Federal Reserve Preview: Set To Resume Its Path Towards 3%

After cutting rates 100bp in the latter part of last year the Fed has been on hold through 2025 as officials took the view that the economy and jobs market were looking fairly“solid”. At the same time inflation remained elevated with tariff-induced price hikes expected to keep inflation above its 2% target through 2026. The Fed concluded they should leave monetary policy in a“slightly restrictive” setting.

That position started to change at the July FOMC meeting with Fed Governors Chris Waller and Michelle Bowman agreeing with President Trump that a weakening jobs market justified a renewed loosening of policy. At the time a majority disagreed, but those views are now being shared more widely within the Fed with Chair Powell acknowledging at last month's Jackson Hole symposium that changes to economic conditions may soon“warrant” lower interest rates.

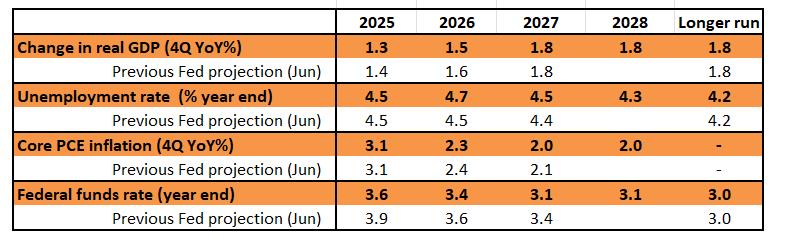

ING's expectations for the updated Fed forecasts

Source: ING, Federal Reserve Labour market weakness is the clear concern

Second-quarter GDP grew 3.3%, but this was down to a dramatic improvement in the US' net trade position that masked a weakening consumer backdrop. Spending effectively plateaued in real terms through the first half of the year with household caution reflecting worries about squeezed spending power from tariffs, a cooling jobs market and volatility in wealth.

This narrative was borne out in the latest Federal Reserve Beige Book, which reported that“Most of the twelve Federal Reserve Districts reported little or no change in economic activity” and that“across Districts, contacts reported flat to declining consumer spending”. It also commented that 11 of the 12 Fed Districts reported no hiring over the previous seven weeks with one reporting a decline. This was broadly in line with last Friday's August jobs report, showing just 22,000 job added last month and unemployment rising to 4.3%. Meanwhile, Tuesday's preliminary payrolls revisions to the 12 months to March 2025 show that the economy added less than half the jobs the Bureau of Labor Statistics had previously reported!

Inflation fears will gradually fade allowing 75bp of cuts this yearInflation is still above target and the Fed is likely to continue suggesting that it will stay elevated in the near-term due to tariffs. However, the downside risk to its jobs mandate is now outweighing that of the upside risk to price stability. The Fed has long believed that tariffs will be a one-off step change in prices, but seemed to want to see that be confirmed in the inflation data. It appears they no longer feel they have enough time and need to start taking steps to move monetary policy closer to neutral already.

We agree. After all, three factors that helped push inflation up to 9% in 2022 – oil prices tripling, housing rents soaring and wages jumping – are clearly absent and if anything will act as a disinflationary influence over coming quarters. A cooling economy with rising unemployment will further contribute to inflation heading back towards 2% by the end of 2026.

We suspect the Fed will take a similar view and trim their forecasts for both growth and inflation, while lifting their projections for unemployment. We expect the Fed to cut interest rates 25bp on 17 September and follow up with 25bp cuts at the October, December, January and March FOMC meetings.

It is possible that the Fed chooses to lead off with a 50bp move, just as they did in September last year. It is likely that Chris Waller and Michelle Bowman vote for the larger cut, justifying it on the basis they felt the Fed should have loosened policy in July and the deteriorating jobs story since then means some catch-up needs to happen. New appointee Stephen Miran could potentially vote for something even larger given his closeness to the President who has called for much more aggressive action. In the end though we suspect he will vote for 50bp. However, the sense of caution amongst the majority of members regarding the tariff impact on inflation means that 25bp is the most likely outcome and that is what the market is anticipating too.

The front end is anchored into the FOMC, but expect the back end to be far more whippy in the coming monthsThe 2yr yield in the 3.5% area is fully braced for a series of rate cuts. The Fed would need to deliver a cumulative 100bp of cuts to take the funds rate below the 2yr yield, and realistically the 2yr yield at its current level anticipates a further 25bp in cuts on top of that (125bp in total). Then to validate the 2yr yield valuation, the Fed would need to hold there for a year. In fact, if that were the outcome (i.e. the Fed lands at 3% - 3.25% and holds there), the fair value 2yr yield would be 3.4%. The current 3.5% yield includes a 10bp premium on top of that to cater for term uncertainty. We're fully valued then, unless the Fed were to cut to below 3%. For example, should the Fed cut to 2.75% - 3%, then the fair value 2yr yield is 3.3% (3.2% + a 10bp premium).

The 10yr yield is hovering at just above 4%, equating to a 10yr SOFR rate at around 3.5% (50bp swap spread). When the Fed cut by 50bp in September 2024, the 10yr SOFR rate was as low as 3.15%. But that's very low in a scenario where the Fed gets the funds rate down to about 3% and holds there. Even at 3.5%, that's a mere 50bp curve from the future funds rate floor. It's quite possible that the 10yr SOFR rate eases down towards 3.25% on rate-cut fever. But we'd view that as an overshoot to the downside. Fairer value for the 10yr SOFR rate is closer to 3.75%; effectively a 75bp curve. That equates to 4.25% for the 10yr Treasury yield. That's our multi-month view (see more here ), driven there by inflation drifting up to 3.5% ahead (tariffs).

In terms of liquidity management, the Fed may choose to opine on bank reserves management. This comes against a backdrop of a rising Treasury cash balance through accelerated bills issuance that in turn acts to place downward pressure on bank reserves. We're relaxed on this for now (see more here ), but let's see how the Fed views it.

Benign dollar decline to extendThe dollar has dropped around 2.5% since the release of the pivotal US July jobs report on 1 August. While a 125bp Fed easing cycle is already largely priced, the delivery of the rate cut will drag three-month USD interest rates lower. These are important for FX hedging and will allow foreign asset managers to increase hedge ratios on their holdings of US assets.

We continue to forecast EUR/USD edging up to 1.20 by the end of this year and 1.22 by end-2026. Seasonality works against the dollar from October onwards and intense speculation over next year's make-up of the FOMC won't help the dollar either.

A Fed cutting interest rates to neutral without the economy entering recession should be good for activity and commodity currencies. Our favourite at the moment is probably the Australian dollar, which could also get a lift if the Chinese consumption story starts to pick up a little. Lagging in this soft dollar environment may be USD/JPY. Uncertainty over the next LDP leader is weighing on the yen. At present we're still favouring an October Bank of Japan rate hike – some 26 days after the LDP leadership election. But certainly any return to Abe-esque policy from the new government can interfere with our current call of USD/JPY ending the year at 140.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- NOVA Collective Invest Showcases Intelligent Trading System7.0 Iterations Led By Brady Rodriguez

- 1Inch Unlocks Access To Tokenized Rwas Via Swap API

- Ethereum-Based Meme Project Pepeto ($PEPETO) Surges Past $6.5M In Presale

- USDT0 And Xaut0 Are Now Live On Polygon

- Falcon Finance Announced $FF And Community Sale On Buidlpad

- Japan Halal Food Market Size To Surpass USD 323.6 Billion By 2033 With A CAGR Of 8.1%

Comments

No comment