Meta Signal 10/09: Is More Downside Ahead? (Chart)

(MENAFN- Daily Forex) Short Trade IdeaEnter your short position between $752.05 (the intra-day low of its last bearish candlestick) and $766.30 (yesterday's intra-day high).Market Index Analysis

- Meta Platforms (META) is a member of the NASDAQ 100, the S&P 100, and the S&P 500 indices. All three indices are near all-time highs, climbing a wall of worry, a bearish trading environment. The Bull Bear Power Indicator for the NASDAQ 100 shows a negative divergence and does not confirm the uptrend.

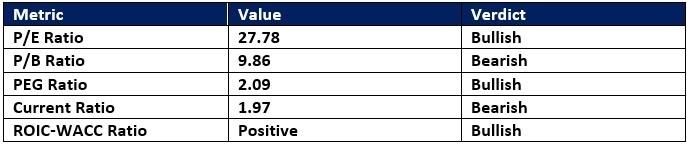

- The META D1 chart above shows price action inside a bearish price channel. It also shows price action trading between its ascending 50.0% and 61.8% Fibonacci Retracement Fan levels. The Bull Bear Power Indicator is bullish with a descending trendline. The average bearish trading volumes are higher than the average bullish trading volumes. META failed to match the record run of the NASDAQ 100, a significant bearish signal.

- META Entry Level: Between $752.05 and $766.30 META Take Profit: Between $678.67 and $691.20 META Stop Loss: Between $784.75 and $796.25 Risk/Reward Ratio: 2.24

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Japan Buy Now Pay Later Market Size To Surpass USD 145.5 Billion By 2033 CAGR Of 22.23%

- BTCC Summer Festival 2025 Unites Japan's Web3 Community

- GCL Subsidiary, 2Game Digital, Partners With Kucoin Pay To Accept Secure Crypto Payments In Real Time

- Smart Indoor Gardens Market Growth: Size, Trends, And Forecast 20252033

- Nutritional Bar Market Size To Expand At A CAGR Of 3.5% During 2025-2033

- Pluscapital Advisor Empowers Traders To Master Global Markets Around The Clock

Comments

No comment