 1.27 | 12.50 | |

| | | | | | | | 115.50 | 132.00 | 16.50 | 14.58 | 0.73 | FOOTWALL ZONE |

| NE-25-260 | 522291.87 | 5473718.27 | 369.00 | 332 | -52 | 177 | Abandoned due to excessive deviation & No significant results | |||||

| NE-25-260A | 522291.87 | 5473718.27 | 369.00 | 332 | -52 | 501 | 202.50 | 208.50 | 6.00 | 5.33 | 2.46 | RENARD ZONE |

| | | | | | | | 260.00 | 270.50 | 10.50 | 9.51 | 0.64 | FOOTWALL ZONE |

| | | | | | | | 283.40 | 287.20 | 3.80 | 3.47 | 1.30 | |

| | | | | | | | 296.00 | 309.00 | 13.00 | 11.87 | 0.88 | |

| | | | | | | | 316.50 | 328.10 | 11.60 | 10.70 | 1.07 | |

| | | | | | | | 393.00 | 403.50 | 10.50 | 9.69 | 1.37 | |

| NE-25-261 | 522233.70 | 5473749.45 | 369.00 | 332 | -50 | 480 | 174.00 | 184.00 | 10.00 | 8.64 | 1.17 | RENARD ZONE |

| | | | | | | | 297.00 | 307.50 | 10.50 | 9.31 | 0.93 | FOOTWALL ZONE |

| | | | | | | | 346.50 | 355.50 | 9.00 | 8.10 | 0.86 | |

| NE-25-262 | 522214.22 | 5473944.76 | 369.00 | 324 | -48 | 192 | 109.50 | 117.00 | 7.50 | 6.94 | 0.77 | FOOTWALL ZONE |

| NE-25-263 | 522273.68 | 5473728.54 | 369.00 | 323 | -54 | 513 | 216.00 | 230.50 | 14.50 | 12.04 | 0.72 | RENARD ZONE |

| | | | | | | | 267.00 | 277.50 | 10.50 | 8.91 | 0.98 | FOOTWALL ZONE |

| | | | | | | | 340.50 | 354.00 | 13.50 | 11.46 | 1.49 | |

| | | | | | | | 414.00 | 424.50 | 10.50 | 9.43 | 1.22 | |

| NE-25-264 | 522215.44 | 5473861.28 | 369.00 | 325 | -47 | 90 | Abandoned due to excessive deviation & No significant results | |||||

| NE-25-264A | 522215.44 | 5473861.28 | 369.00 | 325 | -47 | 297 | 114.00 | 135.00 | 21.00 | 18.50 | 0.97 | FOOTWALL ZONE |

| | | | | | | | 148.50 | 152.90 | 4.40 | 3.93 | 1.53 | |

| | | | | | | | 181.50 | 187.50 | 6.00 | 5.45 | 1.50 | |

| | | | | | | | 216.00 | 228.00 | 12.00 | 11.06 | 0.61 | |

| NE-25-265 | 522728.00 | 5473719.00 | 380.00 | 324 | -55 | 608 | 46.50 | 52.50 | 5.15 | 4.81 | 2.41 | ZONE 36 |

| | | | | | | | 58.70 | 95.50 | 36.45 | 29.60 | 3.03 | |

| Including | | | | | | | 80.50 | 82.00 | 1.50 | 1.22 | 10.10 | |

| | | | | | | | 262.50 | 273.80 | 11.30 | 9.73 | 1.42 | RENARD ZONE |

| | | | | | | | 290.00 | 312.00 | 22.00 | 19.06 | 1.62 | |

| | | | | | | | 316.50 | 334.50 | 18.00 | 15.63 | 0.75 | |

| | | | | | | | 366.00 | 378.00 | 12.00 | 10.58 | 0.95 | FOOTWALL ZONE |

| | | | | | | | 447.00 | 468.00 | 21.00 | 19.32 | 0.95 | |

Notes:

1. True widths are estimated at 70 to 98% of the core interval.

2. Drill hole intercepts are calculated with a lower cut of 0.50 g/t Au and may contain lower grade interval of up to 5 metres in length. They are generally reported with a minimum g*m (or Metal factor) of 5.

3. Assays intervals are reported uncapped and high grade sub-intervals are highlighted.

Table 2. Monster Lake Project Drilling Results - 2024 - 2025 Drilling program

| Hole No. | UTM NAD83 Zone18 | AZ | Dip | Depth | From | To | Interval | True Width (1) | Au (2) (3) | NOTE | ||

| | Easting | Northing | Elevation | (°) | (°) | (m) | (m) | (m) | (m) | (m) | (g/t) | |

| ML-24-277 | 520457.60 | 5488211.90 | 372.50 | 290 | -52 | 838 | 653.60 | 655.50 | 1.90 | 1.84 | 4.47 | Main Shear Zone |

| ML-25-278 | 520320.10 | 5488320.50 | 373.40 | 315 | -61 | 36 | Abandoned due to excessive deviation | |||||

| ML-25-278A | 520320.10 | 5488320.50 | 373.40 | 315 | -61 | 771 | No significant results | |||||

| ML-25-279 | 520342.90 | 5488446.90 | 373.40 | 312 | -60 | 798 | 538.25 | 540.25 | 2.00 | 1.93 | 2.33 | Main Shear Zone |

| | | | | | | | 545.25 | 547.25 | 2.00 | 1.93 | 1.92 | Main Shear Zone |

| | | | | | | | 730.60 | 731.60 | 1.00 | 0.97 | 3.99 | Annie Shear Zone |

| ML-25-280 | 520165.70 | 5488374.00 | 371.10 | 308 | -48 | 534 | No significant results | |||||

| ML-25-281 | 520071.90 | 5488407.60 | 370.60 | 298 | -58 | 450 | 239.65 | 241.45 | 1.80 | 1.74 | 3.87 | Main Shear Zone |

| ML-25-282 | 520044.30 | 5488335.60 | 370.60 | 296 | -50 | 423 | 224.75 | 227.75 | 3.00 | 2.90 | 12.66 | Megane Zone (Main Shear Zone) |

| Including | | | | | | | 225.75 | 226.30 | 0.55 | 0.53 | 54.40 | |

| ML-25-283 | 520006.00 | 5488221.00 | 370.00 | 300 | -65 | 519 | 392.00 | 396.40 | 4.90 | 4.73 | 127.25 | Lower Shear Zone |

| Including | | | | | | | 393.40 | 394.05 | 0.65 | 0.63 | 857.00 | |

| ML-25-284 | 519967.00 | 5488171.00 | 370.00 | 313 | -43 | 426 | 10.50 | 11.00 | 0.50 | 0.48 | 36.10 | 230-Shear Zone |

| | | | | | | | 311.05 | 312.95 | 1.90 | 1.68 | 3.20 | Lower Shear Zone |

| ML-25-285 | 519933.30 | 5488406.30 | 369.70 | 315 | -43 | 255 | 92.40 | 95.50 | 3.10 | 2.99 | 2.33 | Main Shear Zone |

| Including | | | | | | | 94.65 | 95.50 | 0.85 | 0.82 | 6.04 | |

| | | | | | | | 100.35 | 102.10 | 1.75 | 1.69 | 7.95 | Main Shear Zone |

| | | | | | | | 207.50 | 208.50 | 1.00 | 0.97 | 10.80 | Lower Shear Zone |

| ML-25-286 | 519852.12 | 5488328.00 | 370.00 | 320 | -43 | 207 | 26.40 | 27.30 | 0.90 | 0.87 | 11.75 | Main Shear Zone |

| | | | | | | | 30.45 | 35.90 | 5.45 | 5.26 | 1.02 | |

| | | | | | | | 44.55 | 51.45 | 6.90 | 6.66 | 10.59 | Megane Zone (Main Shear Zone) |

| Including | | | | | | | 47.55 | 48.50 | 0.95 | 0.92 | 66.20 | |

| ML-25-287 | 520142.93 | 5488116.66 | 370.10 | 303 | -52 | 567 | 388.60 | 389.50 | 0.90 | 0.87 | 5.65 | Main Shear Zone |

| | | | | | | | 507.45 | 509.60 | 2.15 | 2.08 | 39.42 | Lower Shear Zone |

| Including | | | | | | | 508.85 | 509.60 | 0.75 | 0.72 | 111.00 | |

| ML-25-288 | 520142.93 | 5488116.66 | 370.11 | 310 | -47 | 284 | Abandoned due to excessive deviation & No significant results | |||||

| ML-25-288A | 520142.93 | 5488116.66 | 370.11 | 310 | -47 | 543 | 501.45 | 503.35 | 1.90 | 1.84 | 5.53 | Lower Shear Zone |

| Including | | | | | | | 502.40 | 503.35 | 0.95 | 0.92 | 7.84 | |

| ML-25-289 | 520303.63 | 5488174.53 | 370.79 | 296 | -52 | 754 | 534.30 | 537.30 | 3.00 | 2.90 | 3.36 | Main Shear Zone |

| Including | | | | | | | 536.30 | 537.30 | 1.00 | 0.97 | 7.85 | |

| ML-25-290 | 520226.80 | 5487844.70 | 375.00 | 280 | -50 | 753 | No significant results | |||||

| ML-25-291 | 520550.20 | 5488464.60 | 373.90 | 310 | -60 | 1008 | 775.50 | 779.60 | 4.10 | 3.96 | 2.29 | Main Shear Zone |

| Including | | | | | | | 775.50 | 776.60 | 1.10 | 1.06 | 5.40 | |

| ML-25-292 | 520550.20 | 5488464.60 | 373.90 | 306 | -52 | 972 | 663.00 | 664.50 | 1.50 | 1.45 | 3.61 | Main Shear Zone |

| | | | | | | | 672.00 | 681.00 | 9.00 | 8.69 | 23.37 | Megane Zone (Main Shear Zone) |

| Including | | | | | | | 675.70 | 680.00 | 5.00 | 4.83 | 40.65 | |

| Including | | | | | | | 675.70 | 676.40 | 0.70 | 0.68 | 191.50 | |

Notes:

1. Drill hole intercepts are calculated using a 0.50 g/t Au assay cut-off for exploration holes and 1.0 g/t Au for infill holes.

2. True widths of intersections are approximately 88 to 97% of the core interval.

3. Assays are reported uncut but high grade sub-intervals are highlighted.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

All information included in this news release, including any information as to the Company's vision, strategy, future financial or operating performance and other statements that express management's expectations or estimates of future performance or impact, including statements in respect of the prospects and/or development of the Company's projects, other than statements of historical fact, constitutes forward-looking information or forward-looking statements within the meaning of applicable securities laws (collectively referred to herein as "forward-looking statements") and such forward-looking statements are based on expectations, estimates and projections as of the date of this news release. Forward-looking statements are generally identifiable by the use of words such as "may", "will", "should", "would", "could", "continue", "expect", "budget", "aim", "can", "focus", "forecast", "anticipate", "estimate", "believe", "intend", "plan", "schedule", "guidance", "outlook", "potential", "seek", "targets", "cover", "strategy", "during", "ongoing", "subject to", "future", "objectives", "opportunities", "committed", "prospective", "preliminary", "likely", "progress", "strive", "sustain", "effort", "extend", "on track", "remain", "pursue", "predict", or "project" or the negative of these words or other variations on these words or comparable terminology.

For example, forward-looking statements include, but are not limited to, statements with respect to: the estimation of mineral reserves and mineral resources and the realization of such estimates; operational and financial performance including the Company's guidance for and actual results of production, ESG (including environmental) performance, costs and capital and other expenditures such as exploration and including depreciation expense and effective tax rate, expected benefits from the operational improvements and de-risking strategies implemented or to be implemented by the Company; mine development activities; the Company's capital allocation and liquidity; the composition of the Company's portfolio of assets including its operating mines, development and exploration projects; permitting timelines and the expected receipt of permits; inflation, including global inflation and inflationary pressures; global supply chain constraints; environmental verification, biodiversity and social development projects; plans, targets, proposals and strategies with respect to sustainability, including third party data on which the Company relies, and their implementation; commitments with respect to sustainability and the impact thereof; the development of the Company's Water Management Standard; commitments with respect to biodiversity; commitments related to social performance, including commitments in furtherance of Indigenous relations; the ability to secure alternative sources of consumables of comparable quality and on reasonable terms; workforce and contractor availability, labour costs and other labour impacts; the impacts of weather; the future price of gold and other commodities; foreign exchange rates and currency fluctuations; financial instruments; hedging strategies; impairment assessments and assets carrying values estimates; safety and security concerns in the jurisdictions in which the Company operates and the impact thereof on the Company's operational and financial performance and financial condition; and government regulation of mining operations (including the Competition Act and the regulations associated with the fight against climate change).

The Company cautions the reader that forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, financial, operational and other risks, uncertainties, contingencies and other factors, including those described below, which could cause actual results, performance or achievements of the Company to be materially different from results, performance or achievements expressed or implied by such forward-looking statements and, as such, undue reliance must not be placed on them. Forward-looking statements are also based on numerous material factors and assumptions, including as described in this news release, including with respect to: the Company's present and future business strategies; operations performance within expected ranges; anticipated future production and cash flows; local and global economic conditions and the environment in which the Company will operate in the future; the price of precious metals, other minerals and key commodities; projected mineral grades; international exchanges rates; anticipated capital and operating costs; the availability and timing of required governmental and other approvals for the construction of the Company's projects.

Risks, uncertainties, contingencies and other factors that could cause actual results, performance or achievements of the Company to be materially different from results, performance or achievements expressed or implied by such forward-looking statements include, without limitation: the Company's business strategies and its ability to execute thereon; the development and execution of implementing strategies to meet the Company's sustainability vision and targets; security risks, including civil unrest, war or terrorism and disruptions to the Company's supply chain and transit routes as a result of such security risks, particularly in Burkina Faso and the Sahel region surrounding the Company's Essakane mine; the availability of labour and qualified contractors; the availability of key inputs for the Company's operations and disruptions in global supply chains; the volatility of the Company's securities; litigation; contests over title to properties, particularly title to undeveloped properties; mine closure and rehabilitation risks; management of certain of the Company's assets by other companies or joint venture partners; the lack of availability of insurance covering all of the risks associated with a mining company's operations; unexpected geological conditions; competition and consolidation in the mining sector; the profitability of the Company being highly dependent on the condition and results of the mining industry as a whole, and the gold mining industry in particular; changes in the global prices for gold, and commodities used in the operation of the Company's business (including, but not limited to diesel, fuel oil and electricity); legal, litigation, legislative, political or economic risks and new developments in the jurisdictions in which the Company carries on business; including the imposition of tariffs by the United States on Canadian products; changes in taxes, including mining tax regimes; the failure to obtain in a timely manner from authorities key permits, authorizations or approvals necessary for transactions, exploration, development or operation, operating or technical difficulties in connection with mining or development activities, including geotechnical difficulties and major equipment failure; the availability of capital; the level of liquidity and capital resources; access to capital markets and financing; the Company's level of indebtedness; the Company's ability to satisfy covenants under its credit facilities; changes in interest rates; adverse changes in the Company's credit rating; the Company's choices in capital allocation; effectiveness of the Company's ongoing cost containment efforts; the Company's ability to execute on de-risking activities and measures to improve operations; availability of specific assets to meet contractual obligations; risks related to third-party contractors, including reduced control over aspects of the Company's operations and/or the failure and/or the effectiveness of contractors to perform; risks arising from holding derivative instruments; changes in U.S. dollar and other currency exchange rates or gold lease rates; capital and currency controls in foreign jurisdictions; assessment of carrying values for the Company's assets, including the ongoing potential for material impairment and/or write-downs of such assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; the fact that reserves and resources, expected metallurgical recoveries, capital and operating costs are estimates which may require revision; the presence of unfavourable content in ore deposits, including clay and coarse gold; inaccuracies in life of mine plans; failure to meet operational targets; equipment malfunctions; information systems security threats and cybersecurity; laws and regulations governing the protection of the environment (including greenhouse gas emission reduction and other decarbonization requirements and the uncertainty surrounding the interpretation of omnibus Bill C-59 and the related amendments to the Competition Act (Canada)); employee relations and labour disputes; the maintenance of tailings storage facilities and the potential for a major spill or failure of the tailings facilities due to uncontrollable events, lack of reliable infrastructure, including access to roads, bridges, power sources and water supplies; physical and regulatory risks related to climate change; unpredictable weather patterns and challenging weather conditions at mine sites; disruptions from weather related events resulting in limited or no productivity such as forest fires, severe storms, flooding, drought, heavy snowfall, poor air quality, and extreme heat or cold; attraction and retention of key employees and other qualified personnel; availability and increasing costs associated with mining inputs and labour, negotiations with respect to new, reasonable collective labour agreements and/or collective bargaining agreements may not be agreed to; the ability of contractors to timely complete projects on acceptable terms; the relationship with the communities surrounding the Company's operations and projects; indigenous rights or claims; illegal mining; the potential direct or indirect operational impacts resulting from external factors, including infectious diseases, pandemics, or other public health emergencies; and the inherent risks involved in the exploration, development and mining business generally. Please see the Company's Annual Information Form or Form 40-F available on or for a comprehensive discussion of the risks faced by the Company and which may cause actual results, performance or achievements of the Company to be materially different from results, performance or achievements expressed or implied by forward-looking statements.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as required by applicable law.

To view the source version of this press release, please visit

SOURCE: IAMGOLD Corporation

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment