A Narrow Call For A Norges Bank Cut Next Week

The consensus expectation was that Norway's August CPI report – released on Wednesday – would give the go-ahead for another 25bp cut on 18 September. Underlying inflation was expected to drop below 3.0%, instead it flattened at 3.1% for the third consecutive month, while headline accelerated from 3.3% to 3.5%.

Further complicating our longstanding call for a September cut were stronger-than-expected second-quarter GDP figures (0.4% QoQ) and the Norges Bank's Regional Network Survey showing a stable and relatively upbeat outlook for the current and next quarters (expecting 0.4% growth each). Annual wage growth is projected at 4.5% for 2025 and 4.0% for 2026, also unchanged from the previous survey.

The Regional Network Survey is closely watched by Norges Bank policymakers, but its findings must be interpreted with caution. As explicitly noted, expectations for sales, investment, and hiring were partly shaped by anticipated rate cuts.

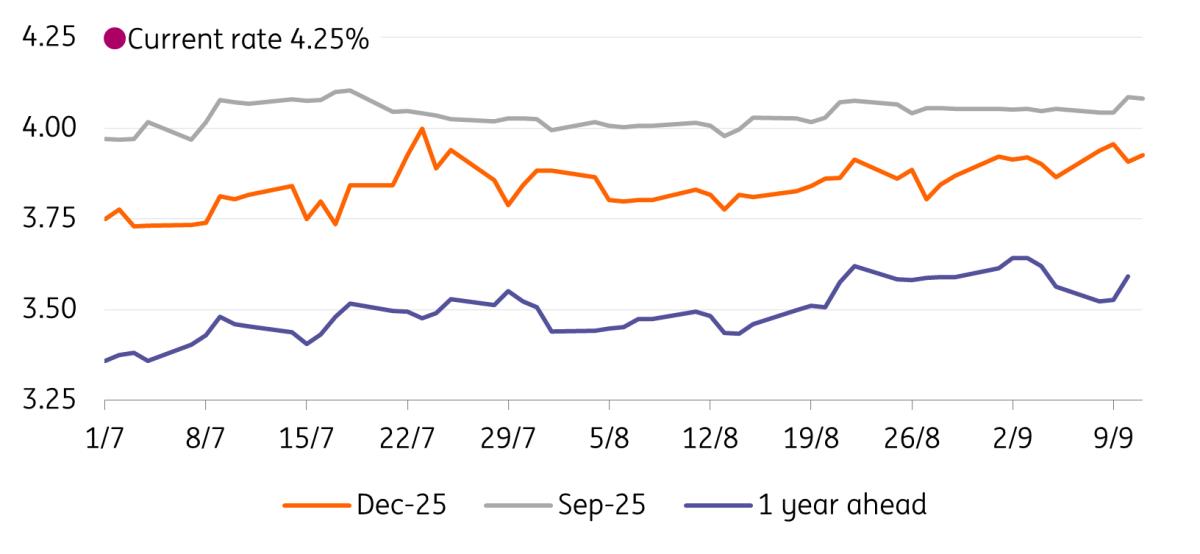

The overnight rate priced one year ahead has hovered between 3.60% and 3.80% throughout the third quarter, compared to the current 4.25%. Until this week, markets had priced in an 80% probability of a September cut (now 65%) and just over 50% for another move in December (now 45%). While it's difficult to quantify how much firms factored in swap-market-implied rate expectations, this does raise a flag about taking survey responses at face value.

Source: Refinitiv, ING The case for a September cut

As mentioned, this is a close call. But on balance, we still see a cut as slightly more likely – driven primarily by market-related factors.

NOK levels have consistently played a key role in Norges Bank's policy decisions. Given the krone's low liquidity, sell-offs tend to be sharp, and the Bank has viewed currency depreciation as a key inflationary risk over the past three years. Just as FX market considerations likely influenced the June decision, we suspect they will again.

EUR/NOK was trading at 11.40 on 18 June when Norges Bank delivered a cut that was entirely unpriced. The resulting NOK sell-off was significant. Today, after a not-usual roller-coaster ride, EUR/NOK sits at 11.60 – but crucially, markets are already pricing in 17bp of easing for this meeting. That means the negative impact of a cut on NOK would likely be more muted, especially if policymakers accompany it with cautious forward guidance for December and beyond.

Given the unpredictable nature of external drivers for NOK, failing to cut during a rally could be a missed opportunity.

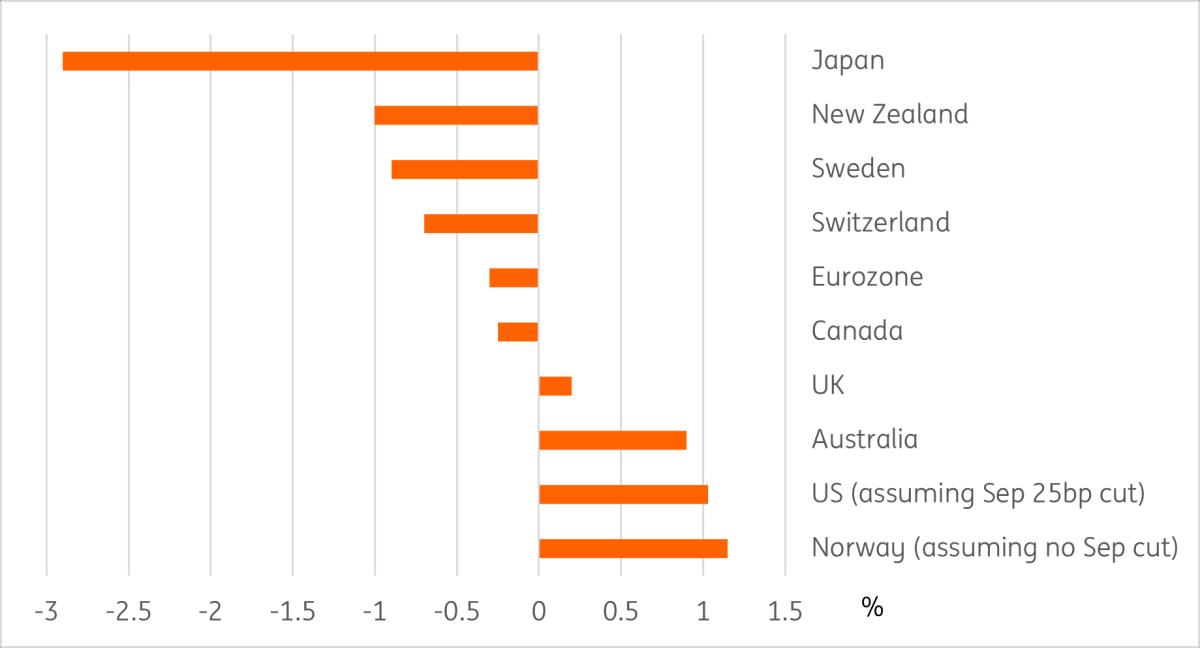

Importantly, rates remain restrictive at 4.25%. Using core CPI as the benchmark (rather than the less-regarded headline rate), a hold would leave Norway with the highest real policy rate in the G10 – assuming the Fed delivers a widely expected 25bp cut next week.

Policy rates minus latest core CPI inflation in G10

Source: Macrobond, ING Our NOK call

As our baseline is a cut next week, we expect EUR/NOK to trade higher in the near term. However, much will depend on the new rate path projections and forward guidance: any indications of greater conditionality on a December move should limit the negative spillover for NOK.

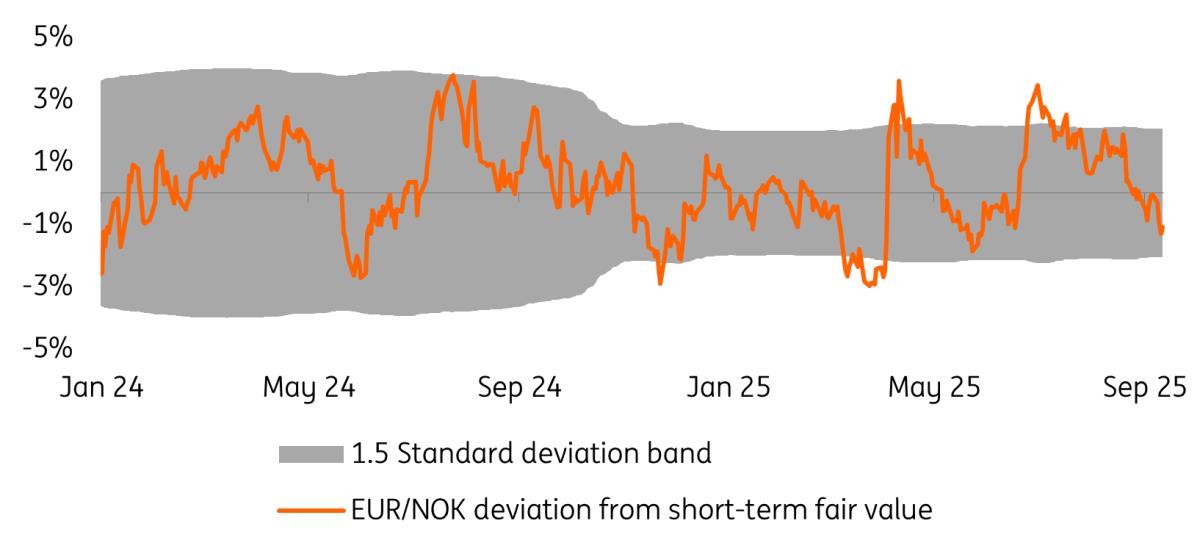

But, as per the chart below, our model shows that EUR/NOK has already undershot its short-term fair value model with the current swap rate pricing. That embeds the higher EUR short-term rates as a consequence of ECB hawkish repricing.

While we continue to see strong medium-term krone fundamentals and rate differentials as likely to drive EUR/NOK sustainably below 11.50 by 1Q26, our tactical, end-3Q 2025 call for EUR/NOK is 11.70-11.75.

Misvaluation of EUR/NOK relative to our short-term fair value model

Source: ING, Refinitiv

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Japan Buy Now Pay Later Market Size To Surpass USD 145.5 Billion By 2033 CAGR Of 22.23%

- BTCC Summer Festival 2025 Unites Japan's Web3 Community

- GCL Subsidiary, 2Game Digital, Partners With Kucoin Pay To Accept Secure Crypto Payments In Real Time

- Smart Indoor Gardens Market Growth: Size, Trends, And Forecast 20252033

- Nutritional Bar Market Size To Expand At A CAGR Of 3.5% During 2025-2033

- Pluscapital Advisor Empowers Traders To Master Global Markets Around The Clock

Comments

No comment