US Inflation Remains Hotter Than Hoped, But The Fed's Focus Is Now Jobs

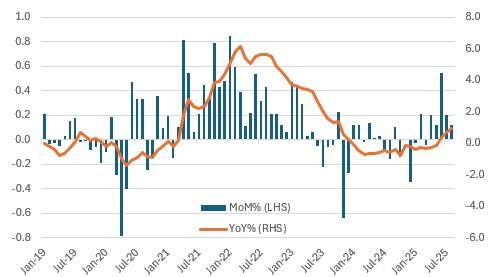

US headline CPI has come in at 0.4% month-on-month, above the 0.3% consensus, but core CPI has come in at 0.3% as predicted - although only just given it was 0.346% to three decimal places. Both are hotter than the 0.17% MoM rate we need to track at to push annual inflation down to the Federal Reserve's 2% year-on-year target and tariffs are likely to keep us tracking above that rate for the next few months as prices adjust to the new environment.

That said tariffs are not particularly evident in today's report. Looking at the details there was strength in airline fares (+5.9% MoM) and used cars (+1%), while shelter was a little above what we thought likely, rising 0.4% after a series of 0.2% MoM prints. Food rose 0.5% and energy was up 0.7% to explain why headline CPI rose faster than core. On the downside, recreation prices fell 0.1% with medical care down 0.2% while education was flat. Core goods ex autos, where we would assume most tariff impact would be evident, rose only 0.1% MoM with new car prices rising 0.3%. This indicates that, for now, most of the tariff cost is being absorbed by corporate profit margins, which was also indicated by the hefty 1.7% MoM drop in the PPI measure of trade services yesterday, used as a proxy for corporate margins. We don't expect this to be a permanent feature.

Core goods ex autos inflation

Source: Macrobond, ING Other factors will start to depress inflation, including a weakening jobs market

Nonetheless, we continue to argue that tariffs will be a one-off step change in prices rather than something that will lead to more persistent inflation. Energy costs, slowing housing rents, and a weakening jobs market will all contribute to softer inflation as we move through 2026. Remember that core goods - the component that is exposed to tariffs - only has a 19% weighting within the inflation basket. Services dominate and it tends to be wages that drive inflation here and they are slowing quickly now that there are more unemployed Americans than there are job vacancies.

In any case, this slight inflation upside miss is heavily mitigated by the rise in initial jobless claims to 263k (highest since October 2021) from 236k. This was well above the 235k consensus. On the face of it, this hints at a pick-up in the pace of lay-offs in an environment of already weak hiring and will re-affirm expectations of a 25bp Fed rate cut next week.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Japan Buy Now Pay Later Market Size To Surpass USD 145.5 Billion By 2033 CAGR Of 22.23%

- BTCC Summer Festival 2025 Unites Japan's Web3 Community

- GCL Subsidiary, 2Game Digital, Partners With Kucoin Pay To Accept Secure Crypto Payments In Real Time

- Smart Indoor Gardens Market Growth: Size, Trends, And Forecast 20252033

- Nutritional Bar Market Size To Expand At A CAGR Of 3.5% During 2025-2033

- Pluscapital Advisor Empowers Traders To Master Global Markets Around The Clock

Comments

No comment